Personal Loan Interest Rates: A Quick Comparison For Today

Table of Contents

Factors Affecting Personal Loan Interest Rates

Several factors influence the loan interest rates you'll receive on a personal loan. Understanding these factors is key to getting the best possible deal.

Credit Score: The Foundation of Your Rate

Your credit score is the most significant factor determining your personal loan interest rates. Lenders use your credit score to assess your creditworthiness – essentially, how likely you are to repay the loan. A higher credit score indicates lower risk, resulting in lower interest rates.

- Excellent Credit (750+): Expect the lowest low interest personal loans with rates often below the national average.

- Good Credit (700-749): You'll likely qualify for competitive rates, though potentially slightly higher than those with excellent credit.

- Fair Credit (650-699): You might still qualify for a loan, but expect higher interest rates and potentially stricter terms.

- Poor Credit (Below 650): Securing a loan might be challenging, and if approved, you'll face significantly higher loan interest rates.

For example, a borrower with excellent credit might receive a rate of 7%, while someone with fair credit might receive a rate of 15% or more on the same loan amount. Checking your credit report from agencies like Experian, Equifax, and TransUnion before applying is crucial to understand your standing and potentially address any issues.

Loan Amount and Term: Size and Duration Matter

The amount you borrow and the length of your repayment term also significantly impact your personal loan interest rates.

- Loan Amount: Larger loan amounts generally carry higher interest rates because they represent a greater risk for lenders.

- Loan Term: Longer loan terms, while resulting in lower monthly payments, lead to higher overall interest paid because you're borrowing the money for a longer period.

For instance, a $10,000 loan over 3 years might have a lower interest rate than a $20,000 loan over 5 years, even if the interest rate per year is the same. The total interest paid over the life of the loan will be higher for the larger, longer-term loan.

Lender Type: Banks, Credit Unions, and Online Lenders

Different lenders offer varying personal loan interest rates.

- Banks: Often offer competitive rates, particularly for borrowers with good credit. However, their application processes can be more rigorous.

- Credit Unions: Membership-based institutions frequently provide lower rates than banks, especially for their members. They often prioritize community service and may have more lenient requirements.

- Online Lenders: Offer convenience and speed but may have higher rates than traditional lenders, particularly for borrowers with less-than-perfect credit. Always check for hidden fees.

Always compare the APR (Annual Percentage Rate), which includes all fees and interest, not just the advertised interest rate.

Debt-to-Income Ratio (DTI): A Crucial Indicator

Your Debt-to-Income Ratio (DTI) measures your monthly debt payments relative to your gross monthly income. A high DTI suggests you have a higher level of existing debt, making you a riskier borrower.

- Calculating DTI: Divide your total monthly debt payments (including the potential loan payment) by your gross monthly income.

- Impact on Rates: A high DTI often leads to higher personal loan interest rates or even loan rejection.

- Improving DTI: Pay down existing debts, increase your income, or both, to lower your DTI before applying.

Lenders carefully assess your DTI to determine your capacity to manage additional debt.

How to Compare Personal Loan Interest Rates

Finding the best deal requires a systematic approach to comparing personal loan interest rates.

Use Online Comparison Tools: Streamline Your Search

Several reputable websites offer personal loan rates comparison tools. These tools allow you to compare offers from multiple lenders simultaneously, saving you valuable time and effort.

- Benefits: Quick comparison, side-by-side view of rates and terms, efficient searching.

- Caution: Be wary of websites that are not transparent about their methodology or appear biased towards certain lenders.

Check APR (Annual Percentage Rate): The Full Picture

Always compare the APR, not just the interest rate. The APR includes all fees and interest, providing a complete picture of the loan's true cost. A lower interest rate with high fees might actually be more expensive than a slightly higher interest rate with fewer fees.

- Components of APR: Interest rate, origination fees, closing costs, prepayment penalties.

- Importance: Comparing APRs ensures you're comparing apples to apples when assessing loan costs.

Read the Fine Print: Avoid Unpleasant Surprises

Before signing any loan agreement, thoroughly review the terms and conditions. Pay close attention to:

- Fees: Origination fees, late payment fees, prepayment penalties.

- Repayment Terms: Understand the repayment schedule, including the length of the loan and monthly payments.

- Transparency: Ensure the lender is transparent about all fees and charges.

If anything is unclear, don't hesitate to ask questions.

Finding the Best Personal Loan Interest Rates Today

Securing the best personal loan rates requires proactive steps.

Improve Your Credit Score: A Long-Term Strategy

Improving your credit score before applying for a loan is the most effective way to secure lower interest rates.

- Tips: Pay bills on time, reduce your debt, maintain a healthy credit utilization ratio.

- Resources: Use free credit score monitoring services and resources to track your progress.

A higher credit score translates directly to lower rates and better loan options.

Shop Around: Compare Multiple Offers

Don't settle for the first offer you receive. Compare offers from at least 3-5 different lenders to find the most competitive personal loan interest rates. Prioritize lenders with transparent fees and terms.

Consider Pre-qualification: Get an Estimate Without Impacting Credit

Pre-qualifying for a loan allows you to get an estimate of your potential interest rate without impacting your credit score.

- Benefits: Understanding your eligibility, exploring options without affecting your credit.

- Drawbacks: Not a guarantee of approval. The pre-qualification rate might not be the final rate.

Conclusion

Securing the best personal loan interest rates requires careful research and planning. By understanding the factors affecting rates, utilizing comparison tools, and improving your credit profile, you can significantly increase your chances of securing a favorable loan. Remember to compare multiple offers, carefully review the terms, and choose a lender that best suits your financial situation. Don't delay – start comparing personal loan interest rates today to find the best deal for your needs.

Featured Posts

-

Prediksi Cuaca Akurat Jawa Timur Hujan Berlanjut 24 Maret

May 28, 2025

Prediksi Cuaca Akurat Jawa Timur Hujan Berlanjut 24 Maret

May 28, 2025 -

Tim Andersons Chicago White Sox Legacy A Look Back

May 28, 2025

Tim Andersons Chicago White Sox Legacy A Look Back

May 28, 2025 -

Household Spending And Chinas Economic Future A Cautious Outlook

May 28, 2025

Household Spending And Chinas Economic Future A Cautious Outlook

May 28, 2025 -

Pacers Vs Hawks March 8th Where To Watch And Stream The Game

May 28, 2025

Pacers Vs Hawks March 8th Where To Watch And Stream The Game

May 28, 2025 -

Leeds United News Kalvin Phillips Transfer Update And Second Summer Signing

May 28, 2025

Leeds United News Kalvin Phillips Transfer Update And Second Summer Signing

May 28, 2025

Latest Posts

-

Top Seed Pegulas Charleston Victory Over Collins

May 30, 2025

Top Seed Pegulas Charleston Victory Over Collins

May 30, 2025 -

Miami Open Raducanus Strong Showing Earns Last 16 Spot

May 30, 2025

Miami Open Raducanus Strong Showing Earns Last 16 Spot

May 30, 2025 -

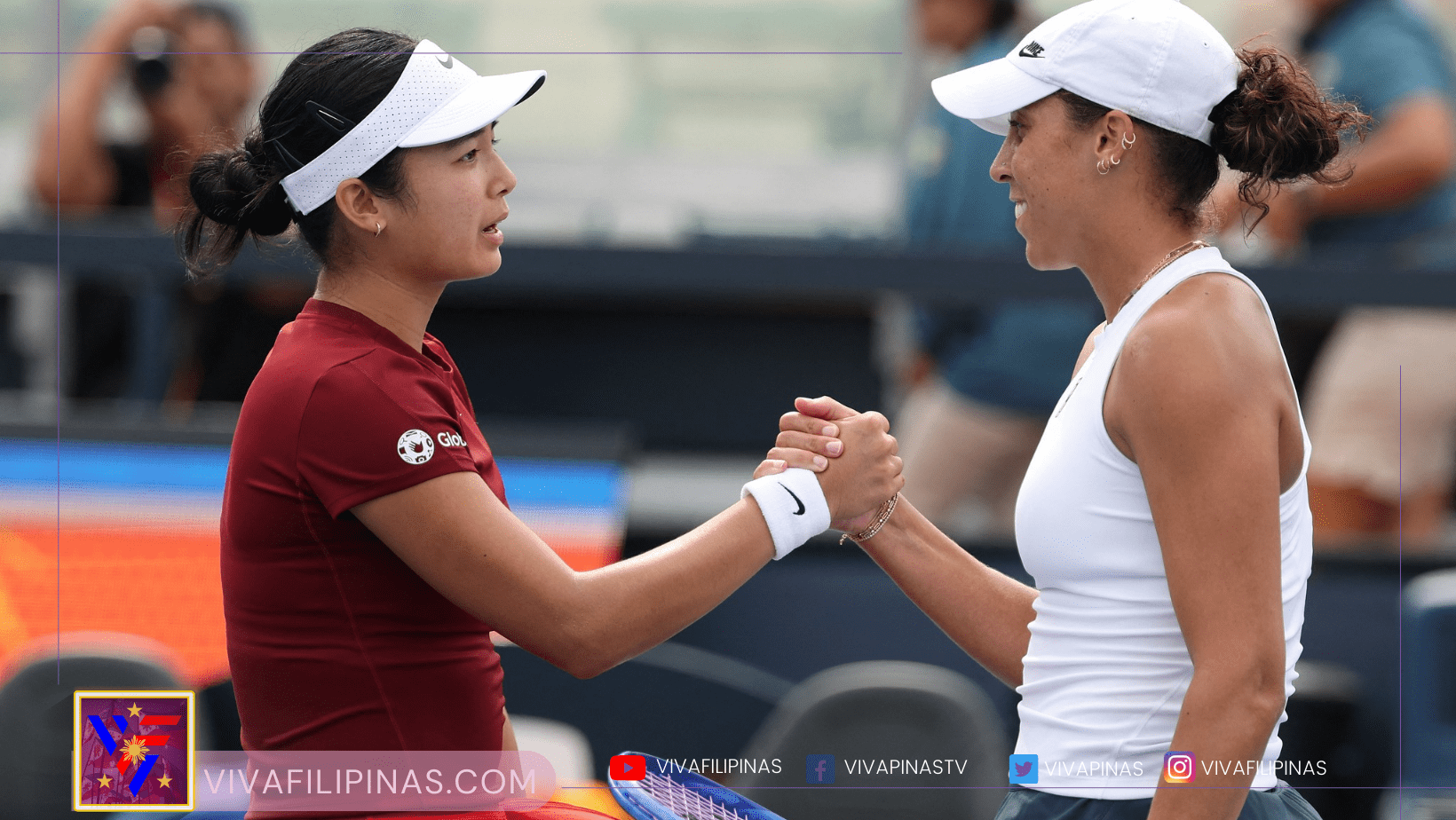

Miami Open Eala Triumphs Over Keys Advances To Quarterfinals

May 30, 2025

Miami Open Eala Triumphs Over Keys Advances To Quarterfinals

May 30, 2025 -

Raducanus Dominant Victory Sends Her Through To Miami Last 16

May 30, 2025

Raducanus Dominant Victory Sends Her Through To Miami Last 16

May 30, 2025 -

Eala Shocks Keys In Miami Secures Quarterfinal Spot

May 30, 2025

Eala Shocks Keys In Miami Secures Quarterfinal Spot

May 30, 2025