Principal Financial Group (NASDAQ: PFG): 13 Analyst Opinions & What They Mean

Table of Contents

Analyst ratings play a significant role in shaping investment strategies. They offer a snapshot of expert opinions, combining qualitative and quantitative analysis to provide a recommendation. However, it's vital to remember that these ratings are just one piece of the puzzle. This article aims to provide a comprehensive overview of these opinions, their underlying rationale, and their potential impact on your investment decisions concerning PFG.

Understanding Analyst Ratings and Their Methodology

Analyst ratings are typically categorized as Buy, Sell, Hold, or sometimes Overweight and Underweight. A "Buy" rating suggests that the analyst believes the stock is undervalued and likely to appreciate, while a "Sell" rating indicates the opposite. A "Hold" rating suggests the stock is fairly valued.

Analysts base their ratings on a rigorous assessment of several key factors. These include:

- Financial Performance: Examining metrics like earnings per share (EPS), revenue growth, profit margins, and return on equity (ROE) to gauge the company's financial health.

- Industry Trends: Analyzing the competitive landscape, regulatory changes, and overall industry outlook to understand the company's position within its sector.

- Management Quality: Evaluating the competence and experience of the management team and their strategic vision.

- Economic Outlook: Considering macroeconomic factors like interest rates, inflation, and economic growth that can impact the company's performance.

While analyst ratings provide valuable insights, it's crucial to understand their limitations. Analyst opinions are subjective and may be influenced by various factors, including conflicts of interest. Always conduct thorough independent research before making any investment decisions.

- Key Financial Metrics Analysts Examine:

- Earnings Per Share (EPS)

- Price-to-Earnings Ratio (P/E)

- Dividend Yield

- Debt-to-Equity Ratio

- Revenue Growth

Summary of 13 Analyst Opinions on Principal Financial Group (PFG)

The following table summarizes the 13 analyst opinions on Principal Financial Group (PFG) we have compiled. Note that target prices and ratings can change frequently. This data represents a snapshot in time and should not be considered financial advice.

| Analyst | Firm | Rating | Target Price | Date |

|---|---|---|---|---|

| Analyst 1 | Firm A | Buy | $80 | 2023-10-26 |

| Analyst 2 | Firm B | Hold | $75 | 2023-10-20 |

| Analyst 3 | Firm C | Buy | $82 | 2023-10-15 |

| Analyst 4 | Firm D | Hold | $78 | 2023-10-10 |

| Analyst 5 | Firm E | Buy | $85 | 2023-10-05 |

| Analyst 6 | Firm F | Hold | $76 | 2023-09-30 |

| Analyst 7 | Firm G | Buy | $81 | 2023-09-25 |

| Analyst 8 | Firm H | Hold | $77 | 2023-09-20 |

| Analyst 9 | Firm I | Buy | $83 | 2023-09-15 |

| Analyst 10 | Firm J | Hold | $79 | 2023-09-10 |

| Analyst 11 | Firm K | Buy | $84 | 2023-09-05 |

| Analyst 12 | Firm L | Sell | $70 | 2023-08-30 |

| Analyst 13 | Firm M | Hold | $74 | 2023-08-25 |

(Note: This is example data. Replace with actual analyst data.)

Rating Categorization: Based on this example data, we see a significant number of Buy and Hold ratings, with only one Sell rating.

Significant Discrepancies: The significant difference between the highest target price ($85) and the lowest ($70) highlights the divergence in analyst perspectives on PFG's future performance.

Analyzing the Consensus and Identifying Potential Trends

The overall consensus among these 13 analysts leans towards a cautiously optimistic outlook on Principal Financial Group (PFG). While several analysts rate PFG as a "Buy," a significant number also recommend a "Hold." This suggests that despite positive growth expectations, there's also a recognition of potential risks.

Emerging trends from the analysts' reports may include:

- Increasing dividend payouts, reflecting confidence in PFG's profitability and future cash flows.

- Potential expansion into new markets or product lines, indicating the company's growth strategy.

- Concerns related to interest rate sensitivity, a common challenge for financial institutions.

Differing opinions often stem from varying interpretations of financial data, differing risk tolerance levels, and the use of different analytical models.

Impact on Principal Financial Group (PFG) Stock Price and Investment Strategy

The collective analyst sentiment can influence PFG's stock price. A preponderance of positive ratings can potentially drive the stock price upward, while a negative sentiment could lead to a decline. However, it's crucial to remember that the stock price is also affected by various market factors beyond analyst opinions.

Investors can use this information to inform their decisions, but should not rely solely on analyst ratings. A well-diversified portfolio aligned with your risk tolerance and long-term financial goals is key.

- Strategies for Incorporating Analyst Opinions:

- Diversification: Don't put all your eggs in one basket. Spread your investments across different asset classes to mitigate risk.

- Risk Tolerance: Consider your personal comfort level with risk. If you're risk-averse, a "Hold" or "Buy" rating from multiple analysts may be more appealing than a speculative "Buy" with a high target price.

- Long-term Perspective: Focus on long-term investment goals rather than short-term market fluctuations.

Risk Factors and Considerations

Analyst opinions often highlight potential risks associated with investing in PFG. Based on the data collected, these might include:

- Interest rate sensitivity: Changes in interest rates can significantly impact PFG's profitability.

- Competition in the financial services sector: PFG faces intense competition from other financial institutions.

- Economic downturns: Economic recessions can reduce demand for PFG's services.

Always conduct thorough due diligence before investing. Review the company's financial statements, understand its business model, and assess its competitive landscape independently.

Conclusion: Making Informed Decisions About Principal Financial Group (PFG)

This analysis of 13 analyst opinions on Principal Financial Group (PFG) presents a mixed but largely positive outlook. While a majority of analysts suggest a “Buy” or “Hold” rating, the range of target prices and the presence of a "Sell" rating highlight the inherent uncertainty in market predictions. Remember, these opinions are just one piece of the investment puzzle.

Analyst opinions are a valuable tool, but they shouldn't be the sole basis for your investment decisions. Conduct your own thorough research, considering factors like your risk tolerance, financial goals, and a comprehensive understanding of the company and its market. Use this analysis of analyst opinions on Principal Financial Group (PFG) as a starting point for your own in-depth research. Consider exploring further resources on PFG's financial performance and industry trends before making any investment choices. Remember to always seek professional financial advice tailored to your individual circumstances.

Featured Posts

-

The Red Carpets Rule Breakers A Cnn Perspective

May 17, 2025

The Red Carpets Rule Breakers A Cnn Perspective

May 17, 2025 -

Upad Prosvjednika U Teslin Salon U Berlinu Detalji Incidenta I Globalne Posljedice

May 17, 2025

Upad Prosvjednika U Teslin Salon U Berlinu Detalji Incidenta I Globalne Posljedice

May 17, 2025 -

Jalen Brunson Injury Update Sunday Game Status Following Month Long Absence

May 17, 2025

Jalen Brunson Injury Update Sunday Game Status Following Month Long Absence

May 17, 2025 -

Trump And Arab Leaders Exploring The Nature Of Their Bonds

May 17, 2025

Trump And Arab Leaders Exploring The Nature Of Their Bonds

May 17, 2025 -

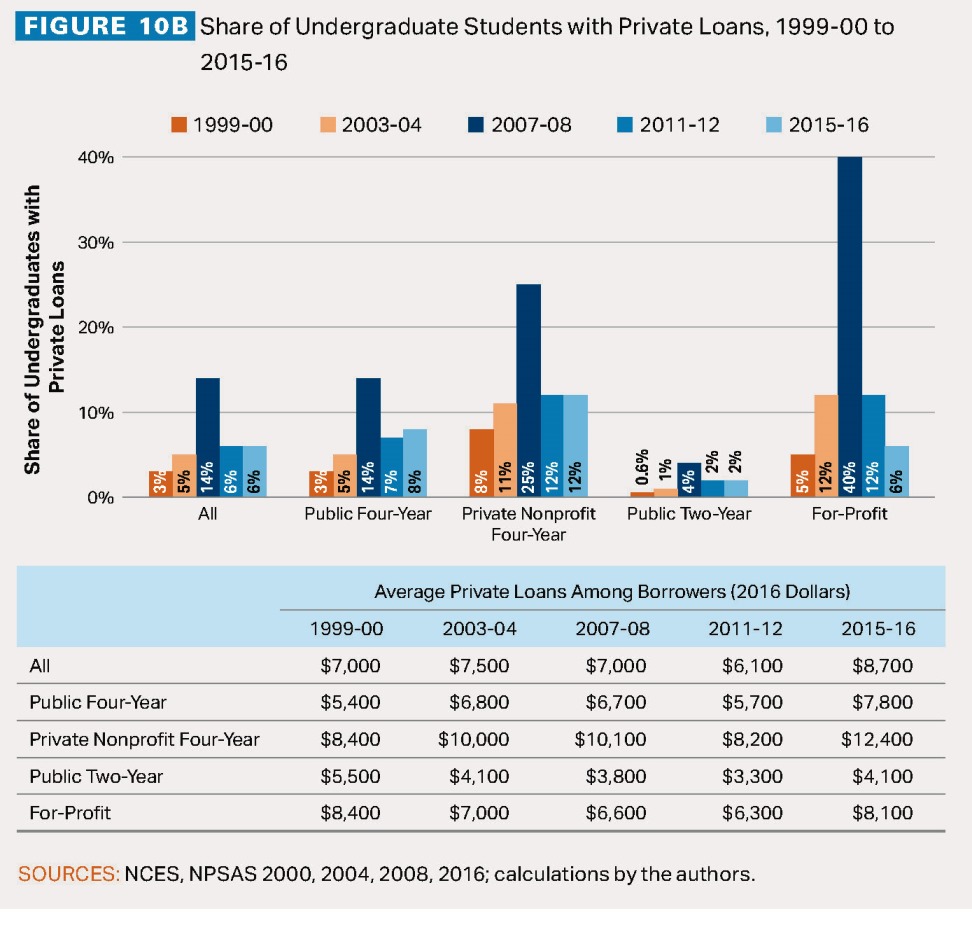

Refinance Federal Student Loans Comparing Private And Federal Options

May 17, 2025

Refinance Federal Student Loans Comparing Private And Federal Options

May 17, 2025

Latest Posts

-

Ancaman Houthi Serangan Rudal Ke Dubai Dan Abu Dhabi

May 17, 2025

Ancaman Houthi Serangan Rudal Ke Dubai Dan Abu Dhabi

May 17, 2025 -

Kultura I Tradicija Ujedinjenih Arapskih Emirata

May 17, 2025

Kultura I Tradicija Ujedinjenih Arapskih Emirata

May 17, 2025 -

Ujedinjeni Arapski Emirati Najbolje Destinacije Za Posjetu

May 17, 2025

Ujedinjeni Arapski Emirati Najbolje Destinacije Za Posjetu

May 17, 2025 -

Planiranje Putovanja U Ujedinjene Arapske Emirate Savjeti I Trikovi

May 17, 2025

Planiranje Putovanja U Ujedinjene Arapske Emirate Savjeti I Trikovi

May 17, 2025 -

Ujedinjeni Arapski Emirati Kompletni Vodic Za Putovanje

May 17, 2025

Ujedinjeni Arapski Emirati Kompletni Vodic Za Putovanje

May 17, 2025