Palantir Stock: Current Valuation And Future Outlook

Table of Contents

Current Valuation of Palantir Stock

Assessing the current valuation of Palantir stock necessitates examining several key metrics. While the company's market capitalization fluctuates with market sentiment and financial performance, understanding its relative valuation compared to competitors is crucial. A key metric is the Price-to-Sales (P/S) ratio, which compares the company's market capitalization to its revenue. A high P/S ratio often suggests investors anticipate significant future growth.

- Current share price and trading volume: These figures provide a real-time snapshot of investor sentiment and market activity surrounding Palantir stock. Monitoring daily fluctuations is essential for understanding short-term market dynamics.

- Historical stock price performance: Analyzing the historical price trajectory helps identify trends and potential patterns, providing context for current valuations. Understanding past volatility is crucial for assessing future risk.

- Comparison with similar companies like Snowflake or Datadog: Benchmarking Palantir against competitors in the big data analytics space allows for a comparative analysis of valuation multiples and growth trajectories. This comparative analysis helps contextualize Palantir’s valuation within the broader market.

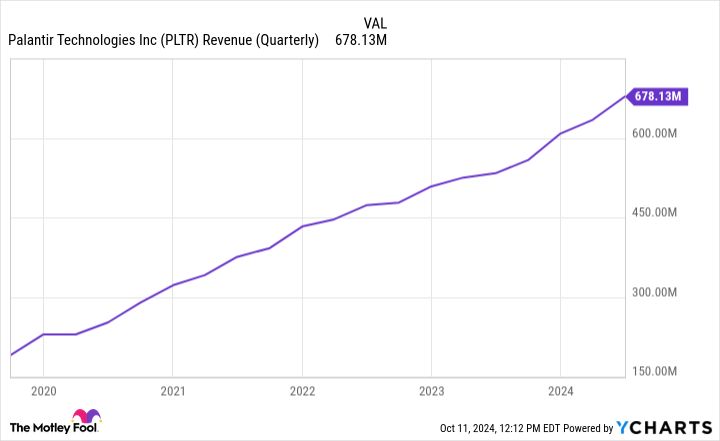

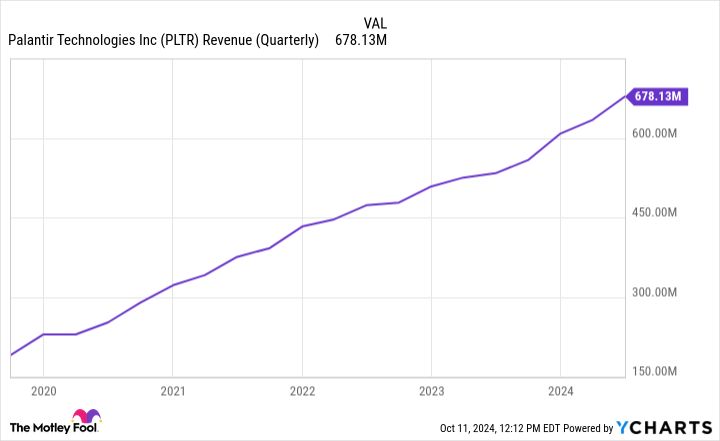

- Impact of recent financial performance on valuation: Strong revenue growth and improving profitability usually lead to higher valuations, while disappointing results can negatively impact the Palantir stock price. Analyzing quarterly earnings reports is crucial.

Palantir's Revenue Streams and Growth Prospects

Palantir's revenue is primarily derived from two sources: government contracts and commercial sales. Understanding the growth potential of each segment is crucial for forecasting the company's overall financial performance.

- Government contracts and their long-term stability: Government contracts often provide predictable revenue streams, but they can be subject to political and budgetary shifts. Analyzing the duration and renewal prospects of these contracts is key.

- Growth opportunities in the commercial sector: Palantir's expansion into the commercial sector presents significant growth potential, as it taps into a larger and more diverse market. Success in this sector will depend on attracting and retaining commercial clients.

- Potential impact of geopolitical factors on revenue: Global events and political instability can significantly influence government spending and, consequently, Palantir's revenue from government contracts.

- Analysis of recent contract wins and losses: Tracking recent contract wins and losses provides valuable insights into the company's competitive position and its ability to secure new business.

Key Risks and Challenges Facing Palantir

Investing in Palantir stock involves understanding the potential risks and challenges that could impact its future performance.

- Competition from established tech giants: Palantir faces stiff competition from established tech giants like Microsoft, Amazon, and Google, who offer similar big data and AI solutions.

- Dependence on a few key clients: Palantir's reliance on a limited number of large clients increases its vulnerability to the loss of key contracts. Diversifying its client base is crucial for mitigating this risk.

- Potential regulatory hurdles and legal challenges: Operating in the data analytics and AI space exposes Palantir to potential regulatory scrutiny and legal challenges related to data privacy and security.

- Risks associated with data security and privacy: Protecting sensitive data is paramount for Palantir. Breaches or failures in data security could severely damage its reputation and business.

Future Outlook and Investment Implications

Predicting the future performance of Palantir stock is inherently challenging, but analyzing potential catalysts for growth and considering potential risks provides valuable insights.

- Projected revenue growth and profitability: Analysts' projections for revenue growth and profitability provide a framework for assessing the company's future financial performance. However, these projections should be considered alongside potential risks.

- Potential for new product launches and innovation: Palantir's ability to innovate and launch new products that meet evolving market demands will be crucial for its long-term success.

- Impact of AI advancements on Palantir's business: Advancements in artificial intelligence will likely reshape the big data analytics landscape, creating both opportunities and challenges for Palantir.

- Long-term investment potential versus short-term volatility: Palantir stock is likely to experience periods of significant volatility. Long-term investors may be better positioned to weather these fluctuations.

Conclusion

Investing in Palantir stock presents a complex equation balancing significant growth potential with considerable risks. The company's valuation, while high compared to some peers, reflects investor expectations of substantial future growth driven by its government and commercial revenue streams. However, dependence on key clients, intense competition, and regulatory uncertainties present significant challenges. Understanding the intricacies of Palantir’s stock price and its future outlook, considering factors like revenue diversification, competitive pressures, and technological advancements, is crucial for informed investment decisions. Conduct your own thorough research and consider consulting a financial advisor before making any investment decisions related to Palantir stock. Understanding the nuances of Palantir's stock price and its future outlook is paramount for making well-informed investment choices.

Featured Posts

-

De Ligt To Inter Loan With Option To Buy On The Cards

May 09, 2025

De Ligt To Inter Loan With Option To Buy On The Cards

May 09, 2025 -

Chute Mortelle A Dijon Un Jeune Ouvrier Decede Apres Une Chute Du 4e Etage

May 09, 2025

Chute Mortelle A Dijon Un Jeune Ouvrier Decede Apres Une Chute Du 4e Etage

May 09, 2025 -

100 Days Of Trump The Impact On Elon Musks Wealth

May 09, 2025

100 Days Of Trump The Impact On Elon Musks Wealth

May 09, 2025 -

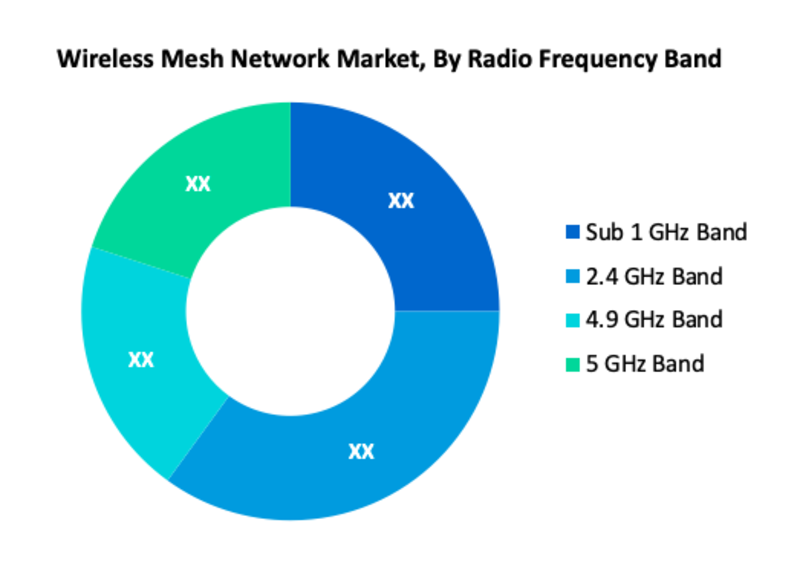

Wireless Mesh Network Market To Expand At A 9 8 Cagr

May 09, 2025

Wireless Mesh Network Market To Expand At A 9 8 Cagr

May 09, 2025 -

Jeanine Pirros North Idaho Visit Date Location And Event Details

May 09, 2025

Jeanine Pirros North Idaho Visit Date Location And Event Details

May 09, 2025