Pound Rises As Traders Reduce Expectations Of BOE Interest Rate Cuts

Table of Contents

Diminishing Expectations of BOE Rate Cuts

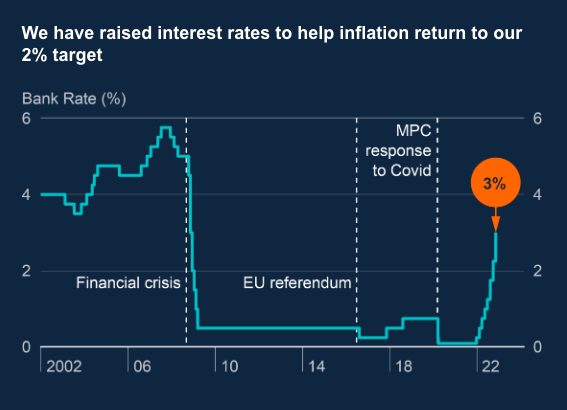

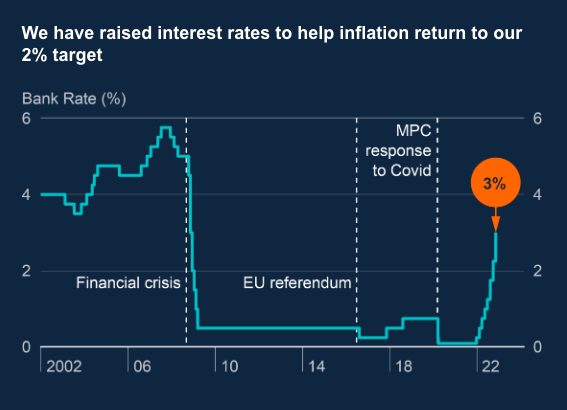

The market's perception of the BOE's future monetary policy has undergone a significant shift. Previously, expectations were rife with predictions of further interest rate cuts to stimulate economic growth. However, recent data and changing economic forecasts have led to a reassessment of this outlook. Several factors are responsible for this change in interest rate expectations:

-

Improved UK Economic Data: Stronger-than-expected GDP growth figures and a decline in the unemployment rate have painted a more optimistic picture of the UK economy. This positive economic data has reduced the perceived need for further stimulus through interest rate cuts. The resilience of the UK economy in the face of global headwinds has also boosted confidence.

-

Increased Inflation Concerns: While economic growth is positive, concerns about inflation remain. Rising energy prices and persistent supply chain disruptions continue to exert upward pressure on prices. This inflation pressure reduces the likelihood of the BOE implementing further rate cuts, as these could exacerbate inflationary pressures. The BOE's mandate is to maintain price stability, making inflation a key factor in their decision-making.

-

Changes in Market Forecasts and Analyst Predictions: Leading economic forecasting institutions and financial analysts have revised their predictions for the UK economy, moving away from scenarios that necessitate further interest rate reductions. This shift in professional opinion has significantly influenced market sentiment and expectations.

-

Potential Impact of Global Economic Factors: While UK-specific data is crucial, the global economic environment also plays a role. A more robust global economic outlook can reduce the need for the BOE to implement drastic monetary easing measures.

[Insert chart or graph here illustrating the change in interest rate expectations, showing a downward trend in predicted rate cuts.] The shift in BOE monetary policy expectations is clearly reflected in the movement of interest rate futures.

Impact on Pound Sterling (GBP)

The reduced expectation of BOE rate cuts has had a direct and positive impact on the Pound Sterling (GBP). As the prospect of further monetary easing diminishes, the GBP's attractiveness as an investment increases. This increased demand directly translates into a stronger GBP exchange rate in the forex market. The implications for the UK are far-reaching:

-

Impact on Import and Export Costs: A stronger GBP makes imports cheaper for UK consumers but can make UK exports more expensive for overseas buyers, potentially impacting UK businesses involved in international trade. This necessitates a careful analysis of currency volatility and its effects on trade balances.

-

Effects on Borrowing Costs: While a stronger Pound might seem positive, it can indirectly impact borrowing costs. A stronger GBP might affect the cost of borrowing for UK businesses dependent on international capital markets.

-

Influence on Investor Confidence: The strengthening GBP reflects increased investor confidence in the UK economy. This positive sentiment can attract further foreign investment, supporting economic growth and stability. The GBP exchange rate is a key indicator of investor sentiment and confidence in the UK.

Alternative Perspectives and Potential Risks

While the current trend shows a strengthening GBP, it's crucial to acknowledge alternative perspectives and potential risks. The Pound's strength is not guaranteed, and several factors could reverse the current trend:

-

Unexpected Economic Slowdown in the UK: A sudden and unexpected economic slowdown in the UK could lead the BOE to reconsider its monetary policy stance, potentially triggering further rate cuts and weakening the Pound. Economic uncertainty remains a significant risk.

-

Geopolitical Instability Affecting the UK Economy: External geopolitical events can significantly impact the UK economy and influence the GBP's value. Geopolitical risks pose a constant threat to currency stability.

-

Changes in Global Economic Conditions: A significant downturn in the global economy could negatively impact the UK, potentially leading to a weakening of the Pound. Changes in global market sentiment can have a ripple effect on national currencies.

Conclusion: Navigating the Future of the Pound and BOE Interest Rates

In summary, the recent rise of the Pound Sterling is largely due to diminishing expectations of further BOE interest rate cuts. Improved UK economic data, inflation concerns, and revised market forecasts have all contributed to this shift. However, potential risks remain, including the possibility of an unexpected economic slowdown, geopolitical instability, and changes in the global economic landscape. These factors highlight the importance of continuous monitoring of GBP forecasts and the broader currency market.

To effectively navigate the currency markets and make informed decisions regarding Pound Sterling trading, stay informed about the latest developments affecting the Pound Sterling and BOE interest rates. Understanding the interplay between economic data, monetary policy, and global events is crucial for anyone involved in British Pound outlook and trading strategies. The GBP exchange rate is a dynamic indicator that requires constant monitoring and analysis.

Featured Posts

-

Upcoming Horror Movie Sinners Filmed In The Bayou State

May 26, 2025

Upcoming Horror Movie Sinners Filmed In The Bayou State

May 26, 2025 -

Mathieu Van Der Poel Spitting Incident Spectators 300 Fine

May 26, 2025

Mathieu Van Der Poel Spitting Incident Spectators 300 Fine

May 26, 2025 -

New York Rangers Shake Up Change Of Plans Underway

May 26, 2025

New York Rangers Shake Up Change Of Plans Underway

May 26, 2025 -

Update Arrest Following Deadly Myrtle Beach Hit And Run

May 26, 2025

Update Arrest Following Deadly Myrtle Beach Hit And Run

May 26, 2025 -

Apples New I Phone Feature A Must Have For Formula 1 Fans

May 26, 2025

Apples New I Phone Feature A Must Have For Formula 1 Fans

May 26, 2025

Latest Posts

-

Irjen Daniel Pimpin Sertijab 7 Perwira Menengah Polda Bali Inilah Pesan Yang Disampaikan

May 28, 2025

Irjen Daniel Pimpin Sertijab 7 Perwira Menengah Polda Bali Inilah Pesan Yang Disampaikan

May 28, 2025 -

Sukses Persemian Gerakan Bali Bersih Sampah Langkah Langkah Menuju Pengelolaan Sampah Yang Efektif

May 28, 2025

Sukses Persemian Gerakan Bali Bersih Sampah Langkah Langkah Menuju Pengelolaan Sampah Yang Efektif

May 28, 2025 -

Bali Gubernur Koster Tolak Canang Jadi Indikator Inflasi

May 28, 2025

Bali Gubernur Koster Tolak Canang Jadi Indikator Inflasi

May 28, 2025 -

Sertijab 7 Pamen Polda Bali Dipimpin Kapolda Irjen Daniel Apa Saja Pesannya

May 28, 2025

Sertijab 7 Pamen Polda Bali Dipimpin Kapolda Irjen Daniel Apa Saja Pesannya

May 28, 2025 -

Persemian Gerakan Bali Bersih Sampah Tantangan Dan Solusi Menuju Lingkungan Berkelanjutan

May 28, 2025

Persemian Gerakan Bali Bersih Sampah Tantangan Dan Solusi Menuju Lingkungan Berkelanjutan

May 28, 2025