Posthaste: Trouble Brewing In The Global Bond Market

Table of Contents

Rising Interest Rates and Their Impact on Bond Yields

The inverse relationship between interest rates and bond prices is a fundamental principle of finance. When interest rates rise, newly issued bonds offer higher yields, making existing bonds with lower coupon rates less attractive. This results in a decline in the prices of existing bonds to match the higher prevailing yields. The impact ripples across the global bond market.

- Impact on different bond types: Government bonds, generally considered safer, may experience less dramatic price declines than corporate bonds, which carry higher default risk and are more sensitive to interest rate changes. Municipal bonds also experience this sensitivity, though their response is often moderated by the specifics of their municipal issuer.

- Federal Reserve's influence: The Federal Reserve's (and other central banks') actions directly influence interest rates. Aggressive rate hikes aimed at curbing inflation can trigger significant downward pressure on bond prices across the global bond market. Similarly, the European Central Bank (ECB) or the Bank of Japan (BOJ) can have significant influence on their respective markets and contribute to global volatility.

- Potential for further rate hikes: The possibility of further interest rate increases casts a long shadow over the global bond market outlook, suggesting that the current volatility may persist or even intensify in the near term. This uncertainty makes accurate predictions challenging, demanding careful risk management.

Inflation's Persistent Pressure on Bond Prices

High inflation erodes the purchasing power of fixed-income investments like bonds. When inflation rises faster than the fixed interest rate on a bond, the real return on the investment decreases, making bonds less appealing. This dynamic significantly impacts the global bond market.

- Impact on long-term bonds: Long-term bonds are particularly vulnerable to inflation, as their fixed payments are less valuable over an extended period of high inflation. Careful analysis is needed when evaluating long-term bond investments given today's uncertain inflationary environment.

- Investor strategies: Investors are adopting various strategies to mitigate inflation risk, including shifting towards inflation-indexed bonds (TIPS), which adjust their principal value based on inflation rates. Other strategies involve actively managing bond portfolios and adjusting to evolving inflationary pressures.

- Inflation-indexed bonds: Inflation-indexed bonds (like TIPS) act as a hedge against inflation. However, they may not offer the same yield as traditional bonds and their returns can still be affected by overall market conditions.

Geopolitical Uncertainty and its Ripple Effect on the Global Bond Market

Geopolitical events, from wars and trade disputes to political instability, introduce uncertainty into the global bond market. This uncertainty can trigger a "flight to safety," pushing investors towards perceived safer assets like government bonds, sometimes at the expense of corporate bonds and emerging market debt. This dynamic significantly influences the global bond market.

- Recent geopolitical events: The ongoing war in Ukraine, trade tensions between major economies, and political instability in various regions have all created ripples throughout the global bond market, impacting investor confidence and asset prices.

- Flight-to-safety trends: During periods of heightened geopolitical uncertainty, investors often flock to government bonds of perceived safe-haven countries like the US, Germany, or Japan, impacting bond yields and pricing across the market.

- Impact on geographical markets: The impact of geopolitical events varies across different geographical bond markets. Emerging market bonds, often considered riskier assets, are particularly sensitive to global uncertainty.

Credit Risk and the Potential for Defaults

Rising interest rates and a potential economic slowdown increase the risk of corporate bond defaults. Companies with high levels of debt may struggle to meet their payment obligations, leading to losses for bondholders. This increased credit risk is a growing concern for investors in the global bond market.

- Credit ratings: Credit rating agencies assess the creditworthiness of bond issuers. A downgrade in a company's credit rating reflects increased default risk, pushing down the price of its bonds. Paying close attention to credit ratings is vital when investing in the global bond market.

- Managing credit risk: Diversification, careful selection of issuers, and hedging strategies are key components of managing credit risk in a bond portfolio. Diversification reduces your reliance on any single issuer's success and lowers overall portfolio risk.

- Contagion effects: Widespread defaults can trigger contagion effects throughout the global bond market, causing panic selling and further price declines. Monitoring interconnectedness between companies is therefore crucial.

Navigating the Troubled Waters of the Global Bond Market

The global bond market currently faces significant headwinds: rising interest rates, persistent inflation, geopolitical uncertainty, and increased credit risk. These challenges necessitate a cautious approach to investing in the global bond market. Careful risk assessment and diversification are paramount.

Investors should consider alternative investment strategies, potentially allocating a portion of their portfolios to assets less correlated with bonds, such as equities or real estate. Seeking advice from a qualified financial advisor is also essential. Staying informed about developments in the global bond market outlook and understanding macroeconomic trends is critical for making sound investment decisions. Actively managing your portfolio and adapting your strategy to changing market conditions is key to navigating the global bond market successfully. Don't delay; start reviewing your global bond market investment strategy today.

Featured Posts

-

Exclusive Neal Mc Donough On Damien Darhk And Future Dc Roles

May 23, 2025

Exclusive Neal Mc Donough On Damien Darhk And Future Dc Roles

May 23, 2025 -

Kiwi Rail Hillside 127 Million Dunedin Site Officially Opened By Peters And Jones

May 23, 2025

Kiwi Rail Hillside 127 Million Dunedin Site Officially Opened By Peters And Jones

May 23, 2025 -

New Documentary Details Andrew Flintoffs Career And Crash Landing On Disney

May 23, 2025

New Documentary Details Andrew Flintoffs Career And Crash Landing On Disney

May 23, 2025 -

Seoul Effondrement De Chaussee Provoque La Mort D Un Motard

May 23, 2025

Seoul Effondrement De Chaussee Provoque La Mort D Un Motard

May 23, 2025 -

Excellent Zimbabwean Opening Day Muzarabani And Masakadzas Key Roles

May 23, 2025

Excellent Zimbabwean Opening Day Muzarabani And Masakadzas Key Roles

May 23, 2025

Essen Heisingen 07 04 2025 Aktuelle Polizeimeldung Zum Waldbrand

Essen Heisingen 07 04 2025 Aktuelle Polizeimeldung Zum Waldbrand

Eiskaltes Ergebnis Der Ueberraschungssieger In Essen

Eiskaltes Ergebnis Der Ueberraschungssieger In Essen

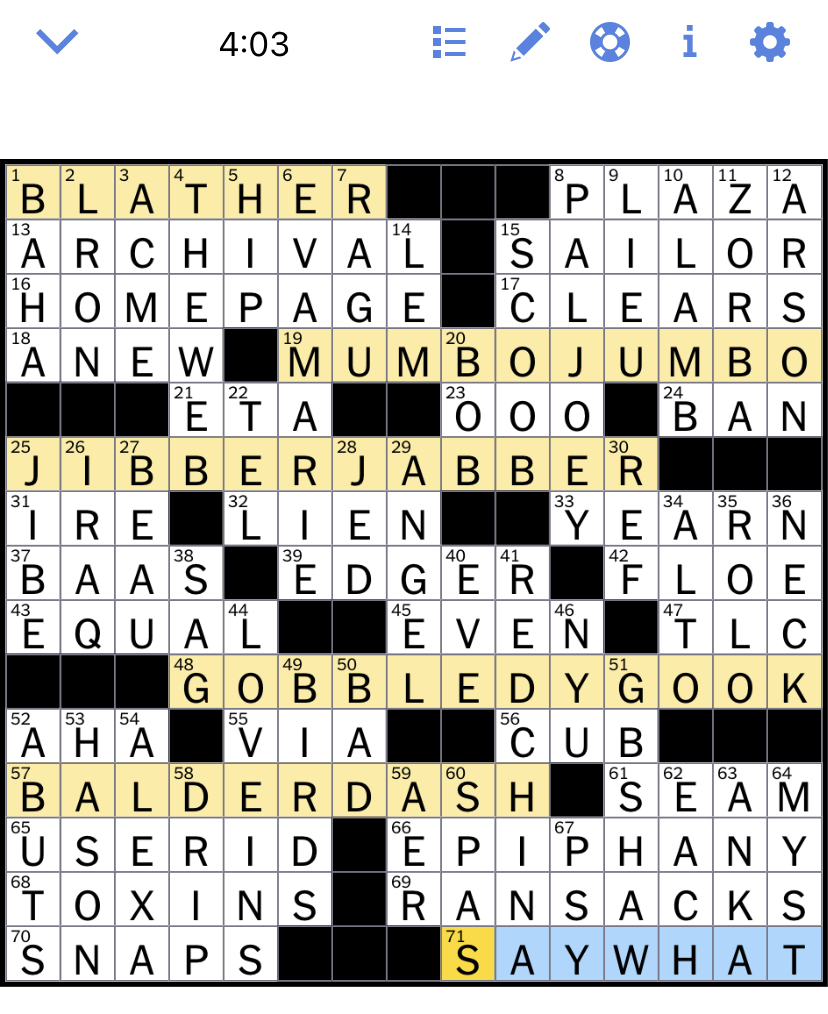

Finding The Answers Nyt Mini Crossword March 16 2025

Finding The Answers Nyt Mini Crossword March 16 2025