Pre-Earnings Analysis: Gibraltar Industries (ROCK) Stock Performance Outlook

Table of Contents

Understanding Gibraltar Industries (ROCK) Business Model and Recent Performance

Gibraltar Industries (ROCK) is a leading manufacturer and distributor of building products, specializing in areas such as residential and commercial construction. They cater to diverse markets, focusing on providing innovative and high-quality solutions to construction professionals. Analyzing their recent performance offers valuable insights for pre-earnings predictions.

Recent financial performance has shown a mixed bag. While revenue has experienced growth in certain segments, profitability has been impacted by rising material costs and supply chain disruptions. Let's delve into the key financial indicators:

- Revenue Growth Trends: Year-over-year revenue growth has been moderate, showing a slight increase in the last quarter but decelerating compared to previous years. Quarter-over-quarter trends display more volatility, reflecting the cyclical nature of the construction industry.

- Profit Margin Analysis: Profit margins have compressed recently due to increased raw material costs. The company's strategy to mitigate this is key to observing in their upcoming earnings report.

- Debt-to-Equity Ratio: A stable debt-to-equity ratio suggests a manageable level of financial leverage. However, a close examination of the company’s debt maturity profile is warranted.

- Return on Equity (ROE): ROE remains relatively healthy, demonstrating the company's ability to generate returns on shareholders' investments. Fluctuations in ROE should be carefully assessed.

- Key Performance Indicators (KPIs): Important industry KPIs, such as market share and backlog levels, will offer additional insights into Gibraltar Industries' operational performance and future outlook.

Analyzing Key Factors Influencing ROCK's Upcoming Earnings

Several factors could significantly influence Gibraltar Industries' upcoming earnings announcement. A thorough pre-earnings analysis requires considering these key elements:

- Macroeconomic Factors: Inflation, interest rates, and commodity prices are significant headwinds. Increased interest rates make borrowing more expensive, impacting construction projects and possibly slowing down Gibraltar Industries' sales.

- Industry-Specific Trends: The overall health of the construction industry plays a critical role. A slowdown in residential or commercial construction can negatively affect Gibraltar Industries' performance. Conversely, increased infrastructure spending could be a positive influence.

- Acquisitions, Mergers, or Divestitures: Any recent corporate actions could have a substantial impact on the company's financial results. The integration of acquired businesses or the divestment of underperforming assets could affect earnings.

- Bullet points outlining additional key factors:

- Impact of raw material costs: Fluctuations in steel, aluminum, and other raw material prices will directly impact Gibraltar Industries' production costs and profitability.

- Supply chain challenges and mitigation strategies: The company's effectiveness in managing supply chain disruptions is vital for maintaining production and meeting customer demand.

- Competitive landscape analysis: Analyzing the actions of competitors and market share dynamics will reveal Gibraltar Industries' competitive position.

- Regulatory changes and their potential effect: New building codes or environmental regulations could have implications for Gibraltar Industries' product offerings and operations.

- Expected demand for Gibraltar Industries' products: Forecasting the demand for building products based on economic indicators and housing market trends is critical.

Estimating ROCK's Earnings Expectations and Potential Surprises

Analysts' consensus earnings estimates provide a benchmark for judging Gibraltar Industries' actual performance. However, understanding the potential for surprises is crucial for a robust pre-earnings analysis.

- Comparison of current estimates with previous quarters: Reviewing past performance relative to estimates reveals patterns and potential for exceeding or underperforming expectations.

- Analyst ratings and price targets: A summary of analyst ratings and price targets offers a collective view of market sentiment and future expectations.

- Potential catalysts for exceeding expectations: Stronger-than-expected demand, successful cost-cutting measures, or strategic partnerships could lead to positive surprises.

- Risks that could lead to earnings disappointments: Unexpected economic slowdown, higher-than-anticipated raw material costs, or supply chain disruptions could negatively impact earnings.

- Sensitivity analysis based on different economic scenarios: Modeling different economic scenarios helps in evaluating the resilience of Gibraltar Industries' earnings under various market conditions.

Valuation and Investment Implications for Gibraltar Industries (ROCK) Stock

A complete pre-earnings analysis must include a thorough valuation of Gibraltar Industries' stock.

- Intrinsic value calculation: Employing various valuation models like discounted cash flow (DCF) analysis to determine the intrinsic value of ROCK provides a measure to compare against its current market price.

- Comparison to competitor valuations: Assessing ROCK's valuation relative to its peers within the building products industry highlights relative value and competitive positioning.

- Investment recommendations (buy, hold, or sell): Based on the valuation analysis and assessment of risk factors, a preliminary investment recommendation can be formulated (this should not be considered financial advice).

- Risk assessment and mitigation strategies: Identifying potential risks (e.g., interest rate hikes, commodity price volatility) and outlining strategies to mitigate these risks is essential.

Conclusion: Pre-Earnings Analysis: Gibraltar Industries (ROCK) Stock Performance Outlook

This pre-earnings analysis of Gibraltar Industries (ROCK) suggests that while the company faces headwinds from macroeconomic factors and industry challenges, its relatively strong financial position and potential for growth warrant close attention. The upcoming earnings report will be pivotal in clarifying its future trajectory. While our analysis points towards a [Insert Investment Recommendation: Buy, Hold, or Sell – Justified by Analysis], remember this is not financial advice.

Conduct your own thorough pre-earnings analysis of Gibraltar Industries (ROCK) before making any investment decisions. Remember to consider your own risk tolerance and financial goals when making investment choices. Stay informed about Gibraltar Industries (ROCK) and conduct your own in-depth pre-earnings analysis to optimize your investment strategy.

Featured Posts

-

New Muslim Community In Texas Faces Setbacks After Mosque Restrictions

May 13, 2025

New Muslim Community In Texas Faces Setbacks After Mosque Restrictions

May 13, 2025 -

Where To Watch Manchester United Tottenham Lyon Uefa Europa League Free Live Streams

May 13, 2025

Where To Watch Manchester United Tottenham Lyon Uefa Europa League Free Live Streams

May 13, 2025 -

Analyzing The Sixers Odds In The Nba Draft Lottery

May 13, 2025

Analyzing The Sixers Odds In The Nba Draft Lottery

May 13, 2025 -

Jom Tempah Byd Ev Di Pameran Automotif Mas 2025 And Menangi Rm 800 Kredit Cas

May 13, 2025

Jom Tempah Byd Ev Di Pameran Automotif Mas 2025 And Menangi Rm 800 Kredit Cas

May 13, 2025 -

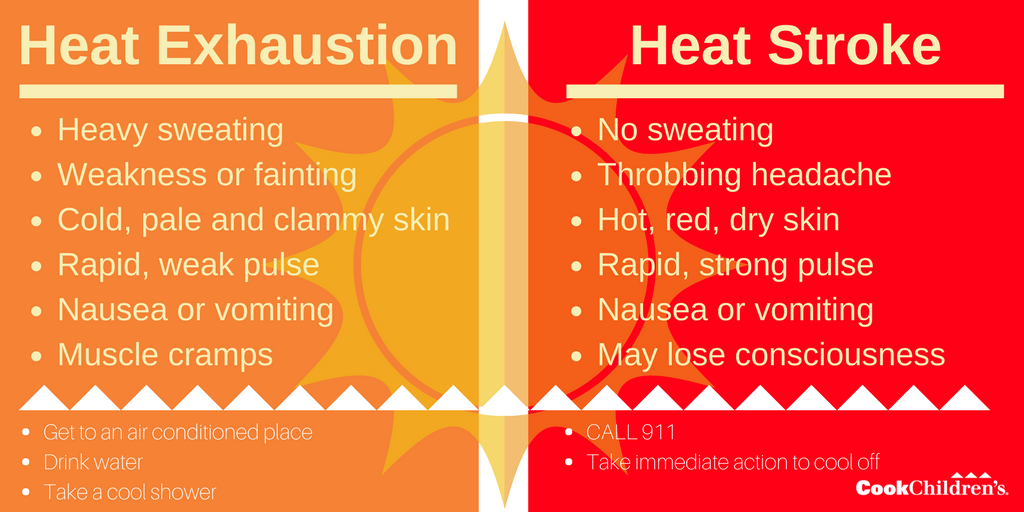

Ghaziabads Heat Advisory Safety Guidelines For Outdoor Workers In Noida

May 13, 2025

Ghaziabads Heat Advisory Safety Guidelines For Outdoor Workers In Noida

May 13, 2025

Latest Posts

-

Kult Statusz Scarlett Johansson Marvel Filmekben Betoeltoett Szerepe

May 13, 2025

Kult Statusz Scarlett Johansson Marvel Filmekben Betoeltoett Szerepe

May 13, 2025 -

Scarlett Johansson Es A Marvel Visszater A Moziuniverzumba

May 13, 2025

Scarlett Johansson Es A Marvel Visszater A Moziuniverzumba

May 13, 2025 -

Scarlett Johansson Visszaterese A Marvel Univerzumba A Kult Statusz Ujraertelmezese

May 13, 2025

Scarlett Johansson Visszaterese A Marvel Univerzumba A Kult Statusz Ujraertelmezese

May 13, 2025 -

Luxury Real Estate Finding Your Dream Home Through Luxury Presence

May 13, 2025

Luxury Real Estate Finding Your Dream Home Through Luxury Presence

May 13, 2025 -

I Black Widow Kai I Klironomia Tis Skarlet Gioxanson

May 13, 2025

I Black Widow Kai I Klironomia Tis Skarlet Gioxanson

May 13, 2025