Palantir Prediction: 2 Stocks To Watch For Higher Returns In 3 Years

Table of Contents

Stock #1: [Company Name A] – A Deep Dive into its Growth Potential

Current Market Position and Financial Performance:

[Company Name A] operates in the [Industry] sector, currently holding a [market share]% market share. Their recent financial performance shows promising signs.

- Revenue Growth: [Company Name A] has demonstrated consistent revenue growth over the past [number] years, averaging [percentage]% annually.

- Earnings Per Share (EPS): EPS has increased from $[EPS amount] to $[EPS amount] in the last [number] years, indicating improving profitability.

- Debt Levels: The company's debt-to-equity ratio is [ratio], suggesting [assessment of debt levels - e.g., a manageable level of debt].

- Recent Developments: The recent launch of their [product/service] has been well-received by the market, potentially boosting future revenue streams. [Mention any relevant news, awards, or partnerships]. Keywords: [Company Name A] stock, financial analysis, market share, revenue growth, earnings per share (EPS)

Palantir's Predictive Insights (Hypothetical):

Hypothetically, Palantir's advanced data analytics could provide valuable insights into [Company Name A]'s future performance. By analyzing vast datasets encompassing market trends, consumer behavior, and competitive dynamics, Palantir's platform could identify:

- Potential Growth Drivers: Palantir's analysis might uncover untapped market segments or predict the success of new product launches, leading to accelerated revenue growth.

- Predictive Modeling: Hypothetical models could project future market share based on current trends and competitive actions, offering a potential outlook for the next three years. This is purely speculative, based on the potential capabilities of Palantir's technology. Keywords: Palantir data analytics, predictive modeling, growth drivers, future performance, hypothetical analysis

Risk Assessment and Potential Downsides:

While [Company Name A]'s outlook appears positive, several factors could negatively impact its stock performance:

- Market Volatility: Overall market downturns could affect the stock price regardless of the company's fundamental strength.

- Competitive Threats: Increased competition from [competitor names] could erode market share and limit growth potential.

- Regulatory Risks: Changes in regulations within the [Industry] sector could negatively impact profitability. Keywords: Risk assessment, market volatility, competitive threats, financial risks

Stock #2: [Company Name B] – Another Promising Candidate for Long-Term Growth

Current Market Position and Financial Performance:

[Company Name B], operating in the [Industry] sector, holds a [market share]% market share. Its financial performance reveals:

- Revenue Growth: Consistent revenue growth of [percentage]% annually over the past [number] years.

- Earnings Per Share (EPS): EPS has increased from $[EPS amount] to $[EPS amount] in the last [number] years.

- Debt Levels: The debt-to-equity ratio stands at [ratio].

- Recent Developments: [Mention key recent developments impacting the company]. Keywords: [Company Name B] stock, financial analysis, market share, revenue growth, earnings per share (EPS)

Palantir's Predictive Insights (Hypothetical):

Hypothetically, applying Palantir's data analytics could reveal:

- Potential Growth Drivers: Analysis could pinpoint key factors driving future growth, such as expansion into new markets or successful product diversification.

- Predictive Modeling: Hypothetical predictive models could forecast market share and revenue growth based on various scenarios. This is purely speculative and based on the potential of Palantir's technology. Keywords: Palantir data analytics, predictive modeling, growth drivers, future performance, hypothetical analysis

Risk Assessment and Potential Downsides:

Potential risks for [Company Name B] include:

- Market Volatility: General market conditions could impact the stock price.

- Competitive Threats: Competition from [competitor names] presents a challenge.

- Technological Disruption: Rapid technological advancements in the [Industry] sector could pose a threat. Keywords: Risk assessment, market volatility, competitive threats, financial risks

Conclusion: Making Informed Decisions with Palantir Prediction

This hypothetical analysis, inspired by the potential applications of Palantir's data analytics, suggests that both [Company Name A] and [Company Name B] may offer significant growth potential over the next three years. However, it's crucial to remember that this is a speculative exercise based on hypothetical scenarios. While Palantir prediction tools can offer valuable insights, they don't guarantee future performance. Thorough due diligence is paramount before making any investment decisions. Remember to consider these stocks as part of a diversified investment portfolio, always prioritizing your risk tolerance. While this Palantir-inspired prediction highlights promising investment opportunities, remember to conduct thorough due diligence before investing. Start your research on these high-return stocks today! Keywords: Palantir prediction, investment strategy, stock market analysis, high-return stocks, three-year forecast, due diligence.

Featured Posts

-

Air Traffic Controller Safety Warnings Preceded Newark System Failure

May 10, 2025

Air Traffic Controller Safety Warnings Preceded Newark System Failure

May 10, 2025 -

Dangotes Influence On Nigerias Petrol Price An Nnpc Perspective

May 10, 2025

Dangotes Influence On Nigerias Petrol Price An Nnpc Perspective

May 10, 2025 -

Dangote And Nnpc The Impact On Petrol Prices In Nigeria

May 10, 2025

Dangote And Nnpc The Impact On Petrol Prices In Nigeria

May 10, 2025 -

Market Instability In Pakistan Stock Exchange Portal Downtime

May 10, 2025

Market Instability In Pakistan Stock Exchange Portal Downtime

May 10, 2025 -

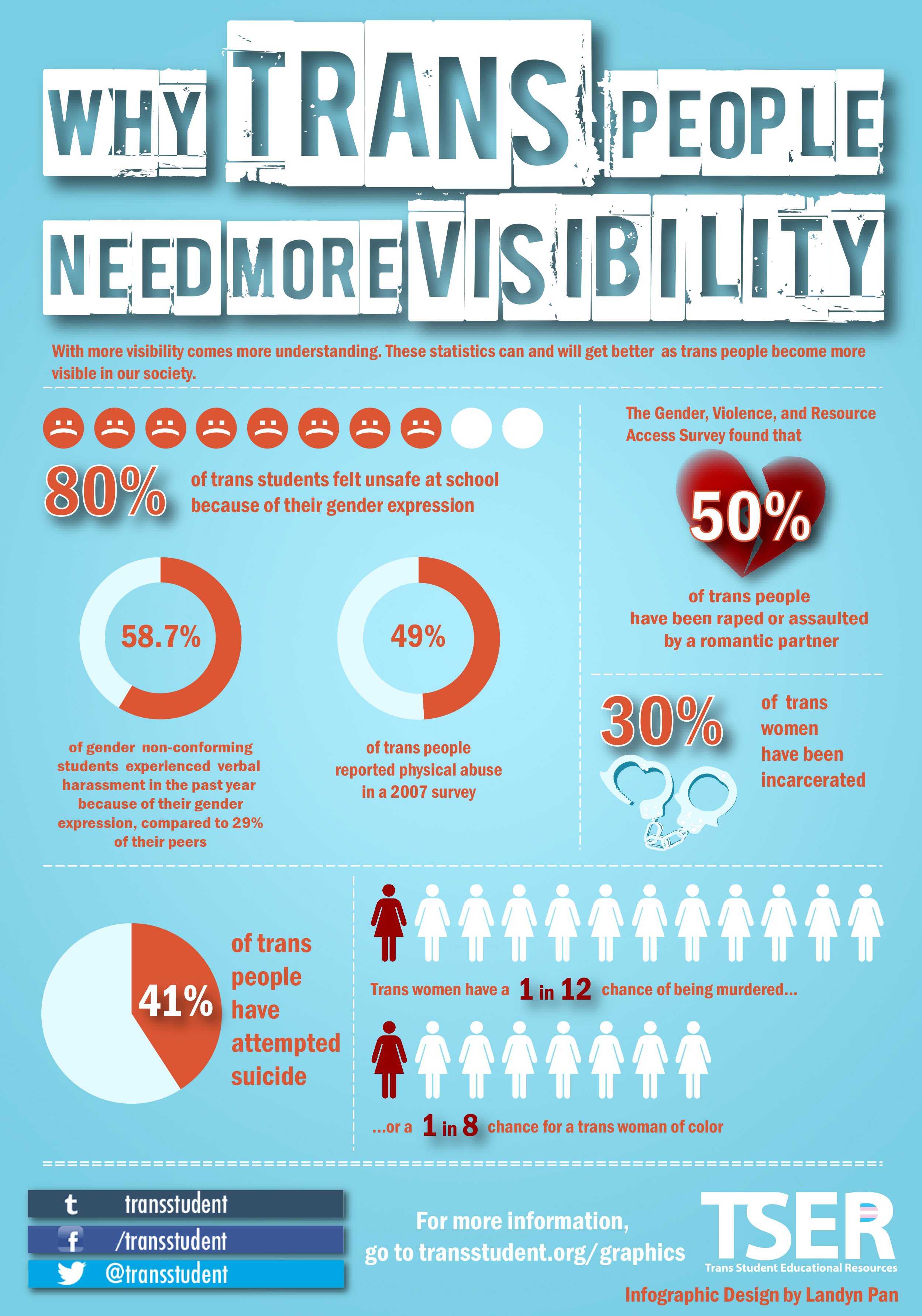

International Transgender Day Of Visibility Becoming A Stronger Ally

May 10, 2025

International Transgender Day Of Visibility Becoming A Stronger Ally

May 10, 2025