Paramount-Skydance Merger: Judge Denies Stay, Fast-Tracks Shareholder Lawsuit

Table of Contents

The Judge's Decision and Its Ramifications

The judge's decision to deny the stay requested by Paramount and Skydance represents a major setback for the companies. The reasoning behind the denial remains unclear, although court documents suggest the judge felt the arguments presented by the companies were not sufficient to justify delaying the shareholder lawsuit. Both sides presented compelling arguments, but ultimately, the court ruled in favor of proceeding directly to the merits of the shareholder's claims. This legal maneuvering carries significant implications for the merger's trajectory.

- Summary of the judge's ruling: The judge's order effectively rejects Paramount and Skydance's request to postpone the shareholder lawsuit until after the merger's completion, forcing the companies to defend themselves immediately.

- Key arguments from Paramount/Skydance’s defense: Paramount and Skydance likely argued that the lawsuit would be disruptive and jeopardize the timely completion of the merger, a complex process involving significant financial and logistical considerations. They likely pointed to potential harm to both company's reputations and stock prices if the merger is delayed or fails.

- Key arguments from the plaintiff shareholders: Shareholders challenging the merger likely presented evidence suggesting that the deal undervalues Skydance Media, potentially violating their fiduciary duty to shareholders. This argument hinges on the claim that shareholders are not receiving fair value in the exchange.

- Timeline implications for the merger: The removal of the stay significantly accelerates the timeline. The merger, originally expected to close by [Insert Original Closing Date, if available], is now shrouded in uncertainty, potentially facing significant delays or even failure.

Key Arguments in the Shareholder Lawsuit

At the heart of the shareholder lawsuit lie several key allegations concerning the Paramount-Skydance merger. Shareholders are primarily concerned about the fairness of the deal and the potential for conflicts of interest. The lawsuit's success hinges on proving that Paramount Global acted improperly in its dealings with Skydance Media.

- Allegations of undervaluation of Skydance: A central complaint is that Skydance Media’s valuation in the merger agreement is significantly lower than its true market value, thereby shortchanging existing Paramount shareholders.

- Claims of conflicts of interest: The lawsuit may allege that key individuals involved in negotiating the merger had personal or professional conflicts of interest that influenced the deal’s terms negatively.

- Potential violations of corporate governance standards: Shareholders may argue that Paramount Global failed to follow proper corporate governance procedures when approving the merger, violating established norms and potentially state law.

- Evidence presented by the plaintiffs: The plaintiffs are likely to present financial analyses, internal communications, and expert testimony to support their claims of undervaluation, conflicts of interest, and breaches of fiduciary duty.

The Future of the Paramount-Skydance Merger

The future of the Paramount-Skydance merger is now undeniably uncertain. While the merger could still proceed as planned, several scenarios are possible, each with significant implications for both companies and the broader market.

- Scenarios for the merger's future: The merger might still be completed if the lawsuit is unsuccessful, or it might be renegotiated to address shareholder concerns. Alternatively, the deal could collapse entirely.

- Potential impact on Paramount’s stock price: The ongoing legal battle and uncertainty surrounding the merger are likely to negatively affect Paramount Global's stock price in the short term. Investor confidence will remain fragile until the legal issues are resolved.

- Impact on Skydance’s future plans: A failed merger would have significant repercussions for Skydance Media's future plans and growth strategy. It could hinder its ability to secure future funding and partnerships.

- Analysis of risk factors: The key risk factors include the strength of the shareholder's case, the judge's interpretation of relevant laws, and the potential for protracted legal battles.

Conclusion: The Paramount-Skydance Merger: Legal Battles Ahead

The judge's decision to deny the stay on the shareholder lawsuit marks a critical turning point in the Paramount-Skydance merger saga. The ramifications are significant, potentially delaying or even derailing the deal. The core allegations of undervaluation and potential conflicts of interest raise serious questions about the fairness and legality of the proposed merger. The coming months will be crucial, as the legal battle unfolds. The outcome will not only determine the fate of the Paramount-Skydance merger but also shape perceptions of corporate governance and merger negotiations within the media industry. To stay informed about the ongoing legal proceedings and the future of the merger, follow the developments closely. Stay updated on the evolving situation surrounding this high-stakes Paramount-Skydance merger.

Featured Posts

-

Interesul Politic Si Modificarea Parerilor O Perspectiva De La Mirel Curea

May 27, 2025

Interesul Politic Si Modificarea Parerilor O Perspectiva De La Mirel Curea

May 27, 2025 -

Flwrnsa Wghwtshy Aktshaf Jdhwr Dar Alazyae Fy Erd Krwz 2026

May 27, 2025

Flwrnsa Wghwtshy Aktshaf Jdhwr Dar Alazyae Fy Erd Krwz 2026

May 27, 2025 -

Chelsea Transfer News Emegha On The Radar

May 27, 2025

Chelsea Transfer News Emegha On The Radar

May 27, 2025 -

Nora Fatehis Sizzling Red Bikini Beach Look Bollywood News

May 27, 2025

Nora Fatehis Sizzling Red Bikini Beach Look Bollywood News

May 27, 2025 -

Ashton Kutcher And Mila Kunis Recent Photos From Beverly Hills Outing

May 27, 2025

Ashton Kutcher And Mila Kunis Recent Photos From Beverly Hills Outing

May 27, 2025

Latest Posts

-

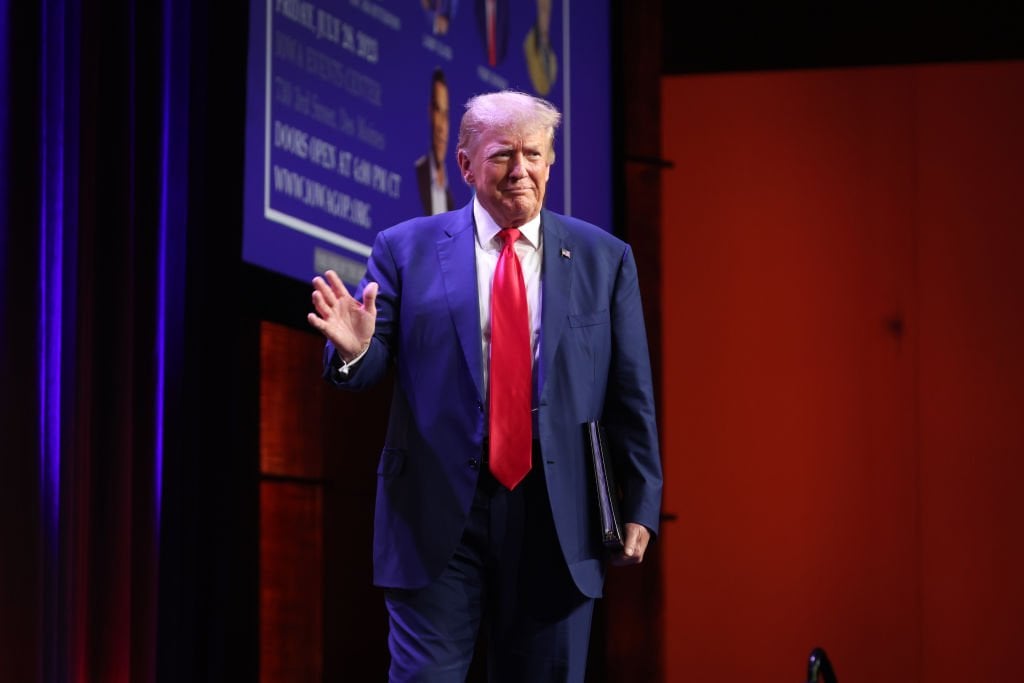

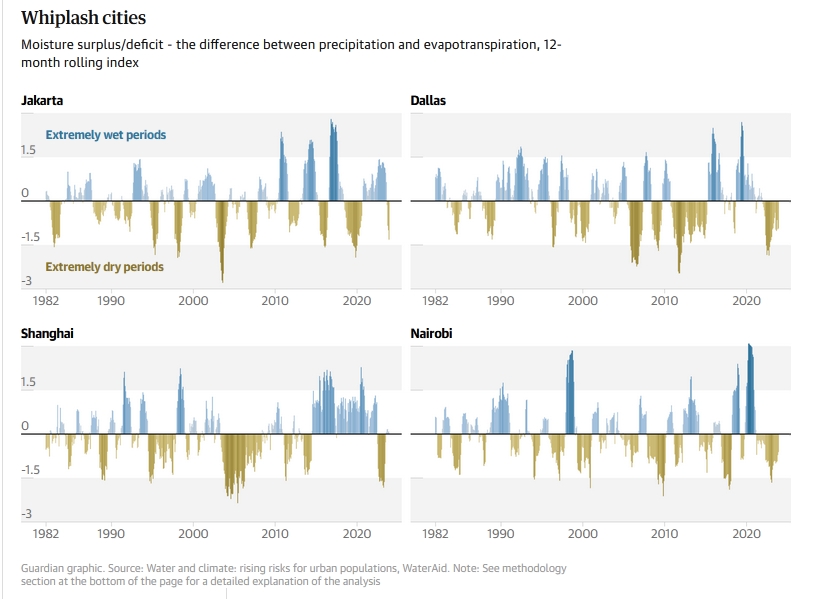

Dangerous Climate Whiplash A Growing Threat To Cities Around The World

May 31, 2025

Dangerous Climate Whiplash A Growing Threat To Cities Around The World

May 31, 2025 -

The Link Between Corporate Targets And Increasing Uk Pet Vet Bills

May 31, 2025

The Link Between Corporate Targets And Increasing Uk Pet Vet Bills

May 31, 2025 -

New Report Highlights Dangerous Climate Whiplash Impacts On Global Cities

May 31, 2025

New Report Highlights Dangerous Climate Whiplash Impacts On Global Cities

May 31, 2025 -

Are Corporate Veterinary Targets Affecting Pet Owner Finances In The Uk

May 31, 2025

Are Corporate Veterinary Targets Affecting Pet Owner Finances In The Uk

May 31, 2025 -

Climate Whiplash How Cities Worldwide Are Experiencing Dangerous Impacts

May 31, 2025

Climate Whiplash How Cities Worldwide Are Experiencing Dangerous Impacts

May 31, 2025