Podcast: Preparing For The End Of Low Inflation

Table of Contents

Understanding the Shift Away from Low Inflation

For decades, low inflation was the norm, fueled by globalization, technological advancements, and abundant supply. However, recent years have witnessed a significant surge in inflation, driven by a complex interplay of factors. This shift requires a thorough understanding of its implications for your financial well-being.

The current inflationary environment is characterized by:

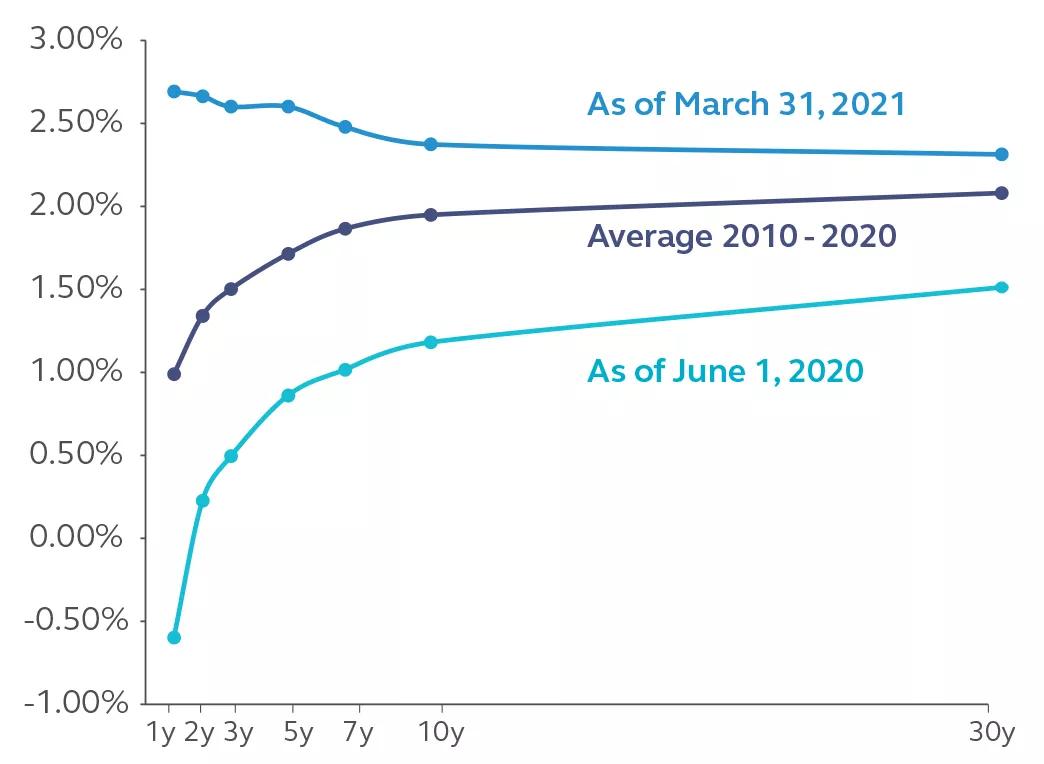

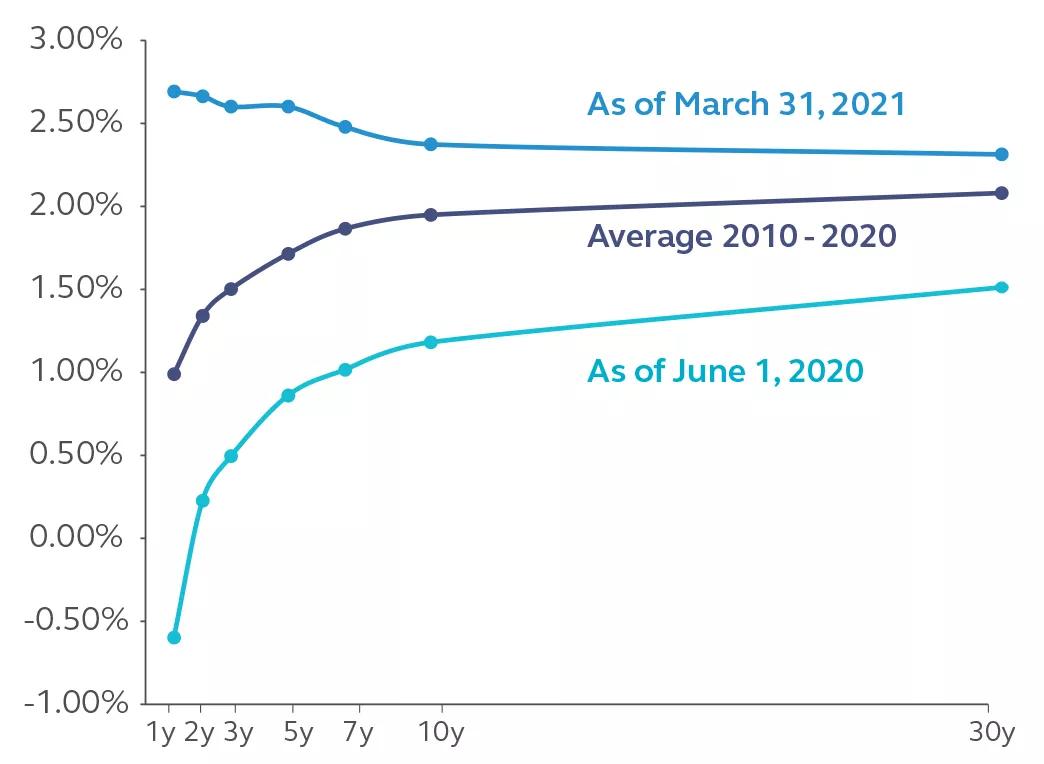

- Rising interest rates: Central banks are raising interest rates to combat inflation, impacting borrowing costs for individuals and businesses alike. This affects everything from mortgages to business loans.

- Increased energy and commodity prices: The global energy crisis and supply chain disruptions have significantly increased the prices of essential commodities, contributing to higher consumer prices. This is particularly noticeable in the cost of gasoline and heating fuel.

- Supply chain disruptions: Ongoing supply chain bottlenecks continue to restrict the availability of goods, leading to increased prices and shortages. The pandemic exacerbated these issues, creating long-lasting effects.

- Geopolitical factors: Global conflicts and political instability contribute to uncertainty and volatility in commodity markets, fueling inflationary pressures. These factors are often unpredictable and can significantly impact prices.

- Government policies: Government spending and monetary policies can significantly influence inflation rates. Expansionary fiscal policies can lead to increased demand and higher prices.

Adjusting Your Investment Strategy for a High-Inflation Environment

A high-inflation environment necessitates a shift in investment strategies. The goal is to preserve purchasing power and potentially benefit from the rising price level. Diversification and risk management are crucial during such times. Consider the following strategies:

- Investing in inflation-protected securities (TIPS): Treasury Inflation-Protected Securities (TIPS) are designed to protect investors from inflation. Their principal adjusts with inflation, ensuring that your investment retains its purchasing power.

- Considering real estate investments: Real estate often performs well during inflationary periods, as property values tend to rise with inflation. This can be a valuable addition to a diversified portfolio.

- Exploring commodities as a hedge against inflation: Commodities like gold and oil are often considered inflation hedges, as their prices tend to increase during inflationary periods.

- Evaluating value stocks over growth stocks: Value stocks, companies with lower price-to-earnings ratios, may outperform growth stocks in a high-inflation environment. This is because value stocks tend to be less sensitive to interest rate increases.

- Rebalancing your portfolio to mitigate risks: Regularly rebalance your investment portfolio to ensure it aligns with your risk tolerance and long-term financial goals. This helps to prevent overexposure to any single asset class.

Protecting Your Savings and Income from Inflation

Protecting your savings and income from the erosive effects of inflation requires proactive measures. Here are several strategies you can consider:

- High-yield savings accounts: While interest rates may not fully outpace inflation, high-yield savings accounts offer a better return than traditional savings accounts.

- Certificates of deposit (CDs): CDs provide a fixed interest rate for a specified period, offering a degree of stability during uncertain times.

- Investing in tangible assets: Consider investing in tangible assets such as precious metals or collectibles, which may retain their value or even appreciate during periods of high inflation.

- Budgeting and reducing expenses: Carefully review your household budget and identify areas where you can reduce expenses to offset the impact of rising prices.

- Negotiating salary increases: If possible, negotiate a salary increase to keep pace with rising inflation.

Resources and Further Learning on Inflation and Investing

Staying informed is crucial in navigating the complexities of inflation and investment strategies. Here are some valuable resources:

- Bureau of Labor Statistics (BLS): The BLS provides comprehensive data on inflation and other economic indicators. [Link to BLS website]

- Federal Reserve: The Federal Reserve provides updates on monetary policy and economic forecasts. [Link to Federal Reserve website]

- Reputable financial news sources: Stay updated on current economic events and market trends through reputable sources such as the Wall Street Journal, Bloomberg, and the Financial Times.

- Financial advisors: Consider consulting with a qualified financial advisor who can help you develop a personalized investment strategy tailored to your specific circumstances.

Conclusion

Preparing for the end of low inflation requires proactive planning and a well-diversified investment strategy. Understanding the factors driving inflation, adjusting your portfolio accordingly, and protecting your savings are essential steps to navigate this changing economic landscape. Don't underestimate the impact of rising inflation on your financial well-being. By implementing the strategies outlined in this podcast, you can better position yourself to weather this economic shift and potentially even benefit from the opportunities it presents. Subscribe now to stay ahead of the curve and learn more about managing inflation effectively! Don't get caught off guard – subscribe to our podcast today!

Featured Posts

-

Nov Razgovor Putin Tramp Shto Veli Peskov

May 27, 2025

Nov Razgovor Putin Tramp Shto Veli Peskov

May 27, 2025 -

Tracker Season 2 Episode 12 Monster Preview And Episode 13 Neptune Early Look

May 27, 2025

Tracker Season 2 Episode 12 Monster Preview And Episode 13 Neptune Early Look

May 27, 2025 -

Las Vegas Janet Jackson Concert Your Bushman Sponsored Getaway

May 27, 2025

Las Vegas Janet Jackson Concert Your Bushman Sponsored Getaway

May 27, 2025 -

Osimhens Napoli Exit Arab Clubs In Transfer Battle

May 27, 2025

Osimhens Napoli Exit Arab Clubs In Transfer Battle

May 27, 2025 -

Star Treks Romulans A Look At Ian Holms Legacy And Potential Returns

May 27, 2025

Star Treks Romulans A Look At Ian Holms Legacy And Potential Returns

May 27, 2025

Latest Posts

-

Mai Arrangementer I Moss En Komplett Oversikt

May 29, 2025

Mai Arrangementer I Moss En Komplett Oversikt

May 29, 2025 -

Feiring Av 17 Mai I Moss Planlegg Dagen Din

May 29, 2025

Feiring Av 17 Mai I Moss Planlegg Dagen Din

May 29, 2025 -

Mai I Moss Hva Skjer Pa Nasjonaldagen

May 29, 2025

Mai I Moss Hva Skjer Pa Nasjonaldagen

May 29, 2025 -

Program For 17 Mai I Moss En Komplett Guide

May 29, 2025

Program For 17 Mai I Moss En Komplett Guide

May 29, 2025 -

Moss 17 Mai Aktiviteter Og Arrangementer

May 29, 2025

Moss 17 Mai Aktiviteter Og Arrangementer

May 29, 2025