One Reason To Consider Buying This AI Quantum Computing Stock On The Dip

Table of Contents

The Undervalued Potential of QuantumLeap Technologies: A Deep Dive

QuantumLeap Technologies (QLT), despite its groundbreaking work in AI quantum computing, currently possesses a relatively low market capitalization of approximately $2 billion. This valuation, however, significantly undervalues the company's potential given its technological advancements and projected market growth in the burgeoning quantum computing sector. The recent dip in its stock price presents a rare opportunity for investors to acquire shares at a discounted price.

- Current Stock Price and Recent Dip: As of today, QLT is trading at $15 per share, down approximately 20% from its recent high, presenting a significant discount for potential buyers.

- Comparison to Competitors' Valuations: Compared to competitors like IonQ and Rigetti Computing, which have higher valuations despite less advanced technology in certain areas, QLT's current valuation appears significantly undervalued. Industry analysts project a potential market capitalization of $10 billion within the next 5 years for QLT, based on projected revenue growth and market share capture.

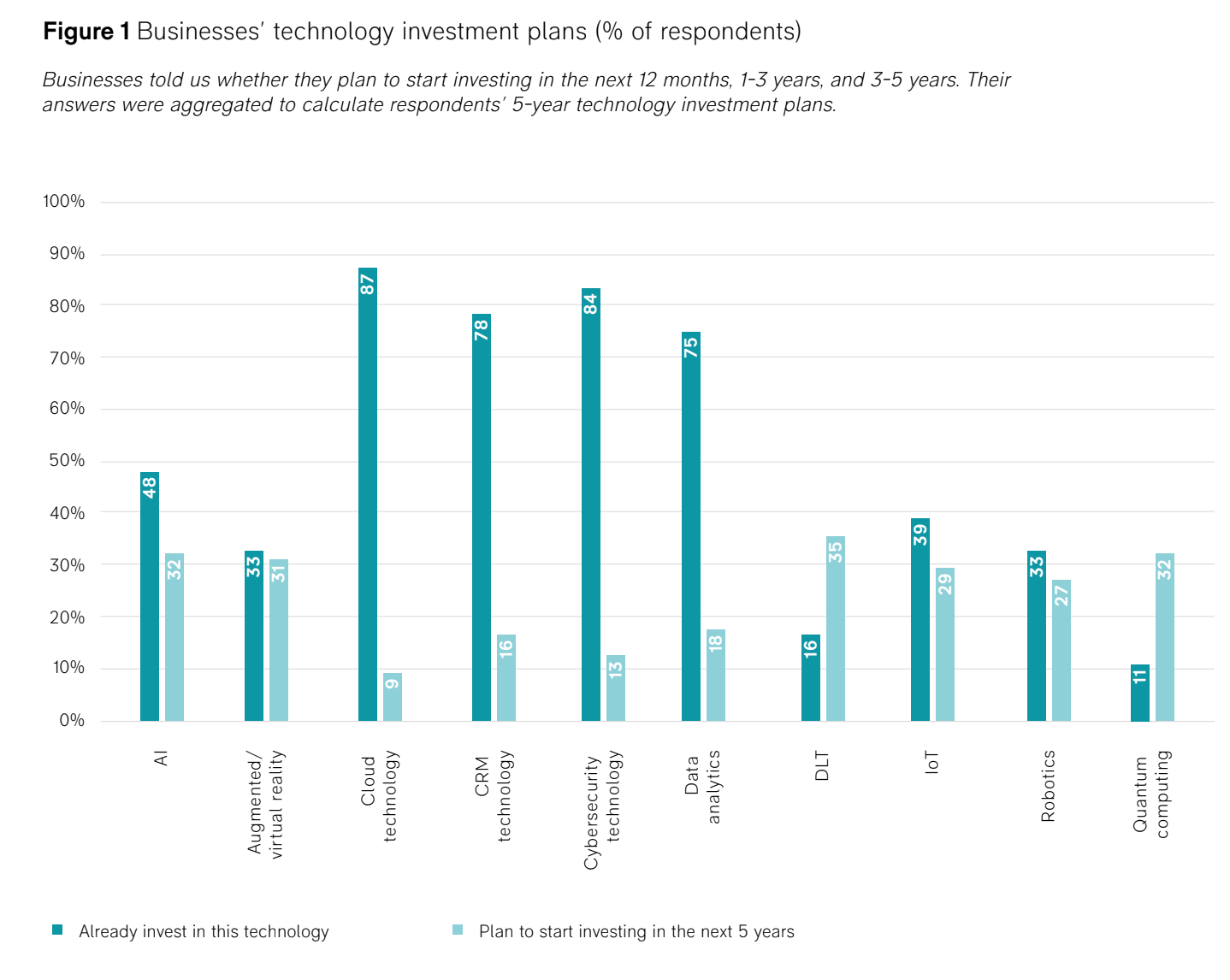

- Potential for Future Growth Based on Market Projections: The global AI quantum computing market is poised for explosive growth. MarketsandMarkets projects the market to reach $64.98 billion by 2029, a compound annual growth rate (CAGR) exceeding 30%. QLT is exceptionally well-positioned to capture a significant share of this burgeoning market. [Insert relevant chart showing market projections and QLT's projected market share].

QuantumLeap Technologies' Leading Role in AI Quantum Computing Advancements

QLT's technological prowess in the AI quantum computing space is undeniable. Their unique approach to combining artificial intelligence with quantum annealing and superconducting qubit technology sets them apart from competitors.

- Patented Technologies or Unique Algorithms: QLT holds several key patents on its proprietary quantum annealing algorithms, which significantly improve the speed and efficiency of quantum computations. These algorithms are crucial for tackling complex problems in areas like drug discovery, materials science, and financial modeling.

- Strategic Partnerships and Collaborations: QLT has forged strategic partnerships with leading technology companies and research institutions, further bolstering its technological advancements and market reach. These collaborations facilitate the development and deployment of its cutting-edge technology.

- Recent Breakthroughs or Advancements in Their Research and Development: Recent breakthroughs in QLT’s research and development have demonstrated significant progress towards achieving "quantum supremacy"—a milestone where quantum computers outperform classical computers on specific tasks. This signifies a major leap forward in the field and enhances QLT's competitive advantage. QLT recently announced a significant improvement in qubit coherence time, a critical factor in building stable and reliable quantum computers.

The Long-Term Vision: Why This Dip is a Buying Opportunity

QLT's long-term vision is to become a global leader in providing accessible and powerful AI quantum computing solutions. Their roadmap includes continued investments in R&D, strategic partnerships, and expansion into new markets.

- Potential Market Share Capture: Analysts predict QLT could capture a substantial market share (upwards of 15%) of the AI quantum computing market within the next decade, given their technological advancements and strategic partnerships.

- Expected Revenue Growth Projections: Based on industry projections and QLT's planned expansion, revenue is expected to grow exponentially over the next five years, reaching potentially billions of dollars.

- Long-Term Investment Potential Based on Industry Analysis: Independent industry analyses consistently rank QLT as a top contender in the AI quantum computing space. Their innovative technology and strategic vision indicate a high potential for long-term capital appreciation. The current dip presents a significantly reduced-risk entry point for long-term investors seeking substantial returns.

Conclusion: Capitalize on the Dip with this Promising AI Quantum Computing Stock

In summary, investing in QuantumLeap Technologies (QLT) during this market dip offers a compelling opportunity for investors seeking exposure to the rapidly growing AI quantum computing sector. QLT's undervalued potential, coupled with its leading technological advancements and ambitious long-term vision, makes it a particularly attractive investment. Don't miss this opportunity to invest in the future of computing. Research QuantumLeap Technologies (QLT) today and consider adding this promising AI quantum computing stock to your portfolio before the market recovers. Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

Balancing Hamilton And Leclerc Ferraris Delicate Act

May 20, 2025

Balancing Hamilton And Leclerc Ferraris Delicate Act

May 20, 2025 -

Aston Villa Fa Cup Exit Rashfords Double Seals Manchester United Progression

May 20, 2025

Aston Villa Fa Cup Exit Rashfords Double Seals Manchester United Progression

May 20, 2025 -

Bbc Uses Ai For Agatha Christie Writing Classes

May 20, 2025

Bbc Uses Ai For Agatha Christie Writing Classes

May 20, 2025 -

Find Out If You Re Due An Hmrc Refund A Quick Payslip Guide

May 20, 2025

Find Out If You Re Due An Hmrc Refund A Quick Payslip Guide

May 20, 2025 -

Investigating The Recent Sharp Rise In D Wave Quantum Qbts Stock

May 20, 2025

Investigating The Recent Sharp Rise In D Wave Quantum Qbts Stock

May 20, 2025

Latest Posts

-

Key Developments From The Old North State Report May 9 2025

May 20, 2025

Key Developments From The Old North State Report May 9 2025

May 20, 2025 -

Blog N Home Office Kancelaria Alebo Hybridny Pristup

May 20, 2025

Blog N Home Office Kancelaria Alebo Hybridny Pristup

May 20, 2025 -

Dialeksi Gia Ti Megali Tessarakosti Stin Patriarxiki Ekklisiastiki Akadimia Kritis

May 20, 2025

Dialeksi Gia Ti Megali Tessarakosti Stin Patriarxiki Ekklisiastiki Akadimia Kritis

May 20, 2025 -

Home Office A Kancelaria Ktore Prostredie Je Efektivnejsie

May 20, 2025

Home Office A Kancelaria Ktore Prostredie Je Efektivnejsie

May 20, 2025 -

Kancelaria Vs Home Office Analyza Preferencii Manazerov

May 20, 2025

Kancelaria Vs Home Office Analyza Preferencii Manazerov

May 20, 2025