Palantir Stock Before May 5th: Is It A Buy?

Table of Contents

Palantir's Recent Performance and Market Position

Analyzing Palantir's recent stock performance is crucial for determining its current valuation. The PLTR stock chart reveals considerable volatility, reflecting the inherent risks and growth potential within the big data analytics market. We need to consider Palantir's revenue growth, market share, and competitive landscape.

-

Review of Q4 2022 and Full-Year 2022 Results: A thorough examination of Palantir's Q4 2022 and full-year 2022 financial reports is vital. Key metrics like revenue growth, operating margins, and net income will provide insights into the company's financial health and trajectory. Significant year-over-year comparisons will showcase the growth (or lack thereof).

-

Comparison to Competitors like AWS, Google Cloud, and Microsoft Azure: Palantir faces stiff competition from industry giants like Amazon Web Services (AWS), Google Cloud, and Microsoft Azure. Analyzing Palantir's competitive positioning, including its strengths and weaknesses against these established players, is essential for evaluating its long-term prospects. Market share analysis within specific sectors (government, finance, etc.) will illuminate Palantir's competitive standing.

-

Analysis of Palantir's Market Share in Key Sectors: Palantir's focus on government contracts and enterprise solutions requires an assessment of its market penetration in these vital sectors. Analyzing its market share and growth within these segments can offer valuable insights into its future revenue streams and potential for expansion.

-

Discussion of Recent Contract Wins and Losses: Tracking recent contract wins and losses provides a real-time view of Palantir's ability to secure new business and maintain its existing customer base. Large contract wins can significantly boost investor sentiment and stock price, while losses can have the opposite effect.

Analyzing Key Financial Indicators

A thorough assessment of Palantir's financial indicators is vital for gauging the company's overall health and stability. Examining key metrics reveals the strength of its financial position and provides insights into its future prospects.

-

Examination of Revenue Growth Trends: Analyzing Palantir's revenue growth trends over time – both short-term and long-term – helps identify its growth trajectory and potential for future revenue increases. A consistent upward trend is generally positive, whereas declining revenue raises concerns.

-

Analysis of Operating Margins and Net Income: Operating margins and net income indicate Palantir's profitability. Positive operating margins and growing net income demonstrate the company's ability to generate profit from its operations. These are crucial indicators of long-term sustainability.

-

Assessment of Debt-to-Equity Ratio and Cash Position: Palantir's debt-to-equity ratio reveals its financial leverage, indicating the risk associated with its debt levels. A high debt-to-equity ratio can indicate potential financial instability. Similarly, a healthy cash position offers a cushion during economic downturns or periods of slower growth.

-

Projection of Future Financial Performance Based on Current Trends: By analyzing existing trends in revenue growth, profitability, and cash flow, it's possible to make educated projections about Palantir's future financial performance. These projections, while not guarantees, provide a framework for evaluating the potential investment return.

Expected Earnings and Market Sentiment

Analyst expectations and prevailing market sentiment significantly influence Palantir's stock price, especially around earnings announcements. Understanding these factors is critical for making informed investment decisions.

-

Summary of Analyst Ratings and Price Targets: Consolidating analyst ratings and price targets provides a range of potential outcomes for Palantir's stock price following the May 5th earnings announcement. These offer a broad perspective, but individual investors should conduct their own research.

-

Overview of Current Investor Sentiment (Bullish, Bearish, Neutral): Gauging investor sentiment – whether it's predominantly bullish, bearish, or neutral – helps understand the prevailing market mood regarding Palantir. This sentiment can drastically impact the stock's price reaction to the earnings announcement.

-

Discussion of Potential Market Reactions to Various Earnings Scenarios: Considering different scenarios – exceeding expectations, meeting expectations, or falling short – and their likely impacts on Palantir's stock price prepares investors for potential volatility. Planning for various outcomes minimizes surprise and allows for strategic decision-making.

-

Consideration of Any Recent News or Events Impacting Investor Sentiment: Any recent news, such as significant contract wins, regulatory changes, or competitor announcements, can affect investor sentiment and consequently, the stock price. Keeping abreast of such developments is essential.

Risks and Potential Downsides of Investing in Palantir

Despite the potential for growth, investing in Palantir stock carries inherent risks. Understanding these risks is crucial for making a well-informed investment decision.

-

High Volatility of the Stock Price: Palantir's stock price is known for its volatility, meaning it can experience significant price swings in relatively short periods. This volatility introduces higher risk for investors.

-

Intense Competition in the Data Analytics Market: The data analytics market is fiercely competitive, with established players and emerging startups vying for market share. This competition puts pressure on Palantir's pricing and profitability.

-

Reliance on Government Contracts for a Significant Portion of Revenue: A substantial portion of Palantir's revenue comes from government contracts. Changes in government policy or budgetary constraints could significantly impact its revenue stream.

-

Potential Regulatory Hurdles and Compliance Risks: Operating in the data analytics sector brings regulatory compliance challenges. Failure to comply with data privacy regulations or other relevant laws can lead to significant financial penalties and reputational damage.

Conclusion: Is Palantir Stock Right for Your Portfolio Before May 5th?

Analyzing Palantir stock before its May 5th earnings report reveals a company with significant growth potential but also considerable risk. While its innovative technology and government contracts provide a strong foundation, competition and volatility are significant concerns. Investors should carefully weigh the potential rewards against the substantial risks before deciding whether to buy Palantir stock. Remember that this analysis is for informational purposes only and does not constitute financial advice. Always conduct thorough research and consult with a financial advisor before making any investment decisions. Is Palantir stock right for your portfolio before May 5th? Only you can answer that question after careful consideration of all the factors discussed.

Featured Posts

-

Kimbal Musk Profile Of Elons Brother And His Activism

May 09, 2025

Kimbal Musk Profile Of Elons Brother And His Activism

May 09, 2025 -

Woman Claims To Be Madeleine Mc Cann Now Faces Stalking Charges

May 09, 2025

Woman Claims To Be Madeleine Mc Cann Now Faces Stalking Charges

May 09, 2025 -

Iditarod Rookies 7 Sled Dog Teams Aiming For Nome

May 09, 2025

Iditarod Rookies 7 Sled Dog Teams Aiming For Nome

May 09, 2025 -

Nhl Highlights Hertls Double Hat Trick Fuels Golden Knights Win

May 09, 2025

Nhl Highlights Hertls Double Hat Trick Fuels Golden Knights Win

May 09, 2025 -

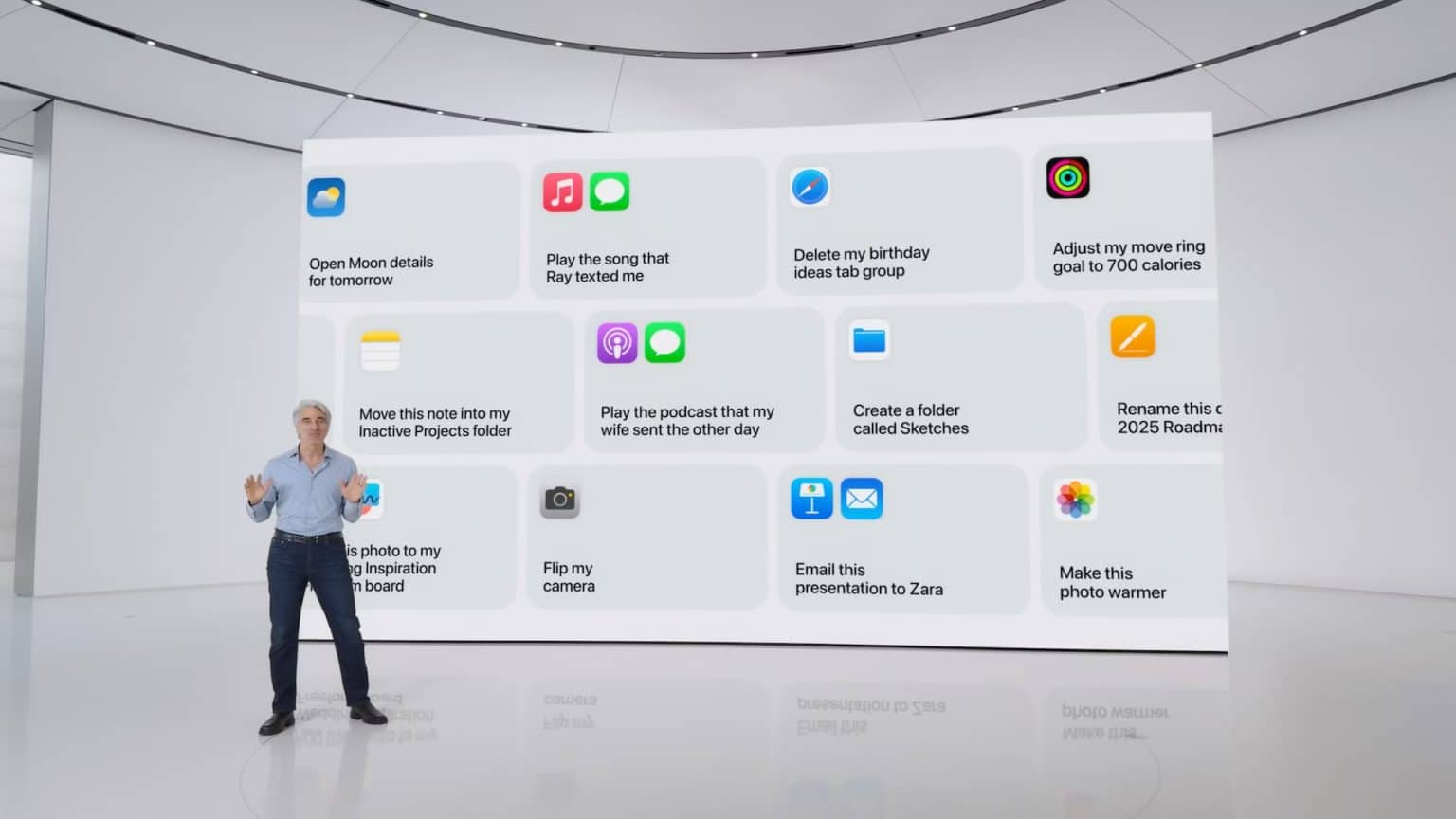

Is Apples Ai Development Sufficient For Future Success

May 09, 2025

Is Apples Ai Development Sufficient For Future Success

May 09, 2025