Pakistan Economic Crisis: IMF Review Of $1.3 Billion Aid Package And Geopolitical Factors

Table of Contents

The IMF's $1.3 Billion Aid Package: Conditions and Challenges

The IMF's $1.3 billion aid package is a lifeline for Pakistan, but it comes with stringent conditions designed to address the root causes of the financial crisis. The success of the package, and the future of the Pakistan economy, hinges on the government's ability to meet these demands.

Key Conditions Imposed by the IMF:

The IMF has imposed several key conditions as part of its bailout package. These include:

-

Fiscal consolidation measures: This involves increasing taxation and significantly reducing government spending. This means potentially unpopular measures like raising fuel prices and cutting subsidies on essential goods, directly impacting the daily lives of ordinary Pakistanis.

-

Currency devaluation: The Pakistani Rupee (PKR) is expected to depreciate further against the US dollar. While this can boost exports, it also leads to higher import costs and increased inflation, further impacting the cost of living.

-

Energy sector reforms: The IMF is pushing for improvements in the efficiency of Pakistan's energy sector and a reduction in costly subsidies. This includes tackling issues of energy theft and improving the overall infrastructure.

-

Structural reforms: This encompasses a wide range of measures aimed at improving governance, tackling corruption, and creating a more favorable business environment to attract foreign investment. This involves complex legal and administrative changes.

-

Specific examples and impact: Increased fuel prices have already led to a surge in transportation costs and inflation, disproportionately affecting lower-income groups. Tax increases have similarly burdened many citizens, leading to public discontent.

Challenges in Meeting IMF Conditions:

Meeting the IMF's conditions presents numerous challenges for the Pakistani government:

-

Political instability: Frequent changes in government and political infighting can hinder the implementation of crucial reforms. A lack of political consensus makes it difficult to enact and enforce unpopular but necessary measures.

-

Public resistance: Austerity measures, such as increased taxes and reduced subsidies, often trigger public protests and social unrest. This can further destabilize the already fragile political landscape.

-

External debt burden: Pakistan's already substantial external debt makes it difficult to service existing loans and allocate sufficient resources to meet the IMF's conditions. Repaying existing debt consumes a significant portion of the national budget.

-

Potential consequences of failure: Failure to meet the IMF's conditions could lead to a deeper economic crisis, potentially resulting in a sovereign debt default and further economic instability. This would have severe consequences for the Pakistani population and regional stability.

Geopolitical Factors Exacerbating the Crisis

The Pakistan economic crisis is not solely a domestic issue; geopolitical factors significantly contribute to the nation's economic woes.

Impact of the Russia-Ukraine War:

The ongoing conflict has had a profound impact on Pakistan's economy:

-

Increased global commodity prices: The war disrupted global supply chains, leading to a surge in prices for essential commodities such as wheat, oil, and fertilizer, increasing Pakistan's import bill dramatically.

-

Supply chain disruptions: The war further exacerbated existing supply chain issues, impacting various sectors of the Pakistani economy, from manufacturing to agriculture.

-

Reduced foreign investment: Global uncertainty stemming from the war has dampened investor confidence, resulting in decreased foreign direct investment (FDI) in Pakistan.

-

Specific effects: The war has significantly contributed to inflation and widened Pakistan's trade deficit, putting further pressure on its already strained economy.

Regional Instability and its Economic Consequences:

Regional instability also plays a crucial role in Pakistan's economic predicament:

-

Tensions with neighboring countries: Strained relationships with neighboring countries can negatively impact trade and investment flows. Political tensions can lead to trade restrictions and limit economic cooperation.

-

Internal security challenges: Internal security concerns, including terrorism and insurgency, deter foreign investment and hamper economic activity. This impacts investor confidence and the overall business environment.

-

Impact on key sectors: Regional conflicts negatively affect Pakistan's tourism sector and discourage foreign direct investment, hindering economic growth.

Potential Outcomes and Future Outlook for the Pakistani Economy

The future trajectory of the Pakistan economy depends on several factors, leading to a range of potential outcomes.

Success Scenarios:

Successful implementation of IMF-mandated reforms could lead to macroeconomic stabilization, gradual economic recovery, and improved investor confidence. This involves sustained political stability and effective implementation of structural reforms.

Failure Scenarios:

Failure to meet IMF conditions could result in a deeper economic crisis, potentially leading to a sovereign debt default. This could trigger severe social unrest and further political instability.

The Role of Foreign Aid and Investment:

Securing additional financial assistance from international partners and attracting significant foreign investment are crucial for Pakistan's economic recovery. This requires addressing concerns about political risk and improving the business environment.

- Long-term growth projections: Successful reform implementation could lead to sustainable long-term economic growth, while failure could lead to prolonged economic hardship and instability. The possibility of social unrest is a significant concern in the latter scenario.

Conclusion

Pakistan's economic crisis is a multifaceted problem stemming from both domestic policies and external geopolitical factors. The IMF's $1.3 billion aid package offers a critical opportunity for stabilization, but its success hinges on effective governance, the implementation of challenging reforms, and navigating the complex geopolitical landscape. The outcome will have far-reaching implications for Pakistan's stability and the broader regional context. Understanding the complexities of the Pakistan economic crisis, including the IMF review and geopolitical influences, is essential for informed decision-making. Staying informed about further developments in the Pakistan economic crisis, including updates on the IMF loan and its impact on the Pakistan economy, is crucial. Continue to follow reputable news sources and economic analysis for the latest updates.

Featured Posts

-

Attorney Generals Fentanyl Display A Deeper Look

May 10, 2025

Attorney Generals Fentanyl Display A Deeper Look

May 10, 2025 -

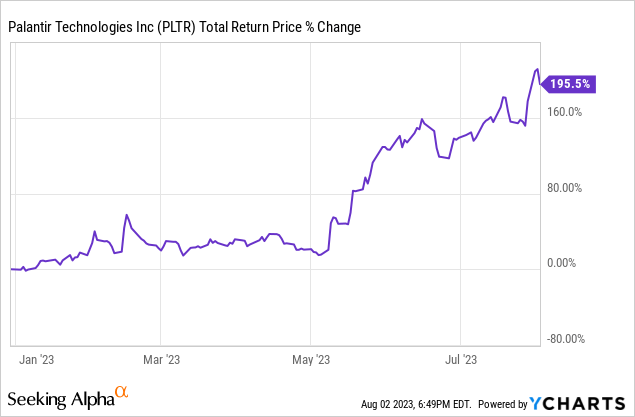

Should You Invest In Palantir Before May 5th A Wall Street Perspective

May 10, 2025

Should You Invest In Palantir Before May 5th A Wall Street Perspective

May 10, 2025 -

Treasury Official Us Debt Limit Measures Could Expire In August

May 10, 2025

Treasury Official Us Debt Limit Measures Could Expire In August

May 10, 2025 -

Racist Stabbing Womans Unprovoked Attack Leaves Man Dead

May 10, 2025

Racist Stabbing Womans Unprovoked Attack Leaves Man Dead

May 10, 2025 -

Nyt Strands Answers Game 402 Wednesday April 9

May 10, 2025

Nyt Strands Answers Game 402 Wednesday April 9

May 10, 2025