Palantir Stock Price Surge: Analysts Adjust Forecasts

Table of Contents

Factors Contributing to the Palantir Stock Price Surge

Several key factors have contributed to the recent surge in the Palantir stock price. These factors paint a picture of a company experiencing robust growth and positive market sentiment.

Stronger-than-Expected Q2 Earnings

Palantir's Q2 2024 earnings report significantly exceeded analyst expectations, fueling the recent stock price increase. The positive results showcased a company performing beyond projections.

- Revenue: Palantir surpassed revenue expectations by [Insert Percentage]%, reaching $[Insert Revenue Figure]. This represents a [Insert Percentage]% increase compared to Q2 2023.

- Margins: Improved operating margins demonstrate increased efficiency and profitability, bolstering investor confidence.

- Guidance: Positive guidance for the remainder of the year further reinforced the bullish outlook for Palantir's financial performance. The company projected [Insert Key Guidance Metrics].

- Key Contracts: The signing of significant new contracts with [mention specific clients if possible, e.g., major government agencies or large commercial enterprises] contributed substantially to the positive earnings report.

Increased Government & Commercial Contracts

A significant driver of Palantir's growth is the increasing number of contracts secured from both government and commercial sectors. This diversification reduces reliance on any single client and demonstrates the broad applicability of Palantir's data analytics platform.

- Government Sector: Palantir continues to secure substantial contracts with various government agencies, reflecting the increasing demand for its advanced data analytics capabilities in national security and intelligence.

- Commercial Partnerships: The company has expanded its footprint in the commercial sector, forging partnerships with key players in healthcare, finance, and other data-intensive industries. For instance, [mention specific examples of partnerships and their impact].

- Industry Traction: Palantir is gaining significant traction in sectors requiring complex data analysis and operational efficiency. This expansion across various industries reduces the risk associated with reliance on a single market segment.

Improved Market Sentiment Towards Data Analytics

The positive market sentiment surrounding data analytics and artificial intelligence (AI) is another factor contributing to the Palantir stock price surge. Palantir is well-positioned to benefit from this broader trend.

- AI Boom: The current focus on AI and machine learning is directly beneficial to Palantir, as its platform leverages these technologies to deliver advanced data solutions.

- Economic Factors: The growing need for data-driven decision-making across all sectors, driven by [mention relevant economic factors, e.g., increased competition, need for operational efficiency], is boosting demand for Palantir's services.

- Competitive Landscape: While competitors exist in the data analytics space, Palantir's unique platform and strong client relationships have allowed it to maintain a competitive edge, resulting in positive market perception.

Analyst Revisions and Updated Forecasts

The strong Q2 earnings and positive market sentiment have led several prominent analysts to revise their price targets for Palantir stock significantly upward.

Upward Revisions of Price Targets

- Analyst X: Increased price target from $[Previous Target] to $[New Target], citing [Analyst's Rationale].

- Analyst Y: Raised price target from $[Previous Target] to $[New Target], highlighting [Analyst's Rationale].

- Analyst Z: Adjusted price target from $[Previous Target] to $[New Target], emphasizing [Analyst's Rationale]. This represents a [Percentage]% increase from the previous forecast.

These upward revisions reflect a growing confidence among analysts in Palantir's future growth trajectory and its ability to deliver strong financial results.

Shifting Long-Term Outlook

Analysts have generally adjusted their long-term outlook for Palantir to a more positive stance. The recent stock surge has significantly impacted the company's valuation, indicating a higher market expectation for future performance.

- Valuation: The increased stock price reflects a higher market valuation for Palantir, suggesting investor belief in its long-term growth prospects.

- Consensus Rating: The consensus rating among analysts may have shifted towards a more bullish "buy" recommendation, reflecting increased confidence in the company's future.

- Long-Term Growth: Analysts' long-term forecasts for revenue and earnings growth have likely been revised upward, reflecting the positive momentum demonstrated in recent quarters.

Potential Risks and Considerations for Investors

Despite the positive outlook, investors should carefully consider potential risks before investing in Palantir stock.

Market Volatility and Economic Uncertainty

The stock market is inherently volatile, and macroeconomic factors can significantly impact even well-performing companies.

- Economic Downturn: A potential economic downturn could reduce demand for Palantir's services, affecting its revenue growth.

- Market Corrections: The stock market is subject to periodic corrections, which could negatively impact Palantir's stock price regardless of its fundamental performance.

- Regulatory Changes: Changes in government regulations or policies could potentially impact Palantir's operations and future growth.

Dependence on Government Contracts

Palantir's revenue is partially dependent on government contracts, which introduces a degree of risk.

- Government Spending: Changes in government spending priorities or budget cuts could affect Palantir's revenue stream.

- Political Factors: Political shifts and changes in administration could influence the awarding of government contracts.

- Contract Renewals: The successful renewal of existing government contracts is crucial for maintaining a stable revenue base. However, this is not guaranteed.

Conclusion

The recent Palantir stock price surge reflects a combination of strong financial performance, increased contract wins, and a generally positive market sentiment towards data analytics. While analysts have significantly revised their forecasts upwards, investors should carefully consider the inherent risks associated with growth stocks and the company's dependence on government contracts. Understanding these factors is crucial for making informed decisions about investing in Palantir stock. To stay updated on the latest developments and analysis surrounding the Palantir stock price, continue following reputable financial news sources and expert opinions. Thorough research is vital before making any investment decisions related to Palantir stock and its future forecasts.

Featured Posts

-

Nyt Strands Puzzle Solutions Saturday February 15th Game 349

May 10, 2025

Nyt Strands Puzzle Solutions Saturday February 15th Game 349

May 10, 2025 -

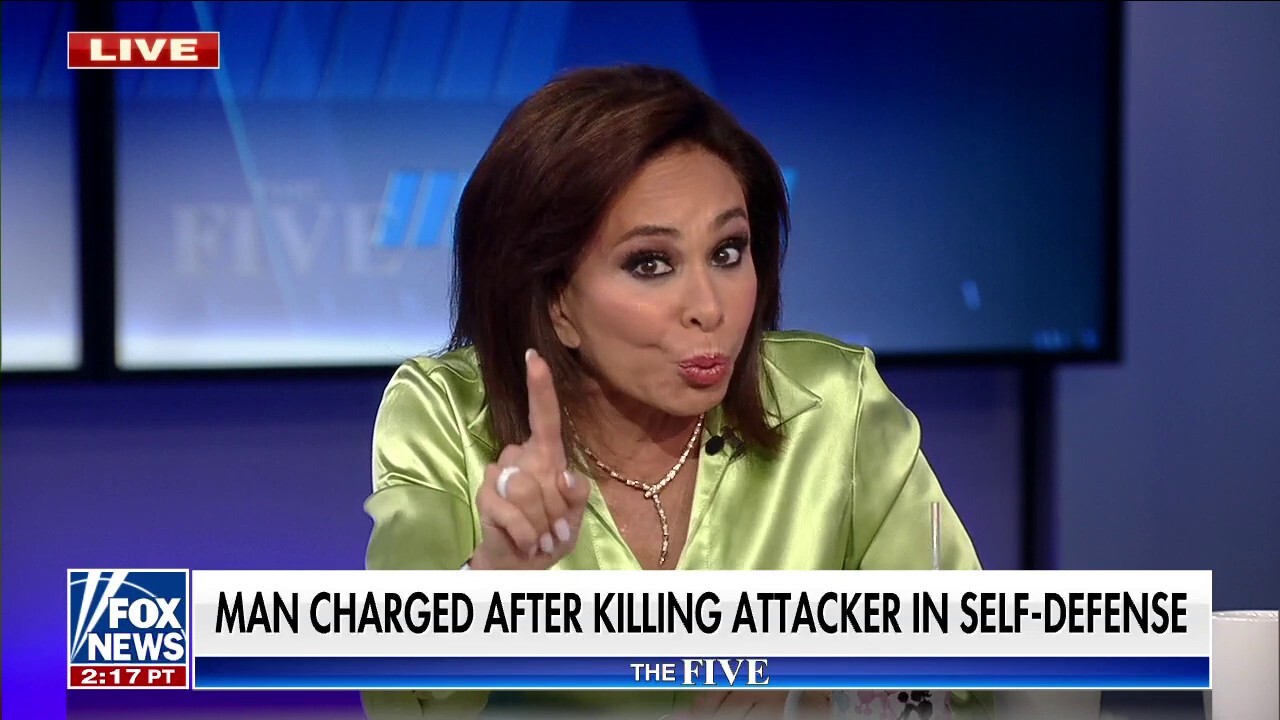

Jeanine Pirros Comments On Due Process And El Salvador Prison Transfers

May 10, 2025

Jeanine Pirros Comments On Due Process And El Salvador Prison Transfers

May 10, 2025 -

Dakota Johnson With Family At Los Angeles Materialist Screening

May 10, 2025

Dakota Johnson With Family At Los Angeles Materialist Screening

May 10, 2025 -

Donner Ses Cheveux A Dijon Guide Complet Pour Faire Un Don

May 10, 2025

Donner Ses Cheveux A Dijon Guide Complet Pour Faire Un Don

May 10, 2025 -

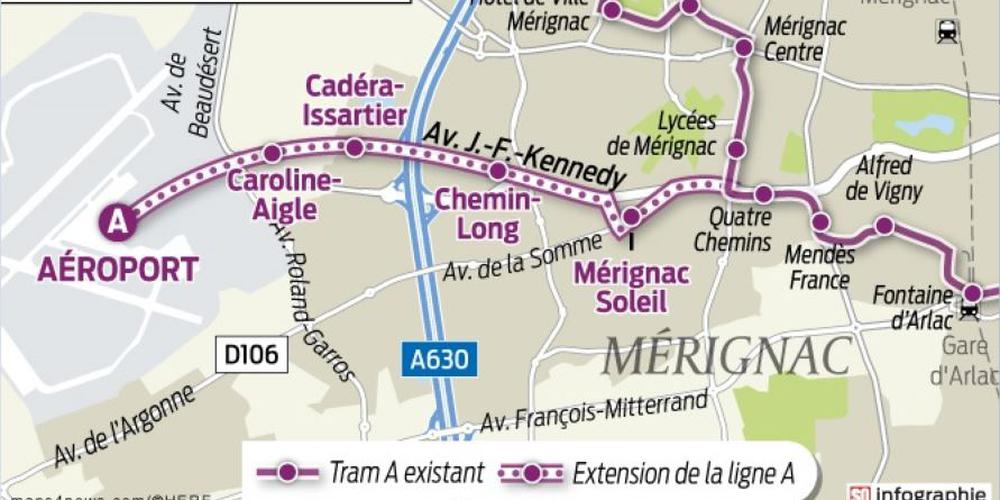

Dijon Concertation Adoptee Pour La Troisieme Ligne De Tram

May 10, 2025

Dijon Concertation Adoptee Pour La Troisieme Ligne De Tram

May 10, 2025