Personal Loan Interest Rates Today: Find Your Best Rate

Table of Contents

Personal loan interest rates represent the cost of borrowing money. They're expressed as a percentage of the loan amount and significantly impact your overall repayment costs. A lower interest rate translates to lower monthly payments and less interest paid over the life of the loan. Several factors influence these rates, including your credit score, the loan amount, the loan term, and the type of lender you choose.

Factors Affecting Your Personal Loan Interest Rate

Several key factors influence the interest rate you'll receive on a personal loan. Understanding these factors empowers you to improve your chances of securing a favorable rate.

Credit Score: The Cornerstone of Your Interest Rate

Your credit score is arguably the most significant factor determining your personal loan interest rate. Lenders use your credit score to assess your creditworthiness – essentially, your ability and willingness to repay borrowed funds. A higher credit score indicates lower risk to the lender, resulting in a lower interest rate.

- Excellent Credit (750+): Expect interest rates as low as 6% - 10%.

- Good Credit (700-749): Rates may range from 10% to 15%.

- Fair Credit (650-699): You'll likely face interest rates between 15% and 25%.

- Poor Credit (Below 650): Rates can soar to 25% or even higher, sometimes making the loan unaffordable.

Strategies to Improve Your Credit Score:

- Pay all bills on time.

- Keep your credit utilization low (ideally below 30%).

- Check your credit report for errors and dispute any inaccuracies.

Loan Amount and Term: Balancing Cost and Convenience

The amount you borrow and the repayment period (loan term) both affect your interest rate. Generally, larger loan amounts and longer terms lead to higher interest rates. This is because lenders perceive a greater risk with larger loans and longer repayment periods.

- Example: A $5,000 loan over 3 years might have a lower interest rate than a $20,000 loan over 5 years.

Trade-offs Between Loan Terms:

- Shorter terms: Higher monthly payments but lower overall interest costs.

- Longer terms: Lower monthly payments but higher overall interest costs.

Lender Type: Banks, Credit Unions, and Online Lenders

Different lenders offer varying interest rates.

- Banks: Typically offer competitive rates, especially for borrowers with excellent credit.

- Credit Unions: Often provide lower rates than banks, particularly for members, due to their not-for-profit structure.

- Online Lenders: Can offer convenient application processes but may have higher rates for those with less-than-perfect credit. They often cater to a broader range of credit scores.

Your Income and Debt-to-Income Ratio: Demonstrating Repayment Ability

Lenders carefully assess your ability to repay the loan by examining your income and debt-to-income (DTI) ratio. Your DTI ratio is the percentage of your monthly income that goes towards debt payments. A high DTI ratio can signal higher risk to lenders and result in a higher interest rate.

Tips for Improving Your DTI Ratio:

- Reduce existing debt.

- Increase your income.

How to Find the Best Personal Loan Interest Rates Today

Finding the best personal loan interest rate requires proactive steps. Don't settle for the first offer you receive.

Shop Around and Compare: The Power of Comparison

Comparing offers from multiple lenders is crucial. Don't limit yourself to just one bank or credit union.

- Online Loan Comparison Websites: Many websites allow you to compare rates from various lenders simultaneously.

- Loan Brokers: A loan broker can help you navigate the process and find competitive offers from several lenders.

Negotiate with Lenders: Don't Be Afraid to Ask

Negotiating a lower interest rate is often possible, especially if you have a strong credit score and a favorable financial situation.

- Leverage Competing Offers: If you receive a better offer from another lender, use it to negotiate a lower rate with your current lender.

Consider Pre-qualification: A Risk-Free Exploration

Pre-qualifying for a loan allows you to see what interest rates you qualify for without impacting your credit score. This lets you compare offers without committing.

- How Pre-qualification Works: Most lenders offer pre-qualification options online; it generally requires basic personal and financial information.

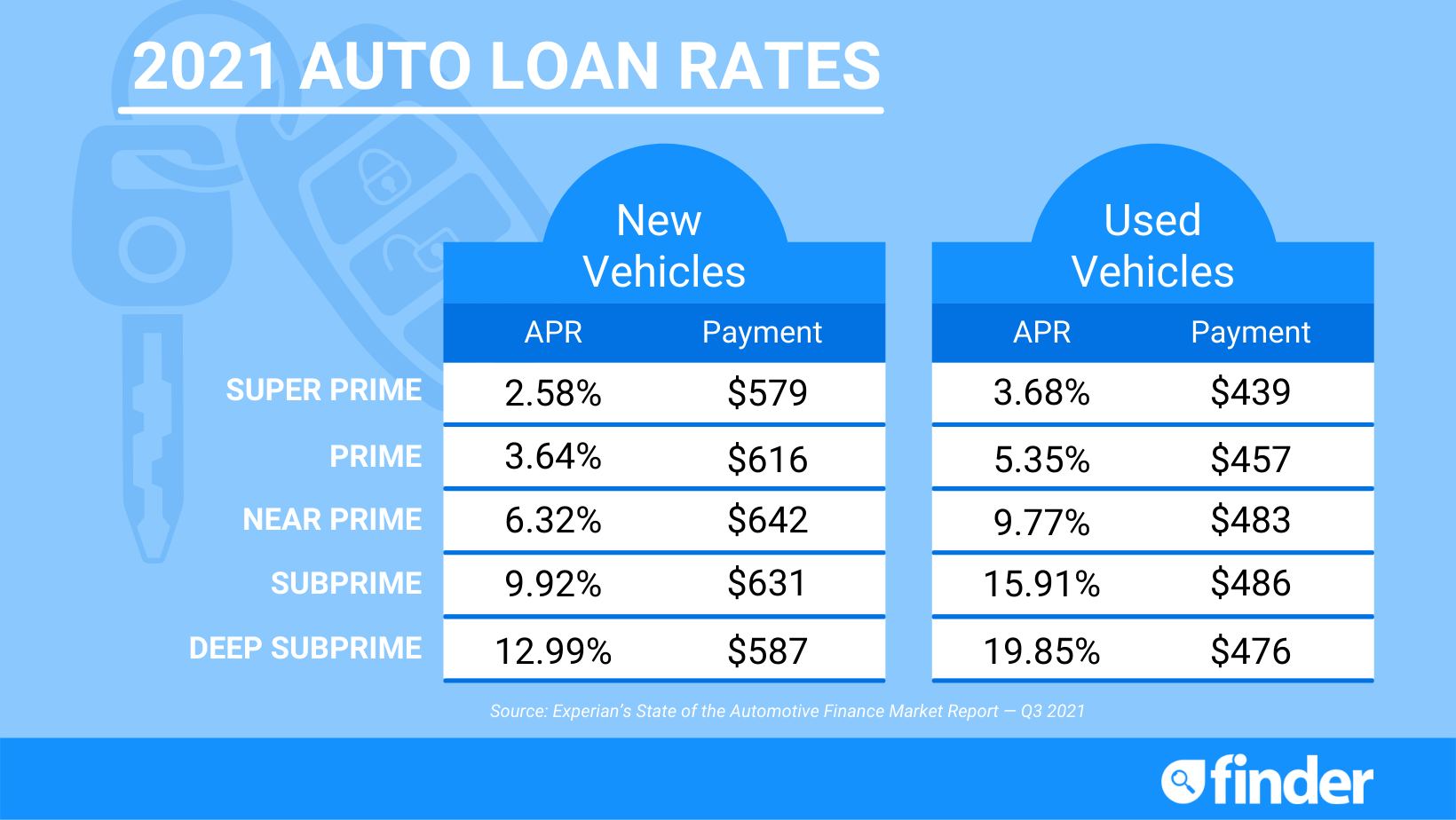

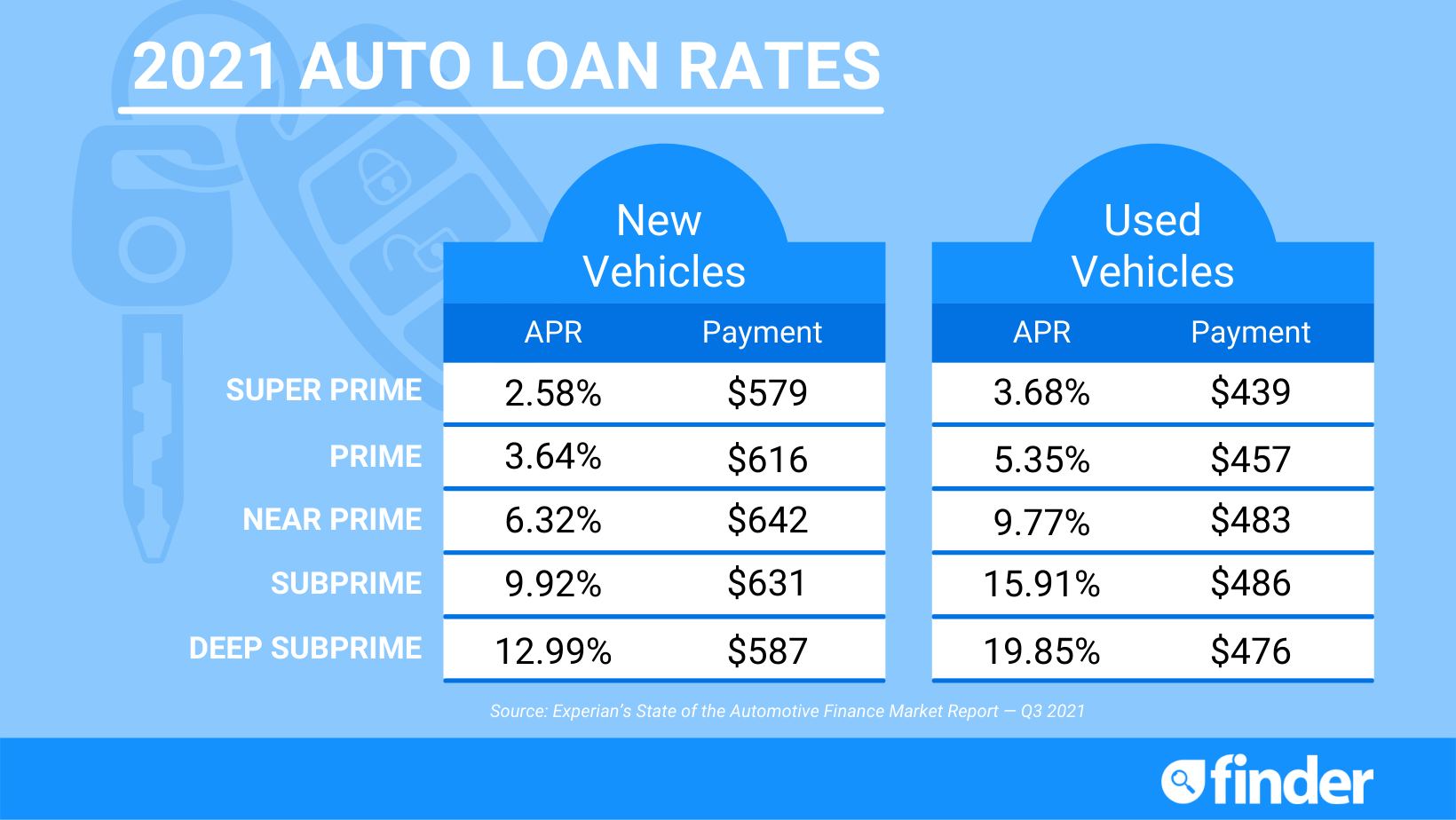

Understanding APR and Other Loan Fees

The Annual Percentage Rate (APR) represents the total cost of your loan, including interest and fees. It's crucial to understand the APR to compare loan offers accurately.

- Components of APR: Interest rate + origination fees + other fees.

Other potential fees include:

- Origination fees (a percentage of the loan amount).

- Late payment fees.

- Prepayment penalties (in some cases).

Always carefully review all fees before accepting a loan offer.

Secure Your Best Personal Loan Interest Rate Today

Securing a favorable personal loan interest rate depends on several factors, primarily your credit score, the loan amount, the loan term, and the lender you choose. Comparing offers from multiple lenders is essential to ensure you get the best possible rate. Don't hesitate to negotiate and consider pre-qualification to make an informed decision. Start your search for the best personal loan interest rates today by comparing offers from reputable lenders. Don't settle for a high interest rate – take control of your finances and secure the best possible loan terms!

Featured Posts

-

Kapolda Bali Irjen Daniel Memimpin Sertijab 7 Pamen Berikut Pesan Dan Arti Pentingnya

May 28, 2025

Kapolda Bali Irjen Daniel Memimpin Sertijab 7 Pamen Berikut Pesan Dan Arti Pentingnya

May 28, 2025 -

Jawa Tengah Diguyur Hujan Peringatan Cuaca 23 April 2024

May 28, 2025

Jawa Tengah Diguyur Hujan Peringatan Cuaca 23 April 2024

May 28, 2025 -

A New Baseball Book Perfect For Opening Day

May 28, 2025

A New Baseball Book Perfect For Opening Day

May 28, 2025 -

California Dreamin One Expats Reality Check In Germany

May 28, 2025

California Dreamin One Expats Reality Check In Germany

May 28, 2025 -

Jennifer Lopez Set To Host The 2025 American Music Awards

May 28, 2025

Jennifer Lopez Set To Host The 2025 American Music Awards

May 28, 2025

Latest Posts

-

Gorillaz House Of Kong Celebrating 25 Years Of Music And Art

May 30, 2025

Gorillaz House Of Kong Celebrating 25 Years Of Music And Art

May 30, 2025 -

Gorillaz 25th Anniversary House Of Kong Exhibition Details

May 30, 2025

Gorillaz 25th Anniversary House Of Kong Exhibition Details

May 30, 2025 -

Secure Your Gorillaz Tickets Londons Copper Box Arena Shows

May 30, 2025

Secure Your Gorillaz Tickets Londons Copper Box Arena Shows

May 30, 2025 -

Gorillaz Celebrate 25 Years A Retrospective Exhibition And Live Performances

May 30, 2025

Gorillaz Celebrate 25 Years A Retrospective Exhibition And Live Performances

May 30, 2025 -

Gorillaz Copper Box Arena Tickets For Four Shows On Sale Today

May 30, 2025

Gorillaz Copper Box Arena Tickets For Four Shows On Sale Today

May 30, 2025