Personal Loan Interest Rates Today: Find Your Lowest Rate

Table of Contents

Factors Influencing Personal Loan Interest Rates

Several key factors significantly impact the interest rate you'll receive on a personal loan. Understanding these factors is crucial for securing the best possible terms.

-

Credit Score: Your credit score is arguably the most important factor. Lenders use your credit history – including payment history, credit utilization, and length of credit history – to assess your creditworthiness. A higher credit score (generally 700 or above) demonstrates lower risk to lenders, resulting in lower interest rates. Conversely, a lower credit score indicates higher risk, leading to higher interest rates or even loan rejection. Improving your credit score before applying is a significant step toward securing a favorable rate.

-

Loan Amount: Generally, larger loan amounts tend to come with slightly higher interest rates. Lenders perceive larger loans as representing greater risk.

-

Loan Term: The length of your loan term directly influences your monthly payment and the total interest paid. A shorter loan term (e.g., 12 months) results in higher monthly payments but lower overall interest because you pay off the principal faster. A longer loan term (e.g., 60 months) means lower monthly payments but significantly higher overall interest due to prolonged interest accrual.

-

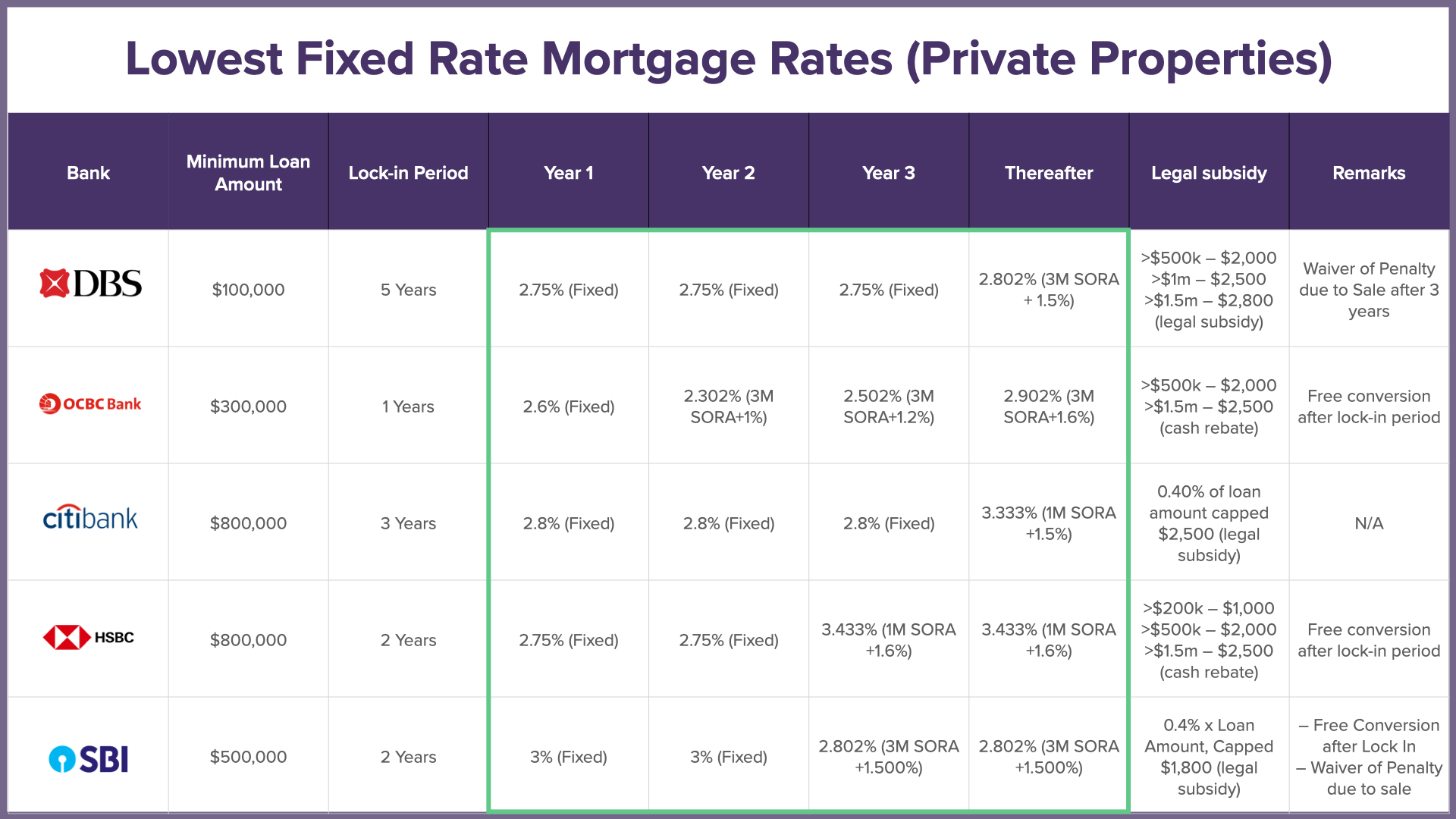

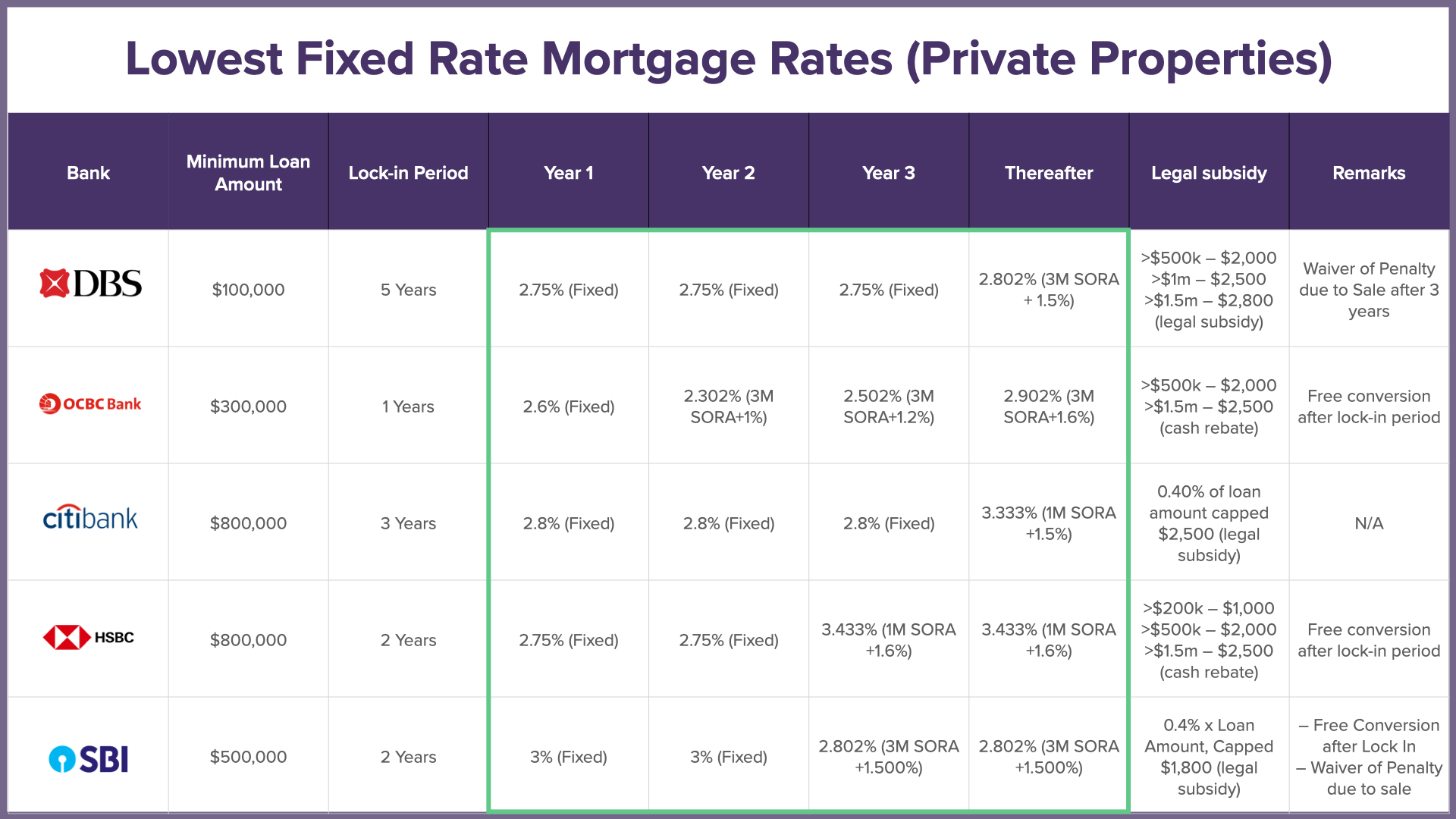

Lender Type: Different lenders offer varying interest rates. Banks typically offer a wide range of loan products but may have stricter lending criteria. Credit unions often provide more competitive rates to their members, focusing on building relationships. Online lenders offer convenience but may have less personalized service and potentially higher fees. Comparing offers across all lender types is vital.

-

Debt-to-Income Ratio (DTI): Your DTI is the ratio of your monthly debt payments to your gross monthly income. A lower DTI demonstrates your ability to manage debt effectively, making you a less risky borrower and increasing your chances of securing a lower interest rate. To calculate your DTI, add up all your monthly debt payments (excluding mortgage if applicable), and divide by your gross monthly income.

How to Find the Lowest Personal Loan Interest Rates

Securing the lowest personal loan interest rate requires a proactive approach. Here are some key strategies:

-

Shop Around: Comparing rates from multiple lenders is essential. Don't settle for the first offer you receive. Use online loan comparison websites to quickly compare offers from various banks, credit unions, and online lenders.

-

Improve Your Credit Score: Before applying for a loan, take steps to improve your credit score. This includes paying all bills on time, keeping your credit utilization low (ideally below 30%), and avoiding opening multiple new credit accounts in a short period. Checking your credit report regularly for errors is also crucial.

-

Negotiate with Lenders: Once you've received loan offers, don't be afraid to negotiate. If you have a strong credit score and have found a more favorable rate elsewhere, you can use this information to negotiate a lower rate with your preferred lender.

-

Consider Secured Loans: If you have assets like a savings account or certificate of deposit, consider a secured loan. Secured loans use your collateral to reduce the lender's risk, potentially leading to lower interest rates.

Understanding APR and Other Fees

Understanding the Annual Percentage Rate (APR) and associated fees is critical for comparing loan offers accurately.

-

APR: The APR represents the annual cost of borrowing, including interest and other fees. It's crucial for comparing the true cost of loans from different lenders, as interest rates alone can be misleading.

-

Origination Fees: These are fees charged by lenders to process your loan application. They can significantly increase the overall cost of your loan, so factor them into your comparison.

-

Prepayment Penalties: Some loans include prepayment penalties, which are charged if you pay off your loan early. Be aware of these penalties before signing any loan agreement.

Resources for Finding the Best Personal Loan Rates

Several reliable resources can help you compare personal loan rates and find the best deal.

-

Loan Comparison Websites: Websites like LendingTree, Bankrate, and NerdWallet allow you to compare offers from multiple lenders simultaneously.

-

Credit Union Websites: Credit unions often offer competitive rates and personalized service. Check with your local credit union or explore national credit union websites.

-

Bank Websites: Many major banks offer personal loans. Explore their websites to compare their rates and terms.

Remember to check the reputation and trustworthiness of any website before sharing your personal information.

Conclusion

Securing the lowest personal loan interest rates requires careful planning and comparison shopping. Understanding the factors influencing rates, such as your credit score, loan amount, and lender type, is crucial. By employing strategies like improving your credit score, negotiating with lenders, and utilizing online resources, you can significantly reduce the cost of your personal loan. Start comparing personal loan interest rates today! Use the resources mentioned above to find the best loan for your financial needs and secure the lowest rate possible. Don't let high interest payments drain your budget – take control and find your ideal personal loan.

Featured Posts

-

Welcome To Wrexham Stadium Tours Local Pubs And More

May 28, 2025

Welcome To Wrexham Stadium Tours Local Pubs And More

May 28, 2025 -

How To Watch The 2025 American Music Awards Online For Free

May 28, 2025

How To Watch The 2025 American Music Awards Online For Free

May 28, 2025 -

French Open Musetti And Sabalenka Win Nadal Celebrated

May 28, 2025

French Open Musetti And Sabalenka Win Nadal Celebrated

May 28, 2025 -

Arsenals Transfer Pursuit 58m Tottenham Bid Wont Deter Striker Target

May 28, 2025

Arsenals Transfer Pursuit 58m Tottenham Bid Wont Deter Striker Target

May 28, 2025 -

Bethlehems Mayoral And Council Races A Look At Recent Negative Campaigning

May 28, 2025

Bethlehems Mayoral And Council Races A Look At Recent Negative Campaigning

May 28, 2025

Latest Posts

-

Experience The Gorillaz House Of Kong Exhibition At Londons Copper Box Arena

May 30, 2025

Experience The Gorillaz House Of Kong Exhibition At Londons Copper Box Arena

May 30, 2025 -

Londons Copper Box Arena Hosts Gorillaz House Of Kong Exhibition This Summer

May 30, 2025

Londons Copper Box Arena Hosts Gorillaz House Of Kong Exhibition This Summer

May 30, 2025 -

Finding Gorillaz Concert Tickets London Show Guide

May 30, 2025

Finding Gorillaz Concert Tickets London Show Guide

May 30, 2025 -

Gorillaz House Of Kong Exhibition Details On The 25th Anniversary Celebration

May 30, 2025

Gorillaz House Of Kong Exhibition Details On The 25th Anniversary Celebration

May 30, 2025 -

Gorillaz House Of Kong Exhibition Immersive Experience At Londons Copper Box Arena

May 30, 2025

Gorillaz House Of Kong Exhibition Immersive Experience At Londons Copper Box Arena

May 30, 2025