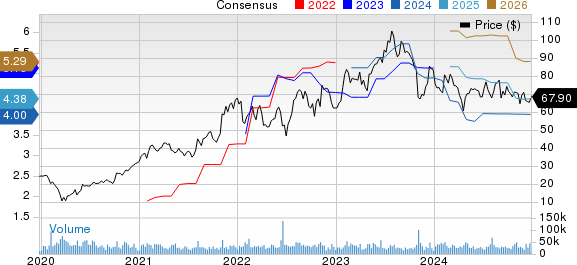

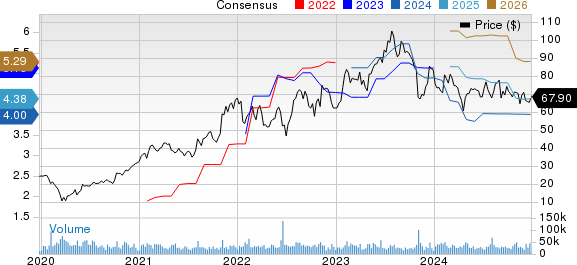

Palantir Plunges 30%: Should You Buy The Dip?

Table of Contents

Understanding the Palantir Stock Dip

Reasons Behind the Price Drop

Several factors contributed to Palantir's recent stock price decline. Recent earnings reports revealed slower-than-expected growth in certain sectors, impacting overall investor confidence. This slowdown, coupled with broader macroeconomic headwinds affecting the technology sector, exacerbated the sell-off. Increased interest rates, designed to combat inflation, have made borrowing more expensive for companies, potentially impacting Palantir's growth trajectory. Furthermore, increased competition in the data analytics space, with established players and new entrants vying for market share, has added to investor uncertainty. Finally, several analyst downgrades contributed to the negative sentiment surrounding Palantir stock.

- Increased interest rates: Higher borrowing costs impact growth and expansion plans.

- Slowing growth in certain sectors: Reduced demand in specific areas directly impacts Palantir's revenue streams.

- Increased competition in the data analytics space: A competitive landscape pressures margins and market share.

- Negative investor sentiment: Analyst downgrades and market anxieties fueled the sell-off.

Analyzing Palantir's Fundamentals

Despite the recent dip, Palantir boasts strong underlying fundamentals. The company continues to demonstrate consistent revenue growth, particularly in its government contracts, which provide a stable and predictable revenue stream. Its long-term vision is focused on leveraging its advanced data analytics platform to address complex challenges across various sectors. Palantir's expanding commercial clientele, including Fortune 500 companies, points to significant growth potential beyond its government contracts.

- Strong government contracts: A reliable revenue stream providing financial stability.

- Growing commercial clientele: Expansion into the private sector suggests broader market adoption.

- Potential for significant revenue growth in the long-term: The data analytics market is vast and expanding rapidly.

Should You Buy the Dip? Weighing the Risks and Rewards

Arguments for Buying Palantir Stock

The significant drop in Palantir's stock price presents a potential entry point for long-term investors. The current valuation may represent a considerable discount compared to its intrinsic value, offering the chance for substantial returns if the stock price recovers. Moreover, the long-term growth potential of the data analytics market remains significant, and Palantir's innovative technology positions it well to capitalize on this growth. Finally, the strength and reliability of its government contracts provide a considerable safety net.

- Discounted entry point: The current price might offer a significantly undervalued opportunity.

- Potential for significant upside: Long-term growth prospects in the data analytics market are substantial.

- Strong technology and government contracts: A solid foundation for sustained growth and stability.

Arguments Against Buying Palantir Stock

While the potential rewards are significant, investing in Palantir stock carries inherent risks. The stock market remains volatile, and the potential for further price drops cannot be discounted. Investing in growth stocks, particularly those with a history of price fluctuations like Palantir, involves considerable risk. The competitive landscape in the data analytics sector is intense, and maintaining market share will require ongoing innovation and adaptation from Palantir.

- Market volatility: The stock market's inherent unpredictability presents a major risk.

- Uncertainty about future growth: The path to consistent growth and profitability remains uncertain.

- Intense competition: Competition in the data analytics market could hinder Palantir's growth.

- High-risk investment: Investing in Palantir requires a high tolerance for risk and volatility.

Developing Your Palantir Investment Strategy

Diversification and Risk Management

To mitigate the risks associated with investing in Palantir, diversification is crucial. Spreading your investments across different asset classes reduces the impact of any single investment's underperformance. Dollar-cost averaging, a strategy that involves investing a fixed amount of money at regular intervals, helps reduce the impact of market volatility. Setting stop-loss orders, which automatically sell your shares if the price drops below a predetermined level, can help limit potential losses. Remember, only invest an amount you can comfortably afford to lose.

- Diversify your portfolio: Spread your investments across different assets to reduce risk.

- Dollar-cost averaging: Invest regularly regardless of price fluctuations to mitigate risk.

- Set stop-loss orders: Protect your investment from significant losses.

- Only invest what you can afford to lose: Avoid investing money you need for other purposes.

Long-Term vs. Short-Term Investment Horizons

The suitability of Palantir as an investment depends heavily on your investment horizon and risk tolerance. Long-term investors, with a horizon of several years or more, are better positioned to weather short-term market fluctuations and potentially benefit from Palantir's long-term growth potential. Short-term investors should be prepared for significant price volatility and potential losses. Consider your personal investment goals and risk tolerance before making any decision.

- Long-term investors: May see greater gains but require patience and tolerance for volatility.

- Short-term investors: Should be prepared for significant price volatility and the potential for losses.

Conclusion

The recent 30% drop in Palantir’s stock price presents a complex investment scenario. While the volatility is undeniably a concern, Palantir’s strong fundamentals and position in a rapidly growing market suggest potential for long-term growth. However, a thorough understanding of the risks involved and a well-defined investment strategy, including robust risk management techniques, are paramount.

Call to Action: Whether you decide to buy the dip in Palantir or explore other technology stocks, always conduct thorough due diligence and assess your own risk tolerance before making any investment decisions. Consider consulting a qualified financial advisor for personalized advice tailored to your specific financial situation and investment goals. Remember, informed decisions are key to successful investing in Palantir stock or any other high-growth technology company.

Featured Posts

-

January 6th Falsehoods Ray Epps Defamation Lawsuit Against Fox News Explained

May 10, 2025

January 6th Falsehoods Ray Epps Defamation Lawsuit Against Fox News Explained

May 10, 2025 -

Us Eu Trade Dispute French Minister Advocates For Increased Retaliation

May 10, 2025

Us Eu Trade Dispute French Minister Advocates For Increased Retaliation

May 10, 2025 -

Will Leon Draisaitl Be Ready For The Oilers Playoffs

May 10, 2025

Will Leon Draisaitl Be Ready For The Oilers Playoffs

May 10, 2025 -

Draisaitls Lower Body Injury Oilers Playoff Hopes Hinge On His Return

May 10, 2025

Draisaitls Lower Body Injury Oilers Playoff Hopes Hinge On His Return

May 10, 2025 -

The Impact Of Trumps Policies On Transgender Rights

May 10, 2025

The Impact Of Trumps Policies On Transgender Rights

May 10, 2025