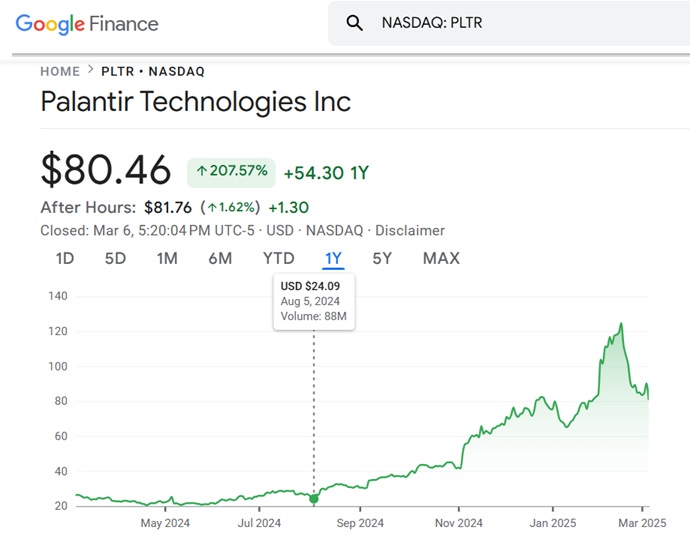

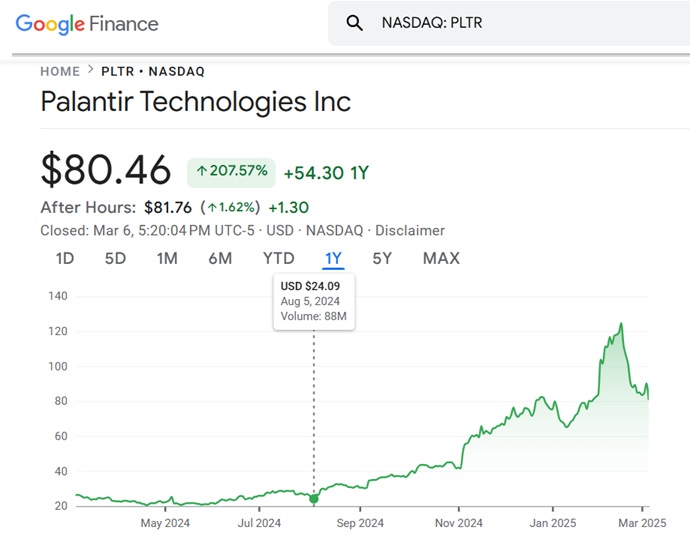

Palantir Stock: Analysts Revise Forecasts Following Market Surge

Table of Contents

The Market Surge: Understanding the Reasons Behind the Rise

The significant increase in Palantir's stock price isn't a random event; several key factors contributed to this positive market shift.

Increased Government Contracts

A major driver of the Palantir stock price increase is the influx of substantial government contracts. These contracts represent a significant portion of Palantir's revenue and underscore the company's position as a leading provider of data analytics solutions to governmental agencies.

- Specific examples: Palantir recently secured a multi-year, multi-billion dollar contract with the US Army for its Foundry platform. Another significant contract was awarded by a major intelligence agency, further solidifying Palantir's presence in the national security sector. These contracts, totaling an estimated $X billion (replace X with actual or estimated figure if available), provide a strong foundation for future revenue growth.

- Strategic importance: These contracts aren't just about immediate revenue; they demonstrate Palantir's ability to secure and maintain long-term partnerships with key government clients. This long-term stability is crucial for sustained growth and investor confidence in Palantir stock.

- Key agencies involved: The contracts involve various agencies including, but not limited to, the Department of Defense, the intelligence community, and various other federal agencies.

Stronger-Than-Expected Q[Quarter] Earnings

Palantir's recent quarterly earnings report significantly exceeded analyst expectations, contributing substantially to the positive market sentiment surrounding Palantir stock.

- Positive surprises: The company reported a significant increase in revenue growth, exceeding the consensus forecast by a considerable margin. Adjusted EBITDA also beat expectations, demonstrating improved operational efficiency and profitability. Specific data points (e.g., percentage increase in revenue, exact EBITDA figures) should be included here if available from official reports.

- Comparison to previous quarters: Comparing these results to previous quarters reveals a clear upward trend in key performance indicators (KPIs), suggesting sustainable growth rather than a temporary spike. The consistent improvement further strengthens investor confidence in Palantir's long-term trajectory.

- Exceeding analyst predictions: The fact that Palantir exceeded even the most optimistic analyst predictions underscores the company's capacity to outperform expectations.

Positive Market Sentiment and Investor Confidence

The market surge wasn't solely driven by fundamentals; positive market sentiment and increased investor confidence played a crucial role in pushing Palantir stock higher.

- Positive news coverage: Favorable media coverage highlighting Palantir's success in securing large contracts and exceeding earnings expectations contributed to the positive narrative surrounding the company. This positive publicity attracts more investor attention.

- Analyst upgrades: Several prominent financial analysts upgraded their ratings and price targets for Palantir stock, further boosting investor confidence. This positive feedback loop, created by positive news and analyst upgrades, encourages further investment.

- Overall market conditions: While specific market conditions influence all stocks, the overall positive sentiment within the technology sector generally aided Palantir's stock price increase.

Analyst Revisions: A Look at the Updated Forecasts

Following the market surge, numerous analysts revised their forecasts for Palantir, reflecting the positive developments.

Upward Revisions in Price Targets

Many analysts significantly increased their price targets for Palantir stock after the recent market surge and strong earnings report.

- Specific examples: Analyst A raised their price target from $X to $Y, while Analyst B increased theirs from $Z to $W. (Replace A, B, X, Y, Z, and W with actual analyst names and figures). This range of price targets showcases the various levels of optimism among financial experts.

- Magnitude of changes: The magnitude of these upward revisions reflects the significant impact of the positive news on analyst expectations regarding Palantir's future performance.

Revised Revenue and Earnings Projections

Analysts also adjusted their revenue and earnings projections upwards, reflecting the company's improved performance and increased contract wins.

- Comparison to previous forecasts: The revised projections show a substantial increase compared to previous forecasts, highlighting the positive impact of the recent events. Specific numerical comparisons should be included here if available.

- Influencing factors: The factors influencing these revisions include the substantial increase in government contracts, demonstrating the company's ability to secure large deals, and improved operational efficiency which leads to better profitability.

Varying Degrees of Optimism

Despite the overall positive sentiment, there's still a range of opinions among analysts regarding Palantir's future.

- Bullish outlooks: Some analysts remain extremely bullish on Palantir, citing its strong technological capabilities and significant growth potential in various sectors.

- Cautious outlooks: Others maintain a more cautious stance, highlighting potential risks such as intense competition in the data analytics market and the company's dependence on government contracts for a large portion of its revenue. Understanding these differing opinions is key for assessing your own risk tolerance.

Future Outlook and Investment Considerations for Palantir Stock

While the recent surge is encouraging, potential investors should carefully consider both the opportunities and risks associated with Palantir stock.

Risk Assessment

Investing in Palantir stock carries inherent risks.

- Competition: The data analytics market is highly competitive, with established players and emerging startups vying for market share. This competition could impact Palantir's growth and profitability.

- Dependence on government contracts: A significant portion of Palantir's revenue comes from government contracts. Changes in government spending or priorities could significantly impact the company's financial performance.

- Market volatility: The technology sector, and particularly the stock market, is subject to significant volatility. Unexpected market downturns could negatively impact Palantir's stock price, regardless of the company's underlying performance.

Growth Potential

Despite the risks, Palantir possesses considerable growth potential.

- Expansion into new markets: Palantir is actively expanding into new markets beyond government, targeting commercial clients in various sectors. Success in these sectors could significantly increase revenue streams.

- Development of innovative technologies: The company continues to invest heavily in research and development, constantly improving its platform and exploring new applications for its technology. This innovation is crucial for maintaining a competitive edge.

Investment Strategies

Potential investors should develop an investment strategy based on their risk tolerance and investment goals.

- Long-term holding: A long-term investment strategy is suitable for investors with a higher risk tolerance and a longer time horizon. This strategy allows for weathering short-term market fluctuations.

- Short-term trading: Short-term trading involves more risk and requires close monitoring of market conditions. This approach may be suitable for more experienced investors.

- Diversification: Diversifying your portfolio across various asset classes and industries is crucial to mitigating risk. Don't put all your eggs in one basket.

Conclusion

The recent surge in Palantir stock, fueled by increased government contracts and stronger-than-expected earnings, has led to upward revisions in analyst forecasts. While significant growth potential exists, investors should carefully consider the associated risks. Understanding the factors driving this market movement and the range of analyst opinions is crucial for making informed investment decisions about Palantir stock. Conduct thorough research and consult with a financial advisor before making any investment in Palantir or any other stock. Remember to always carefully assess your risk tolerance before investing in Palantir stock.

Featured Posts

-

King Protiv Maska Pisatel Vernulsya V X I Vyskazalsya Rezko

May 09, 2025

King Protiv Maska Pisatel Vernulsya V X I Vyskazalsya Rezko

May 09, 2025 -

Pam Bondi And The Killing Of American Citizens A Video Analysis

May 09, 2025

Pam Bondi And The Killing Of American Citizens A Video Analysis

May 09, 2025 -

I Control You Analyzing Jack Doohan And Briatores Tense Netflix Scene

May 09, 2025

I Control You Analyzing Jack Doohan And Briatores Tense Netflix Scene

May 09, 2025 -

Treiler Materialists Ntakota Tzonson Pedro Paskal And Kris Evans Se Romantiki Komodia

May 09, 2025

Treiler Materialists Ntakota Tzonson Pedro Paskal And Kris Evans Se Romantiki Komodia

May 09, 2025 -

Harry Styles Reaction To That Awful Snl Impression Devastated

May 09, 2025

Harry Styles Reaction To That Awful Snl Impression Devastated

May 09, 2025