Private Equity Firm Acquires Boston Celtics: Impact On The Franchise

Table of Contents

Financial Implications of the Acquisition

The injection of private equity capital into the Boston Celtics could dramatically alter the franchise's financial landscape. Private equity firms are known for their strategic investment approaches, often focusing on maximizing returns through operational efficiency and revenue generation. This means several potential positive impacts for the Celtics:

- Debt Reduction: Private equity funding could be used to alleviate existing debt, providing greater financial flexibility for future investments. This financial stability is critical for long-term success.

- Increased Investment in Player Acquisition: With improved financial stability, the Celtics might be able to invest more aggressively in acquiring top-tier players through free agency or trades, potentially bolstering their roster strength significantly.

- Upgrades to Facilities: Private equity investment could lead to renovations and upgrades to the Celtics' training facilities and arena, improving the overall player and fan experience.

- Improved Marketing and Revenue Streams: Private equity firms often bring expertise in marketing and branding, potentially leading to increased revenue from ticket sales, sponsorships, and merchandise. This could involve innovative marketing strategies and expansion into new markets.

The acquisition's impact on ticket prices, sponsorships, and merchandise sales remains to be seen. However, a strategic approach by the new owners could lead to both increased revenue and enhanced fan engagement. Careful analysis of the financial strategy employed will be crucial in assessing the long-term success of this investment.

Impact on Team Performance and Player Recruitment

The change in ownership could significantly impact the Celtics' on-court performance and player recruitment strategies. Private equity firms often prioritize winning, as it directly impacts the franchise's valuation and future returns. This could manifest in several ways:

- Player Acquisition: The new owners might pursue a more aggressive strategy in acquiring talent, aiming to build a championship-caliber team. This could involve significant roster changes and increased spending on player salaries.

- Coaching Staff Changes: A new ownership group might opt to replace the coaching staff, bringing in individuals with a proven track record of success or a different coaching philosophy aligned with their strategic goals.

- Team Strategy: The private equity firm's strategic approach could lead to a shift in the team's playing style and overall strategy, focusing on a more data-driven or analytics-based approach to player development and game planning.

The balance between short-term wins and long-term sustainability will be a critical factor in determining the team's success under new ownership. Analyzing player contracts and the team's overall approach to player recruitment will be key in understanding the new ownership's vision for the future.

Changes in Franchise Management and Operations

A private equity firm's acquisition will likely bring about significant changes in the Celtics' management and day-to-day operations. Private equity is known for its focus on efficiency and cost optimization. We can anticipate the following:

- Management Structure: Restructuring of the front office and management teams is highly probable, with the introduction of new executives possessing expertise in areas crucial for private equity's success.

- Operational Efficiency: The new owners might implement cost-cutting measures and streamline operations to enhance efficiency and profitability.

- Data-Driven Decision Making: A key characteristic of private equity is a reliance on data-driven decision making. This approach might affect decisions about player acquisition, marketing strategies, and even game-day operations.

These changes, while potentially disruptive in the short term, could contribute to long-term financial health and operational effectiveness for the franchise.

Long-Term Vision and Strategic Goals

The long-term vision of the private equity firm acquiring the Boston Celtics will be a determining factor in the franchise's future success. Several key questions need to be answered:

- Sustained Success vs. Aggressive Expansion: Will the new owners prioritize sustained competitiveness and consistent playoff appearances, or will they pursue a more aggressive expansion strategy, potentially involving significant investments in player acquisitions and marketing campaigns?

- Future Investments: What are their plans for future investments in the team's infrastructure, training facilities, and technology?

- Brand Enhancement and Market Position: How will they leverage the Celtics' brand and market position to maximize returns and expand the team's global reach?

The answers to these questions will reveal the private equity firm's long-term strategic goals for the Celtics and its impact on the team's overall trajectory. Understanding this vision is crucial to evaluating the lasting effects of this acquisition.

Conclusion

The acquisition of the Boston Celtics by a private equity firm presents a significant turning point for the franchise. The potential impacts are far-reaching, encompassing financial stability, team performance, management changes, and long-term strategic direction. While the short-term effects might involve significant restructuring and adjustments, the long-term success will depend heavily on the private equity firm’s strategic vision and its ability to effectively manage and invest in the franchise. The future of the Boston Celtics under new ownership is full of possibilities.

Call to Action: Follow the Boston Celtics' journey under new ownership and stay informed about the evolving impact of private equity on the NBA. Learn more about the financial strategies employed by private equity firms in professional sports by exploring additional resources and articles on this topic. Understanding these strategies is crucial for appreciating the complex dynamics shaping the future of the Boston Celtics and the broader landscape of professional sports.

Featured Posts

-

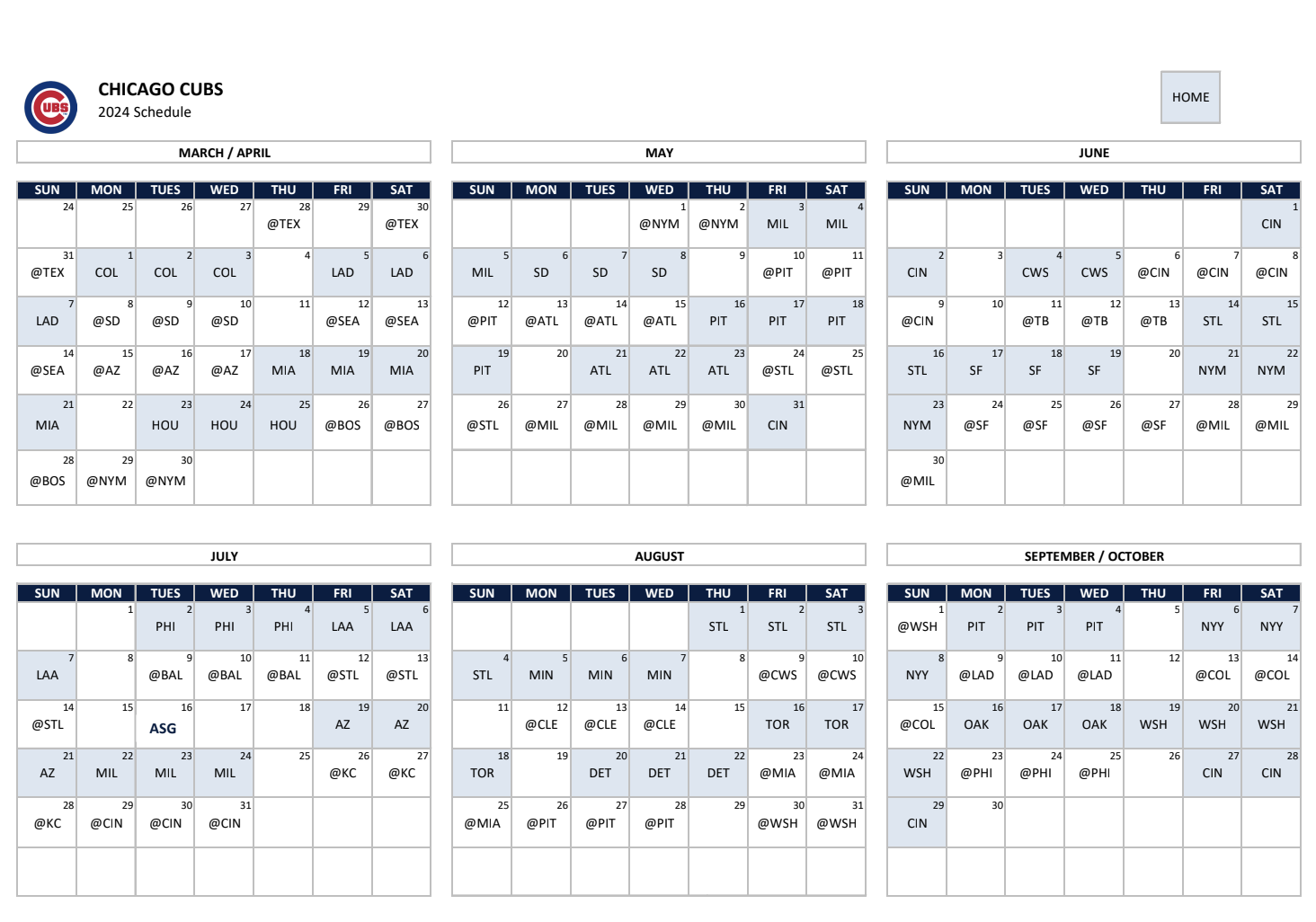

Cody Poteets First Abs Challenge Win A Chicago Cubs Spring Training Success

May 16, 2025

Cody Poteets First Abs Challenge Win A Chicago Cubs Spring Training Success

May 16, 2025 -

The Truth Behind The Rumors Elon Musk And Amber Heards Twin Children

May 16, 2025

The Truth Behind The Rumors Elon Musk And Amber Heards Twin Children

May 16, 2025 -

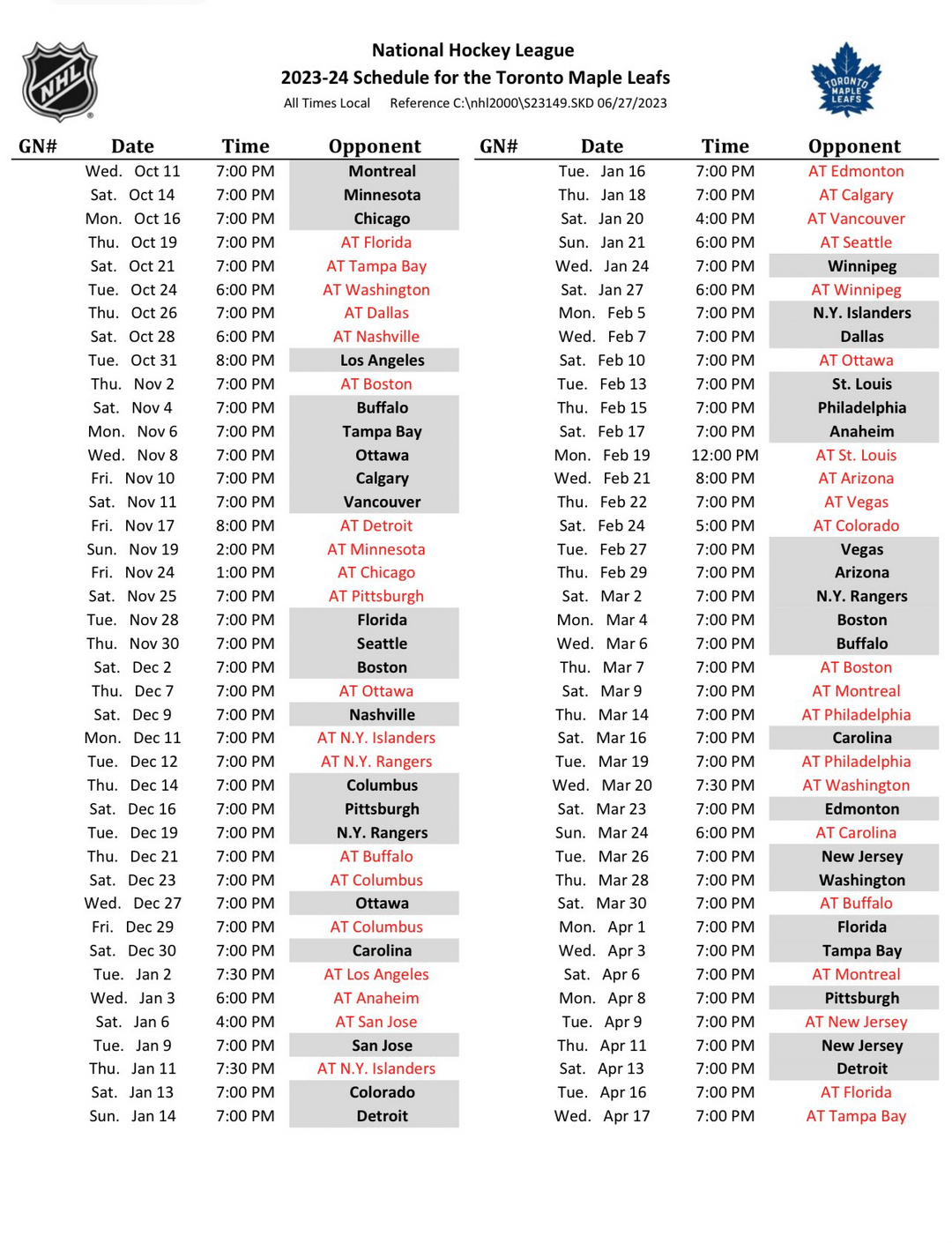

Toronto Maple Leafs Playoff Chances Rise Against Florida Panthers

May 16, 2025

Toronto Maple Leafs Playoff Chances Rise Against Florida Panthers

May 16, 2025 -

Former All Star Jake Peavys New Role With The San Diego Padres

May 16, 2025

Former All Star Jake Peavys New Role With The San Diego Padres

May 16, 2025 -

Biden Health Concerns A Former Cnn Journalist Breaks Silence

May 16, 2025

Biden Health Concerns A Former Cnn Journalist Breaks Silence

May 16, 2025

Latest Posts

-

And 7

May 17, 2025

And 7

May 17, 2025 -

The Unpaid 1 Tom Cruises Outstanding Debt To Tom Hanks

May 17, 2025

The Unpaid 1 Tom Cruises Outstanding Debt To Tom Hanks

May 17, 2025 -

Tom Cruise And Tom Hanks 1 Debt A Hollywood Oddity

May 17, 2025

Tom Cruise And Tom Hanks 1 Debt A Hollywood Oddity

May 17, 2025 -

The 1 Debt Tom Cruise And Tom Hanks Unresolved Hollywood Story

May 17, 2025

The 1 Debt Tom Cruise And Tom Hanks Unresolved Hollywood Story

May 17, 2025 -

Tom Cruises Unpaid Debt To Tom Hanks The 1 Role He Never Played

May 17, 2025

Tom Cruises Unpaid Debt To Tom Hanks The 1 Role He Never Played

May 17, 2025