Posthaste: Are Canadian Home Prices Entering A Correction?

Table of Contents

Rising Interest Rates and Their Impact on Affordability

Increased interest rates are arguably the most significant factor impacting Canadian home prices. Higher rates directly translate to larger monthly mortgage payments, significantly reducing the borrowing power of potential homebuyers. This decreased affordability shrinks the pool of qualified buyers, putting downward pressure on demand. The Bank of Canada's recent interest rate hikes have already shown a correlation with a decrease in home sales across the country.

- Impact on first-time homebuyers: First-time buyers, often operating with smaller down payments and less financial flexibility, are particularly vulnerable to rising interest rates, pushing homeownership further out of reach.

- Effect on variable vs. fixed-rate mortgages: Borrowers with variable-rate mortgages immediately feel the pinch of rate increases, while those with fixed-rate mortgages experience the impact when their term expires. This creates a two-tiered effect on the market.

- Potential for further interest rate increases: The Bank of Canada's future monetary policy decisions remain uncertain, leaving the potential for further rate hikes and their consequent impact on affordability a significant factor in the ongoing housing market discussion.

Inventory Levels and Market Supply

The level of housing inventory across Canada plays a crucial role in determining price trends. While inventory levels vary significantly between provinces, a general increase in available homes can lead to decreased prices as competition among sellers intensifies. Comparing current inventory levels to those of previous years reveals significant shifts in several regions.

- Regional variations in inventory levels: While some areas experience substantial inventory growth, others remain tight, highlighting the importance of a localized analysis of Canadian real estate.

- Impact of new construction on market supply: New housing construction projects contribute to increasing inventory, potentially easing price pressures in some markets. However, the pace of new construction needs to match demand to have a substantial effect.

- Potential for increased inventory in the coming months: Many experts predict a continued increase in inventory, particularly as some homeowners, facing higher mortgage payments, may consider selling their properties.

Economic Indicators and Their Influence on the Housing Market

Several key economic indicators significantly influence consumer spending and purchasing power, which directly impacts the housing market. GDP growth, employment rates, and consumer confidence all play a part in shaping the demand for Canadian real estate. A potential economic slowdown or recession could further dampen demand and affect home prices.

- Inflation's role in impacting home affordability: High inflation erodes purchasing power, making homes less affordable even before considering interest rate increases.

- The influence of immigration on housing demand: Continued immigration to Canada contributes significantly to housing demand, potentially offsetting the negative impacts of economic slowdown in some regions.

- Impact of potential recession on the housing market: A recession typically leads to decreased consumer confidence and spending, negatively affecting the housing market and potentially driving down prices.

Signs of a Correction vs. a Market Slowdown

It's crucial to differentiate between a market correction (a significant price drop) and a market slowdown (reduced sales activity). While a slowdown is characterized by fewer transactions, a correction involves a substantial decline in home prices. Several indicators might suggest a correction, including price reductions, increased days on the market, and a higher number of unsold properties.

- Examples of areas showing significant price drops: Certain regions may already be experiencing noticeable price declines, signaling a localized correction.

- Data showing decreased sales activity: A decline in the number of transactions is a clear sign of a market slowdown, which could precede a correction.

- Expert opinions on the current market trends: Analyzing expert opinions and forecasts offers valuable insights into potential future trends in the Canadian housing market.

Navigating the Canadian Housing Market Correction

In summary, several factors suggest a potential for a Canadian home price correction, although the extent and timing remain uncertain. Rising interest rates are significantly impacting affordability, while increasing inventory levels are adding to the downward pressure. Economic indicators paint a complex picture, with the potential for a slowdown adding to the uncertainty. It is important to remember the distinction between a market slowdown and a full-blown correction. While a slowdown in sales is evident, the degree to which prices will actually correct remains to be seen.

Stay informed on the evolving landscape of Canadian home prices and consult a real estate professional to navigate this dynamic Canadian real estate market effectively. Understanding these market trends is critical for both buyers and sellers in the Canadian housing market.

Featured Posts

-

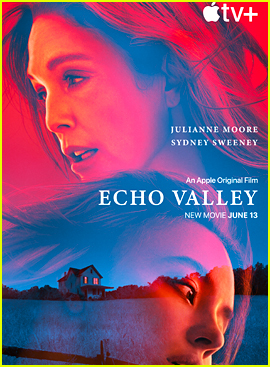

Images From Echo Valley Sydney Sweeney And Julianne Moore Star In Upcoming Thriller

May 22, 2025

Images From Echo Valley Sydney Sweeney And Julianne Moore Star In Upcoming Thriller

May 22, 2025 -

Bank Of Canadas Inflation Dilemma Core Inflation Heats Up

May 22, 2025

Bank Of Canadas Inflation Dilemma Core Inflation Heats Up

May 22, 2025 -

Bwtshytynw Ystdey Thlatht Wjwh Jdydt Lmntkhb Alwlayat Almthdt Alamrykyt

May 22, 2025

Bwtshytynw Ystdey Thlatht Wjwh Jdydt Lmntkhb Alwlayat Almthdt Alamrykyt

May 22, 2025 -

Netflix Adds Sesame Street Catch Up On Todays Important Stories

May 22, 2025

Netflix Adds Sesame Street Catch Up On Todays Important Stories

May 22, 2025 -

Western Separation Movement A Focus On Saskatchewans Role

May 22, 2025

Western Separation Movement A Focus On Saskatchewans Role

May 22, 2025

Latest Posts

-

Route 581 Box Truck Collision Results In Road Closure And Delays

May 22, 2025

Route 581 Box Truck Collision Results In Road Closure And Delays

May 22, 2025 -

Box Truck Crash Leads To Significant Route 581 Traffic Disruption

May 22, 2025

Box Truck Crash Leads To Significant Route 581 Traffic Disruption

May 22, 2025 -

Route 581 Shutdown Box Truck Accident Investigation

May 22, 2025

Route 581 Shutdown Box Truck Accident Investigation

May 22, 2025 -

Fed Ex Truck Blaze Closes Portion Of Route 283 Lancaster County

May 22, 2025

Fed Ex Truck Blaze Closes Portion Of Route 283 Lancaster County

May 22, 2025 -

Lancaster County Fed Ex Truck Catches Fire On Route 283

May 22, 2025

Lancaster County Fed Ex Truck Catches Fire On Route 283

May 22, 2025