Powell's Hawkish Stance Undermines Bond Trader Rate Cut Hopes

Table of Contents

Powell's Hawkish Rhetoric and its Market Impact

Powell's recent pronouncements have significantly impacted market sentiment, primarily due to persistent inflation concerns and his clear signaling of a less dovish approach than many had predicted.

Persistent Inflation Concerns

Inflation remains stubbornly high, exceeding the Federal Reserve's target rate of 2%. This persistent inflationary pressure is forcing the Fed to maintain a hawkish stance, prioritizing inflation control even if it means slowing economic growth.

- Inflation data points: The Consumer Price Index (CPI) and Producer Price Index (PPI) continue to show elevated inflation levels, suggesting that the fight against inflation is far from over.

- Fed's inflation target: The Fed's commitment to achieving its 2% inflation target remains unwavering, and deviations from this target are likely to influence future policy decisions.

- Potential risks of premature rate cuts: Premature interest rate cuts risk reigniting inflation, potentially leading to a more painful and prolonged period of high inflation in the long run.

Analysis of Powell's Recent Statements

Powell's recent speeches and press conferences have been notably hawkish, emphasizing the need for further monetary tightening or at least a prolonged period of holding rates at the current level. He has repeatedly highlighted the resilience of the labor market and the persistence of inflationary pressures as reasons to remain cautious about rate cuts.

- Specific examples of hawkish language: Phrases like "data-dependent," "patient," and careful consideration of "further tightening" signal a reluctance to commit to immediate rate cuts.

- Implications for future rate hikes/holds: The market now anticipates that the Fed will maintain interest rates at their current level for a considerable period, with the possibility of further rate hikes if inflation proves more persistent than anticipated.

Impact on Bond Yields

Powell's hawkish comments have directly impacted bond yields, pushing them higher (or keeping them elevated). This reflects the inverse relationship between interest rates and bond prices: as interest rates rise, bond prices fall, leading to higher yields.

- Yield curve movements: The yield curve, which illustrates the relationship between the yields of bonds with different maturities, has steepened as investors price in the expectation of higher interest rates for longer.

- Implications for bond investors: Rising bond yields represent a decrease in the value of existing bonds, resulting in potential capital losses for bond investors holding long-term bonds.

Dashed Expectations of Bond Traders

Prior to Powell's recent statements, many bond traders anticipated imminent interest rate cuts. This expectation has been significantly undermined by Powell's hawkish rhetoric.

Initial Rate Cut Predictions

Before Powell's shift in tone, many market analysts and bond traders predicted that the Fed would begin cutting interest rates later in 2024 or early 2025 to stimulate economic growth and counter a potential recession.

- Surveys of bond trader sentiment: Surveys conducted before Powell's statements indicated a significant degree of optimism regarding rate cuts.

- Market pricing before Powell's speech: Market pricing of interest rate futures contracts reflected a strong expectation of rate cuts, which have subsequently been revised downwards.

Shift in Market Sentiment

Powell's comments immediately shifted market sentiment, leading to a significant reassessment of interest rate expectations. The anticipation of rate cuts was replaced by a more cautious outlook, impacting various market segments.

- Changes in bond prices: Bond prices fell sharply following Powell's statements, reflecting the rise in bond yields.

- Stock market reactions: Stock markets also experienced volatility in response to the changed outlook for interest rates.

- Trading volume spikes: Trading volumes in both bond and equity markets increased significantly as investors reacted to the news.

Impact on Investment Strategies

The shift in market sentiment has forced bond traders and other investors to re-evaluate their investment strategies. Many are adjusting their portfolios and employing different risk management techniques.

- Revised portfolio allocations: Investors are likely reducing their exposure to long-term bonds, opting for shorter-term bonds or other assets perceived as less vulnerable to interest rate increases.

- Hedging strategies: Increased use of hedging strategies to protect against potential losses in bond portfolios is expected.

- Increased risk aversion: The overall level of risk aversion among investors has increased following Powell's comments.

The Future Outlook for Interest Rates and Bond Markets

The future direction of interest rates and the performance of bond markets remain uncertain, dependent on various economic factors and the Fed's ongoing response to inflation.

Potential Scenarios

Several potential scenarios exist for future interest rates, each with significant implications for bond investors.

- Potential for further rate hikes: If inflation remains stubbornly high, the Fed may opt for further interest rate hikes, which would negatively impact bond prices.

- Prolonged high interest rates: Even without further hikes, the Fed may choose to keep rates high for a prolonged period, creating a challenging environment for bond investors.

- Timing of potential rate cuts: The timing of any future rate cuts remains highly uncertain and will depend on several economic factors, including inflation, employment, and economic growth.

Implications for Bond Investors

The different potential scenarios have distinct implications for bond investors.

- Risks of holding long-term bonds: Long-term bonds are particularly vulnerable to rising interest rates, increasing the risk of capital losses.

- Potential for capital losses: Investors holding bonds may experience capital losses if interest rates rise further.

- Attractive yields on shorter-term bonds: Shorter-term bonds offer potentially higher yields in a high-interest-rate environment, making them a more attractive option for some investors.

The Role of Economic Data

Upcoming economic data releases will play a crucial role in shaping future interest rate decisions and their impact on the bond market.

- Key economic indicators to watch: Key indicators such as inflation (CPI and PPI), employment data (nonfarm payrolls), and GDP growth will be closely scrutinized by the Fed and market participants.

- Potential market reactions to data releases: Unexpectedly strong or weak data releases could cause significant shifts in market sentiment and bond prices.

Conclusion

Powell's hawkish stance has dramatically altered the expectations of bond traders anticipating rate cuts. This has resulted in increased bond yields and a more cautious market outlook. The future remains uncertain, dependent on incoming economic data and the Fed's subsequent reactions. The implications for bond investors are substantial, requiring careful consideration of potential risks and opportunities. Stay informed about the evolving economic situation and the Fed's policy decisions by regularly checking reliable financial news sources to adjust your investment strategies according to the evolving situation around Powell's hawkish stance and the bond market outlook. Actively monitor interest rate predictions and refine your investment strategies accordingly.

Featured Posts

-

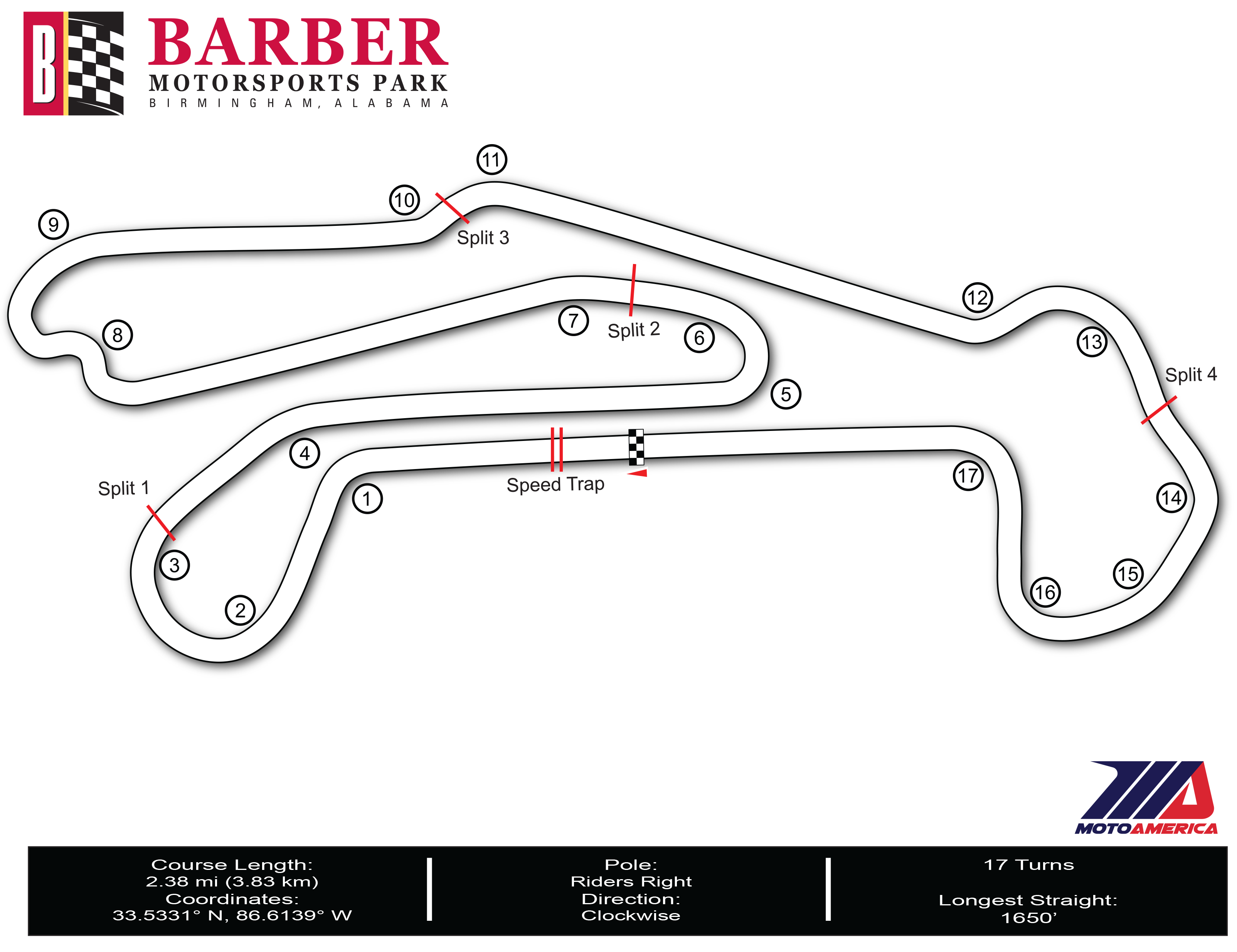

Colton Hertas Barber Motorsports Park Challenge Finding Pace When It Matters

May 12, 2025

Colton Hertas Barber Motorsports Park Challenge Finding Pace When It Matters

May 12, 2025 -

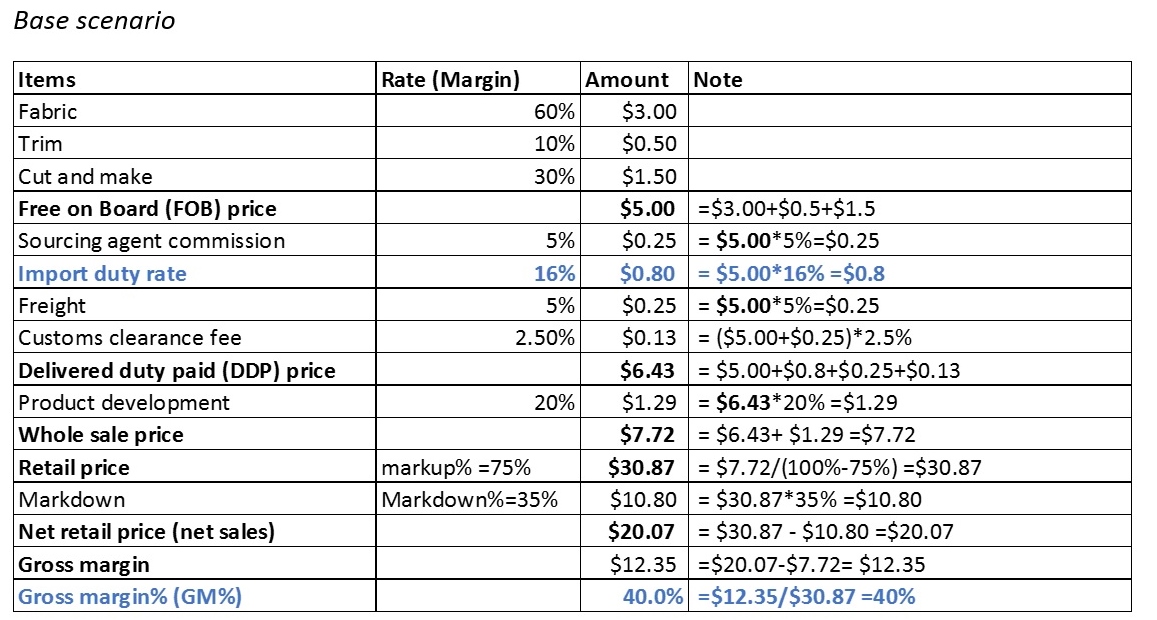

Canada Us Tariffs A Partial Removal Predicted

May 12, 2025

Canada Us Tariffs A Partial Removal Predicted

May 12, 2025 -

Resurrecting A Classic Lynx And The Ford Gt Restoration Project

May 12, 2025

Resurrecting A Classic Lynx And The Ford Gt Restoration Project

May 12, 2025 -

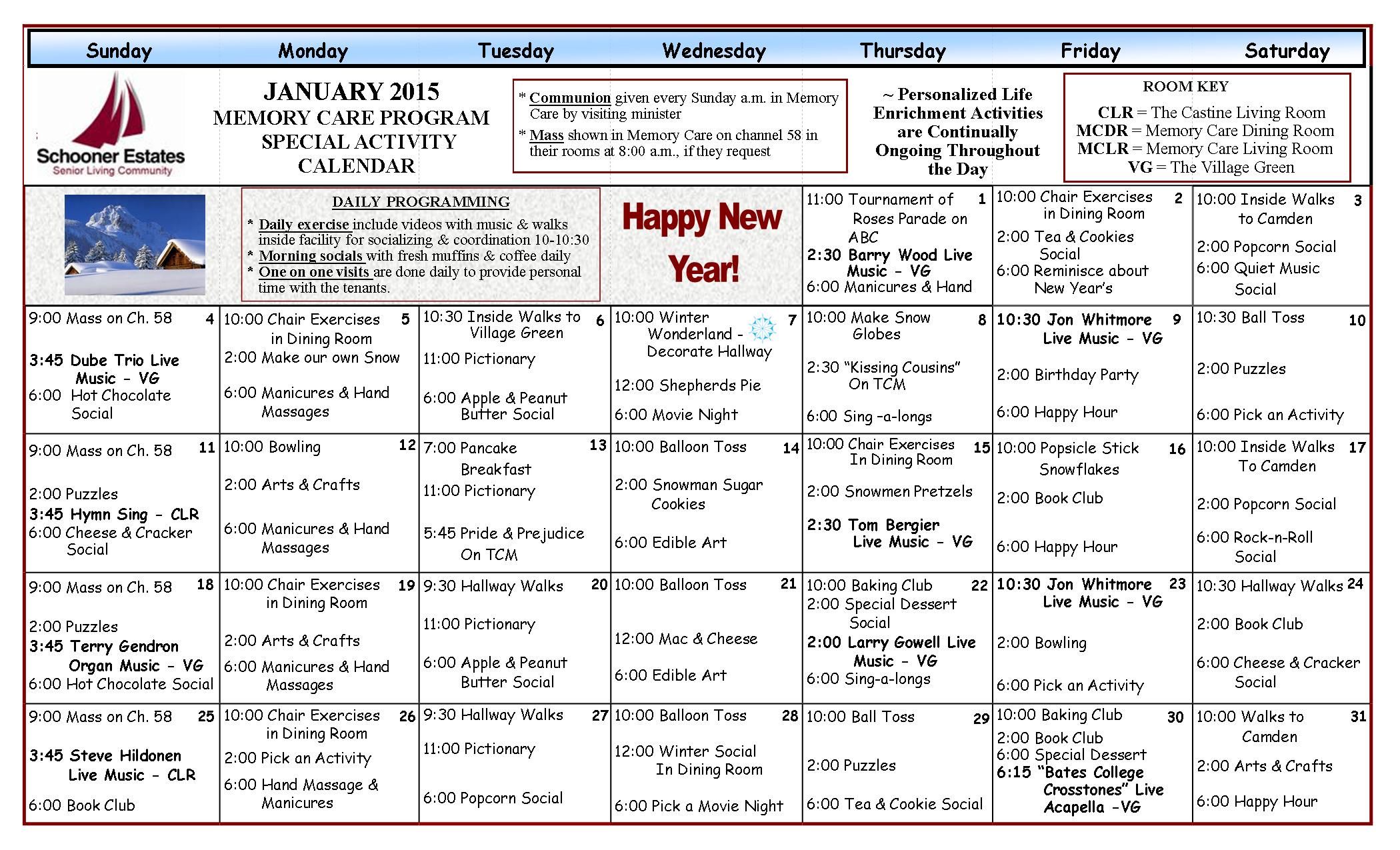

Your Guide To Senior Trips Activities And Events A Monthly Calendar

May 12, 2025

Your Guide To Senior Trips Activities And Events A Monthly Calendar

May 12, 2025 -

New Calvin Klein Campaign Featuring Lily Collins Images From Photo 5133599

May 12, 2025

New Calvin Klein Campaign Featuring Lily Collins Images From Photo 5133599

May 12, 2025

Latest Posts

-

Premier Ligata Gi Dochekuva Lids I Barnli

May 13, 2025

Premier Ligata Gi Dochekuva Lids I Barnli

May 13, 2025 -

Lids I Barnli Nov Sezon Vo Premier Ligata

May 13, 2025

Lids I Barnli Nov Sezon Vo Premier Ligata

May 13, 2025 -

Triumf Lids Una Ted I Barnli Vo Premier Ligata

May 13, 2025

Triumf Lids Una Ted I Barnli Vo Premier Ligata

May 13, 2025 -

Povratok Vo Premier Ligata Za Lids I Barnli

May 13, 2025

Povratok Vo Premier Ligata Za Lids I Barnli

May 13, 2025 -

Vozvratok Vo Premier Ligata Barnli Slavi Pobeda Vo Derbito Lids Isto Taka Se Vrakja

May 13, 2025

Vozvratok Vo Premier Ligata Barnli Slavi Pobeda Vo Derbito Lids Isto Taka Se Vrakja

May 13, 2025