Palantir Technologies Stock: Buy, Sell, Or Hold? A Current Market Evaluation

Table of Contents

Palantir's Business Model and Recent Performance

Palantir Technologies is a data analytics company offering software platforms to government and commercial clients. Its flagship products, Gotham and Foundry, provide advanced data integration, analysis, and visualization capabilities. The company's success hinges on its ability to process and interpret vast datasets, providing actionable insights for its clients.

-

Government Contracts: Government contracts represent a significant portion of Palantir's revenue. While exact figures fluctuate, this segment consistently contributes substantially to the company's bottom line. Future projections for government contracts depend heavily on continued US government spending on defense and intelligence initiatives. Increased geopolitical instability could positively impact this sector.

-

Commercial Sector Growth: Palantir is actively expanding its presence in the commercial sector, targeting large enterprises across various industries like finance, healthcare, and manufacturing. Key clients include Fortune 500 companies who utilize Palantir's platforms for operational efficiency, risk management, and fraud detection. Market penetration in the commercial sector is a key driver for future growth.

-

Recent Financial Results: Palantir's recent financial results show a mixed bag. While revenue has shown consistent growth year-over-year, profitability remains a challenge. For example, in Q2 2024 (replace with actual data when available), the company reported [insert actual revenue figures] in revenue and [insert actual earnings figures] in earnings. This compares to [insert previous quarter/year figures for comparison]. Analyzing these trends requires a close look at the underlying factors driving revenue growth and cost structures.

-

Key Performance Indicators (KPIs): Analyzing Palantir's KPIs, such as customer acquisition cost (CAC) and average revenue per user (ARPU), is essential to understanding its business model's effectiveness. A declining CAC or rising ARPU would indicate positive trends. Tracking these metrics alongside revenue growth gives a holistic picture of the company's financial health.

Growth Potential and Future Outlook

Palantir's growth potential is significant, particularly within the rapidly expanding artificial intelligence (AI) and big data markets. Its platforms are well-positioned to benefit from the increasing demand for advanced data analytics and AI-driven insights.

-

Market Opportunity Analysis: The market for data analytics and AI is projected to grow exponentially in both the government and commercial sectors. Palantir's ability to capitalize on this growth depends on its capacity for innovation and its success in securing new clients.

-

New Product Development: Continuous innovation and the development of new products and services are crucial for Palantir's long-term growth. Expansion into adjacent markets, like cybersecurity or supply chain management, could diversify revenue streams and reduce reliance on existing offerings.

-

Competition: Palantir faces competition from established tech giants like Microsoft, Amazon, and Google, as well as specialized data analytics companies. Its competitive advantages lie in its proprietary technology, strong government relationships, and focus on highly secure and complex data analysis.

-

Long-Term Growth Projections: Analyst estimates for Palantir's long-term growth vary considerably. Some analysts project significant growth, while others express caution due to the inherent challenges in the market. Understanding the range of projections and the underlying assumptions is essential.

Risk Assessment and Valuation

Investing in Palantir Technologies carries significant risks. A thorough understanding of these risks is essential for any investor considering a position in PLTR stock.

-

Valuation Multiples: Palantir's valuation, as measured by metrics like Price-to-Sales (P/S) ratio and Price-to-Earnings (P/E) ratio, is high compared to its peers. This high valuation reflects investor expectations of significant future growth but also presents a risk if growth fails to materialize.

-

Dependence on Government Contracts: Palantir's substantial reliance on government contracts exposes it to changes in government spending and regulatory shifts. A decrease in government spending could significantly impact its financial performance.

-

Competitive Pressures: Intense competition from established tech giants and emerging players poses a considerable risk. Palantir needs to continuously innovate and maintain a competitive edge to retain its market share.

-

Potential for Losses: While Palantir is growing its revenue, the company has historically not been consistently profitable. The possibility of future losses or slower-than-expected growth represents a significant investment risk.

-

High Stock Price Relative to Earnings: The high stock price relative to its earnings is a major risk factor. If the company fails to meet investor expectations for growth, the stock price could experience a significant correction.

Palantir Stock Valuation Metrics

A detailed analysis of Palantir's valuation metrics, including the P/S ratio, P/E ratio, and other relevant metrics, is crucial. Comparing these ratios to industry benchmarks provides context and helps determine whether the stock is overvalued or undervalued. This requires careful examination of financial statements and industry reports.

Analyst Ratings and Recommendations

Analyst ratings on Palantir Technologies stock are mixed. Some analysts maintain a "buy" rating, citing the company's strong technology and growth potential. Others issue "hold" or "sell" recommendations, pointing to valuation concerns and risks. It's crucial to consult multiple reputable sources like [link to reputable source 1], [link to reputable source 2], and [link to reputable source 3] for a comprehensive view of analyst sentiment.

Conclusion

This analysis of Palantir Technologies stock provides a balanced perspective, weighing its growth potential against significant risks. While Palantir operates in a high-growth market with strong technology, its valuation and dependence on government contracts present substantial challenges. The company's future success hinges on its ability to execute its growth strategy, navigate competitive pressures, and consistently deliver on its financial promises.

Call to Action: Ultimately, the decision to buy, sell, or hold Palantir Technologies stock depends on your individual risk tolerance and investment goals. Conduct thorough due diligence, consider consulting a financial advisor, and remember to research and understand the inherent risks associated with Palantir Technologies stock and any other stock investment before making any decisions. Careful consideration of the factors discussed above is vital before investing in Palantir Technologies stock.

Featured Posts

-

Dakota Johnson Melanie Griffith And Siblings Attend Materialist Screening

May 09, 2025

Dakota Johnson Melanie Griffith And Siblings Attend Materialist Screening

May 09, 2025 -

Fake Madeleine Mc Cann Uk Arrest Stuns Passengers

May 09, 2025

Fake Madeleine Mc Cann Uk Arrest Stuns Passengers

May 09, 2025 -

Nhl 2024 25 Key Storylines To Follow For The Rest Of The Season

May 09, 2025

Nhl 2024 25 Key Storylines To Follow For The Rest Of The Season

May 09, 2025 -

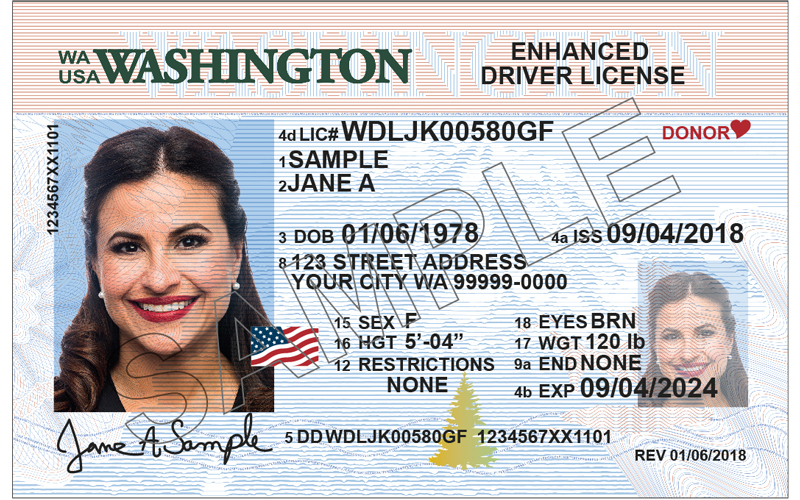

Real Id Enforcement Summer Travel Guide And What You Need To Know

May 09, 2025

Real Id Enforcement Summer Travel Guide And What You Need To Know

May 09, 2025 -

Chinas Canola Imports A Diversification Strategy

May 09, 2025

Chinas Canola Imports A Diversification Strategy

May 09, 2025