Palantir Stock Analysis: Time To Buy, Sell, Or Hold?

Table of Contents

Investing in the stock market always involves a degree of risk, and Palantir Technologies (PLTR) stock is no exception. This in-depth Palantir stock analysis aims to provide you with the information you need to make an informed decision about whether to buy, sell, or hold PLTR stock. We'll delve into Palantir's business model, financial performance, competitive landscape, and future prospects to help you assess the investment risks and potential rewards. This Palantir investment analysis considers various factors influencing the PLTR stock price prediction.

Palantir's Business Model and Market Position

Palantir Technologies is a data analytics company offering two primary platforms: Gotham, focused on government clients, and Foundry, targeting commercial enterprises. Both platforms utilize proprietary technology to process and analyze massive datasets, providing actionable intelligence to clients across various sectors.

Competitive Advantages

Palantir boasts several key competitive advantages:

-

Proprietary Technology: Its advanced data integration and analysis capabilities provide a significant edge over competitors. The sophisticated algorithms and user interfaces are difficult to replicate.

-

Strong Government Relationships: Palantir has established deep relationships with numerous government agencies, securing long-term contracts and creating a strong revenue base.

-

Competitive Landscape: While facing competition from established players like Microsoft and Salesforce, Palantir's niche focus on complex data problems and its strong security reputation differentiates it in the market.

-

Bullet points:

- Strong data security, ensuring compliance with strict government regulations.

- Large data processing capabilities, handling petabytes of information efficiently.

- Long-term contracts with government agencies, providing revenue stability.

Market Growth Potential

The big data analytics market is experiencing explosive growth, driven by increasing data volumes and the demand for insightful business intelligence. Government spending on technology is also rising, further bolstering Palantir's target markets.

- Bullet points:

- Growing demand for data analytics across all sectors, including finance, healthcare, and defense.

- Increasing government spending on technology, particularly for national security and intelligence applications.

- Potential for significant international expansion, tapping into global markets.

Palantir's Financial Performance

Analyzing Palantir's financial performance is crucial for any Palantir stock analysis.

Revenue and Profitability

Palantir has demonstrated consistent revenue growth, although profitability remains a focus area. Examining key metrics such as operating income and free cash flow offers a clearer picture of the company's financial health. [Insert chart showing revenue growth and profit margins here].

- Bullet points:

- Revenue growth rate (year-over-year): [Insert Data]

- Gross profit margin: [Insert Data]

- Operating income: [Insert Data]

- Free cash flow generation: [Insert Data]

Debt and Liquidity

Understanding Palantir's debt levels and cash reserves is essential for assessing its financial stability. A review of its debt-to-equity ratio and current ratio reveals its ability to meet financial obligations. [Insert chart showing debt and liquidity ratios here].

- Bullet points:

- Debt-to-equity ratio: [Insert Data]

- Cash on hand: [Insert Data]

- Current ratio: [Insert Data]

Risks and Challenges Facing Palantir

Despite its potential, Palantir faces several significant challenges.

Competition and Market Saturation

The data analytics market is becoming increasingly competitive, with both established tech giants and new entrants vying for market share. This competition could lead to pricing pressure and slower growth for Palantir.

- Bullet points:

- New entrants in the market with innovative solutions.

- Pricing pressure from competitors with broader product offerings.

- Dependence on government contracts for a significant portion of revenue.

Regulatory and Legal Risks

Palantir operates in a heavily regulated environment, particularly in the government sector. Data privacy regulations and government contract scrutiny pose significant legal and operational risks.

- Bullet points:

- Data privacy regulations, such as GDPR and CCPA, require strict compliance.

- Government contract scrutiny, increasing the likelihood of audits and potential delays.

- Potential lawsuits related to data security or contract disputes.

Valuation and Investment Implications

This section of our Palantir stock analysis provides a crucial assessment for your investment decision.

Stock Price Analysis

Analyzing Palantir's current stock price, historical performance, and valuation metrics (P/E ratio, PEG ratio) helps to determine whether it's currently undervalued or overvalued. [Insert chart showing stock price history and valuation metrics here].

- Bullet points:

- Current stock price: [Insert Data]

- Historical price chart (5-year): [Insert Chart]

- Key valuation metrics (P/E ratio, PEG ratio): [Insert Data]

Investment Recommendations

Based on our analysis of Palantir's business model, financial performance, competitive landscape, and future prospects, we provide the following investment recommendation: [Insert Buy, Sell, or Hold recommendation here, clearly justifying the choice based on the data presented].

Conclusion

This Palantir stock analysis highlights the company's strengths, such as its proprietary technology and strong government relationships, as well as its challenges, including increasing competition and regulatory risks. Our recommendation is to [Reiterate Buy, Sell, or Hold recommendation]. Remember, this Palantir stock analysis is not financial advice. Conduct your own thorough due diligence and consult with a financial advisor before making any investment decisions regarding Palantir Technologies (PLTR) stock. Carefully assess your risk tolerance before investing in PLTR or any other security. Further research into Palantir stock is recommended.

Featured Posts

-

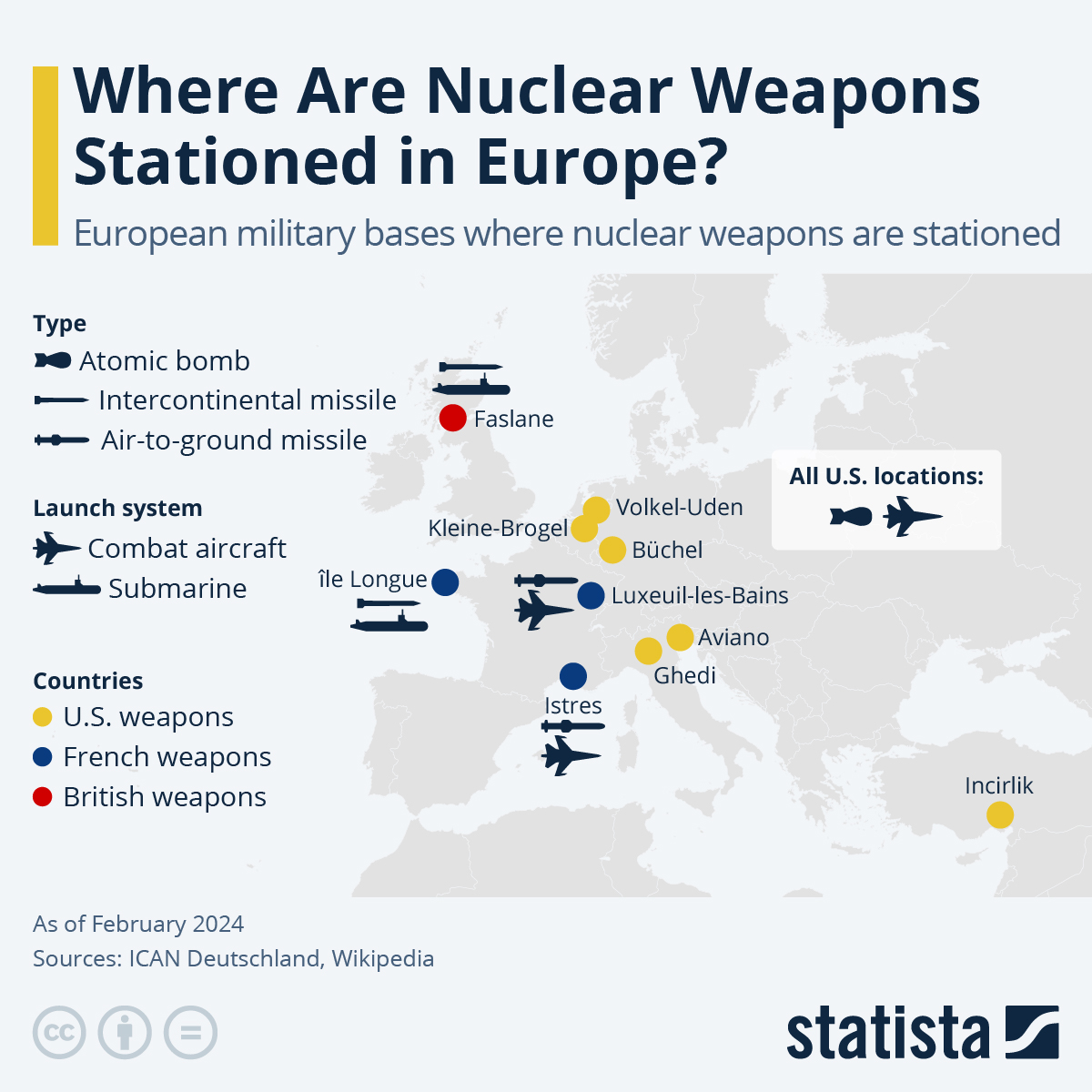

Radio Schuman Frances Push For Shared Nuclear Shield In Europe

May 09, 2025

Radio Schuman Frances Push For Shared Nuclear Shield In Europe

May 09, 2025 -

Stivn King Na Netflix Ochakvame Rimeyk

May 09, 2025

Stivn King Na Netflix Ochakvame Rimeyk

May 09, 2025 -

Britannian Kruununperimysjaerjestys 2024 Taeydellinen Lista

May 09, 2025

Britannian Kruununperimysjaerjestys 2024 Taeydellinen Lista

May 09, 2025 -

Otkaz Makrona Starmera Mertsa I Tuska Ot Poezdki V Kiev Prichiny I Posledstviya

May 09, 2025

Otkaz Makrona Starmera Mertsa I Tuska Ot Poezdki V Kiev Prichiny I Posledstviya

May 09, 2025 -

Social Media Censorship In Turkey X Restricts Access To Jailed Mayors Page

May 09, 2025

Social Media Censorship In Turkey X Restricts Access To Jailed Mayors Page

May 09, 2025