Palantir Stock (PLTR) - Pre-May 5th Investment Analysis

Table of Contents

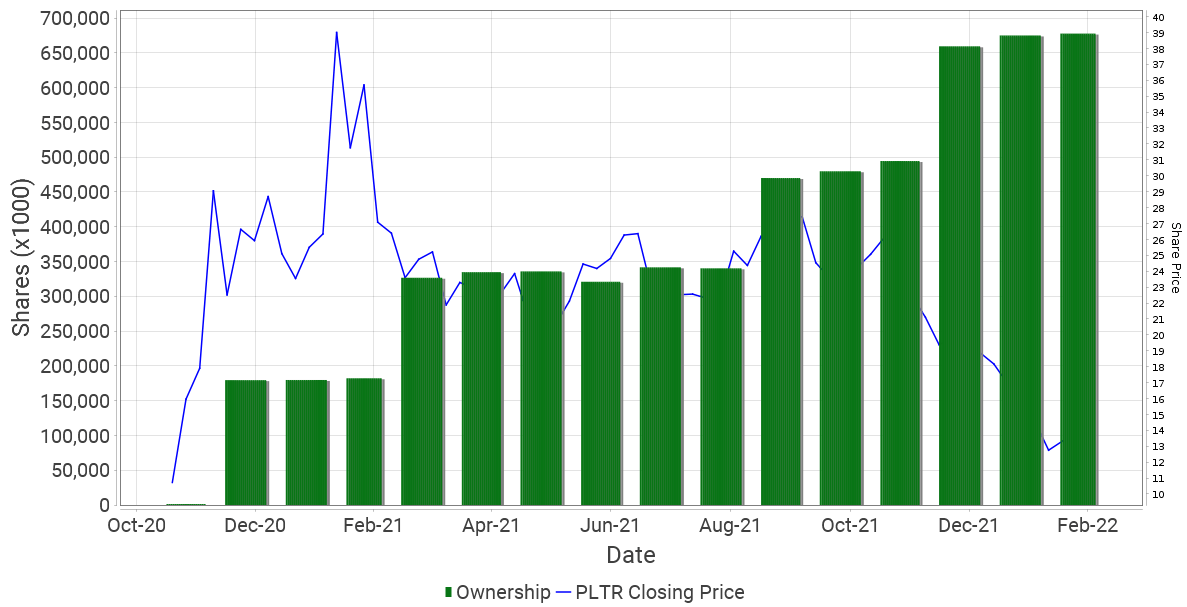

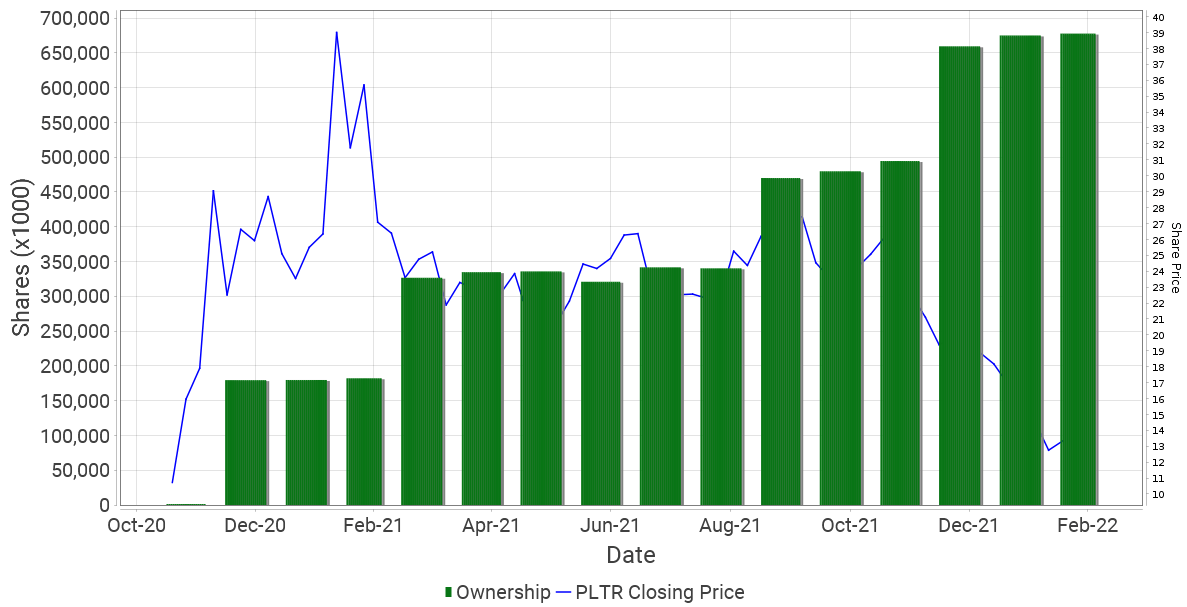

Palantir Technologies (PLTR) stock has experienced significant volatility in recent months, making investors question its future prospects. With a key date, May 5th, approaching (replace with actual relevant date and event if applicable), analyzing the current state of Palantir Stock (PLTR) is crucial for potential investors. This pre-May 5th investment analysis of Palantir Stock (PLTR) will delve into the company's recent financial performance, competitive landscape, and associated risks to help you make an informed decision. We will examine key factors influencing Palantir Stock (PLTR) before you consider adding it to your portfolio.

H2: Palantir's Recent Financial Performance and Future Projections

H3: Revenue Growth and Profitability

Palantir's revenue growth has been a key focus for investors. Examining recent quarterly reports reveals valuable insights. While the company has shown consistent revenue growth, profitability remains a key area of focus. Let's look at the numbers:

- Key Metrics: Analyze the year-over-year (YoY) and quarter-over-quarter (QoQ) revenue growth rates. Compare these figures to previous years and competitor performance. Access and analyze data from sources such as SEC filings and financial news outlets.

- Gross Margins and Operating Expenses: Scrutinize gross margins to understand Palantir's pricing power and efficiency in delivering its services. Analyze operating expenses to identify areas for potential improvement and cost optimization.

- Analysts' Predictions: Consult financial analyst reports to understand their forecasts for Palantir's future revenue growth and profitability. Consider the range of predictions and the underlying assumptions used. Different analysts may have varying expectations for Palantir Stock (PLTR).

The key drivers of Palantir's revenue growth include its strong presence in government contracts and its expanding commercial partnerships. Analyzing the growth rate of each sector offers valuable insight into future revenue projections.

H3: Government vs. Commercial Revenue

Palantir's revenue streams are split between government and commercial sectors. Understanding the proportion and growth of each is vital:

- Revenue Breakdown: Determine the percentage of revenue derived from government contracts versus commercial partnerships.

- Growth Prospects: Assess the growth potential of each sector independently. The government sector may be more stable but potentially slower growing, whereas the commercial sector may offer higher growth but with increased competition.

- Contract Wins/Losses: Keep track of significant government contract wins and losses, as these can significantly impact Palantir's revenue and overall valuation.

A healthy balance between government and commercial revenue is generally considered beneficial for mitigating risk and ensuring sustainable growth for Palantir Stock (PLTR).

H3: Cash Flow and Debt

A strong financial foundation is crucial for long-term success. Analyzing Palantir's cash flow and debt will provide a comprehensive picture of its financial health:

- Free Cash Flow (FCF): Examine Palantir's FCF to assess its ability to generate cash from its operations. Strong positive FCF indicates a healthy financial position.

- Debt-to-Equity Ratio: Calculate the debt-to-equity ratio to assess Palantir's financial leverage. A lower ratio signifies lower financial risk.

- Cash on Hand: Analyze the amount of cash and cash equivalents Palantir holds, providing a buffer for unforeseen circumstances.

- Capital Expenditure Plans: Evaluate Palantir's plans for future capital expenditures, as this can impact its cash flow and overall financial position.

H2: Competitive Landscape and Market Position

H3: Key Competitors and Market Share

Palantir operates in a competitive market with established players and emerging startups. Understanding the competitive landscape is crucial:

- Direct and Indirect Competitors: Identify Palantir's main competitors, including Databricks, Snowflake, and other data analytics companies. Consider both direct and indirect competitors based on overlapping services and target markets.

- Competitive Analysis: Compare Palantir's strengths and weaknesses against its competitors, focusing on factors such as pricing, technology, and market reach.

- Palantir's Unique Selling Proposition (USP): Identify Palantir's unique value proposition, which allows it to stand out in the market and attract clients. This may include its proprietary technology, data integration capabilities, or its strong relationships with government agencies.

H3: Technological Advantages and Innovation

Palantir's technological capabilities and innovation are key drivers of its success:

- AI Capabilities: Evaluate Palantir's AI capabilities and their potential to enhance its offerings and attract new customers.

- Data Analytics Platform: Analyze the scalability and functionality of Palantir's data analytics platform, comparing its features and capabilities to those of competitors.

- Platform Scalability: Assess the scalability of Palantir's platform to handle large volumes of data and cater to the needs of growing businesses and governments.

- Future Technology Roadmap: Investigate Palantir's plans for future technological advancements and innovations.

H2: Risk Factors and Potential Downsides

H3: Geopolitical Risks

Palantir's reliance on government contracts exposes it to geopolitical risks:

- International Relations: Assess the impact of international relations on Palantir's government contracts, particularly in regions with political instability.

- Government Budget Cuts: Consider the potential impact of government budget cuts on Palantir's revenue and future contracts.

- Regulatory Changes: Analyze the potential effects of changes in government regulations on Palantir's business operations and growth prospects.

H3: Dependence on Large Contracts

Reliance on a small number of large contracts poses significant risk:

- Contract Renewal Risks: Assess the risks associated with contract renewals, including the possibility of contract non-renewal or renegotiation.

- Concentration of Revenue: Analyze the concentration of Palantir's revenue from a limited number of clients and the potential impact on its financial performance if these contracts are lost.

- Potential Contract Disputes: Consider the potential for disputes or delays in the execution of contracts, which can impact revenue and profitability.

H3: Valuation and Stock Price

Evaluating Palantir's valuation relative to its peers and market conditions is essential:

- Current Stock Price: Note the current market price of Palantir Stock (PLTR).

- Historical Performance: Review the historical performance of Palantir Stock (PLTR) to understand its price volatility and trends.

- Analyst Price Targets: Compare the current stock price to analysts' price targets to gauge potential upside or downside.

- Key Valuation Metrics: Analyze relevant valuation metrics such as P/E ratio, price-to-sales ratio, and others to determine if Palantir Stock (PLTR) is overvalued or undervalued.

3. Conclusion: Investing in Palantir Stock (PLTR) – A Pre-May 5th Summary and Call to Action

This pre-May 5th analysis of Palantir Stock (PLTR) reveals a company with significant growth potential but also substantial risks. While Palantir demonstrates strong revenue growth and innovative technology, its reliance on government contracts and the competitive data analytics market present challenges. The valuation of Palantir Stock (PLTR) needs careful consideration. Therefore, a cautious approach is warranted. Whether Palantir stock is a buy, sell, or hold before May 5th depends on your individual risk tolerance and investment strategy. This analysis should be considered alongside your own thorough research and consultation with a qualified financial advisor.

Before making any investment decisions regarding Palantir Stock (PLTR) or any other investment, conduct your own thorough due diligence and consider consulting with a financial advisor. Remember, this article provides an analysis and not financial advice. Learn more about Palantir investment strategies and PLTR stock analysis through further research.

Featured Posts

-

Nottingham Attack Over 90 Nhs Staff Viewed Victim Records Data Breach Concerns

May 09, 2025

Nottingham Attack Over 90 Nhs Staff Viewed Victim Records Data Breach Concerns

May 09, 2025 -

High Potential Episode 13 Unmasking The Actor Behind David The Kidnapper

May 09, 2025

High Potential Episode 13 Unmasking The Actor Behind David The Kidnapper

May 09, 2025 -

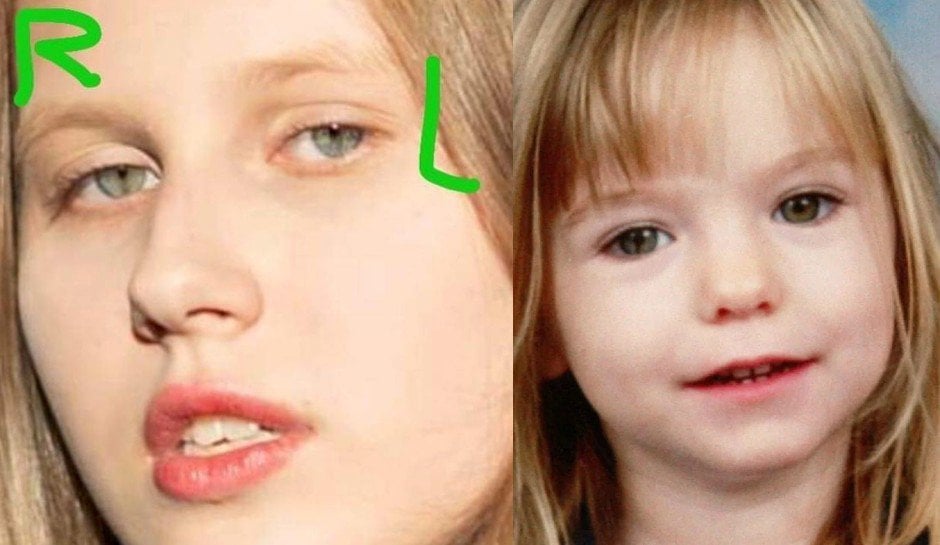

New Dna Test Results In Madeleine Mc Cann Case A 23 Year Olds Claim Examined

May 09, 2025

New Dna Test Results In Madeleine Mc Cann Case A 23 Year Olds Claim Examined

May 09, 2025 -

Dons De Cheveux A Dijon Informations Pratiques

May 09, 2025

Dons De Cheveux A Dijon Informations Pratiques

May 09, 2025 -

Imalaia Xamila Epipeda Xionioy Anisyxia Gia To Mellon

May 09, 2025

Imalaia Xamila Epipeda Xionioy Anisyxia Gia To Mellon

May 09, 2025