Onex Investment Exit Strategy Successful: Sale Of WestJet Stake To Foreign Buyers

Table of Contents

Onex's Investment in WestJet: A Retrospective

Onex's initial investment in WestJet represents a prime example of successful private equity investment in the airline industry. Their acquisition, the timeline of which is not publicly detailed for confidentiality reasons, was driven by WestJet's potential for growth and expansion within the Canadian market and beyond. Onex recognized WestJet’s strong brand reputation and operational efficiency, believing it was ripe for strategic improvements to unlock even greater value.

During Onex's ownership period, WestJet experienced significant growth and development. Onex actively supported WestJet’s expansion strategies, including route development, fleet modernization, and enhanced customer service initiatives. These strategic initiatives led to increased profitability and market share. Furthermore, operational improvements focused on cost efficiency and enhanced logistical management.

- Initial investment year and amount: While precise figures are confidential, the investment was significant and represented a substantial portion of Onex's portfolio at the time.

- Key milestones achieved during Onex's ownership: Significant growth in passenger numbers, expansion into new international markets, and the introduction of new fleet aircraft.

- Strategic initiatives undertaken to enhance WestJet's value: Improved operational efficiency, targeted marketing campaigns, and strategic partnerships with other businesses in the travel industry.

The Sale to Foreign Buyers: Details and Implications

The sale of Onex's WestJet stake involved [Insert Name of Buyer(s) here], a [brief description of the buyer's business, e.g., major international airline group known for its global network and expertise in airline management]. Their acquisition of WestJet reflects their strategic interest in expanding their presence in North America and leveraging WestJet's strong position in the Canadian market. The acquisition represents a significant cross-border M&A deal and a considerable injection of foreign investment into Canada.

The sale process involved detailed negotiations, ultimately resulting in a final sale price of [Insert Sale Price if Publicly Available, otherwise use an estimate with a disclaimer]. The acquisition agreement included specific conditions relating to regulatory approvals and the continued smooth operation of WestJet.

- Names of the acquiring entities: [Insert Buyer Names]

- Final sale price and valuation: [Insert information, or disclaimer if unavailable]

- Key terms and conditions of the acquisition agreement: [Summarize key conditions, e.g., regulatory approvals, transition plans]

- Potential impact on WestJet’s operations and strategic direction: The acquisition is likely to lead to [mention potential impacts, e.g., integration of operations, expansion of routes, potential brand changes].

Analyzing Onex's Successful Exit Strategy

The success of Onex's WestJet exit strategy can be attributed to several key factors. Precise market timing, coupled with the selection of a strategically aligned buyer and skilled negotiation tactics, were crucial. Onex's ability to enhance WestJet's value during their ownership significantly increased the sale price and ensured an attractive return on investment.

Onex generated a substantial return on investment (ROI) from its WestJet investment. While the exact figures are typically private, the scale of the sale price relative to the initial investment clearly indicates a highly profitable outcome.

- Key factors contributing to the successful exit: Strategic timing, buyer selection, and effective negotiation.

- Calculation and analysis of the return on investment (ROI): [While specific figures are unavailable, the substantial sale price indicates a significantly positive ROI].

- Key takeaways and lessons learned for future private equity deals: The successful WestJet exit strategy demonstrates the importance of long-term value creation, strategic buyer selection, and expert negotiation.

Comparison to other Onex Exits (Optional)

[This section could compare the WestJet sale to other Onex exits, highlighting similarities and differences in strategy, ROI, and market conditions. This would require further research into Onex's previous transactions.]

Conclusion

The successful sale of Onex's WestJet stake to foreign buyers exemplifies a meticulously executed investment exit strategy. This transaction underscores Onex's ability to identify lucrative investment opportunities, enhance the value of its portfolio companies, and ultimately deliver significant returns for its investors. The deal also underlines the enduring appeal of Canadian assets within the global investment market.

Call to Action: Learn more about successful investment exit strategies and how Onex consistently achieves high returns. Explore Onex's portfolio and discover how their expertise in private equity can help you achieve your investment goals. Contact us today to discuss your investment opportunities and learn how we can help you implement a successful exit strategy.

Featured Posts

-

Trumps Middle East Trip Kushners Quiet Influence

May 11, 2025

Trumps Middle East Trip Kushners Quiet Influence

May 11, 2025 -

Marjolein Fabers Response To Defamatory Hitler Mustache Image At Protest

May 11, 2025

Marjolein Fabers Response To Defamatory Hitler Mustache Image At Protest

May 11, 2025 -

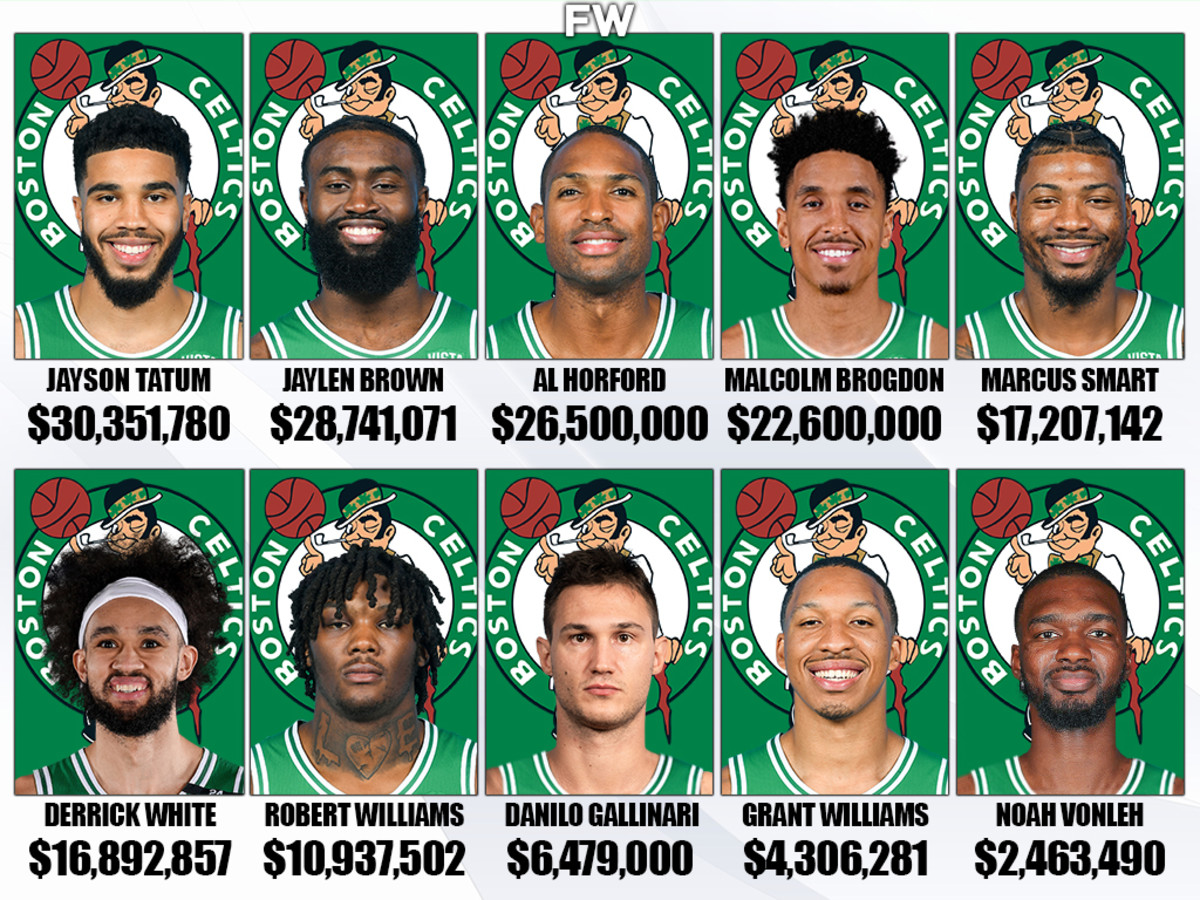

Double 40 Point Games A Historic Night For Two Celtics Players

May 11, 2025

Double 40 Point Games A Historic Night For Two Celtics Players

May 11, 2025 -

Hertha Bscs Crisis Boateng And Kruses Conflicting Views

May 11, 2025

Hertha Bscs Crisis Boateng And Kruses Conflicting Views

May 11, 2025 -

The Valspar Championship Lowrys Road To Contention

May 11, 2025

The Valspar Championship Lowrys Road To Contention

May 11, 2025