Paramount Investigative Services: Acquisition Talks In Progress

Table of Contents

Potential Benefits of the Acquisition for Paramount Investigative Services

An acquisition could bring substantial advantages to Paramount Investigative Services, propelling the company to new heights of success.

Expanded Market Reach and Client Base

The most immediate benefit is likely an expansion of Paramount's market reach. A larger acquirer would instantly grant access to new geographical territories and industry sectors.

- New Geographic Regions: Paramount could potentially expand into previously untapped international markets, accessing a global client base and increasing revenue streams.

- New Industries: The acquisition could introduce Paramount to new client sectors, such as expanding from primarily focusing on corporate investigations to including forensic accounting or cybersecurity investigations.

- Synergies: Combining the client lists of both entities could lead to cross-selling opportunities and significant revenue increases. Streamlining operations through shared resources will increase efficiency and reduce overhead.

Enhanced Technological Capabilities and Resources

The acquiring company likely possesses advanced technology and resources that could significantly enhance Paramount's operational capabilities.

- Advanced Data Analytics: Access to sophisticated data analytics platforms could revolutionize Paramount's investigative processes, improving efficiency and accuracy.

- State-of-the-Art Surveillance Equipment: Upgraded surveillance technology could significantly improve the quality and effectiveness of investigations.

- Cost Savings and Efficiency Gains: Consolidated resources and streamlined operations can result in significant cost reductions, increasing profitability and competitiveness.

Increased Financial Stability and Growth Opportunities

Joining forces with a larger entity will likely improve Paramount's financial stability and unlock significant growth opportunities.

- Increased Investment in R&D: Access to greater financial resources could lead to increased investments in research and development, leading to innovative investigative techniques and tools.

- Employee Training and Development: Enhanced training programs and professional development opportunities will benefit employees, boosting morale and improving service quality.

- Strategic Expansion: The acquisition could provide the financial backing necessary for strategic expansion, opening new offices and expanding services nationally or internationally. This would lead to increased brand recognition and market share.

Potential Challenges and Risks Associated with the Acquisition

While the potential benefits are significant, the Paramount Investigative Services acquisition also presents several challenges and risks.

Integration Challenges and Potential Job Losses

Merging two distinct organizations is never straightforward. Integration issues could arise, potentially leading to job losses.

- Cultural Clashes: Different corporate cultures and management styles can create friction and hinder integration efforts.

- System Incompatibilities: Integrating disparate IT systems and operational procedures can be complex and time-consuming.

- Redundancies: Overlapping roles and functions may lead to redundancies, causing job losses and potential employee unrest. Careful planning and transparent communication are crucial for a smooth transition.

Regulatory Scrutiny and Antitrust Concerns

The acquisition may face regulatory scrutiny and antitrust concerns, potentially causing delays or even preventing the deal from closing.

- Antitrust Review: Regulatory bodies might investigate the potential impact of the acquisition on market competition, leading to delays while approvals are sought.

- Compliance Requirements: Paramount must ensure strict adherence to all relevant laws and regulations during the acquisition process and post-merger integration.

- Potential Investigations: Depending on the nature of the acquisition, thorough investigations by regulatory authorities can be expected to determine the impact on the market and fair competition.

Impact on Paramount Investigative Services' Current Clients and Operations

The acquisition could potentially disrupt service delivery and client relationships, requiring careful management.

- Maintaining Service Quality: Paramount needs to reassure its existing clients that the transition will not affect the quality of service they receive.

- Communication Strategy: Proactive and transparent communication with clients during the transition period will be critical in maintaining trust and confidence.

- Transition Plan: A comprehensive transition plan will address potential disruptions to service delivery, ensuring minimal impact on client operations and satisfaction.

Speculation and Analysis of Potential Buyers (if applicable)

While the identity of the potential buyer remains unconfirmed, industry analysts speculate that several large private equity firms specializing in the professional services sector could be involved. However, it is important to stress that this analysis is entirely speculative and based on publicly available information. A full picture would only be revealed upon official confirmation.

Conclusion: The Future of Paramount Investigative Services After the Acquisition Talks

The potential acquisition of Paramount Investigative Services marks a pivotal moment for the company and the investigative services industry. While the integration process presents challenges, the potential benefits—expanded market reach, enhanced technology, and improved financial stability—are significant. The success of the acquisition will depend heavily on effective planning, transparent communication, and a smooth integration process.

To stay updated on further developments regarding the Paramount Investigative Services acquisition, including any announcements regarding the buyer and the timeline for completion, we encourage you to subscribe to our newsletter or follow our social media channels for the latest news and updates on this landmark Paramount Investigative Services merger. Stay informed on all Paramount acquisition news.

Featured Posts

-

Why Does King Charles Iii Celebrate Two Birthdays A Royal Explanation

May 27, 2025

Why Does King Charles Iii Celebrate Two Birthdays A Royal Explanation

May 27, 2025 -

Ukraina Na Puti V Nato Rol Germanii I Perspektivy Chlenstva

May 27, 2025

Ukraina Na Puti V Nato Rol Germanii I Perspektivy Chlenstva

May 27, 2025 -

Jupiter Ascending Exploring The Films Complex Mythology And Themes

May 27, 2025

Jupiter Ascending Exploring The Films Complex Mythology And Themes

May 27, 2025 -

Putyin Es Trump Kueloenmegbizottjanak Ujabb Talalkozoja

May 27, 2025

Putyin Es Trump Kueloenmegbizottjanak Ujabb Talalkozoja

May 27, 2025 -

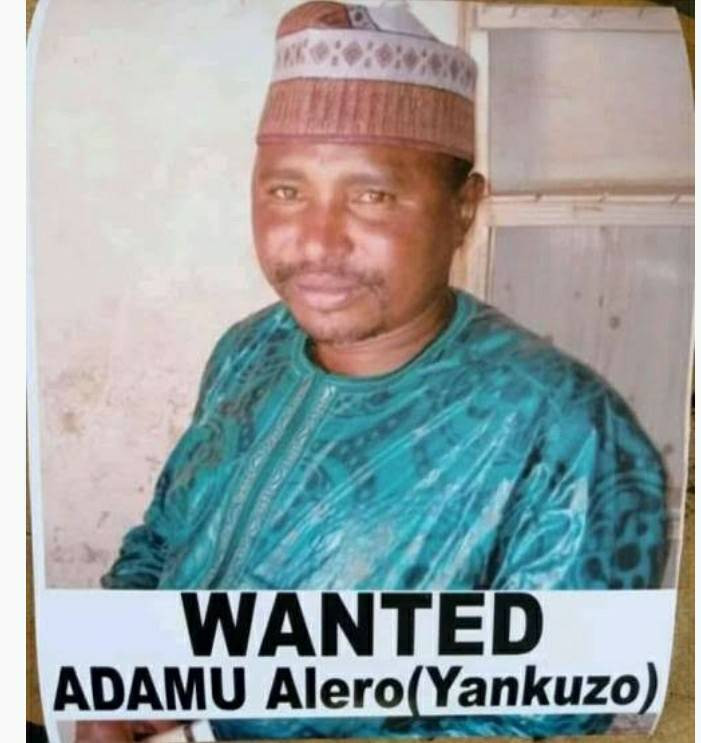

Major Bandit Kingpin Killed In Zamfara Police Operation

May 27, 2025

Major Bandit Kingpin Killed In Zamfara Police Operation

May 27, 2025

Latest Posts

-

Investigation Could Price Caps And Comparison Sites Improve Vet Costs

May 31, 2025

Investigation Could Price Caps And Comparison Sites Improve Vet Costs

May 31, 2025 -

Rogart Veterinary Surgery Relocates To Tain After Fire Damage

May 31, 2025

Rogart Veterinary Surgery Relocates To Tain After Fire Damage

May 31, 2025 -

Price Caps And Comparison Sites For Vets Under Scrutiny

May 31, 2025

Price Caps And Comparison Sites For Vets Under Scrutiny

May 31, 2025 -

Rogart Vets Find Temporary Home In Tain Following Devastating Fire

May 31, 2025

Rogart Vets Find Temporary Home In Tain Following Devastating Fire

May 31, 2025 -

A Plastic Glove Project Fostering Collaboration Between The Rcn And Vet Nursing Professionals

May 31, 2025

A Plastic Glove Project Fostering Collaboration Between The Rcn And Vet Nursing Professionals

May 31, 2025