Palantir Technologies Stock: A Detailed Investment Overview

Table of Contents

Palantir's Business Model and Revenue Streams

Palantir's core business revolves around providing cutting-edge data analytics software to both government and commercial clients. This is achieved through two primary platforms:

- Gotham: This platform caters primarily to government agencies and intelligence organizations, assisting them with complex data integration, analysis, and decision-making. Its applications span counter-terrorism, cybersecurity, and fraud detection.

- Foundry: Designed for commercial clients, Foundry offers a flexible and scalable platform for data integration and analysis across various industries, from finance and healthcare to manufacturing and energy.

Palantir's revenue model is a blend of:

- Software licensing: Recurring revenue generated from client subscriptions to its platforms.

- Services revenue: Professional services, implementation support, and ongoing maintenance contracts.

Key Revenue Sources and Growth Potential:

- Gotham's continued dominance in the government sector offers a stable and potentially high-growth revenue stream.

- Foundry's expansion into diverse commercial markets holds significant growth potential, though it faces stiffer competition.

The company's significant dependence on government contracts, particularly through Gotham, represents both a strength (stable, high-value contracts) and a risk (potential dependence on government spending). The balance between government and commercial revenue will significantly influence future growth.

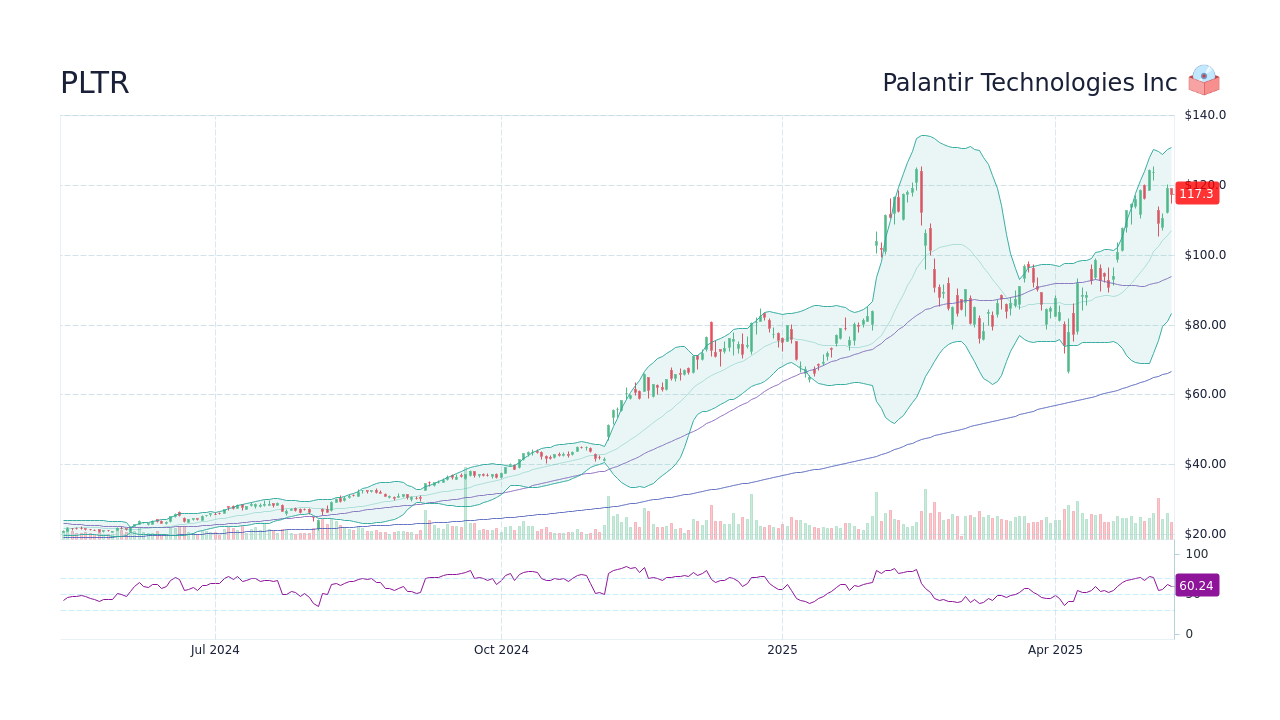

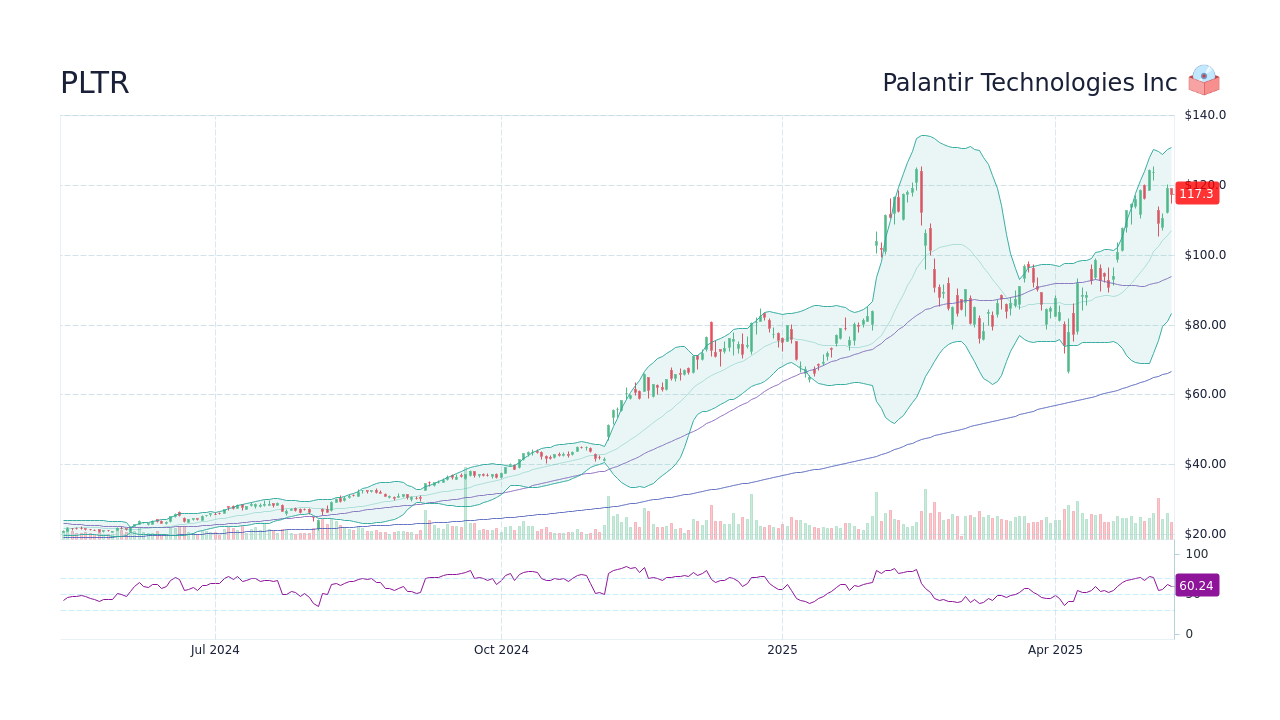

Financial Performance and Key Metrics

Analyzing Palantir's financial performance requires examining several key metrics:

- Revenue Growth: Palantir has demonstrated significant revenue growth, though profitability remains a focus. Examining year-over-year revenue growth is crucial for understanding the trajectory of the business.

- Profitability: Achieving consistent profitability is a key objective for Palantir. Investors should track metrics such as operating margin and net income to assess the company's efficiency.

- Cash Flow: Analyzing cash flow from operations is essential for determining the company's ability to generate cash and fund future growth.

Key Financial Ratios:

- P/E Ratio: This helps evaluate the valuation of Palantir stock relative to its earnings. A high P/E ratio can indicate high growth expectations, but also potential overvaluation.

- Debt-to-Equity Ratio: This provides insight into Palantir's financial leverage and risk profile. A high ratio indicates higher financial risk.

Palantir's growth trajectory, while impressive, needs careful scrutiny. The sustainability of this growth is tied to continued success in securing both government and commercial contracts, as well as efficient execution of its business strategy.

Competitive Landscape and Market Opportunities

Palantir competes with several established players and emerging startups in the data analytics market. Key competitors include companies offering similar big data and analytics solutions, such as:

- [Insert names of major competitors here, e.g., Databricks, Snowflake, etc.]

Palantir's Competitive Advantages:

- Proprietary technology: Palantir's advanced algorithms and data integration capabilities provide a significant competitive edge.

- Strong client relationships: Its deep relationships with government agencies and large commercial organizations offer a substantial barrier to entry for competitors.

- Market positioning: Palantir's established presence in high-value government and commercial sectors provides a strong foundation for future growth.

Market Opportunities:

- Expansion into new commercial sectors, such as pharmaceuticals and supply chain management.

- International market expansion, particularly in Europe and Asia.

These market opportunities represent significant potential for revenue growth and market share expansion for Palantir.

Risks and Challenges for Palantir Investors

Investing in Palantir Technologies stock carries inherent risks:

- Government contract dependence: A significant portion of Palantir's revenue comes from government contracts, making it susceptible to changes in government spending and policy.

- Competition: The data analytics market is becoming increasingly competitive, with both established and emerging players vying for market share.

- Regulatory hurdles: Palantir operates in a heavily regulated environment, and changes in regulations could impact its business.

- Macroeconomic factors: Economic downturns can significantly impact both government and commercial spending, potentially affecting Palantir's revenue and profitability.

These risks, while significant, are not insurmountable. Palantir's strong technology, established client base, and market positioning provide some mitigation against these challenges.

Palantir Stock Valuation and Investment Considerations

Evaluating Palantir's stock requires a comprehensive valuation analysis:

- Discounted Cash Flow (DCF) Analysis: This method projects future cash flows and discounts them back to their present value to estimate the intrinsic value of the stock.

- Comparable Company Analysis: This involves comparing Palantir's valuation metrics (e.g., P/E ratio) to those of similar companies in the industry.

Based on these analyses, one can determine whether the current stock price reflects the company's intrinsic value. Is it overvalued, undervalued, or fairly valued? This analysis, combined with an understanding of the risks and opportunities discussed earlier, forms the basis for an informed investment recommendation (buy, sell, or hold).

Conclusion: Investing in Palantir Technologies Stock – A Final Verdict

Investing in Palantir Technologies stock (PLTR) presents a compelling opportunity for growth, but it's crucial to acknowledge the inherent risks. The company's innovative technology and strong client relationships provide a competitive edge, but its dependence on government contracts and the competitive landscape pose significant challenges. Thorough due diligence, including an in-depth understanding of its financial performance, competitive position, and potential risks, is essential before making any investment decision. Remember to consider your own risk tolerance and investment goals. Conduct your own research and consider investing in Palantir Technologies stock (PLTR) only if it aligns with your personal investment strategy.

Featured Posts

-

Proposed Changes To Bond Forward Regulations For Indian Insurers

May 09, 2025

Proposed Changes To Bond Forward Regulations For Indian Insurers

May 09, 2025 -

Thailand Seeks New Bot Governor Amidst Rising Tariff Concerns

May 09, 2025

Thailand Seeks New Bot Governor Amidst Rising Tariff Concerns

May 09, 2025 -

Otkaz Makrona Starmera Mertsa I Tuska Ot Poezdki V Kiev Prichiny I Posledstviya

May 09, 2025

Otkaz Makrona Starmera Mertsa I Tuska Ot Poezdki V Kiev Prichiny I Posledstviya

May 09, 2025 -

Early Childhood Development The Daycare Dilemma

May 09, 2025

Early Childhood Development The Daycare Dilemma

May 09, 2025 -

Wireless Mesh Network Market Expansion A 9 8 Cagr Projection

May 09, 2025

Wireless Mesh Network Market Expansion A 9 8 Cagr Projection

May 09, 2025