Ozempic And The Weight-Loss Market: Novo Nordisk's Strategic Missteps

Table of Contents

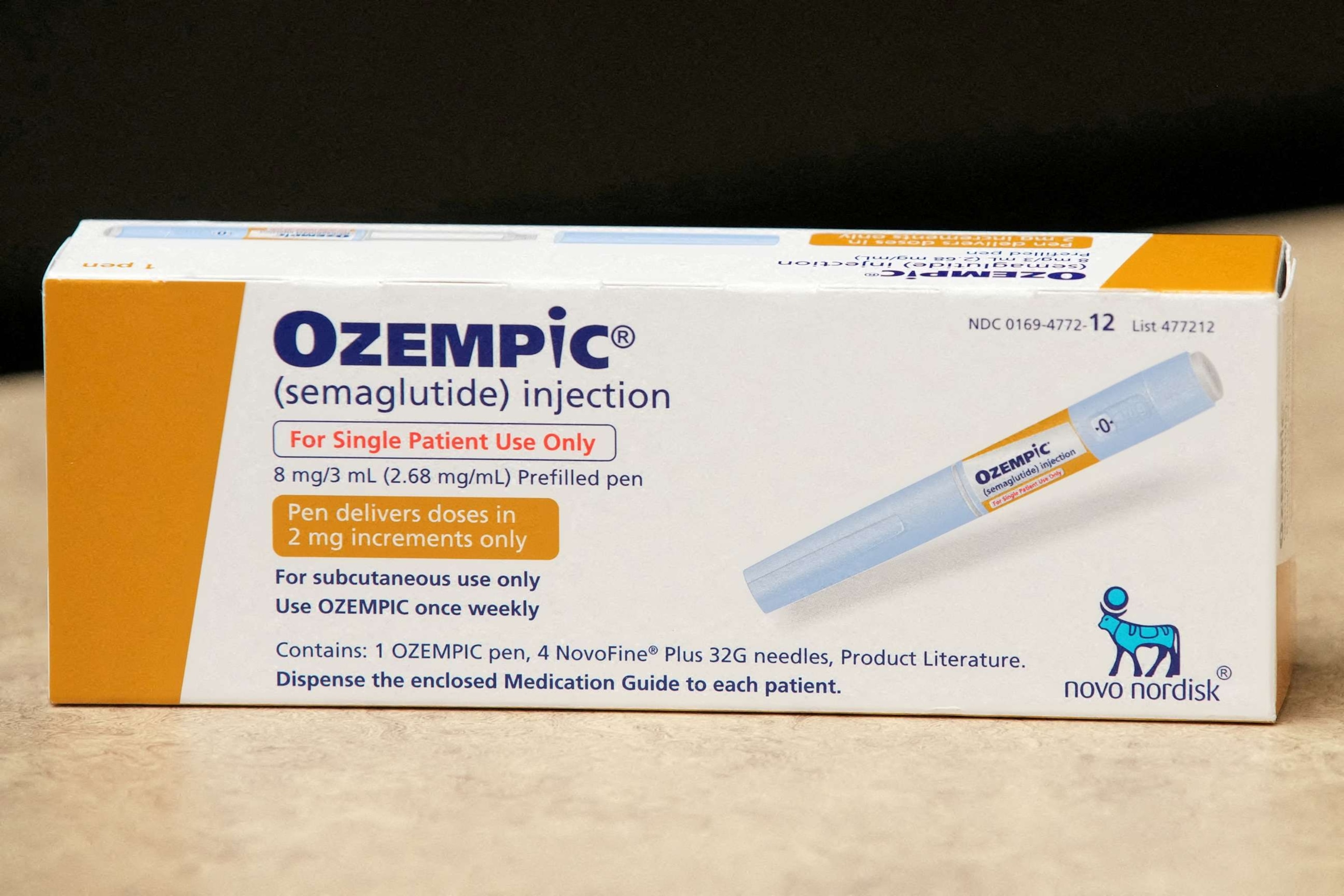

The meteoric rise of Ozempic in the weight-loss market has been both a triumph and a source of controversy for Novo Nordisk. While the drug's efficacy in managing type 2 diabetes and promoting significant weight loss is undeniable, the company's handling of its unprecedented popularity reveals potential strategic missteps that could impact its long-term success. This article examines those missteps, analyzing the factors contributing to the challenges Novo Nordisk faces in this rapidly evolving market. We will delve into the complexities of supply chain management, pricing strategies, and the increasingly competitive landscape of GLP-1 receptor agonists.

Unforeseen Demand and Supply Chain Issues

The success of Ozempic, a GLP-1 receptor agonist containing semaglutide, far exceeded Novo Nordisk's initial projections. This unexpected surge in demand, fueled by its off-label use for weight loss, exposed significant vulnerabilities in the company's supply chain.

The Unexpected Surge in Off-Label Use

The unexpectedly high demand for Ozempic for weight loss stemmed from several factors:

- Increased media attention: Extensive media coverage highlighted Ozempic's impressive weight-loss results, creating significant public awareness.

- Social media influence: Social media platforms amplified this awareness, with influencers and celebrities endorsing the drug, further driving demand.

- Lack of readily available alternatives: The relative lack of effective and widely accessible weight-loss treatments created a high demand for a drug demonstrably effective in promoting weight loss.

This resulted in demand vastly outstripping the manufacturing capacity, creating widespread shortages and impacting patients who rely on Ozempic for diabetes management. Many patients experienced difficulty accessing their prescription, leading to frustration and impacting their health.

Supply Chain Bottlenecks and Production Challenges

Novo Nordisk faced considerable difficulties in scaling up production to meet the unprecedented demand. Several factors contributed to these challenges:

- Manufacturing limitations: Existing manufacturing facilities were not designed to handle the exponentially increased demand.

- Raw material sourcing challenges: Securing sufficient quantities of raw materials needed for production proved difficult.

- Distribution logistics: Efficiently distributing the drug to meet the increased demand across diverse geographical regions presented considerable logistical hurdles.

- Difficulties in expanding production facilities: Expanding manufacturing capacity takes considerable time and investment, further exacerbating the supply issues.

These bottlenecks significantly impacted patient access to Ozempic and damaged Novo Nordisk's reputation, highlighting the need for robust and flexible supply chain strategies within the pharmaceutical industry.

Pricing Strategies and Accessibility Concerns

The high cost of Ozempic and its sister drug Wegovy, also containing semaglutide, has raised significant concerns about accessibility.

The High Cost of Ozempic and Wegovy

Novo Nordisk's pricing strategy for Ozempic and Wegovy has made these medications inaccessible to many individuals seeking weight-loss treatment.

- High out-of-pocket costs: The cost, even with insurance, is prohibitive for many patients.

- Limited insurance coverage: Many insurance plans have limited or no coverage for Ozempic and Wegovy, particularly for off-label use.

- Cost comparisons with alternative weight-loss treatments: Compared to other weight-loss options, the cost of Ozempic and Wegovy is substantially higher.

This raises ethical concerns about equitable access to a highly effective medication and its impact on the overall market reach. The high price point limits the potential patient pool significantly.

The Impact of Insurance Reimbursement Policies

Insurance reimbursement policies play a significant role in determining access to Ozempic and Wegovy.

- Varying insurance coverage across different plans: Coverage varies dramatically across different insurance providers and plans.

- Pre-authorization requirements: Many insurers require pre-authorization, adding another layer of complexity and potential delay for patients.

- The impact of formulary placement: The placement of Ozempic and Wegovy on a formulary (a list of approved drugs) significantly affects patient access and cost-sharing.

The disparity in access based on insurance coverage underscores the need for more equitable distribution strategies and discussions around fair pricing for life-altering medications.

Increased Competition and Market Dynamics

The success of Ozempic has attracted significant competition in the GLP-1 receptor agonist market.

The Emergence of Rival GLP-1 Receptor Agonists

Several pharmaceutical companies are developing and marketing similar GLP-1 receptor agonists, posing a challenge to Novo Nordisk's dominance.

- Mounjaro (Eli Lilly): Mounjaro, a competitor drug, is gaining significant traction in the market.

- Other emerging competitors: Several other companies are developing their own versions, further intensifying competition.

- The competitive landscape of the weight-loss market: The market is rapidly evolving with new drugs and therapeutic approaches emerging frequently.

Comparing efficacy, safety profiles, and pricing of these rival drugs reveals the dynamic nature of this space and highlights the need for Novo Nordisk to continually innovate and adapt.

Adapting to Evolving Regulatory and Marketing Landscapes

Novo Nordisk faces the challenge of navigating evolving regulatory landscapes and adapting its marketing strategies.

- FDA regulations: Strict FDA regulations govern the marketing and advertising of prescription medications, including GLP-1 receptor agonists.

- Marketing restrictions: Marketing Ozempic and Wegovy for weight loss is subject to significant restrictions.

- Public perception: Public perception and media narratives play a crucial role in shaping the market for weight-loss medications.

- Addressing safety concerns: Addressing potential safety concerns and side effects is critical for maintaining public trust and regulatory compliance.

Adapting its approach to remain competitive and maintain its position will require Novo Nordisk to remain agile and responsive to the ever-changing regulatory and marketing environments.

Conclusion

The rapid success of Ozempic in the weight-loss market presented both immense opportunities and significant challenges for Novo Nordisk. The company's response to the unforeseen surge in demand, coupled with its pricing strategies and increasing competition, highlights potential strategic missteps. Addressing supply chain issues, enhancing accessibility through improved pricing and insurance coverage, and proactively adapting to the evolving competitive landscape are crucial for Novo Nordisk to maintain its market leadership in the dynamic world of GLP-1 receptor agonists. Understanding the lessons learned from Ozempic's journey is vital for both Novo Nordisk and other pharmaceutical companies navigating this rapidly evolving market. The future of Ozempic and similar weight-loss medications depends on addressing these strategic challenges effectively. The continued success of Ozempic hinges on improved strategic decision-making in the years to come.

Featured Posts

-

San Diego Rain Total Rainfall Accumulation From Cbs 8 Com

May 30, 2025

San Diego Rain Total Rainfall Accumulation From Cbs 8 Com

May 30, 2025 -

Adu Mekanik Kawasaki W175 Vs Honda St 125 Dax Mana Yang Lebih Unggul

May 30, 2025

Adu Mekanik Kawasaki W175 Vs Honda St 125 Dax Mana Yang Lebih Unggul

May 30, 2025 -

100 000 Signatures Fans Call For Jon Jones Title Removal

May 30, 2025

100 000 Signatures Fans Call For Jon Jones Title Removal

May 30, 2025 -

Holder Vejret Vil Han Afvise Danmark Spaendingen Stiger

May 30, 2025

Holder Vejret Vil Han Afvise Danmark Spaendingen Stiger

May 30, 2025 -

Motor Cruiser Kawasaki Vulcan S 2025 Sentuhan Futuristik Di Indonesia

May 30, 2025

Motor Cruiser Kawasaki Vulcan S 2025 Sentuhan Futuristik Di Indonesia

May 30, 2025

Latest Posts

-

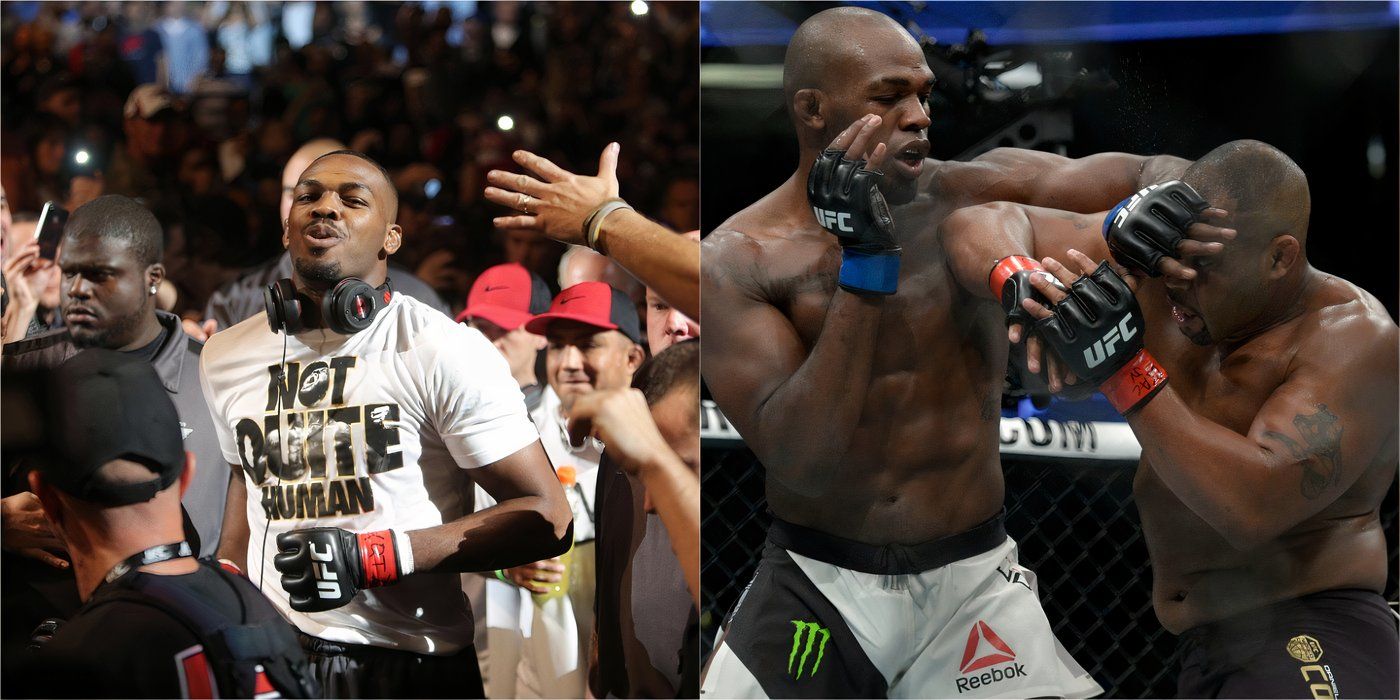

Health Impacts Of Canadian Wildfire Smoke On Minnesota

May 31, 2025

Health Impacts Of Canadian Wildfire Smoke On Minnesota

May 31, 2025 -

Dangerous Air Quality In Minnesota Due To Canadian Wildfires

May 31, 2025

Dangerous Air Quality In Minnesota Due To Canadian Wildfires

May 31, 2025 -

Canadian Wildfires Cause Dangerous Air In Minnesota

May 31, 2025

Canadian Wildfires Cause Dangerous Air In Minnesota

May 31, 2025 -

Eastern Manitoba Wildfires Rage Crews Struggle For Control

May 31, 2025

Eastern Manitoba Wildfires Rage Crews Struggle For Control

May 31, 2025 -

Homes Lost Lives Disrupted The Newfoundland Wildfire Crisis

May 31, 2025

Homes Lost Lives Disrupted The Newfoundland Wildfire Crisis

May 31, 2025