Palantir's 30% Drop: Time To Buy The Dip?

Table of Contents

Understanding Palantir's Recent Decline

The substantial drop in Palantir's stock price is a complex issue with roots in both macroeconomic factors and company-specific concerns.

Macroeconomic Factors

The current economic climate presents significant headwinds for growth stocks like Palantir.

- Rising Interest Rates and Inflation: The Federal Reserve's aggressive interest rate hikes aim to curb inflation, but this higher cost of borrowing impacts companies reliant on future growth, making investors less willing to pay a premium for their shares. This directly affects Palantir's valuation as a high-growth tech company.

- Broader Tech Sector Sell-Off: The recent downturn hasn't spared even the strongest tech performers. A general risk-off sentiment has led to widespread selling across the tech sector, dragging down Palantir alongside its peers.

- Investor Concerns about Future Revenue Growth: Concerns about the sustainability of Palantir's revenue growth, particularly in the face of economic uncertainty, have contributed to the sell-off. Investors are scrutinizing the company's ability to convert its large customer base into consistent, high-margin revenue streams.

- Analyze recent market reports on growth stock performance: Reports from major financial institutions consistently highlight the underperformance of growth stocks in the current macroeconomic environment.

- Discuss correlation between Palantir's stock price and broader market indices: A strong negative correlation exists between Palantir's stock price and major market indices like the Nasdaq Composite, indicating that broader market sentiment heavily influences Palantir's performance.

Company-Specific News and Concerns

Beyond macroeconomic factors, specific news and concerns surrounding Palantir have also impacted investor sentiment.

- Recent Earnings Reports and Guidance: Analyzing Palantir's recent earnings reports reveals key information regarding revenue growth, profitability, and future guidance. Any shortfall in meeting expectations or a less-than-optimistic outlook on future performance can significantly impact investor confidence.

- Contract Wins and Losses: Securing and maintaining significant government and commercial contracts is crucial for Palantir's growth. News of major contract wins can boost investor confidence, while contract losses or delays can trigger negative sentiment and impact the Palantir stock price.

- Examine the company's guidance for future performance: Closely reviewing Palantir's official guidance for future quarters and years is essential for understanding the company's own projections and identifying potential upside or downside risks.

- Assess the impact of any recent strategic decisions: Major strategic decisions, such as new product launches, acquisitions, or partnerships, can influence investor perception and ultimately the price of Palantir stock.

Evaluating the Potential for a Rebound

Despite the recent decline, several factors suggest a potential for a Palantir stock rebound.

Long-Term Growth Prospects

Palantir operates in a rapidly growing market with significant long-term potential.

- Dominating Government and Commercial Data Analytics: Palantir holds a strong position in both the government and commercial sectors, providing advanced data analytics solutions to a diverse range of clients. This positions the company for continued growth as data becomes increasingly vital for businesses and governments worldwide.

- AI and Big Data Applications: Palantir's technology is well-positioned to benefit from the ongoing expansion of artificial intelligence and big data applications. The company is continuously investing in research and development, striving to stay at the forefront of these crucial technologies.

- Discuss Palantir's competitive advantages and technological innovation: Palantir's proprietary technologies, strong data security features, and deep expertise in complex data analysis provide substantial competitive advantages in the marketplace.

- Analyze long-term market forecasts for the data analytics industry: Industry forecasts consistently point towards robust growth in the data analytics sector over the coming years, suggesting strong tailwinds for Palantir's future prospects.

Valuation and Financial Metrics

Analyzing Palantir's valuation against its historical performance and competitors is crucial in assessing the potential for a rebound.

- Comparative Valuation: Comparing Palantir's current valuation (P/E ratio, Price-to-Sales ratio) to its historical performance and to similar companies in the data analytics sector provides context and helps determine whether the current price represents a buying opportunity.

- Key Financial Metrics: Examining key financial metrics such as revenue growth, operating margins, and cash flow provides valuable insights into Palantir's financial health and future potential.

- Consider the potential impact of future profitability on the stock price: If Palantir successfully achieves profitability, it could significantly boost investor confidence and drive up the stock price.

- Compare Palantir's valuation to similar companies: Benchmarking Palantir's valuation against its competitors helps determine whether its current price is undervalued or overvalued.

Risk Assessment and Mitigation

While the potential for a rebound exists, investors must carefully consider the associated risks.

Downside Risks

Several factors could contribute to further declines in Palantir's stock price.

- Continued Macroeconomic Headwinds: Persisting inflation, rising interest rates, and a potential economic slowdown could continue to weigh on Palantir's stock price.

- Intense Competition: The data analytics market is becoming increasingly competitive, with both established players and new entrants vying for market share.

- Execution Risks: Palantir's ambitious growth strategy carries inherent execution risks, including potential delays in product development, challenges in integrating acquisitions, and difficulties in scaling its operations.

- Identify potential catalysts for further price declines: Factors such as disappointing earnings reports, unexpected contract losses, or negative news regarding the company's technology could trigger further price declines.

- Discuss the impact of geopolitical events on Palantir's business: Geopolitical instability and international conflicts can impact Palantir's operations and investor sentiment.

Strategies for Mitigating Risk

Investors can employ several strategies to mitigate the risks associated with investing in Palantir.

- Diversification: Diversifying your investment portfolio across different asset classes and sectors reduces the overall risk.

- Dollar-Cost Averaging: Investing a fixed amount of money at regular intervals reduces the impact of market volatility.

- Stop-Loss Orders: Setting stop-loss orders limits potential losses by automatically selling your shares when the price drops to a predetermined level.

- Discuss options for hedging against market volatility: Hedging strategies, such as using options or inverse ETFs, can help mitigate risk in volatile market conditions.

- Advise on appropriate risk tolerance levels: Investors should only invest in Palantir if they have a high-risk tolerance and a long-term investment horizon.

Conclusion

This analysis of Palantir's recent 30% drop reveals a mixed picture. While significant risks remain, including continued macroeconomic headwinds and intense competition, the potential for long-term growth in the data analytics sector makes this Palantir stock dip potentially attractive for investors with a high-risk tolerance and a long-term investment horizon. Careful consideration of the macroeconomic environment and company-specific factors is crucial.

Call to Action: Should you buy the Palantir dip? The decision is highly individual and depends entirely on your own risk tolerance and investment strategy. Conduct thorough due diligence, carefully assess your risk appetite, and consider consulting with a qualified financial advisor before making any investment decisions. Remember, this analysis is not financial advice. Weigh the potential rewards against the significant risks associated with investing in Palantir stock or any other growth stock experiencing a significant price decline.

Featured Posts

-

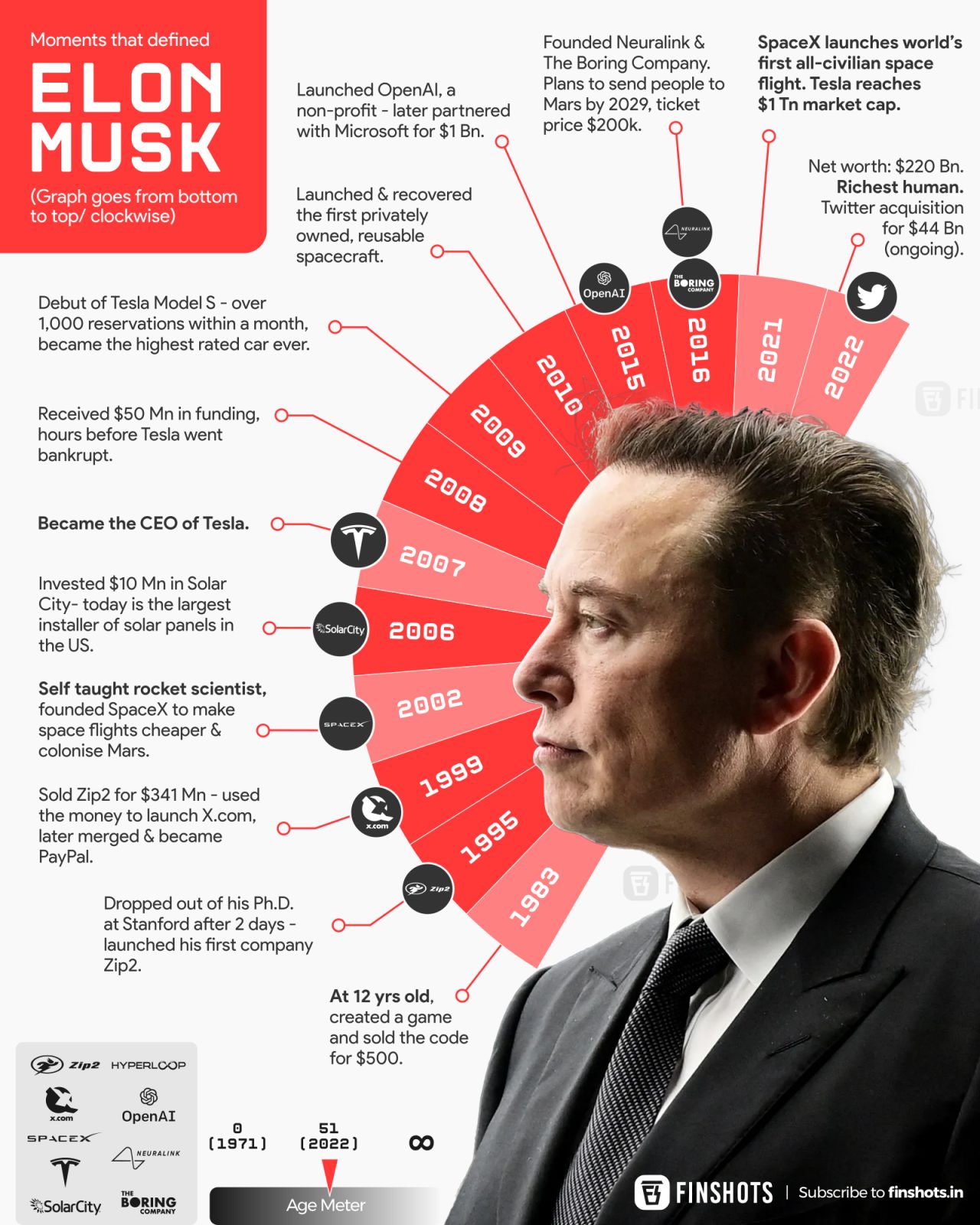

Understanding Elon Musks Financial Journey Strategies And Investments

May 09, 2025

Understanding Elon Musks Financial Journey Strategies And Investments

May 09, 2025 -

100 Days Of Trump The Impact On Elon Musks Wealth

May 09, 2025

100 Days Of Trump The Impact On Elon Musks Wealth

May 09, 2025 -

Arsenals Ucl Dream Ferdinands Finalist Prediction And Arsenals Prospects

May 09, 2025

Arsenals Ucl Dream Ferdinands Finalist Prediction And Arsenals Prospects

May 09, 2025 -

Stivn King Na Netflix Ochakvame Rimeyk

May 09, 2025

Stivn King Na Netflix Ochakvame Rimeyk

May 09, 2025 -

Pakistans 1 3 Billion Imf Bailout A Review Amidst Regional Tensions

May 09, 2025

Pakistans 1 3 Billion Imf Bailout A Review Amidst Regional Tensions

May 09, 2025