Post-US-China Trade Talks: Market Sentiment And The Verdict On Promises

Table of Contents

Immediate Market Reactions to the Trade Talks

The announcement of the latest US-China trade agreement triggered immediate, albeit varied, reactions across global markets. Understanding these initial responses is crucial to gauging the overall success and potential long-term effects of the negotiations.

Stock Market Volatility

Following the announcement, major stock indices experienced significant fluctuations.

- Dow Jones Industrial Average: A slight initial surge was followed by a period of consolidation, indicating some investor hesitation despite the positive headlines.

- S&P 500: Similar to the Dow, the S&P 500 showed a cautious response, with gains failing to fully reflect the apparent optimism surrounding the trade deal.

- Shanghai Composite: The Shanghai Composite index showed more pronounced volatility, reflecting China's greater direct exposure to the trade agreement's implications. Early gains were followed by a more subdued performance.

- Investor Confidence: While initial investor sentiment was positive, lingering concerns about the long-term enforceability of the promises led to a degree of uncertainty in trading volumes. This cautious optimism highlights the need for further observation to confirm the deal's lasting impact.

Currency Fluctuations

The impact on global currencies was also notable.

- US Dollar: The US dollar initially strengthened slightly against the Chinese yuan, reflecting a potential increase in investor confidence in the US economy. However, this strengthening proved to be temporary.

- Chinese Yuan: The yuan showed moderate fluctuations, with initial strength followed by a period of slight weakening, suggesting some uncertainty regarding the agreement's long-term benefits for the Chinese economy.

- Market Speculation: Currency movements were influenced by market speculation about the deal's enforceability and its impact on future trade relations. Uncertainty remains a dominant force.

Commodity Prices

The effect on commodity prices was sector-specific.

- Soybeans: Prices initially rose on expectations of increased Chinese demand for US soybeans, reflecting a key promise within the agreement.

- Oil: Oil prices showed limited reaction, suggesting that the trade deal's impact on global energy markets was less direct.

- Metals: Prices of certain metals remained relatively stable, indicating a lack of major supply chain disruptions due to the agreement. However, the long-term effects remain uncertain.

Analysis of the Promises Made During the Trade Talks

Understanding the promises made and their feasibility is key to evaluating the success of the US-China trade talks.

Specific Promises and Their Feasibility

Both sides made significant promises, the fulfillment of which is crucial for judging the agreement's success.

- Increased Purchases of US Goods: China pledged to significantly increase its purchases of US agricultural products, manufactured goods, and energy. The feasibility of this pledge is subject to ongoing scrutiny, with concerns about potential market distortions and the ability of US producers to meet increased demand.

- Intellectual Property Protection: Both sides committed to enhancing intellectual property rights protection, a critical area of previous contention. The effectiveness of these measures will require continuous monitoring and enforcement.

- Technology Transfer: Promises around fairer technology transfer practices need clear definitions and robust mechanisms for enforcement to ensure compliance.

Areas of Continued Disagreement

Despite the agreement, some key areas of disagreement persist.

- Trade Tariffs: While some tariffs were reduced or suspended, others remain in place, potentially hindering further economic integration.

- State-Owned Enterprises: Concerns persist over the competitive practices of Chinese state-owned enterprises. Addressing these concerns will likely necessitate further negotiations and monitoring.

- Cybersecurity: Cybersecurity continues to be a point of contention, potentially leading to future trade disputes.

Long-Term Implications for Businesses

The agreement presents both challenges and opportunities for businesses engaged in US-China trade.

- Increased Market Access: US businesses may see increased access to the Chinese market, benefiting from reduced tariffs and improved regulatory environments.

- Supply Chain Adjustments: Businesses may need to adjust their supply chains to accommodate the changing trade landscape.

- Investment Decisions: The agreement's long-term success will influence investment decisions, requiring businesses to carefully assess the risks and rewards associated with the US-China trade relationship.

The Verdict: Assessing the Success of the Trade Talks

Determining the success of the US-China trade talks requires considering both short-term market reactions and potential long-term outcomes.

Short-Term vs. Long-Term Perspectives

While the immediate market reactions showed some positivity, long-term implications remain uncertain.

- Short-Term Gains: Certain sectors, like agriculture, experienced short-term gains due to increased demand.

- Long-Term Uncertainty: The long-term success hinges on the fulfillment of promises and the resolution of ongoing trade disputes. A balanced perspective acknowledges both the positive and negative aspects, demanding cautious optimism.

Geopolitical Implications

The trade talks have broader geopolitical implications.

- Global Trade Relations: The agreement’s success or failure could influence global trade relations and the stability of the international economic order.

- US-China Relations: The agreement's impact on the overall US-China relationship remains to be seen, with potential implications for broader diplomatic ties.

Conclusion:

The post-US-China trade talks market sentiment is complex and reflects a mixture of optimism and caution. While some immediate gains were observed in certain sectors, the long-term success of the promises made remains to be seen. Careful analysis of both short-term market reactions and the long-term feasibility of the agreement is crucial for investors and businesses alike. Staying informed on future developments in post-US-China trade talks is vital for navigating the evolving global economic landscape. Continue to monitor news and analyses to make informed decisions about your investments and business strategies in this crucial area of international trade. The success or failure of this agreement will significantly shape the future of global trade and requires continued vigilance.

Featured Posts

-

Yankees Confident Aaron Judge Is A Future Hall Of Famer After 1 000 Games

May 12, 2025

Yankees Confident Aaron Judge Is A Future Hall Of Famer After 1 000 Games

May 12, 2025 -

Mlb Commissioner Manfred Discusses The Speedway Classic

May 12, 2025

Mlb Commissioner Manfred Discusses The Speedway Classic

May 12, 2025 -

Indy Car Documentary Fox Announces May 18 Release Date

May 12, 2025

Indy Car Documentary Fox Announces May 18 Release Date

May 12, 2025 -

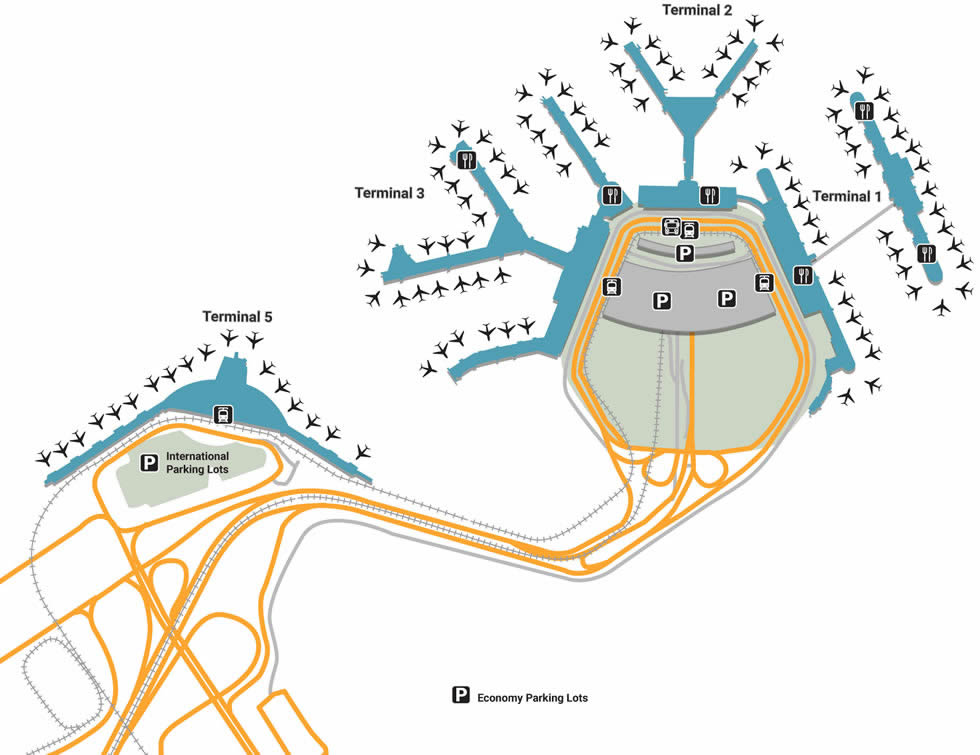

Why United And American Airlines Dominate Chicago O Hare A Head To Head Battle

May 12, 2025

Why United And American Airlines Dominate Chicago O Hare A Head To Head Battle

May 12, 2025 -

Selena Gomez Responds To Cheating Rumors With Benny Blanco

May 12, 2025

Selena Gomez Responds To Cheating Rumors With Benny Blanco

May 12, 2025