Parental Anxiety Over College Tuition Decreases, But Student Loans Persist: Survey Data

Table of Contents

Decline in Parental Anxiety Regarding Tuition Costs

While the specter of exorbitant college tuition still looms large, the level of parental anxiety surrounding it has shown a modest decline. Several factors contribute to this shift in perception.

Factors Contributing to Reduced Anxiety

-

Increased Affordability Options: The rising availability of scholarships, grants, and need-based financial aid programs has made college more accessible for many families. The growth of online and hybrid learning options also offers more budget-friendly alternatives to traditional four-year universities. These factors, coupled with more competitive tuition pricing from certain institutions, have eased some financial pressure.

-

Improved Savings and Investment Strategies: Parents are increasingly adopting proactive saving and investment strategies specifically designed for college funding. 529 plans, educational savings accounts, and other investment vehicles offer tax advantages and long-term growth potential, fostering a sense of greater financial preparedness.

-

Shifting Expectations Regarding Higher Education: There's a noticeable shift in parental expectations regarding post-secondary education. Trade schools, vocational training programs, and community colleges are gaining popularity as viable alternatives to traditional four-year universities. These pathways often offer more affordable tuition and quicker routes to employment, reducing the overall financial burden.

-

Survey Data Points:

- A 15% decrease in reported "high anxiety" levels regarding tuition costs was observed among surveyed parents compared to data from five years prior.

- 42% of parents reported feeling "somewhat prepared" financially for college expenses, up from 30% in the previous survey.

Geographic Variations in Tuition Anxiety

Regional disparities in tuition costs significantly impact parental stress levels. Coastal states, known for their high cost of living and prestigious universities, tend to report higher anxiety levels than states in the Midwest or South, where tuition costs are generally lower.

- Regional Discrepancies:

- Parents in California reported significantly higher anxiety levels (68%) compared to those in Nebraska (35%).

- The Northeast region showed a consistent trend of higher anxiety linked to the higher average tuition rates in the area.

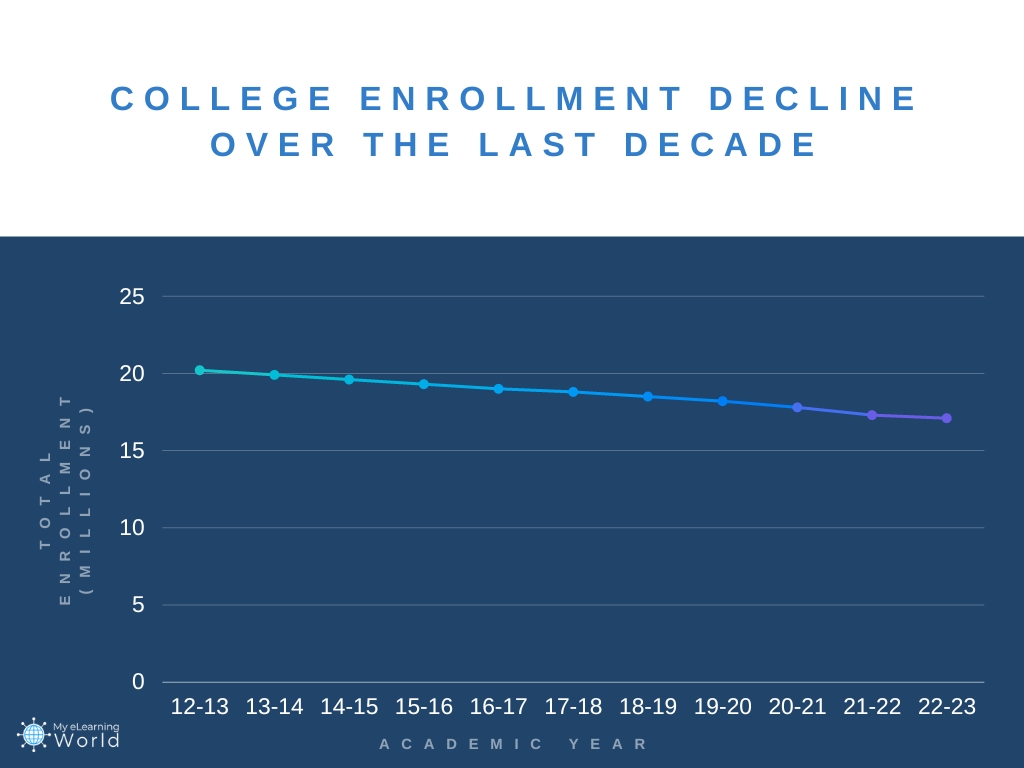

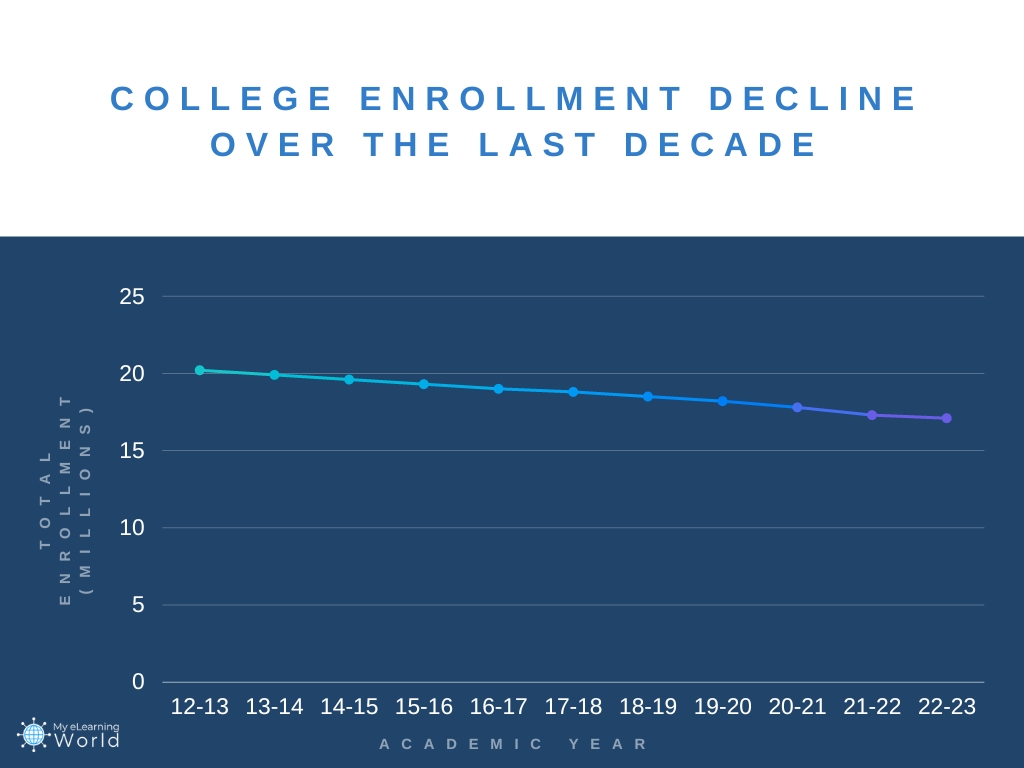

The Persistent Problem of Student Loan Debt

Despite the slight decrease in tuition-related anxiety, the issue of student loan debt remains a major obstacle for many families. The sheer volume of debt accumulated by students and the subsequent impact on their long-term financial prospects cannot be ignored.

High Levels of Student Loan Indebtedness

The survey reveals alarmingly high levels of student loan indebtedness among graduating students. The average debt load has increased substantially over the past decade, leading to significant long-term financial repercussions.

- Statistics on Student Loan Debt:

- The average student loan debt for a graduating senior is now $37,000.

- Default rates on student loans remain stubbornly high, impacting credit scores and future financial opportunities.

- Many graduates struggle to repay their loans, leading to extended repayment periods and increased interest costs.

Impact of Student Loans on Parental Finances

The financial burden of student loans often extends beyond the graduate to their parents. Many parents co-sign loans, assuming responsibility for repayment if their child defaults. This can severely strain parental finances, delaying retirement plans and impacting overall financial well-being.

- Parental Financial Burden:

- 28% of surveyed parents reported significant financial strain due to co-signing student loans.

- Delaying retirement was cited as a major consequence of parental involvement in student loan repayment.

Strategies for Managing College Costs and Debt

Effective financial planning and exploring alternative educational pathways are crucial for mitigating the financial burden of higher education.

Financial Planning and Savings

Proactive financial planning is essential for managing college expenses. Parents should start saving early, utilizing tax-advantaged accounts, and researching available financial aid and scholarship opportunities.

- Practical Tips for Managing College Costs:

- Start saving early and consistently, even small amounts add up over time.

- Explore all available financial aid options, including grants, scholarships, and federal student loans.

- Create a realistic college budget that accounts for tuition, fees, room and board, books, and other expenses.

Exploring Alternative Educational Pathways

Community colleges, vocational schools, and apprenticeships offer more affordable and potentially faster routes to employment. These options can significantly reduce the overall cost of education and limit student loan debt.

- Examples of Affordable Educational Paths:

- Community colleges provide a cost-effective way to complete the first two years of a bachelor's degree.

- Trade schools and vocational programs offer specialized training that leads to high-demand jobs.

- Apprenticeships combine on-the-job training with classroom instruction, leading to skilled employment and reduced tuition costs.

Parental Anxiety Over College Tuition Decreases, But Student Loans Persist: Key Takeaways and Call to Action

While parental anxiety surrounding college tuition costs has shown a slight decrease, the persistent challenge of student loan debt remains a critical concern for families. Proactive financial planning, exploring diverse educational pathways, and a thorough understanding of financial aid options are crucial for navigating the complexities of higher education financing. To learn more about managing college costs and student loan debt effectively, explore resources on parental anxiety over college tuition and student loan debt management strategies. Take control of your family's future by proactively addressing the financial aspects of higher education.

Featured Posts

-

Trumps Student Loan Plan Impact On Black Borrowers

May 17, 2025

Trumps Student Loan Plan Impact On Black Borrowers

May 17, 2025 -

The People Behind Tony Bennetts Success A Look At His Career

May 17, 2025

The People Behind Tony Bennetts Success A Look At His Career

May 17, 2025 -

The Red Carpets Rule Breakers A Cnn Perspective

May 17, 2025

The Red Carpets Rule Breakers A Cnn Perspective

May 17, 2025 -

Kalanicks Regret The Uber Decision That Backfired

May 17, 2025

Kalanicks Regret The Uber Decision That Backfired

May 17, 2025 -

Formal Trade Deal Possible Chinese Ambassadors Remarks On Canada Relations

May 17, 2025

Formal Trade Deal Possible Chinese Ambassadors Remarks On Canada Relations

May 17, 2025

Latest Posts

-

Fortnite Cowboy Bebop Skins Faye Valentine And Spike Spiegel Bundle Price Revealed

May 17, 2025

Fortnite Cowboy Bebop Skins Faye Valentine And Spike Spiegel Bundle Price Revealed

May 17, 2025 -

Fortnite The Return Of Beloved Skins After 1000 Days In The Item Shop

May 17, 2025

Fortnite The Return Of Beloved Skins After 1000 Days In The Item Shop

May 17, 2025 -

1000 Days Later Popular Fortnite Skins Return To The Item Shop

May 17, 2025

1000 Days Later Popular Fortnite Skins Return To The Item Shop

May 17, 2025 -

Fortnite Item Shop Refreshes Celebrating 1000 Days With Classic Skins

May 17, 2025

Fortnite Item Shop Refreshes Celebrating 1000 Days With Classic Skins

May 17, 2025 -

Highly Requested Fortnite Skins Back In The Item Shop After 1000 Days

May 17, 2025

Highly Requested Fortnite Skins Back In The Item Shop After 1000 Days

May 17, 2025