Pakistan's IMF Bailout: $1.3 Billion Package Under Review Amidst India Tensions

Table of Contents

The $1.3 Billion IMF Bailout: Details and Conditions

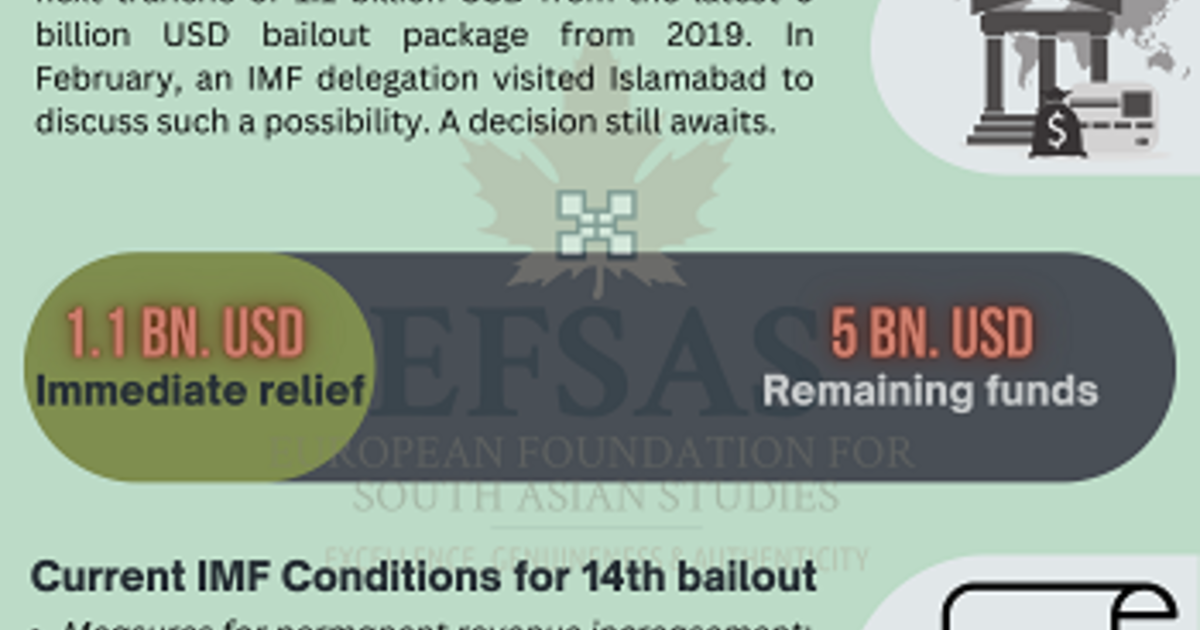

The $1.3 billion IMF bailout package represents a lifeline for Pakistan, aiming to stabilize its teetering economy and prevent a potential default. However, this assistance comes with a series of stringent conditions designed to ensure fiscal responsibility and long-term economic sustainability. The IMF's demands are far-reaching, impacting various sectors of the Pakistani economy.

- Fiscal consolidation measures: These include increased taxation, particularly on higher earners and businesses, and a significant reduction in government spending. This will require difficult choices regarding public sector subsidies and social programs.

- Structural reforms: The IMF insists on improving governance structures, tackling endemic corruption, and significantly enhancing tax collection efficiency. This involves strengthening institutions and implementing robust anti-corruption measures.

- Exchange rate adjustments: The Pakistani Rupee has been under considerable pressure. The IMF will likely push for a managed devaluation to improve export competitiveness and reduce reliance on imports. This could lead to increased inflation in the short term.

- Energy sector reforms: Pakistan grapples with a substantial circular debt in its energy sector. The IMF bailout conditions include addressing this debt and implementing measures to improve energy efficiency and reduce reliance on costly imported fuels.

Geopolitical Implications: India-Pakistan Tensions and the Bailout

The ongoing tensions between India and Pakistan significantly complicate Pakistan's ability to secure and implement the IMF bailout. The precarious security situation diverts resources and impacts investor confidence.

- Military spending constraints: The need for significant defense spending puts pressure on the government's ability to meet the IMF's fiscal consolidation targets. Balancing national security with economic reforms is a major challenge.

- Foreign investment hesitation: Geopolitical instability deters foreign direct investment (FDI), which is crucial for economic growth and for repaying the IMF loan. Investors are hesitant to commit capital to an environment perceived as risky.

- International pressure: Global powers exert considerable influence on the bailout negotiations. The international community's stance on the India-Pakistan conflict indirectly influences the terms and conditions of the bailout package.

The Role of China and Other International Actors

China, a key economic partner of Pakistan, plays a significant role in this situation. Other international lenders also have a stake in the outcome.

- China's financial assistance: China has provided substantial financial assistance to Pakistan in the past and is expected to continue supporting the country, even as it navigates the IMF's conditions. This support might come in the form of loans or investments.

- Other international lenders: The World Bank and the Asian Development Bank may also provide additional financial assistance to Pakistan, potentially complementing the IMF bailout and supporting specific reform initiatives.

- Geopolitical maneuvering: Both China and other international actors use the situation strategically. Their involvement, financial and political, is interwoven with their own broader geopolitical objectives in the region.

Potential Economic Consequences for Pakistan

The IMF bailout offers both opportunities and risks for the Pakistani economy.

- Short-term pain, long-term gain?: The initial implementation of the IMF's conditions may lead to short-term economic hardship, including potential increases in inflation and unemployment. However, the long-term goal is to stabilize the economy and create sustainable growth.

- Inflation and poverty: The devaluation of the Pakistani Rupee and fiscal austerity measures could exacerbate inflation and increase poverty levels in the short-term. Targeted social safety nets will be critical to mitigate the impact on vulnerable populations.

- Economic growth prospects: Successful implementation of the IMF's conditions could lead to improved macroeconomic stability, attract more FDI, and foster long-term economic growth. However, the success hinges upon Pakistan’s ability to implement the conditions effectively.

Conclusion

Pakistan's $1.3 billion IMF bailout package is a critical step in tackling the nation's economic crisis. However, the success of this bailout heavily depends on fulfilling the stringent conditions while navigating the complex geopolitical landscape, particularly the ongoing tensions with India. While the package offers a pathway toward economic stability, significant challenges remain. Understanding the nuances of this Pakistan IMF bailout, including its conditions, geopolitical implications, and potential consequences, is vital for comprehending the future of Pakistan's economy. Stay informed about further developments in the Pakistan IMF bailout situation to gain a clearer understanding of its effects on the nation's economic future.

Featured Posts

-

Red Wings Playoff Push Takes Hit Following Loss To Vegas

May 10, 2025

Red Wings Playoff Push Takes Hit Following Loss To Vegas

May 10, 2025 -

9 Maya V Kieve Kto Iz Soyuznikov Ukrainy Priedet

May 10, 2025

9 Maya V Kieve Kto Iz Soyuznikov Ukrainy Priedet

May 10, 2025 -

Luis Enriques Psg Transformation How They Won The Ligue 1 Title

May 10, 2025

Luis Enriques Psg Transformation How They Won The Ligue 1 Title

May 10, 2025 -

West Hams 25m Financial Gap How Will They Fill It

May 10, 2025

West Hams 25m Financial Gap How Will They Fill It

May 10, 2025 -

Jogsertes Floridaban Transznemu No Letartoztatasa Noi Mosdo Miatt

May 10, 2025

Jogsertes Floridaban Transznemu No Letartoztatasa Noi Mosdo Miatt

May 10, 2025