Ontario's $14.6 Billion Deficit: Tariff Impacts And Economic Outlook

Table of Contents

The Role of Tariffs in Ontario's Fiscal Situation

The impact of tariffs on Ontario's economy is undeniable and has significantly contributed to the current $14.6 billion deficit. This section explores the effects of both international trade wars and Canadian tariff policies on Ontario businesses and the broader provincial economy.

Impact of US-China Trade War on Ontario Businesses

The US-China trade war, characterized by escalating tariffs on goods traded between the two economic giants, significantly impacted Ontario businesses, particularly those in the manufacturing and automotive sectors. These tariffs increased production costs, reduced export competitiveness, and led to job losses. For instance, the automotive sector alone experienced a 15% decline in exports to China due to tariffs imposed during the trade war, resulting in thousands of job losses and a significant slowdown in production. Companies like Magna International, a major automotive supplier, faced considerable challenges navigating these increased trade barriers.

- Increased production costs: Tariffs increased the price of imported raw materials and components, impacting profit margins.

- Reduced export competitiveness: Higher prices for Ontario-made goods made them less competitive in international markets.

- Job losses in affected industries: Reduced production and decreased competitiveness led to significant job losses across various sectors.

- Decline in foreign investment: The uncertainty created by the trade war discouraged foreign investment in Ontario.

Impact of Canadian Tariffs on International Trade and Ontario's Economy

While Canada has also implemented tariffs on various imported goods, their impact on Ontario's economy is complex and multifaceted. While some tariffs might protect domestic industries, they can also lead to retaliatory tariffs from other countries, further harming Ontario's export-oriented businesses. For example, retaliatory tariffs imposed by the EU on Canadian agricultural products impacted Ontario farmers, contributing to the overall deficit.

- Reduced imports and exports: Tariffs create barriers to trade, reducing the volume of both imports and exports.

- Increased prices for consumers: Tariffs increase the cost of imported goods, leading to higher prices for consumers.

- Strain on supply chains: Trade disruptions caused by tariffs can disrupt global supply chains, impacting businesses' ability to obtain necessary inputs.

- Impact on specific sectors: The impact of tariffs varies across sectors, with some industries more affected than others.

Analyzing Ontario's Economic Outlook in the Context of the Deficit

Understanding Ontario's economic outlook is crucial for addressing the $14.6 billion deficit. This involves analyzing government spending, revenue projections, and identifying potential growth sectors and challenges.

Government Spending and Revenue Projections

The Ontario government's current spending plans and revenue forecasts are critical in assessing the feasibility of addressing the deficit. Plans might involve potential tax increases, spending cuts in certain areas, or a combination of both. Achieving fiscal balance will require careful consideration of these competing factors.

- Projected GDP growth: Moderate GDP growth is projected, but it's not sufficient to eliminate the deficit without further action.

- Employment forecasts: Job creation is expected, but significant challenges remain in specific sectors impacted by tariffs.

- Government revenue projections: Revenue projections need to be realistic and account for potential economic downturns.

- Debt-to-GDP ratio projections: The debt-to-GDP ratio is a key indicator of fiscal health, and managing it effectively is paramount.

Potential Economic Growth Sectors and Challenges

Despite the deficit, Ontario has potential for economic growth in several sectors, including technology, clean energy, and life sciences. However, significant challenges remain, including infrastructure needs, skills gaps, and attracting foreign investment. Addressing these challenges is crucial for stimulating economic growth and reducing the deficit.

- Infrastructure investment needs: Significant investments in infrastructure are needed to support economic growth and attract investment.

- Skills gap in the workforce: Addressing skills gaps through education and training initiatives is essential for a competitive workforce.

- Attracting foreign investment: Creating a favorable business environment to attract foreign investment is crucial for economic growth.

- Promoting innovation and entrepreneurship: Supporting innovation and entrepreneurship can create new jobs and stimulate economic activity.

Policy Recommendations for Addressing Ontario's $14.6 Billion Deficit

Addressing Ontario's $14.6 billion deficit requires a multi-pronged approach that includes fiscal responsibility measures and strategies to mitigate the negative impact of tariffs.

Fiscal Responsibility Measures

The government needs to implement prudent fiscal measures to reduce the deficit. This could involve targeted spending cuts, revenue generation strategies, and effective debt management.

- Targeted spending cuts: Identifying areas where spending can be reduced without impacting essential services.

- Revenue generation strategies: Exploring options to increase government revenue, such as tax reforms.

- Debt management strategies: Developing effective strategies to manage and reduce the provincial debt.

- Economic diversification initiatives: Promoting economic diversification to reduce reliance on vulnerable sectors.

Strategies to Mitigate Tariff Impacts

Mitigating the negative impact of tariffs requires proactive strategies that support affected industries and promote trade diversification.

- Negotiating better trade deals: Actively negotiating trade agreements that minimize the impact of tariffs.

- Investing in workforce retraining: Providing training and support to workers in affected industries to transition to new jobs.

- Providing financial assistance to affected businesses: Offering financial assistance to businesses struggling due to tariff impacts.

- Promoting domestic production: Encouraging domestic production to reduce reliance on imports and increase competitiveness.

Conclusion: Understanding and Addressing Ontario's $14.6 Billion Deficit

Ontario's $14.6 billion deficit is a serious challenge with significant implications for the province's economic future. The impact of tariffs, both international and domestically imposed, has exacerbated this situation. Addressing this deficit requires a combination of fiscal responsibility measures and strategies to mitigate the negative effects of tariffs. By implementing effective policies, Ontario can foster economic growth, create jobs, and build a more resilient and sustainable economy. Stay informed about the evolving situation surrounding Ontario's $14.6 billion deficit and participate in the ongoing dialogue to find effective solutions for a more robust and resilient provincial economy.

Featured Posts

-

Mariners Vs Reds Mlb Game Prediction Picks And Betting Odds

May 17, 2025

Mariners Vs Reds Mlb Game Prediction Picks And Betting Odds

May 17, 2025 -

Analyzing The Giants And Mariners Injured Lists Before The April 4 6 Series

May 17, 2025

Analyzing The Giants And Mariners Injured Lists Before The April 4 6 Series

May 17, 2025 -

New York Knicks Mitchell Robinsons Post Surgery Return Season Debut Achieved

May 17, 2025

New York Knicks Mitchell Robinsons Post Surgery Return Season Debut Achieved

May 17, 2025 -

Moto Racing News Gncc Mx Sx Flat Track And Enduro Coverage

May 17, 2025

Moto Racing News Gncc Mx Sx Flat Track And Enduro Coverage

May 17, 2025 -

Josh Cavallo Breaking Barriers After Coming Out

May 17, 2025

Josh Cavallo Breaking Barriers After Coming Out

May 17, 2025

Latest Posts

-

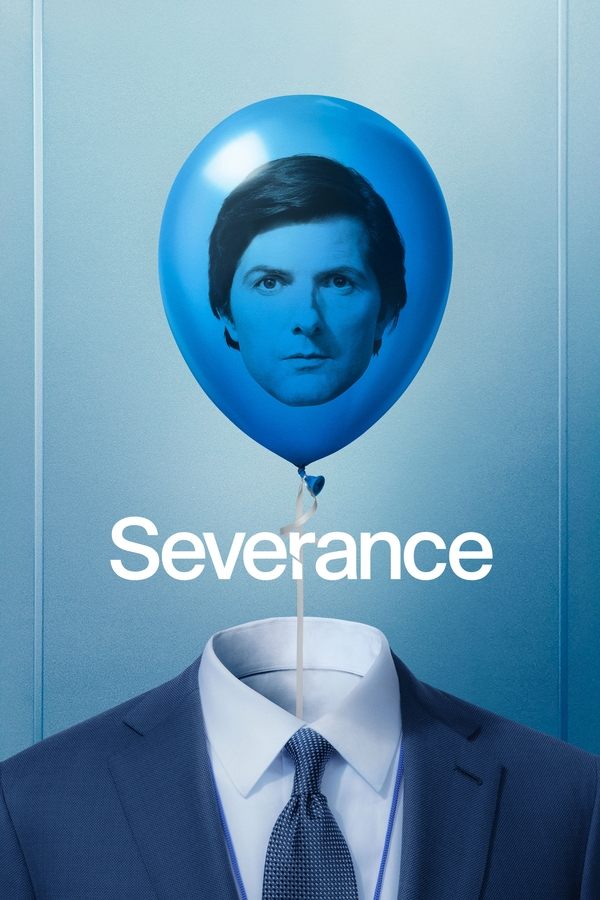

Severance Season 3 Renewal What We Know

May 17, 2025

Severance Season 3 Renewal What We Know

May 17, 2025 -

100 On Rotten Tomatoes Seth Rogens The Studio Makes History

May 17, 2025

100 On Rotten Tomatoes Seth Rogens The Studio Makes History

May 17, 2025 -

Severance And Game Of Thrones Gwendoline Christie On Embracing Challenging Roles

May 17, 2025

Severance And Game Of Thrones Gwendoline Christie On Embracing Challenging Roles

May 17, 2025 -

Severance Season 3 Will It Happen

May 17, 2025

Severance Season 3 Will It Happen

May 17, 2025 -

Seth Rogen Breaks Rotten Tomatoes Record The Studio Scores A Perfect 100

May 17, 2025

Seth Rogen Breaks Rotten Tomatoes Record The Studio Scores A Perfect 100

May 17, 2025