Pakistan's Volatile Market: PSX Portal Downtime And Current Events

Table of Contents

Recent PSX Portal Downtime: Causes and Consequences

The recent PSX portal downtime has brought the issue of Pakistan Stock Exchange volatility sharply into focus. Understanding the causes and consequences of these outages is crucial for building investor confidence and ensuring market stability.

Technical Glitches vs. Overwhelming Traffic

PSX portal downtime can stem from various sources. Technical glitches, ranging from server issues to software bugs, can disrupt trading activities. Conversely, unexpectedly high trading volumes can overwhelm the system's capacity, leading to temporary outages. Cyberattacks also pose a significant threat, potentially causing prolonged disruptions and data breaches.

The impact on investors is substantial. Downtime prevents trading, leading to missed opportunities and potential financial losses. Investors might be unable to buy or sell shares at desired prices, affecting their portfolio performance and potentially resulting in significant losses depending on market movements during the outage.

The PSX's response to downtime is a crucial factor in managing investor confidence. Clear and timely communication with investors is paramount, outlining the nature of the problem, the expected resolution time, and measures taken to prevent future occurrences. A lack of transparency can exacerbate anxieties and fuel negative market sentiment.

- Examples of previous downtime incidents: [Insert dates and brief descriptions of past PSX downtime events].

- Duration of outages: [Insert typical duration of past outages].

- Official statements released by the PSX: [Link to official PSX statements regarding downtime].

Regulatory Scrutiny and Market Confidence

Regulatory bodies play a crucial role in ensuring the stability and integrity of the PSX. Their response to downtime incidents and their efforts to prevent future occurrences significantly impact investor confidence. Swift investigations into the causes of downtime and the implementation of robust measures to enhance system resilience are essential.

The impact of downtime on investor confidence is profound. Repeated outages erode trust in the market's efficiency and reliability, potentially leading to reduced market liquidity and impacting foreign investment. Negative media coverage and public perception further fuel this downward spiral. Conversely, a decisive and transparent response from the PSX and regulatory bodies can help mitigate negative sentiment.

- Statements from regulatory bodies: [Link to statements from relevant regulatory bodies].

- Investor reactions to the downtime: [Summarize reactions from investor forums, news articles, etc.].

- Impact on foreign investment: [Discuss potential impact on foreign direct investment (FDI) in Pakistan].

Factors Contributing to PSX Volatility

Pakistan Stock Exchange volatility is a complex issue influenced by a multitude of interacting factors, both domestic and international. Understanding these contributing factors is crucial for investors seeking to navigate the market effectively.

Macroeconomic Instability

Pakistan's economy faces significant macroeconomic challenges that directly impact PSX performance. High inflation erodes purchasing power, currency devaluation increases import costs, and political uncertainty creates an unstable investment climate. These factors collectively influence investor sentiment and lead to market fluctuations.

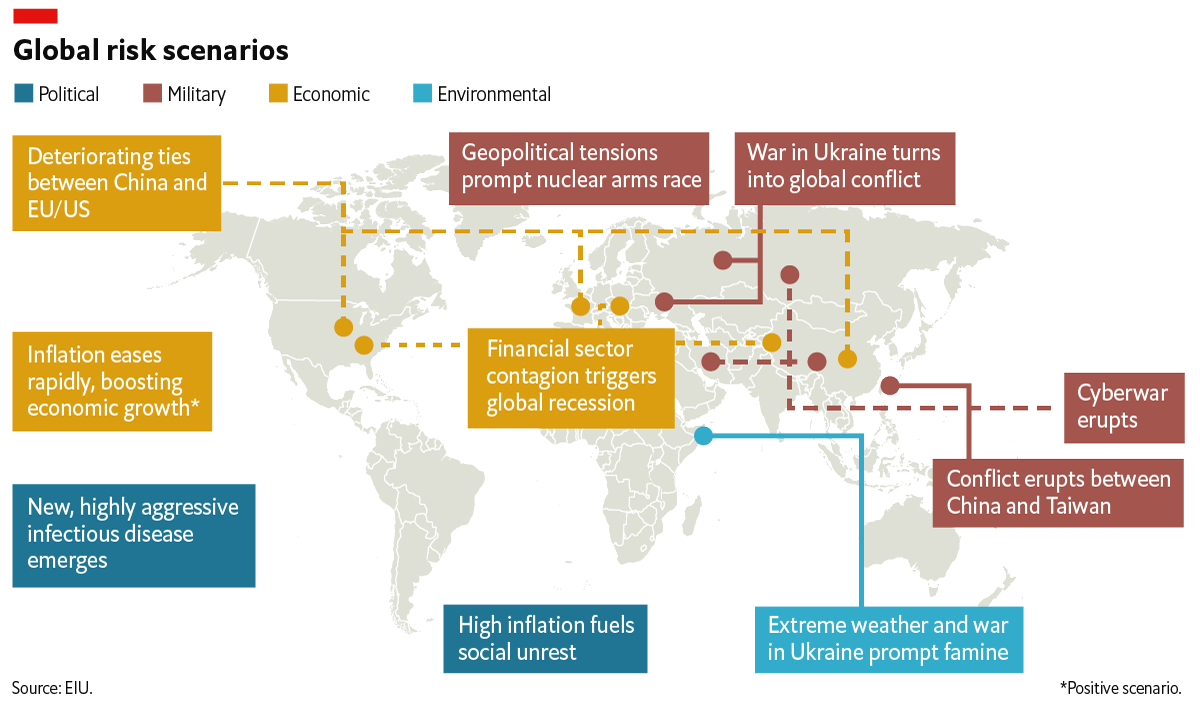

External factors such as global economic downturns and geopolitical events also play a significant role. Global economic shocks can trigger capital flight from emerging markets like Pakistan, putting downward pressure on stock prices. Similarly, international events impacting Pakistan’s trade relations or foreign investment flows can exacerbate market instability. Government policies, including monetary and fiscal policies, also exert a considerable influence on investor confidence and market performance.

- Key economic indicators: [Mention key indicators like inflation rate, currency exchange rate, and GDP growth].

- Recent policy changes: [Highlight recent government policies and their impact on the PSX].

- Effect on stock prices: [Analyze the correlation between economic indicators and stock market performance].

Geopolitical Risks and Security Concerns

Geopolitical risks and security concerns significantly influence investor sentiment and Pakistan Stock Exchange volatility. Regional conflicts, political instability, and security incidents can create uncertainty, deterring both domestic and foreign investment.

Terrorism and related security concerns also negatively impact investor confidence. The perception of risk associated with investing in a region with heightened security threats can lead to capital flight and depress stock prices. This is particularly true for foreign investors who may have higher risk aversion thresholds.

- Recent geopolitical events: [Mention recent geopolitical events and their impact on the PSX].

- Security incidents: [Highlight any recent security incidents and their impact on market sentiment].

- Effect on market indices: [Analyze the correlation between security concerns and fluctuations in market indices].

Strategies for Navigating PSX Volatility

Successfully navigating Pakistan Stock Exchange volatility requires a well-defined investment strategy that incorporates diversification, risk management, and a commitment to staying informed.

Diversification and Risk Management

Diversification is a fundamental principle of risk management. Spreading investments across different asset classes (e.g., stocks, bonds, real estate) reduces the impact of any single asset's underperformance. Within the PSX, diversifying across different sectors and companies minimizes the risk associated with investing in a single sector or company.

Effective risk management involves understanding your risk tolerance and implementing strategies to protect your investments during periods of market uncertainty. This includes setting stop-loss orders to limit potential losses and diversifying investment holdings.

- Different asset classes: [List diverse asset classes and their suitability for different risk profiles].

- Hedging strategies: [Briefly explain hedging techniques relevant to the PSX].

- Risk assessment tools: [Mention resources available for risk assessment].

Staying Informed and Monitoring Market Trends

Staying informed about PSX news and market trends is crucial for making informed investment decisions. Reliable financial news sources provide valuable insights into economic conditions, regulatory changes, and geopolitical developments.

Effectively monitoring key market indicators and economic data enables investors to anticipate potential market shifts and adjust their portfolios accordingly. Utilizing market analysis tools can further enhance understanding of market dynamics and inform investment strategies.

- Recommended financial news sources: [List reputable Pakistani and international financial news outlets].

- Key market indicators to track: [Mention key indicators like the KSE-100 index, trading volume, and investor sentiment].

- Tools for market analysis: [Mention available online tools and resources for market analysis].

Conclusion

The Pakistan Stock Exchange's recent volatility and instances of PSX portal downtime underscore the multifaceted challenges impacting the market. Macroeconomic instability, geopolitical risks, and technical issues all contribute to the dynamic and often unpredictable nature of the PSX. Investors need to adopt robust risk management strategies, diversify their portfolios, and remain diligently informed about market trends to effectively navigate this volatile environment. Understanding the factors contributing to PSX volatility is crucial for making informed investment decisions and mitigating potential losses. By consistently monitoring the PSX and staying updated on market developments, investors can better position themselves for success amidst Pakistan Stock Exchange volatility. Continue to monitor the PSX and its related news to make sound investment choices and mitigate the risks associated with Pakistan Stock Exchange volatility.

Featured Posts

-

Objavena Slovenska Dvojnicka Dakoty Johnson Pozrite Si Ich Porovnanie

May 09, 2025

Objavena Slovenska Dvojnicka Dakoty Johnson Pozrite Si Ich Porovnanie

May 09, 2025 -

Young Thugs Loyalty Vow To Mariah The Scientist New Snippet Surfaces

May 09, 2025

Young Thugs Loyalty Vow To Mariah The Scientist New Snippet Surfaces

May 09, 2025 -

Stivn King Na Netflix Ochakvame Rimeyk

May 09, 2025

Stivn King Na Netflix Ochakvame Rimeyk

May 09, 2025 -

Spac Stock Frenzy Should You Invest In This Micro Strategy Competitor

May 09, 2025

Spac Stock Frenzy Should You Invest In This Micro Strategy Competitor

May 09, 2025 -

Greenland And Denmark Trumps Influence And The Shifting Geopolitical Landscape

May 09, 2025

Greenland And Denmark Trumps Influence And The Shifting Geopolitical Landscape

May 09, 2025