Palantir Plunges 30%: Investment Analysis And Outlook

Table of Contents

Understanding the 30% Drop: Key Contributing Factors

The recent 30% decline in Palantir's stock price wasn't a singular event but rather a confluence of factors. While pinpointing the exact cause is difficult, several key contributors stand out.

-

Analysis of Q[Quarter] Earnings Report: Palantir's [Quarter] earnings report revealed [mention specific details, e.g., slower-than-expected revenue growth, a decline in operating margin, or lower-than-projected customer acquisition]. These figures fell short of analyst expectations, triggering a sell-off. Investors reacted negatively to [mention specific metric, e.g., the slowing growth in the commercial sector, or unexpectedly high operating costs]. This negative sentiment contributed significantly to the stock's decline.

-

Impact of Macroeconomic Factors: The current macroeconomic environment, characterized by high inflation, rising interest rates, and recessionary fears, significantly impacts Palantir's business. Investors are generally more risk-averse during such periods, leading to a sell-off in growth stocks like Palantir. The increased cost of capital makes it more expensive for Palantir to invest in growth initiatives, potentially hindering its future expansion.

-

Competitive Landscape Analysis: Palantir faces stiff competition from established players in the data analytics and government contracting sectors. Competitors like [mention key competitors, e.g., Microsoft, Google, and smaller specialized firms] are aggressively pursuing market share, increasing the pressure on Palantir to maintain its competitive edge. Any success by competitors could negatively impact Palantir's growth trajectory and investor confidence.

-

Regulatory Changes and Legal Challenges: [Mention any recent regulatory changes or legal challenges that might have impacted investor sentiment. For example, discuss potential impacts of government contracts, data privacy regulations, or antitrust concerns]. Any negative news related to regulatory scrutiny or legal battles can significantly impact investor confidence and contribute to stock price volatility.

Analyzing Palantir's Long-Term Growth Potential

Despite the recent setback, Palantir retains significant long-term growth potential. Its focus on data analytics and government contracting positions it well for continued expansion.

-

Government Contracts and Future Prospects: Palantir's substantial government contracts provide a stable revenue stream. The long-term nature of these contracts offers a degree of predictability, mitigating some of the risks associated with its commercial ventures. However, the renewal of these contracts and the potential for future awards remain crucial factors in assessing Palantir's long-term prospects.

-

Commercial Sector Growth and Market Expansion: Palantir is actively expanding its presence in the commercial sector. Success in this area is crucial for long-term growth. Its ability to attract and retain commercial clients will be key to its overall financial performance. Further penetration into key industries and successful expansion into new markets are crucial for long-term growth.

-

Technological Innovation and Competitive Advantages: Palantir's proprietary technology, particularly its Foundry platform, provides a competitive advantage. Continued investment in research and development (R&D) is essential for maintaining this edge. Its ability to innovate and adapt to changing technological landscapes is a key factor to consider in assessing its long-term potential.

-

Strategic Partnerships and Collaborations: Palantir's strategic partnerships and collaborations can unlock new market opportunities and accelerate growth. The success of these collaborations in driving revenue and expanding its reach will be crucial for its future success.

Assessing the Risk vs. Reward for Palantir Investors

Investing in Palantir after the recent price drop presents a complex risk-reward scenario.

-

Volatility of PLTR Stock Price: Palantir's stock price is inherently volatile. Investors need to have a high risk tolerance to consider investing in this stock. The recent drop highlights this volatility and its potential impact on investor portfolios.

-

Financial Health (Debt Levels, Cash Flow): Analyzing Palantir's financial health, including its debt levels and cash flow, is crucial. A strong financial position can mitigate some of the risks associated with its volatile stock price. Understanding the company’s financial stability is vital before considering an investment.

-

Potential for Future Price Appreciation: The potential for future price appreciation depends heavily on several factors, including the company's ability to execute its growth strategy, the macroeconomic environment, and competitive pressures. Various scenarios should be considered to evaluate the potential return on investment.

-

Valuation Compared to Competitors: Comparing Palantir's valuation to its competitors provides context for assessing whether its current price reflects its potential. Is it undervalued, fairly valued, or overvalued compared to similar companies? This comparison helps gauge the investment's attractiveness.

Technical Analysis of PLTR Stock Chart

[Optional: Include a brief, objective analysis of the PLTR stock chart, mentioning key technical indicators such as support and resistance levels, moving averages, and any relevant chart patterns. This section should be data-driven and avoid subjective opinions.]

Conclusion

The 30% drop in Palantir's stock price is a complex event stemming from disappointing earnings, macroeconomic headwinds, competitive pressures, and potential regulatory concerns. While the long-term growth potential remains significant, the inherent volatility of PLTR stock demands careful consideration. The risk-reward profile requires a high-risk tolerance. Further research, including a thorough analysis of the company's financials, competitive landscape, and future growth prospects, is crucial before making any investment decisions regarding Palantir. Conduct your own thorough due diligence before investing in Palantir stock. Remember to consult with a financial advisor before making any investment choices.

Featured Posts

-

Pogoda V Permi I Permskom Krae V Kontse Aprelya 2025 Prognoz Pokholodaniya I Snegopadov

May 09, 2025

Pogoda V Permi I Permskom Krae V Kontse Aprelya 2025 Prognoz Pokholodaniya I Snegopadov

May 09, 2025 -

The Billionaire Successor To Warren Buffett A Canadian Perspective

May 09, 2025

The Billionaire Successor To Warren Buffett A Canadian Perspective

May 09, 2025 -

Policia Britanica Deixa Mulher Que Se Diz Madeleine Mc Cann Presa

May 09, 2025

Policia Britanica Deixa Mulher Que Se Diz Madeleine Mc Cann Presa

May 09, 2025 -

Suspect Sought In Elizabeth City Vehicle Break In Spree

May 09, 2025

Suspect Sought In Elizabeth City Vehicle Break In Spree

May 09, 2025 -

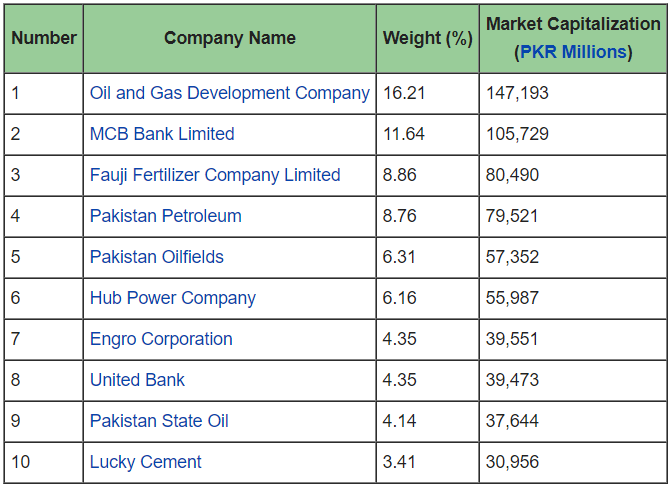

Kse 100 Freefall Operation Sindoor And The Pakistan Stock Market Crash

May 09, 2025

Kse 100 Freefall Operation Sindoor And The Pakistan Stock Market Crash

May 09, 2025