Palantir Stock Outlook: Wall Street's Unanimous Pre-May 5th Recommendation

Table of Contents

Analyzing Palantir's Recent Financial Performance and Growth Trajectory

Revenue Growth and Profitability

Palantir's Q4 2022 earnings report showcased significant progress. Let's examine the key figures:

- Revenue Growth: Palantir exceeded expectations, demonstrating strong revenue growth compared to Q4 2021. While precise figures require referencing the official report, the growth rate was a key driver of the positive analyst sentiment. This growth was fueled by both government and commercial sectors.

- Profitability Margins: Improvements in gross and operating profit margins indicated increased efficiency and cost management. Analyzing the percentage change compared to previous quarters provides insight into the sustainability of this trend. A continued upward trajectory in profitability is crucial for a positive Palantir stock outlook.

- Key Revenue Drivers: Government contracts continued to be a significant revenue source, but the growth in commercial sales demonstrated Palantir's success in diversifying its client base. This diversification reduces reliance on any single sector and minimizes risk, enhancing the Palantir stock appeal for investors.

Palantir's guidance for future revenue growth further bolsters investor confidence. However, it's crucial to analyze the sustainability of this growth and identify potential risks, such as economic downturns impacting government spending or increased competition.

Key Metrics and Indicators

Beyond revenue, several key metrics influence the Palantir stock price:

- Customer Churn Rate: A low churn rate indicates customer satisfaction and loyalty. A decreasing churn rate is a positive indicator for long-term growth and stability, impacting the Palantir stock positively.

- Average Revenue Per User (ARPU): Growth in ARPU suggests successful upselling and cross-selling of Palantir's products and services, leading to higher profitability and a more robust Palantir stock valuation.

- Customer Acquisition Cost (CAC): A low CAC indicates efficient customer acquisition strategies, contributing to healthier financial performance and a more attractive Palantir stock investment.

Analyzing these metrics in conjunction with revenue growth provides a holistic view of Palantir's performance and its implications for the Palantir stock price.

Debt and Cash Position

A strong financial position is crucial for long-term growth and stability:

- Debt Levels: Palantir's current debt levels should be evaluated to understand its financial leverage. Low debt levels reduce financial risk and increase investor confidence.

- Cash Reserves: Sufficient cash reserves provide financial flexibility, allowing Palantir to invest in R&D, acquisitions, and withstand economic downturns. A strong cash position directly influences the Palantir stock valuation.

- Overall Financial Health: A strong balance sheet, demonstrated by a healthy debt-to-equity ratio and positive cash flow, is essential for sustainable growth and makes the Palantir stock more attractive.

Evaluating the Impact of Geopolitical Factors and Industry Trends

Government Spending and Defense Contracts

Government spending, particularly on defense and national security, significantly impacts Palantir:

- Increased Spending: Increased government budgets for these sectors directly translate into increased opportunities for Palantir to secure lucrative contracts. This is a crucial factor in the positive Palantir stock outlook.

- New Contract Awards: Successfully winning new contracts is vital for sustained revenue growth and maintains confidence in the Palantir stock.

- Budgetary Constraints: Potential reductions in government spending represent a risk that could negatively impact Palantir's revenue and the Palantir stock price.

Competition and Market Share

Palantir operates in a competitive market:

- Key Competitors: Identifying and analyzing key competitors, understanding their strengths and weaknesses, is crucial for assessing Palantir's competitive position.

- Market Share: Maintaining or expanding market share is paramount for long-term success and positively influences Palantir stock performance.

- Competitive Advantages: Palantir's unique technological capabilities and strong customer relationships provide a competitive edge, supporting the positive Palantir stock projections.

Technological Innovation and Future Growth

Continuous innovation is key to Palantir's long-term success:

- R&D Investments: Significant investments in research and development are essential for creating cutting-edge products and services. This is a key driver of the positive sentiment surrounding Palantir stock.

- New Product Launches: Successful product launches expand Palantir's offerings and address evolving market needs, which enhances its competitiveness and positively impacts Palantir stock.

- Future Growth Prospects: The potential for new technologies to disrupt the market and create new opportunities is a crucial factor in assessing the future growth of Palantir and its stock performance.

Interpreting Wall Street's Consensus and Analyst Ratings

Pre-May 5th Analyst Ratings and Price Targets

Before May 5th, the consensus among leading analysts was overwhelmingly positive:

- Consensus Rating: A summary of ratings from multiple reputable analysts provides a comprehensive overview of Wall Street's sentiment towards Palantir stock.

- Price Targets: Analysts' price targets indicate their expectations for the future Palantir stock price, providing investors with valuable information.

- Rationale: Understanding the reasoning behind analysts' recommendations is crucial for evaluating the validity of their projections and forming your own informed opinion on Palantir stock.

Risk Assessment and Potential Downsides

Despite the positive outlook, investors must consider potential risks:

- Economic Downturns: Recessions can significantly impact government and commercial spending, affecting Palantir's revenue and Palantir stock performance.

- Regulatory Changes: New regulations could impact Palantir's operations and profitability, affecting the Palantir stock outlook.

- Cybersecurity Threats: Data breaches and cybersecurity vulnerabilities could damage Palantir's reputation and customer trust, negatively impacting the Palantir stock price.

- Increased Competition: Intensified competition could erode Palantir's market share and profitability.

Considering Diversification and Risk Tolerance

Smart investing involves diversification:

- Portfolio Diversification: Investing in Palantir stock shouldn't be the only component of an investment portfolio. Diversification reduces risk.

- Risk Tolerance: Investors must assess their own risk tolerance before investing in Palantir stock, considering the potential for both high rewards and significant losses.

- Financial Advice: Seeking professional financial advice is recommended before making any major investment decisions, especially regarding a volatile stock like Palantir.

Conclusion

The pre-May 5th unanimous positive sentiment surrounding Palantir stock reflects strong underlying financial performance and positive growth prospects. While the company faces potential challenges, the analysts' consensus points towards a positive outlook. However, investors should carefully consider the risks associated with investing in Palantir stock and align their investment decisions with their individual risk tolerance and financial goals. Before making any investment decisions on Palantir stock, conduct thorough research and potentially consult with a qualified financial advisor. Remember to stay informed about future Palantir stock developments and adjust your investment strategy as needed.

Featured Posts

-

Lisa Ray Vs Air India Airline Rejects Actresss Claims

May 09, 2025

Lisa Ray Vs Air India Airline Rejects Actresss Claims

May 09, 2025 -

Dealers Double Down Fighting Back Against Ev Mandates

May 09, 2025

Dealers Double Down Fighting Back Against Ev Mandates

May 09, 2025 -

Bbc Show Sees Joanna Page Confront Wynne Evans Over Performance

May 09, 2025

Bbc Show Sees Joanna Page Confront Wynne Evans Over Performance

May 09, 2025 -

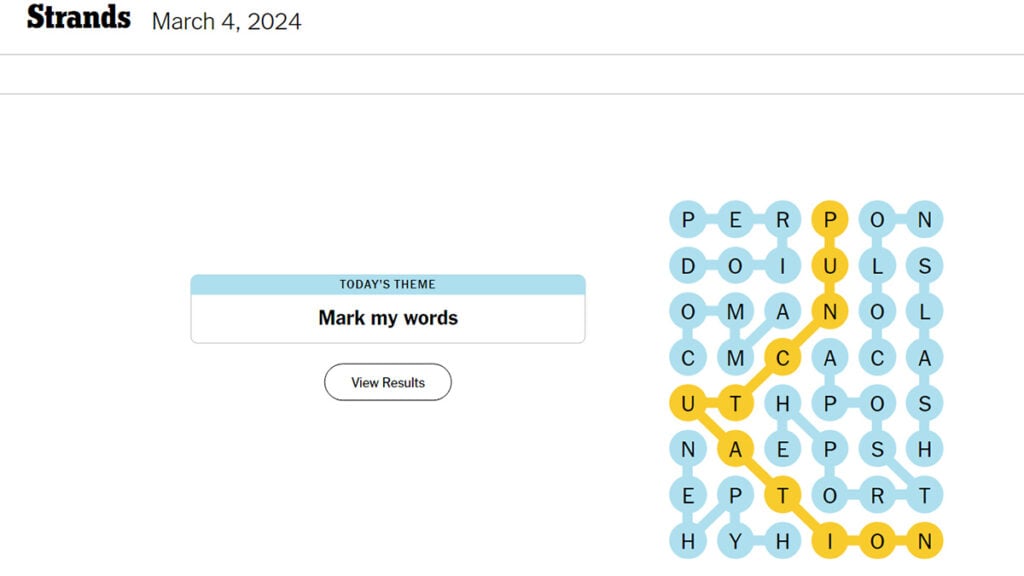

Nyt Strands Hints And Answers Saturday March 15 Game 377

May 09, 2025

Nyt Strands Hints And Answers Saturday March 15 Game 377

May 09, 2025 -

108 000 Funding Boost For Renewed Madeleine Mc Cann Investigation

May 09, 2025

108 000 Funding Boost For Renewed Madeleine Mc Cann Investigation

May 09, 2025