Palantir's Path To A Trillion-Dollar Market Cap: A 2030 Forecast

Table of Contents

Can Palantir Technologies, currently valued significantly lower, truly reach a trillion-dollar market cap by 2030? This ambitious goal requires a deep dive into the company's potential, considering its current trajectory and the numerous factors that could influence its future growth. This article analyzes the plausibility of Palantir's trillion-dollar market cap, examining its competitive advantages, financial projections, and potential challenges. Our thesis is to assess whether Palantir’s innovative data analytics solutions and strategic market positioning can propel it to this extraordinary valuation within the next decade.

Palantir's Competitive Advantages and Market Dominance:

Palantir Government Contracts and Data Analytics Expertise:

Palantir holds a commanding position in the government data analytics market. Its Gotham and Foundry platforms provide powerful solutions for complex data integration and analysis, crucial for national security and intelligence agencies globally. The company's deep expertise in handling sensitive data and delivering mission-critical solutions has solidified its partnerships with key government entities.

- Successful Government Projects: Palantir has played a significant role in numerous high-profile government projects, demonstrating the efficacy of its platforms in diverse applications.

- Gotham and Foundry Platforms: These platforms represent the core of Palantir’s offerings to government clients, providing comprehensive data integration, analysis, and visualization capabilities. Their adaptability and scalability are key differentiators.

- Future Government Spending: Growing government investments in data analytics and cybersecurity will likely fuel further growth in Palantir's government contracts. The increasing need for advanced data analysis across national security, intelligence, and public services promises sustained demand for Palantir's services. This makes "Palantir government contracts" a significant driver of future revenue.

Expanding Commercial Market Penetration:

While Palantir has a strong foothold in government, its expansion into the commercial sector is pivotal to reaching a trillion-dollar valuation. The company is aggressively targeting key sectors such as healthcare, finance, and energy, leveraging its data analytics expertise to offer tailored solutions.

- Successful Commercial Partnerships: Palantir has secured partnerships with major corporations across diverse industries, showcasing the adaptability of its platforms.

- Growth Strategies: The company is actively investing in R&D to enhance its product offerings and expand into new commercial markets, aiming for significant market share growth.

- Competitive Landscape: Although competition exists in the broader data analytics market, Palantir’s unique capabilities in handling complex, sensitive data offer a significant competitive advantage, especially for clients prioritizing data security and integrity. Analyzing “Palantir commercial clients” and their growth will be crucial in evaluating its trajectory.

Financial Projections and Growth Trajectory:

Revenue Growth and Profitability:

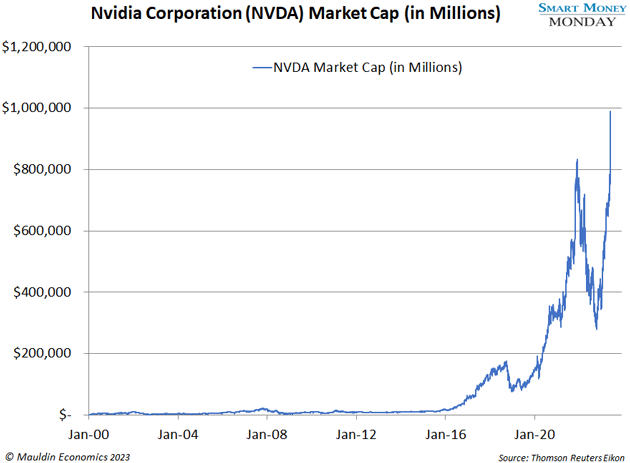

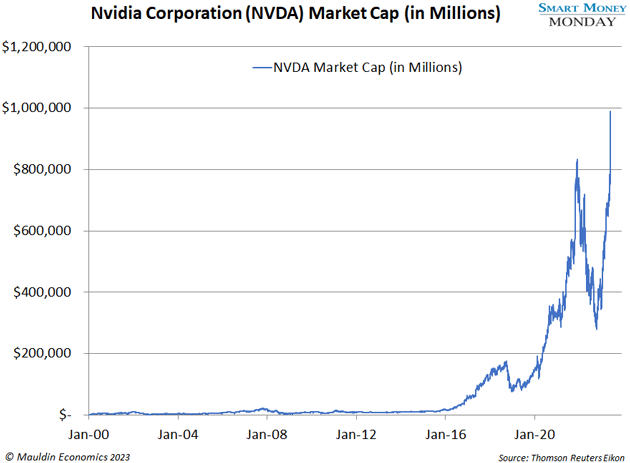

Analyzing Palantir's historical revenue growth provides insights into its future potential. To reach a trillion-dollar market cap, the company needs to maintain robust revenue growth and achieve sustained profitability. Sophisticated financial models, incorporating various growth scenarios, are necessary for accurate projections.

- Key Performance Indicators (KPIs): Tracking KPIs like revenue growth rate, profit margins, and return on investment (ROI) is essential for evaluating Palantir's financial health and forecasting its future performance. Sustained, high growth in "Palantir revenue projections" is paramount.

- Profitability Analysis: Achieving and maintaining profitability is crucial for attracting investors and supporting future growth. Factors influencing profitability include cost optimization strategies, successful market expansion, and pricing strategies.

Valuation and Market Factors:

Palantir's valuation is dynamic and influenced by various factors beyond its core performance. Market sentiment, investor confidence, and broader macroeconomic conditions all play a critical role.

- Price-to-Earnings (P/E) Ratio: Monitoring the P/E ratio, a crucial valuation metric, provides insights into investor perceptions of Palantir’s growth potential relative to its earnings.

- Market Corrections and Growth Spurts: The technology sector is prone to market corrections and periods of rapid growth. The ability of "Palantir valuation" to withstand market downturns and capitalize on growth periods will be vital.

- Macroeconomic Trends: Broader economic conditions, interest rates, and geopolitical events can all significantly impact Palantir’s valuation and overall market performance.

Challenges and Risks to Palantir's Growth:

Competition and Technological Disruption:

The data analytics market is competitive, with established players and emerging startups vying for market share. Technological disruptions, particularly in artificial intelligence and machine learning, pose a potential threat to Palantir’s long-term success.

- Key Competitors: Identifying and analyzing the strengths and weaknesses of key competitors is crucial for understanding the competitive landscape and Palantir’s competitive advantage.

- Emerging Technologies: The rapid advancements in AI and machine learning could disrupt the data analytics market, requiring Palantir to continuously innovate and adapt. Assessing the impact of "AI in data analytics" on Palantir's market position is crucial.

Regulatory and Ethical Concerns:

Palantir's data analytics capabilities raise ethical and regulatory concerns, particularly around data privacy and the potential for biased algorithms. Compliance with regulations like GDPR and CCPA is crucial to avoid legal and reputational risks.

- Data Privacy Regulations: Adherence to data privacy regulations is paramount for Palantir’s continued success. Non-compliance could result in significant financial penalties and reputational damage.

- Ethical AI: The ethical implications of using AI in decision-making processes need careful consideration. Palantir must demonstrate responsible AI development and deployment to maintain public trust. Addressing "ethical AI" concerns is crucial for long-term success.

Conclusion:

Reaching a trillion-dollar market cap by 2030 presents a significant challenge for Palantir. While the company possesses considerable strengths – including a dominant position in government contracts, a growing commercial presence, and innovative technology – it also faces risks, including competition, technological disruption, and regulatory hurdles. Successfully navigating these challenges, while maintaining robust revenue growth and profitability, will be crucial for realizing Palantir's ambitious goal. Careful monitoring of Palantir's financial performance, its progress in expanding its commercial client base, and its ability to innovate and adapt to emerging technological advancements are critical to analyzing Palantir's path to a trillion-dollar market cap. Conduct your own thorough research and assess Palantir's potential for future growth based on your own risk tolerance.

Featured Posts

-

Unlocking The Nyt Spelling Bee April 6 2025 Strategies And Solutions

May 09, 2025

Unlocking The Nyt Spelling Bee April 6 2025 Strategies And Solutions

May 09, 2025 -

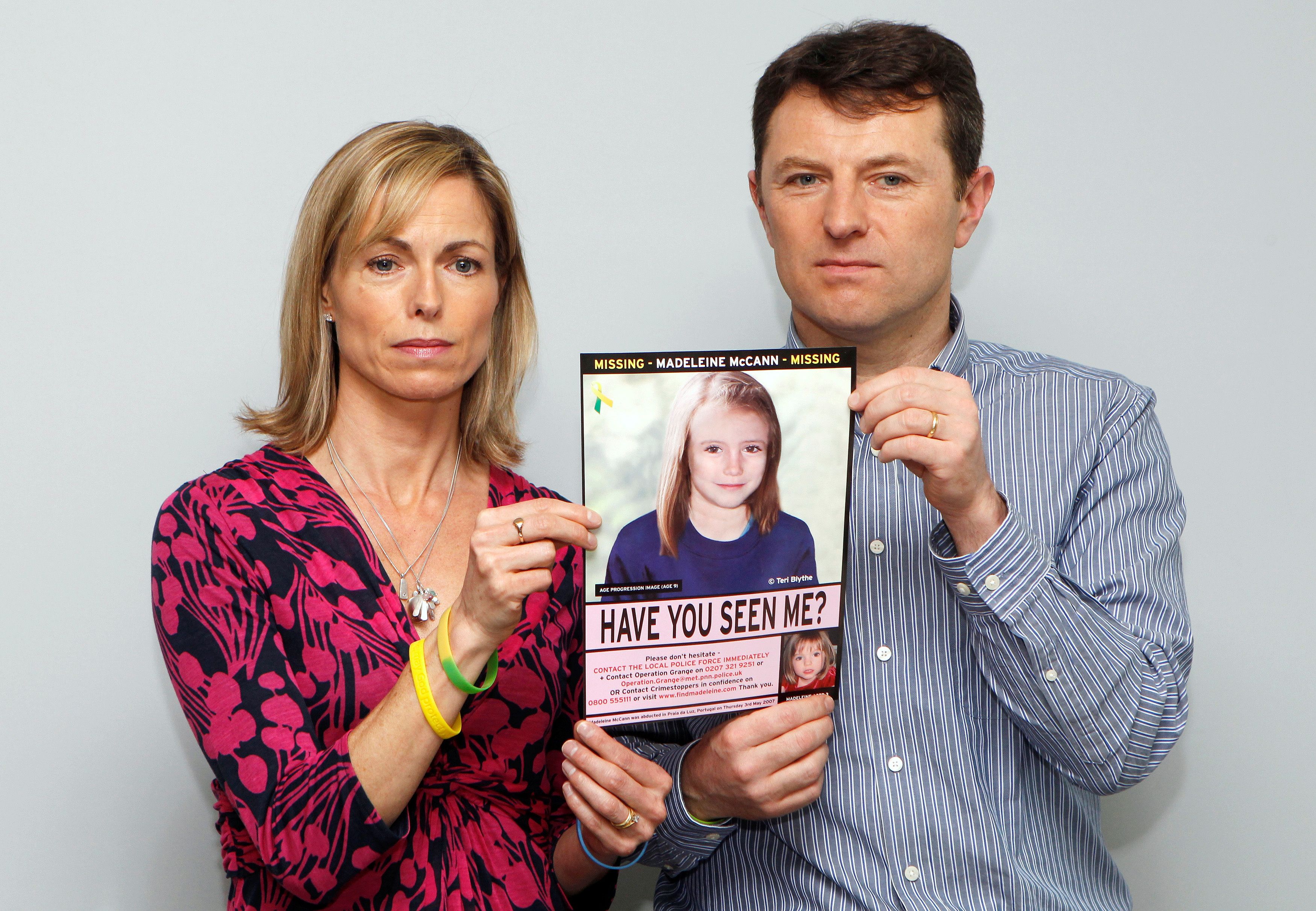

Madeleine Mc Cann Case New Dna Evidence And A 23 Year Olds Claim

May 09, 2025

Madeleine Mc Cann Case New Dna Evidence And A 23 Year Olds Claim

May 09, 2025 -

Large Scale Anchorage Protest Renewed Opposition To Trumps Policies

May 09, 2025

Large Scale Anchorage Protest Renewed Opposition To Trumps Policies

May 09, 2025 -

Joanna Page Accuses Wynne Evans Of Trying Too Hard On Bbc Show

May 09, 2025

Joanna Page Accuses Wynne Evans Of Trying Too Hard On Bbc Show

May 09, 2025 -

Suncor High Production Lower Sales Understanding The Inventory Discrepancy

May 09, 2025

Suncor High Production Lower Sales Understanding The Inventory Discrepancy

May 09, 2025