Personal Loans: Check Today's Interest Rates And Financing Options

Table of Contents

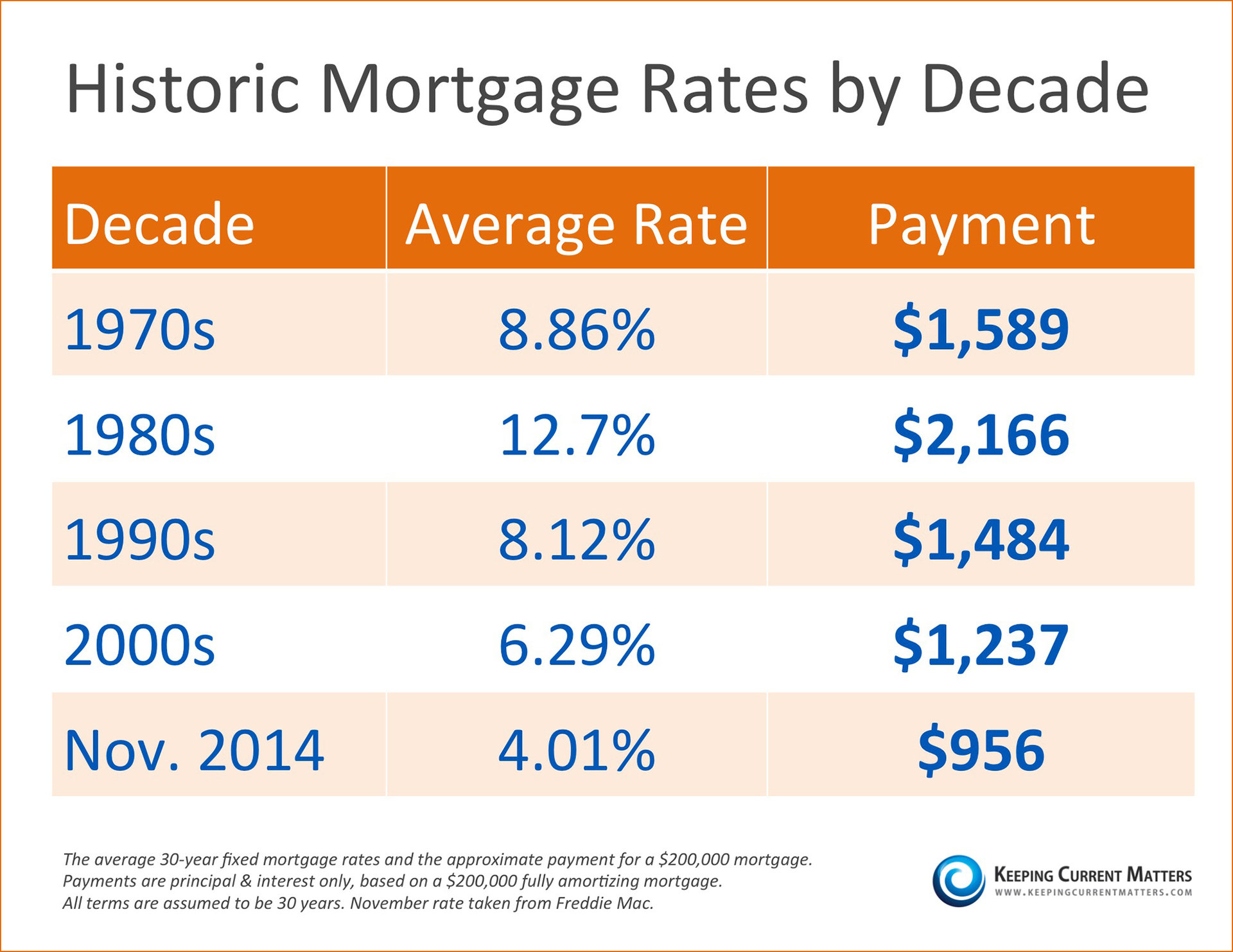

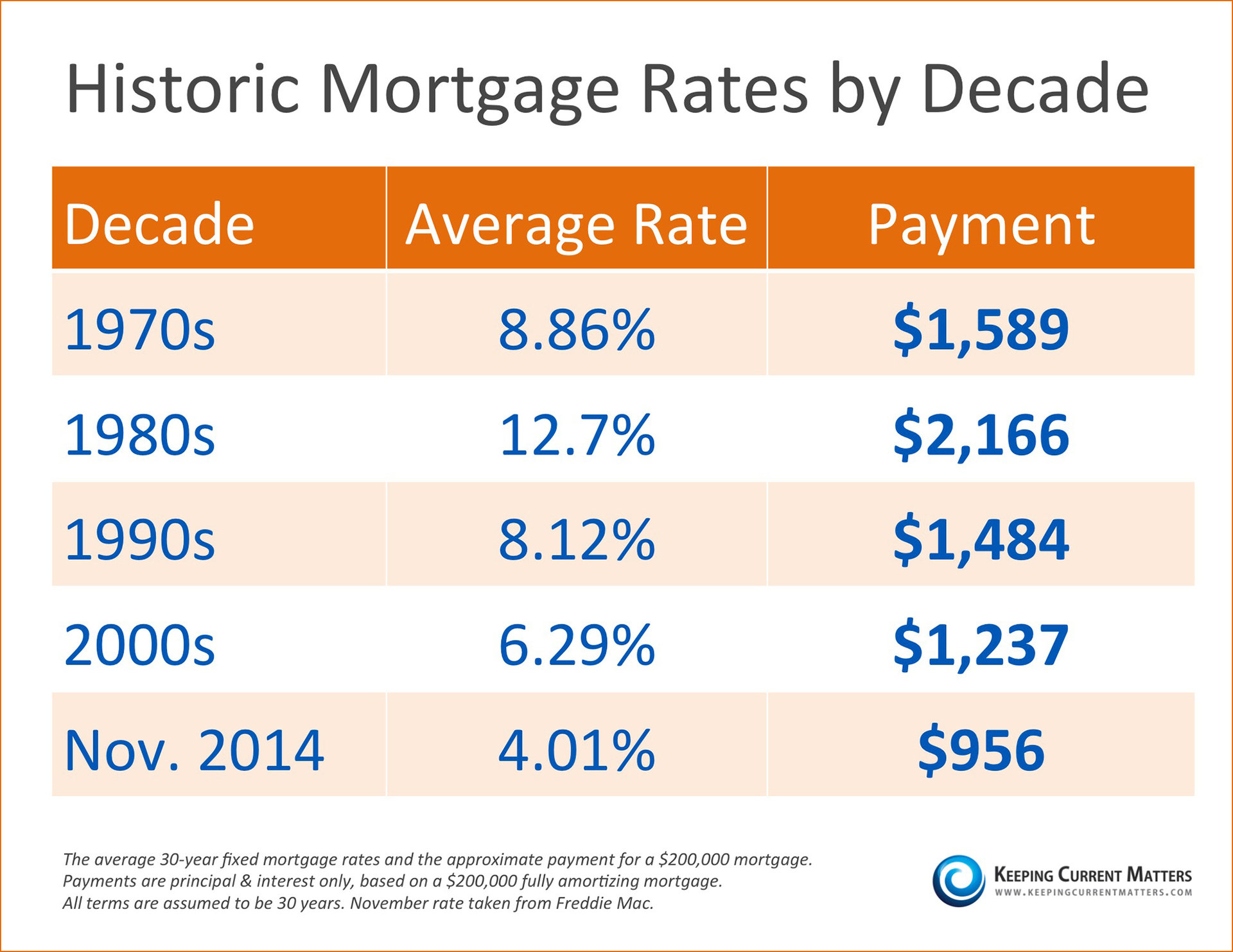

Understanding Today's Personal Loan Interest Rates

Securing a favorable interest rate on your personal loan is paramount to managing your debt effectively. The interest rate, often expressed as an Annual Percentage Rate (APR), significantly impacts your overall loan cost.

Factors Affecting Interest Rates

Several factors influence the personal loan interest rates you'll receive:

-

Credit Score Impact: Your credit score is a major determinant. A higher credit score (generally above 700) typically qualifies you for lower loan rates, reflecting your reduced risk to the lender. A lower credit score means higher interest rates and potentially stricter lending requirements. Improving your credit score before applying for a personal loan can significantly impact your interest rate.

-

Loan Amount and Term: Larger loan amounts and longer repayment terms often come with higher interest rates. Lenders perceive a higher risk associated with larger loans and extended periods. A shorter loan term, while requiring higher monthly payments, generally results in lower overall interest paid.

-

Income and Debt-to-Income Ratio: Lenders assess your ability to repay the loan by examining your income and debt-to-income (DTI) ratio. A higher income and a lower DTI (the percentage of your income dedicated to debt payments) typically translate to better interest rates.

-

Secured vs. Unsecured Loans: Secured personal loans, which require collateral (like a car or savings account), usually come with lower interest rates than unsecured loans. Unsecured loans carry higher risk for lenders, resulting in higher rates.

-

Current Market Trends: Prevailing economic conditions and interest rate adjustments by the central bank also play a role. Market fluctuations can influence the overall interest rates offered by lenders.

How to Find the Best Interest Rates

Finding the best personal loan interest rates involves proactive research and comparison:

-

Shop Around: Don't settle for the first offer. Compare offers from multiple banks, credit unions, and online lenders to find the most competitive rates.

-

Utilize Online Tools: Online loan comparison tools and loan calculators can streamline the process by allowing you to input your details and instantly compare offers from different lenders.

-

Check Lender Reviews: Research lenders' reputations and read reviews from other borrowers to gauge their reliability and customer service.

-

Negotiate: Don't hesitate to negotiate with lenders for a better interest rate, especially if you have a strong credit score and a stable income.

-

Improve Your Credit: Working to improve your credit score before applying can significantly increase your chances of securing a lower interest rate.

Exploring Various Personal Loan Financing Options

The market offers a variety of personal loan financing options, each with its own set of features and advantages:

Different Types of Personal Loans

-

Unsecured Personal Loans: These loans don't require collateral. Eligibility depends primarily on your creditworthiness, income, and debt-to-income ratio. They offer flexibility but typically carry higher interest rates than secured loans.

-

Secured Personal Loans: These loans use an asset as collateral, reducing the lender's risk and resulting in lower interest rates. However, defaulting on a secured loan could lead to the loss of your collateral.

-

Debt Consolidation Loans: These loans help combine multiple debts into a single, manageable payment, often with a lower interest rate than the individual debts. This simplifies repayment and can potentially save you money.

-

Peer-to-Peer (P2P) Lending: P2P platforms connect borrowers directly with individual investors, sometimes offering competitive rates. However, it's crucial to carefully vet the platform and understand the terms.

-

Bank Loans vs. Credit Union Loans: Banks generally offer a wider range of loan products, but credit unions often provide more personalized service and potentially lower interest rates for their members.

Choosing the Right Loan for Your Needs

Selecting the right personal loan involves careful consideration:

-

Credit Score & Borrowing Capacity: Understand your credit score and borrowing capacity to determine the loan amount you can realistically afford.

-

Repayment Ability: Choose a loan term that aligns with your repayment capacity. Shorter terms mean higher monthly payments but lower overall interest.

-

Fees & Charges: Compare all associated fees, including origination fees, prepayment penalties, and late payment fees.

-

Terms & Conditions: Carefully review the loan agreement before signing to ensure you fully understand all terms and conditions.

The Application Process for Personal Loans

Applying for a personal loan involves several steps:

Gathering Necessary Documents

Typically, you'll need:

- Proof of Income (pay stubs, tax returns)

- Photo ID

- Proof of Address (utility bill, bank statement)

Completing the Application Form

Online applications usually require accurate and complete information regarding your personal details, financial situation, and loan requirements. Ensure you provide accurate information to avoid delays.

Loan Approval and Disbursement

The loan approval process can take a few days to several weeks, depending on the lender and your individual circumstances. Once approved, funds are typically disbursed directly into your bank account.

Tips for Managing Your Personal Loan Effectively

Effective loan management is crucial for maintaining good credit and avoiding financial strain:

Creating a Repayment Plan

Develop a realistic budget that prioritizes loan repayments. Automate payments whenever possible to avoid missed payments.

Avoiding Late Payments

Late payments negatively impact your credit score and incur additional fees. Set reminders, use autopay, or explore options like refinancing if you anticipate difficulty making timely payments.

Monitoring Your Credit Report

Regularly check your credit report for any errors or inaccuracies. This helps you ensure your credit information is correct and reflects your responsible repayment history.

Conclusion

Securing a personal loan requires careful planning and research. Understanding today's personal loan interest rates and exploring the various financing options available are critical steps in finding the best loan for your needs. By comparing offers, choosing a suitable loan type, and effectively managing your repayments, you can successfully navigate the personal loan process and achieve your financial goals. Start your search for the perfect personal loan today! Utilize our loan comparison tool to find the best rates and terms. (Link to comparison tool, if applicable)

Featured Posts

-

Adanali Ronaldo Nun Aciklamasi Ve Cristiano Ronaldo Nun Yaniti

May 28, 2025

Adanali Ronaldo Nun Aciklamasi Ve Cristiano Ronaldo Nun Yaniti

May 28, 2025 -

Salengs Salary Moroka Swallows Vs Orlando Pirates

May 28, 2025

Salengs Salary Moroka Swallows Vs Orlando Pirates

May 28, 2025 -

Report Exposes Dangerous Climate Whiplash And Its Effects On Cities

May 28, 2025

Report Exposes Dangerous Climate Whiplash And Its Effects On Cities

May 28, 2025 -

Justin Baldoni Lawsuit Lawyer Denounces Blake Livelys Attempt To Dismiss Case

May 28, 2025

Justin Baldoni Lawsuit Lawyer Denounces Blake Livelys Attempt To Dismiss Case

May 28, 2025 -

Cristiano Ronaldo Nun Marka Degeri Sasirtici Rakamlar Ve Etkisi

May 28, 2025

Cristiano Ronaldo Nun Marka Degeri Sasirtici Rakamlar Ve Etkisi

May 28, 2025

Latest Posts

-

Miley Cyrus Unveils New Visuals For End Of The World Single

May 31, 2025

Miley Cyrus Unveils New Visuals For End Of The World Single

May 31, 2025 -

Is Miley Cyrus Hit Een Plagiaat Van Bruno Mars Rechtszaak Wordt Voortgezet

May 31, 2025

Is Miley Cyrus Hit Een Plagiaat Van Bruno Mars Rechtszaak Wordt Voortgezet

May 31, 2025 -

Analisis Lirik Dan Musik Video Single Baru Miley Cyrus End Of The World

May 31, 2025

Analisis Lirik Dan Musik Video Single Baru Miley Cyrus End Of The World

May 31, 2025 -

Resmi Miley Cyrus Rilis Singel Baru End Of The World

May 31, 2025

Resmi Miley Cyrus Rilis Singel Baru End Of The World

May 31, 2025 -

Donderdag Miley Cyrus Onthult Eerste Single Van Nieuw Album

May 31, 2025

Donderdag Miley Cyrus Onthult Eerste Single Van Nieuw Album

May 31, 2025