Pressure Mounts On Tesla Board: State Treasurers Question Musk's Strategies

Table of Contents

State Treasurers' Concerns Regarding Elon Musk's Leadership

State treasurers, responsible for managing significant public funds, are voicing serious concerns about Tesla's direction under Musk's leadership. Their unease stems from several key areas:

Stock Volatility and Investor Confidence

Musk's impulsive actions and controversial tweets have created significant volatility in Tesla's stock price, eroding investor confidence. This instability poses a risk to pension funds and other investments managed by state treasurers.

- Examples of negative impacts: Musk's tweets about taking Tesla private, his erratic behavior related to Dogecoin, and his recent involvement in the Twitter saga have all led to dramatic stock price swings.

- Stock volatility statistics: A comparison of Tesla's stock price volatility with that of established automotive competitors like Ford and General Motors reveals a significantly higher degree of fluctuation, indicating greater risk. (Specific data and source citations would be included here).

- Financial analyst concerns: Many financial analysts have expressed concerns about the negative impact of Musk's actions on Tesla's long-term investor appeal and valuation. (Quotes from analysts and links to their reports would be inserted here).

Questionable Spending and Resource Allocation

State treasurers are also questioning Tesla's spending priorities, citing concerns about wasteful expenditures and resource misallocation.

- Examples of questionable spending: The controversial acquisition of Twitter, significant investments in new factory expansions without clear profitability timelines, and other large-scale projects have raised eyebrows.

- Spending comparison to competitors: A comparison of Tesla's capital expenditures with those of other major automotive companies could highlight potential overspending. (Data and source citations would be provided).

- Expert opinions: Financial experts and state treasurers have voiced concerns that these expenditures may be diverting resources from core business operations and hindering Tesla's long-term competitiveness. (Quotes and sources would be added here).

Governance and Corporate Responsibility Issues

The concerns extend beyond financial matters to encompass governance and corporate responsibility. State treasurers are expressing doubts about the effectiveness of Tesla's board oversight and the potential for conflicts of interest.

- Examples of governance failures: (Examples of specific instances of questionable practices or lack of transparency would be detailed here, with supporting evidence).

- Comparison to best practices: Tesla's corporate governance structure could be compared to industry best practices to highlight any shortcomings. (This section would require research and comparison data).

- Potential legal ramifications: The concerns raised could lead to increased regulatory scrutiny and even potential legal challenges for Tesla. (A discussion of potential legal ramifications would be added here).

The Impact of the Pressure on Tesla's Future

The mounting Tesla Board Pressure has significant implications for Tesla's future, impacting its shareholder relations, brand reputation, and strategic direction.

Potential for Shareholder Activism

The current situation is likely to fuel increased shareholder activism and potential lawsuits against Tesla's board.

- Potential legal strategies: Shareholders might pursue derivative lawsuits alleging breaches of fiduciary duty or seek changes in corporate governance.

- Existing lawsuits and proposals: Any existing shareholder lawsuits or proposals for board changes should be mentioned and analyzed here.

- Impact on stock price: Increased shareholder activism could further destabilize Tesla's stock price.

Effects on Tesla's Brand Reputation and Customer Perception

Negative press and scrutiny surrounding Musk's leadership are damaging Tesla's brand image and customer loyalty.

- Impact on sales and market share: The negative publicity could affect sales and market share, especially if consumer confidence erodes.

- Consumer sentiment analysis: Analysis of consumer sentiment towards Tesla would be included here, based on surveys, social media analysis, and other data.

- Mitigation strategies: Tesla might need to implement aggressive marketing and PR strategies to mitigate the damage.

Long-Term Implications for Tesla's Strategic Direction

The current crisis could significantly affect Tesla's ability to innovate, compete effectively, and achieve its ambitious goals.

- Potential for leadership changes: There is a possibility of leadership changes within Tesla, either voluntarily or due to shareholder pressure.

- Impact on future growth: The ongoing controversies could hinder Tesla's future growth prospects and investor confidence.

- Possible future scenarios: Different scenarios for Tesla's future, considering the current pressure, will be explored.

Conclusion

The concerns raised by state treasurers represent significant Tesla Board Pressure, highlighting serious issues regarding Elon Musk's leadership, questionable spending, and corporate governance. The potential consequences for Tesla are substantial, including increased shareholder activism, damage to brand reputation, and challenges to its long-term strategic direction. The intensifying pressure on the Tesla Board highlights the need for greater transparency and accountability. Stay informed about the evolving situation and the potential consequences of this ongoing Tesla Board Pressure. Continue to follow our coverage for updates on this critical development.

Featured Posts

-

Good Morning Business Edition Du Lundi 24 Fevrier A Retrouver Ici

Apr 23, 2025

Good Morning Business Edition Du Lundi 24 Fevrier A Retrouver Ici

Apr 23, 2025 -

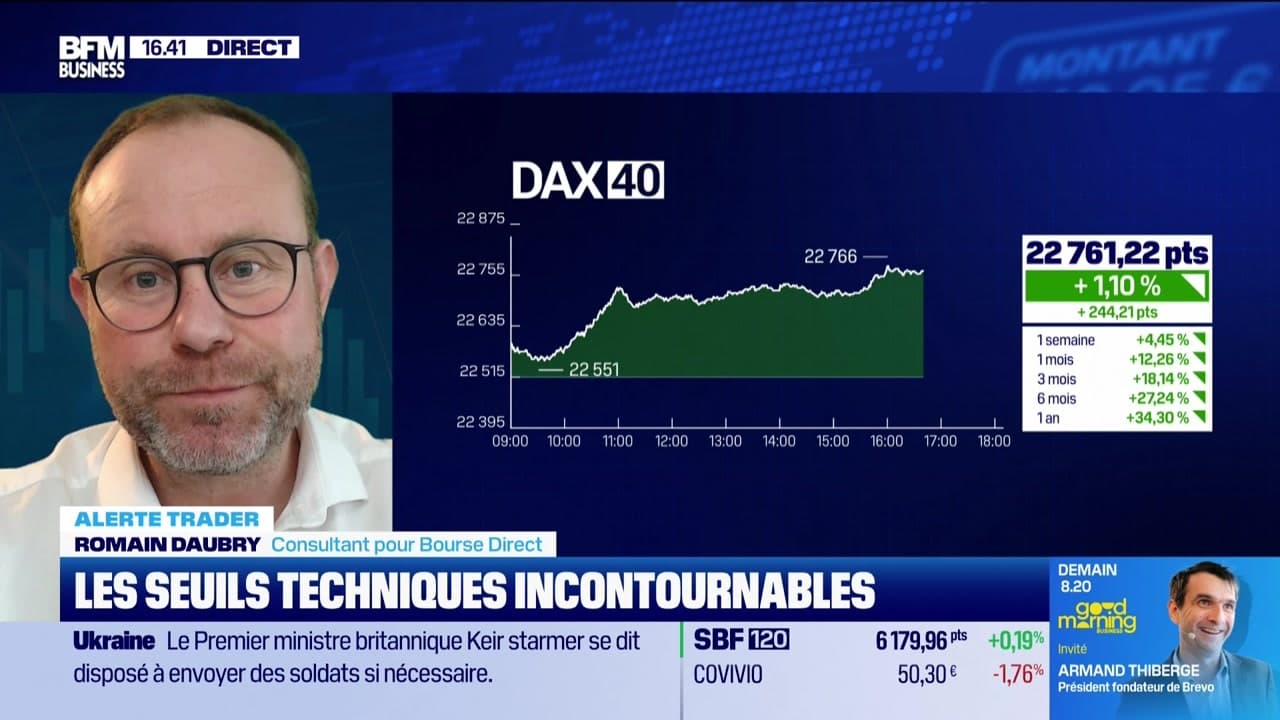

Seuils Techniques Le Guide Complet Pour L Alerte Trader

Apr 23, 2025

Seuils Techniques Le Guide Complet Pour L Alerte Trader

Apr 23, 2025 -

Experience The Best Of Pentrich Brewing At Its Factory Location

Apr 23, 2025

Experience The Best Of Pentrich Brewing At Its Factory Location

Apr 23, 2025 -

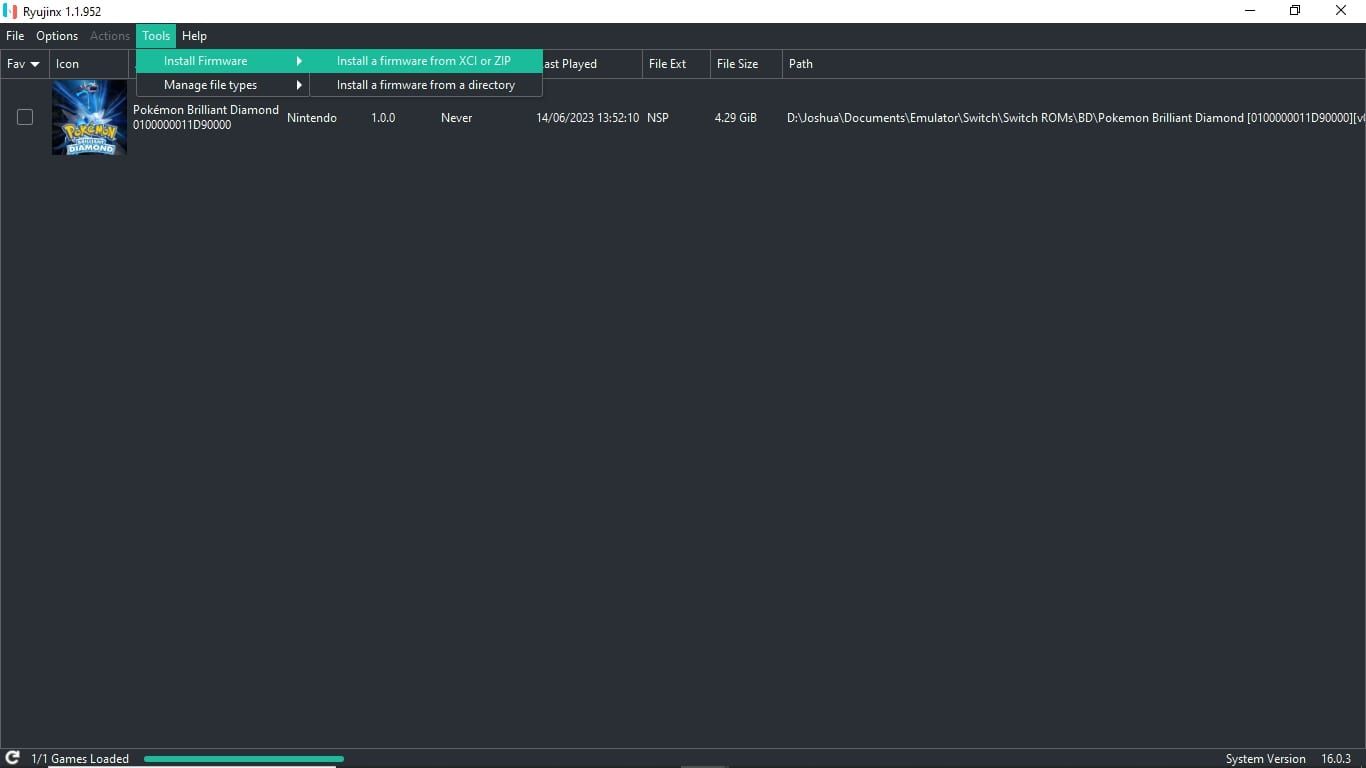

Ryujinx Emulator Development Halted Nintendos Involvement Confirmed

Apr 23, 2025

Ryujinx Emulator Development Halted Nintendos Involvement Confirmed

Apr 23, 2025 -

Die 50 2025 Alle Teilnehmer Sendetermine Stream And Mehr

Apr 23, 2025

Die 50 2025 Alle Teilnehmer Sendetermine Stream And Mehr

Apr 23, 2025

Latest Posts

-

Concarneau Bat Dijon 0 1 Compte Rendu De La 28e Journee De National 2

May 10, 2025

Concarneau Bat Dijon 0 1 Compte Rendu De La 28e Journee De National 2

May 10, 2025 -

Dijon Concarneau 0 1 Resume Du Match National 2 28e Journee

May 10, 2025

Dijon Concarneau 0 1 Resume Du Match National 2 28e Journee

May 10, 2025 -

Uk Government Restricts Visa Access For Selected Nationalities

May 10, 2025

Uk Government Restricts Visa Access For Selected Nationalities

May 10, 2025 -

Resultat Dijon Concarneau 0 1 National 2 2024 2025 Journee 28

May 10, 2025

Resultat Dijon Concarneau 0 1 National 2 2024 2025 Journee 28

May 10, 2025 -

Updated Uk Visa Policy Impact Assessment For International Applicants

May 10, 2025

Updated Uk Visa Policy Impact Assessment For International Applicants

May 10, 2025