Pakistan Stock Exchange Offline: Analysis Of Current Market Volatility

Table of Contents

Macroeconomic Factors Driving PSX Volatility

Several interconnected macroeconomic factors have contributed to the recent volatility on the PSX. Understanding these factors is crucial for grasping the current market dynamics and anticipating future trends.

Political Instability and its Impact

Political uncertainty significantly impacts investor confidence. Periods of political instability often lead to decreased foreign investment as international investors seek safer, more stable markets. This capital flight weakens the Pakistani Rupee and puts further pressure on the already fragile economy.

- Decreased foreign investment: Political risk discourages foreign direct investment (FDI) and portfolio investment, reducing the influx of much-needed capital.

- Capital flight: Investors withdraw their funds from the PSX, further reducing liquidity and exacerbating market declines.

- Weakening rupee: Political instability often weakens the Pakistani Rupee against major currencies, increasing the cost of imports and fueling inflation. This further discourages investment and impacts the profitability of businesses listed on the PSX.

Global Economic Headwinds and their Ripple Effect on Pakistan

Pakistan's economy is susceptible to global economic shocks. Global inflation, recession fears, and aggressive interest rate hikes by major central banks have created a ripple effect, impacting the PSX significantly.

- Impact of rising energy prices: Pakistan's reliance on energy imports makes it particularly vulnerable to global price fluctuations. Rising energy costs increase production costs for businesses, impacting profitability and investor sentiment.

- Dependence on imports: A significant portion of Pakistan's consumption relies on imports. A weakening rupee increases the cost of these imports, further fueling inflation and negatively impacting the PSX.

- Debt servicing challenges: The increasing cost of servicing Pakistan's external debt further strains the economy, impacting the government's ability to implement supportive economic policies.

Domestic Economic Challenges

High inflation, a persistent current account deficit, and significant fiscal imbalances have all played a crucial role in the PSX downturn. These domestic challenges compound the impact of global economic headwinds.

- Impact of monetary policy changes: While intended to curb inflation, aggressive interest rate hikes can also stifle economic growth and negatively impact business performance, leading to lower stock prices.

- Challenges in tax revenue collection: Inefficient tax collection mechanisms hinder the government's ability to fund essential services and reduce the fiscal deficit, creating further economic uncertainty.

- Rising debt levels: High levels of public debt limit the government's fiscal flexibility and increase the risk of a sovereign debt crisis, further dampening investor confidence.

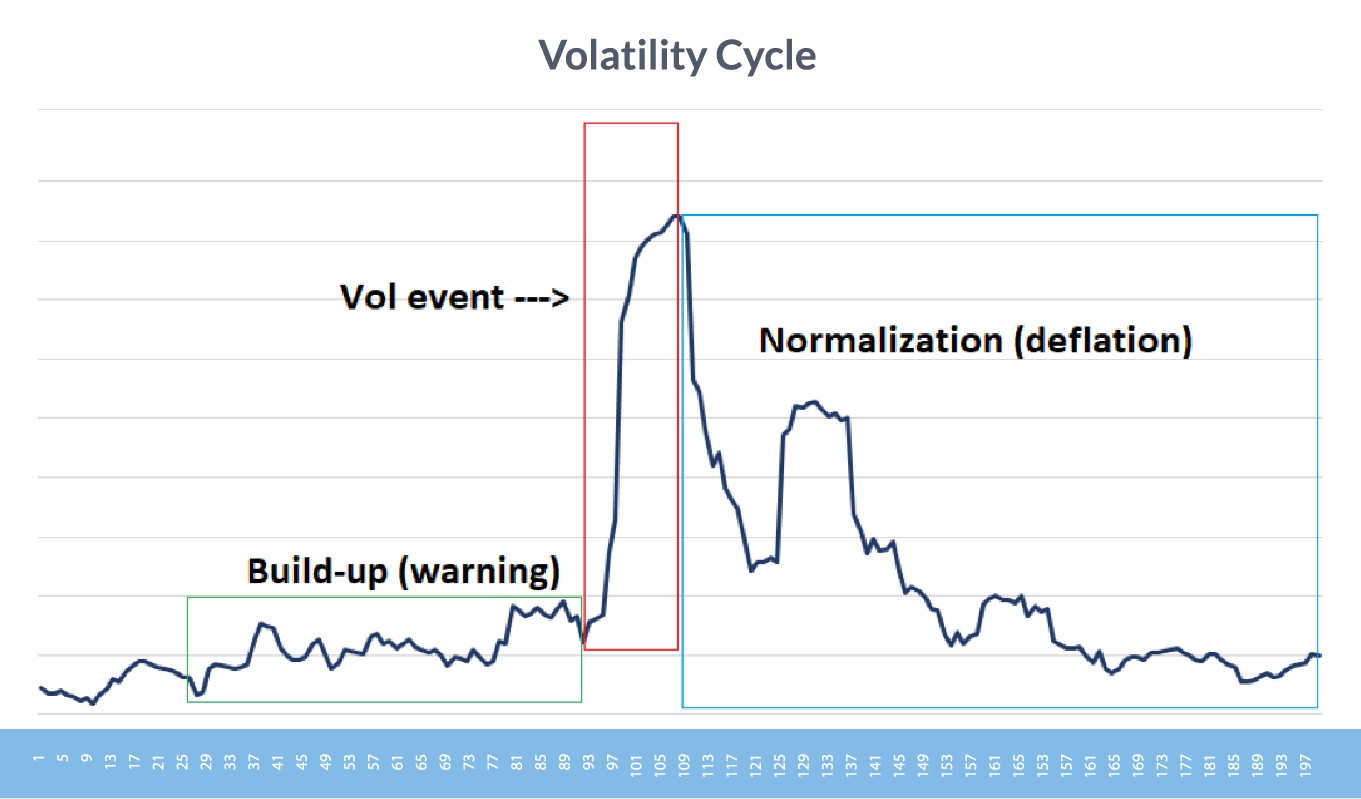

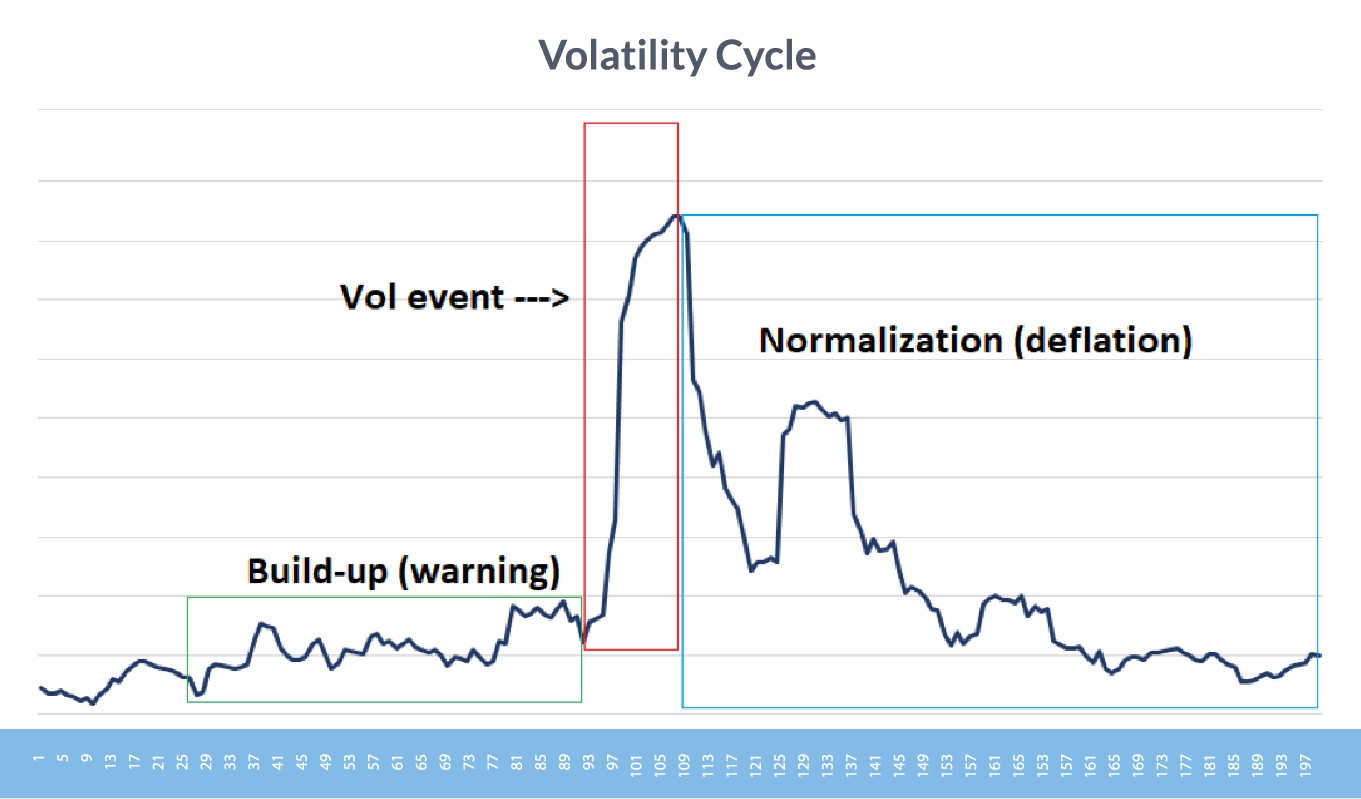

The Impact of PSX Offline Trading Periods

Periods of offline trading on the PSX have significant consequences for both investor sentiment and market liquidity.

Investor Sentiment and Confidence

Offline trading periods increase uncertainty and trigger panic selling, leading to a further decline in market confidence. The lack of transparency during such periods exacerbates the psychological impact on investors.

- Increased uncertainty: The inability to trade freely creates uncertainty about the true value of assets, prompting some investors to sell their holdings to minimize potential losses.

- Panic selling: Fear and uncertainty can lead to a wave of panic selling, driving down prices further.

- Loss of potential gains: Investors miss opportunities to buy low and sell high during offline trading periods.

Liquidity and Trading Volume

Temporary closures severely impact market liquidity and trading volume. This makes it challenging for investors to buy or sell shares at desired prices.

- Difficulty in buying or selling shares: Offline trading restricts the ability of investors to execute trades, potentially leading to missed opportunities or forced sales at unfavorable prices.

- Missed opportunities: Investors might miss out on buying undervalued stocks or selling overvalued ones during periods of offline trading.

- Price manipulation concerns: The lack of transparency during offline trading periods raises concerns about potential price manipulation.

Potential Future Scenarios and Mitigation Strategies

The future trajectory of the PSX hinges on effective government intervention, investor behavior, and robust risk management strategies.

Government Interventions and Policy Changes

The government needs to implement comprehensive policies to stabilize the PSX. This may involve a combination of fiscal stimulus measures and monetary policy adjustments.

- Fiscal stimulus measures: Targeted fiscal stimulus can boost economic activity and investor confidence.

- Monetary policy adjustments: Careful adjustments to interest rates can balance inflation control with the need to support economic growth.

- Structural reforms: Implementing structural reforms to improve governance, transparency, and ease of doing business can attract foreign investment and boost long-term growth.

Investor Behavior and Risk Management

Investors need to adapt their strategies to navigate the current volatility. Diversification and robust risk management are crucial.

- Long-term investment strategies: Focusing on long-term investment goals rather than short-term gains can help mitigate the impact of market volatility.

- Diversifying portfolios: Spreading investments across different asset classes and sectors reduces overall portfolio risk.

- Risk assessment tools: Utilizing risk assessment tools and seeking professional financial advice can help investors make informed decisions.

Conclusion

The Pakistan Stock Exchange's recent volatility, including periods of offline trading, reflects the complex interaction of macroeconomic factors, domestic challenges, and investor sentiment. Understanding these elements is vital for navigating the market and making informed investment choices. The PSX's future depends on effective government policies, investor confidence, and robust risk management. By carefully analyzing these factors and adapting investment approaches, investors can mitigate risks and potentially benefit from future opportunities within the Pakistani stock market. Stay informed about the evolving situation of the Pakistan Stock Exchange and its impact on market volatility to make well-informed investment decisions.

Featured Posts

-

The Effects Of Trumps Executive Orders On Transgender People

May 10, 2025

The Effects Of Trumps Executive Orders On Transgender People

May 10, 2025 -

27 Saves By Hill Power Vegas Golden Knights Past Columbus Blue Jackets

May 10, 2025

27 Saves By Hill Power Vegas Golden Knights Past Columbus Blue Jackets

May 10, 2025 -

Indian Stock Market Update Sensex Gains Niftys Positive Trend

May 10, 2025

Indian Stock Market Update Sensex Gains Niftys Positive Trend

May 10, 2025 -

X Blocks Turkish Mayors Social Media Opposition Protest Fallout

May 10, 2025

X Blocks Turkish Mayors Social Media Opposition Protest Fallout

May 10, 2025 -

Aoc Vs Pirro A Fact Check Showdown On Fox News

May 10, 2025

Aoc Vs Pirro A Fact Check Showdown On Fox News

May 10, 2025