Palantir Technologies Stock: Is It A Good Investment In 2024?

Table of Contents

Palantir's Business Model and Growth Prospects

Palantir's core offerings, Gotham and Foundry, are powerful big data analytics platforms. Gotham caters primarily to government agencies, assisting in counterterrorism, intelligence gathering, and other critical missions. Foundry, on the other hand, targets commercial clients across various industries, helping them leverage their data for improved decision-making.

Palantir's success hinges on its ability to secure and retain lucrative contracts. Its government contracts, while significant, also expose it to political and budgetary shifts. The company is aggressively expanding its commercial client base, aiming for broader market penetration.

- Market Share in Big Data Analytics: While precise market share figures are difficult to obtain, Palantir holds a strong position in the niche market of highly secure, complex data analysis for government and enterprise clients.

- Recent Contract Wins: Palantir has consistently secured significant contracts, often valued in the tens or hundreds of millions of dollars. Specific contract details are often confidential, but publicly available information from press releases and financial reports should be reviewed for the most up-to-date figures.

- Expansion into New Markets: Palantir's expansion strategy includes targeting new sectors like healthcare and finance, leveraging its platform's adaptability. This diversification reduces reliance on any single market segment.

- Growth Potential in AI and Related Technologies: Palantir is actively integrating AI and machine learning capabilities into its platforms, further enhancing its offerings and driving growth. This positions the company for long-term success in the rapidly evolving technology landscape.

Financial Performance and Valuation

Analyzing Palantir's financial statements is crucial for evaluating its investment potential. While the company has shown revenue growth, profitability has remained a challenge. Investors should carefully examine key metrics:

- Key Financial Ratios (YoY Comparisons): Closely monitor revenue growth, operating margins, and net income to assess the company's financial health and profitability trends over time. Comparing year-over-year changes provides valuable insights into the company's performance.

- Debt Levels and Credit Rating: Understanding Palantir's debt burden and credit rating provides a measure of its financial risk profile. High debt levels can limit financial flexibility and increase vulnerability during economic downturns.

- Free Cash Flow Generation: Free cash flow (FCF) is a critical indicator of a company's ability to generate cash after covering its operating expenses and capital expenditures. Strong FCF generation is a positive sign of financial health and sustainability.

- Profitability Trends: Analyze the trends in gross margin, operating margin, and net income margin to gauge the company’s ability to translate revenue into profits.

Valuation metrics like the Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio should be compared to competitors to determine whether Palantir is overvalued or undervalued.

Risks and Challenges Facing Palantir

Despite its potential, Palantir faces several significant risks:

- Major Competitors and Their Strengths: The big data analytics market is competitive, with players like Databricks and Snowflake offering alternative solutions. Understanding their strengths and weaknesses is crucial for evaluating Palantir's competitive advantage.

- Potential Regulatory Changes Impacting the Business: Government regulations, particularly concerning data privacy and security, can significantly impact Palantir's operations and profitability.

- Dependence on Large Contracts (Potential for Contract Loss): The loss of a major government contract could severely impact Palantir's revenue and stock price.

- Economic Downturn Risk: During economic downturns, government and commercial clients may reduce spending on technology solutions, affecting Palantir's revenue and growth.

Palantir is actively working on mitigating these risks through diversification, technological innovation, and strategic partnerships.

Comparing Palantir to Competitors

A comprehensive analysis requires comparing Palantir to its key competitors in the big data analytics space. Consider factors such as:

- Comparison of Market Share: While precise figures are difficult to obtain, assessing relative market share provides insight into Palantir’s competitive position.

- Comparison of Revenue and Profitability: Comparing revenue growth and profitability metrics against competitors helps gauge Palantir’s relative financial performance.

- Analysis of Competitive Advantages: Palantir's proprietary technology, strong customer relationships, and focus on highly secure data analysis provide certain competitive advantages.

Expert Opinions and Analyst Ratings

Staying informed about analyst ratings and price targets is essential. Consult reputable financial news sources and analyst reports to understand the consensus view on Palantir's stock. Consider the range of opinions, understanding that analyst predictions are not guarantees of future performance.

- Summary of Recent Analyst Reports: Summarize the key findings and recommendations from recent analyst reports on Palantir.

- Average Price Target from Analysts: Note the average price target set by analysts, keeping in mind that this is just a prediction.

- Range of Analyst Ratings: Understand the distribution of buy, hold, and sell ratings to get a broader perspective.

Conclusion: Should You Invest in Palantir Technologies Stock in 2024?

Palantir Technologies presents a compelling but risky investment opportunity. Its strong technology and potential for growth in AI and expanding markets are counterbalanced by its dependence on large contracts, competitive landscape, and profitability challenges. The decision to invest in Palantir stock depends heavily on your risk tolerance and investment horizon. Conservative investors might prefer to wait for clearer signs of consistent profitability. More risk-tolerant investors might see the potential for significant returns.

Recommendation: Conduct thorough due diligence before investing in Palantir Technologies stock. Consider consulting with a financial advisor to determine if it aligns with your personal financial goals and risk profile.

Call to Action: Before making any investment decisions related to Palantir Technologies stock, conduct independent research using reputable financial resources. Carefully consider your personal financial circumstances and risk tolerance. Remember that past performance is not indicative of future results. Investing in Palantir Technologies stock, or any stock, involves inherent risk.

Featured Posts

-

Jeanine Pirros North Idaho Trip What To Expect From The Conservative Talk Show Host

May 10, 2025

Jeanine Pirros North Idaho Trip What To Expect From The Conservative Talk Show Host

May 10, 2025 -

Perus Mining Restrictions 200 Million Gold Output At Risk

May 10, 2025

Perus Mining Restrictions 200 Million Gold Output At Risk

May 10, 2025 -

Leon Draisaitl Injury Out Against Winnipeg Jets

May 10, 2025

Leon Draisaitl Injury Out Against Winnipeg Jets

May 10, 2025 -

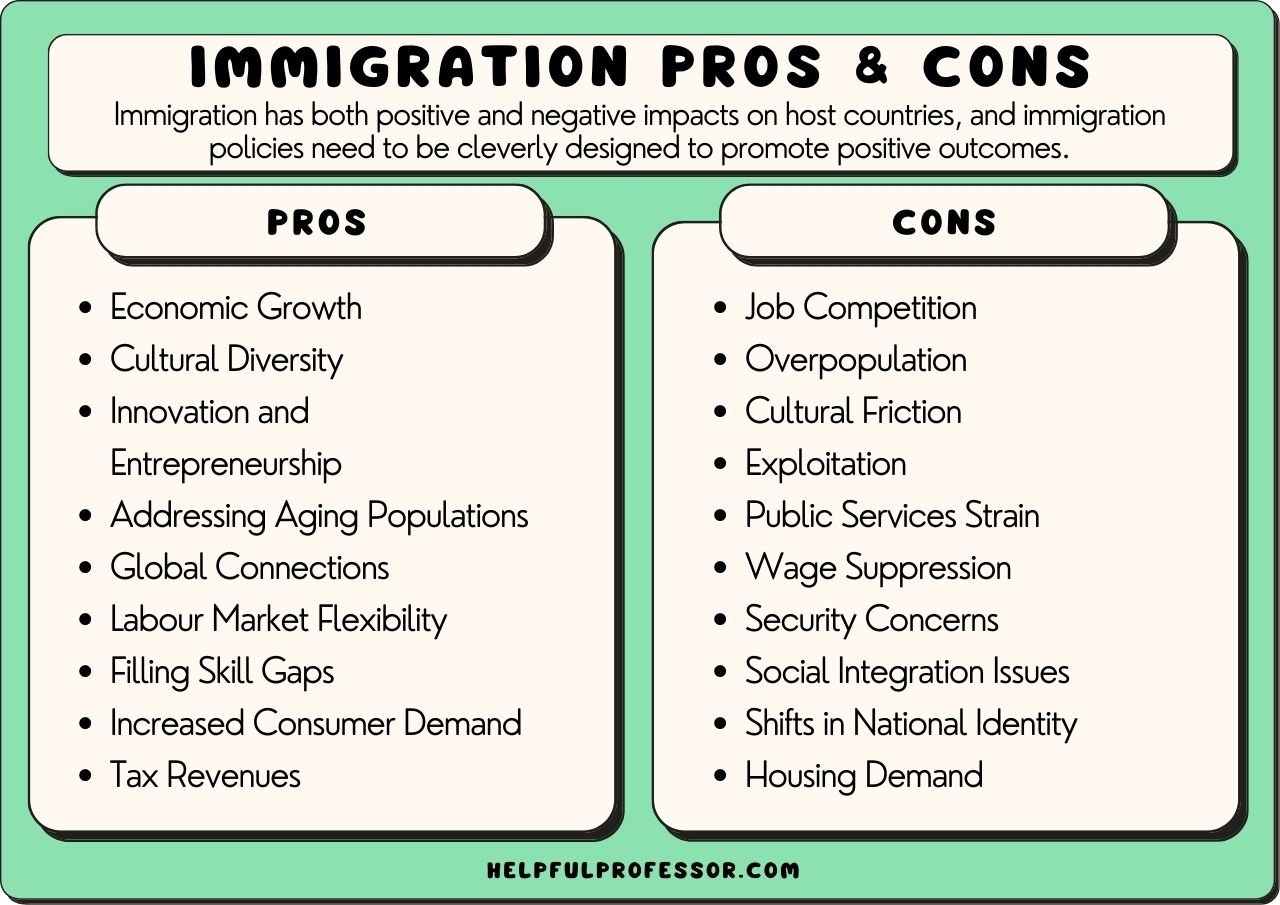

Changes To Uk Immigration Increased Emphasis On English Language Competency

May 10, 2025

Changes To Uk Immigration Increased Emphasis On English Language Competency

May 10, 2025 -

Elizabeth Line Strike Dates Planned Action And Route Impacts In February And March

May 10, 2025

Elizabeth Line Strike Dates Planned Action And Route Impacts In February And March

May 10, 2025