Pakistan, Sri Lanka, Bangladesh To Strengthen Capital Market Ties

Table of Contents

Enhanced Investment Opportunities through Regional Collaboration

Closer ties between the capital markets of Pakistan, Sri Lanka, and Bangladesh will create a wealth of new investment avenues for businesses across the region. This enhanced connectivity will lead to a more dynamic and integrated South Asian business environment. The benefits are numerous:

- Increased access to capital for businesses: Companies will have a wider pool of investors to tap into, facilitating expansion and innovation. This increased liquidity will be particularly beneficial for small and medium-sized enterprises (SMEs) often underserved by traditional financial institutions.

- Diversification of investment portfolios: Investors will have access to a broader range of investment options, reducing risk and improving returns. This diversification across different markets mitigates the impact of local economic downturns.

- Reduced reliance on traditional investment sources: The region will be less dependent on external funding, fostering greater economic independence and resilience.

- Opportunities for joint ventures and partnerships: Cross-border collaborations will become easier, fostering innovation and shared expertise. This will lead to more competitive regional industries.

- Growth of regional financial markets: The combined market size will attract more international investors, increasing liquidity and depth within the South Asian capital markets.

This increased Foreign Direct Investment (FDI) and portfolio investment will drive regional economic integration and create significant investment opportunities.

Facilitating Cross-Border Trading and Investment

To realize the full potential of this initiative, several measures are crucial to simplify cross-border transactions and boost investor confidence. These include:

- Harmonization of regulations and standards: Aligning regulations and accounting standards across the three countries will reduce ambiguity and transaction costs. This will improve transparency and increase trust amongst investors.

- Development of efficient clearing and settlement mechanisms: Modern, efficient systems for processing trades will enhance speed, accuracy, and security of transactions. This will directly reduce the time it takes to finalize investments.

- Improved information sharing and communication: A robust system for sharing market data and information will enhance transparency and promote informed decision-making. This is crucial for investor confidence.

- Strengthening regulatory cooperation among the three countries' securities commissions: Closer collaboration between regulatory bodies is necessary to ensure consistent oversight and investor protection. This coordination will prevent regulatory arbitrage and ensure a fair market.

- Establishment of a common platform for trading securities: A unified platform could significantly simplify cross-border trading, reducing costs and enhancing efficiency.

These measures will enhance cross-border trading and create a more accessible and attractive investment landscape within South Asian trade.

Promoting Regional Financial Stability and Resilience

Closer collaboration between Pakistan, Sri Lanka, and Bangladesh's financial systems will bolster regional stability and mitigate various risks. This cooperation will foster greater resilience against external shocks. Key areas of collaboration include:

- Sharing of best practices in risk management: Sharing knowledge and expertise in risk management techniques will enhance the overall resilience of the regional financial system.

- Joint efforts to combat financial crime: Coordinated efforts to combat money laundering, terrorist financing, and other financial crimes will protect the integrity of the markets.

- Cooperation in crisis management: A collaborative framework for crisis management will enable a coordinated response to financial shocks, minimizing their impact.

- Development of regional early warning systems: Early warning systems can help identify potential vulnerabilities and allow for proactive measures to prevent or mitigate crises.

- Increased resilience against external shocks: A more integrated and resilient financial system will be better equipped to withstand external shocks, such as global economic downturns.

This enhanced financial stability will improve investor confidence and attract increased investment into the region.

Potential Challenges and Mitigation Strategies

Despite the significant opportunities, several challenges need to be addressed to ensure the success of this initiative:

- Political and economic instability in the region: Political and economic volatility in any of the three countries could negatively impact investor confidence and market stability. Addressing these underlying issues is crucial.

- Differences in regulatory frameworks: Significant differences in legal and regulatory frameworks could create obstacles to cross-border transactions. Harmonization efforts are vital.

- Concerns about investor protection: Robust investor protection mechanisms are needed to build investor confidence and attract foreign capital. This will require strengthening legal frameworks and enforcing them effectively.

- Need for capacity building and technical assistance: Capacity building initiatives are crucial to develop the necessary expertise and infrastructure to support the integrated capital markets.

- Addressing infrastructural limitations: Improvements in IT infrastructure and communication networks are essential to support efficient cross-border transactions.

Addressing these challenges through proactive measures will ensure the initiative's success and foster sustainable growth.

Conclusion: Building a Stronger Future through South Asian Capital Market Integration

Strengthening capital market ties between Pakistan, Sri Lanka, and Bangladesh offers substantial benefits, including increased investment, robust economic growth, and greater regional stability. While challenges exist, addressing them proactively will pave the way for a more integrated and prosperous South Asia. This initiative represents a significant opportunity to unlock the region's economic potential and create a more resilient and interconnected future. We encourage readers to learn more about the investment opportunities in this dynamic region and follow the progress of this important initiative to strengthen South Asian capital market ties. [Link to relevant resource 1] [Link to relevant resource 2]

Featured Posts

-

Review St Albert Dinner Theatres High Energy Farce

May 10, 2025

Review St Albert Dinner Theatres High Energy Farce

May 10, 2025 -

Palantir Stock Forecast Revised Understanding The Recent Market Rally

May 10, 2025

Palantir Stock Forecast Revised Understanding The Recent Market Rally

May 10, 2025 -

Exploring The Business Acumen Of Samuel Dickson A Canadian Lumber Baron

May 10, 2025

Exploring The Business Acumen Of Samuel Dickson A Canadian Lumber Baron

May 10, 2025 -

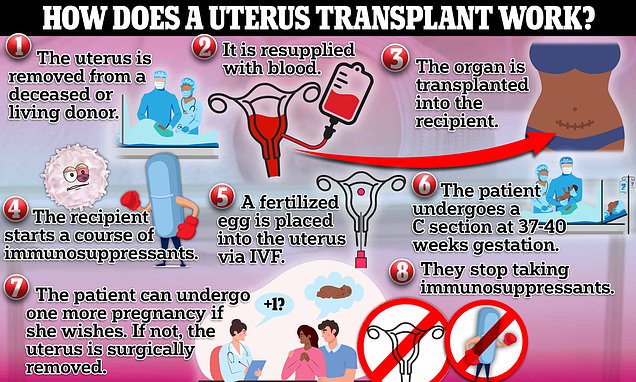

Transgender Women And Pregnancy A Community Activists Proposal For Uterine Transplants

May 10, 2025

Transgender Women And Pregnancy A Community Activists Proposal For Uterine Transplants

May 10, 2025 -

April 10th Nyt Strands Solutions Game 403

May 10, 2025

April 10th Nyt Strands Solutions Game 403

May 10, 2025