Private Lender Refinancing: A Guide To Federal Student Loans

Table of Contents

Understanding Federal Student Loan Refinancing

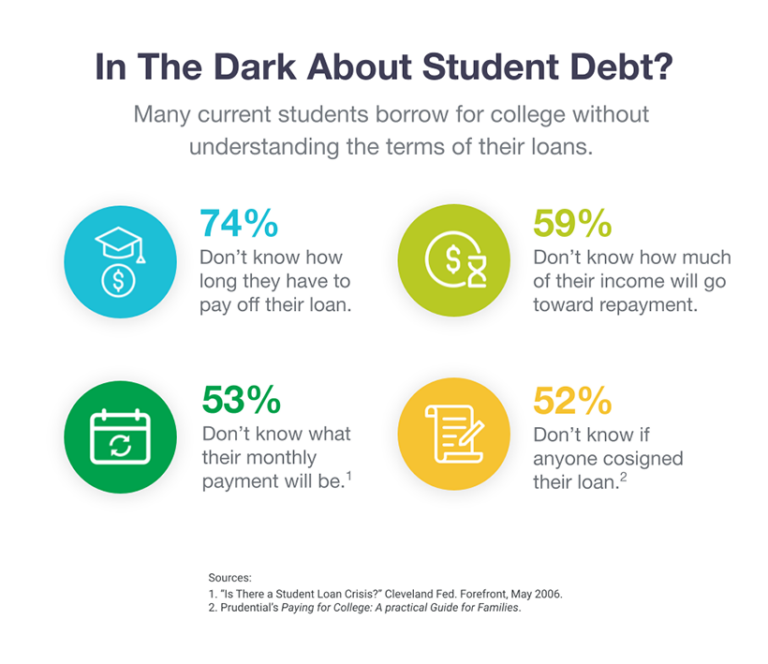

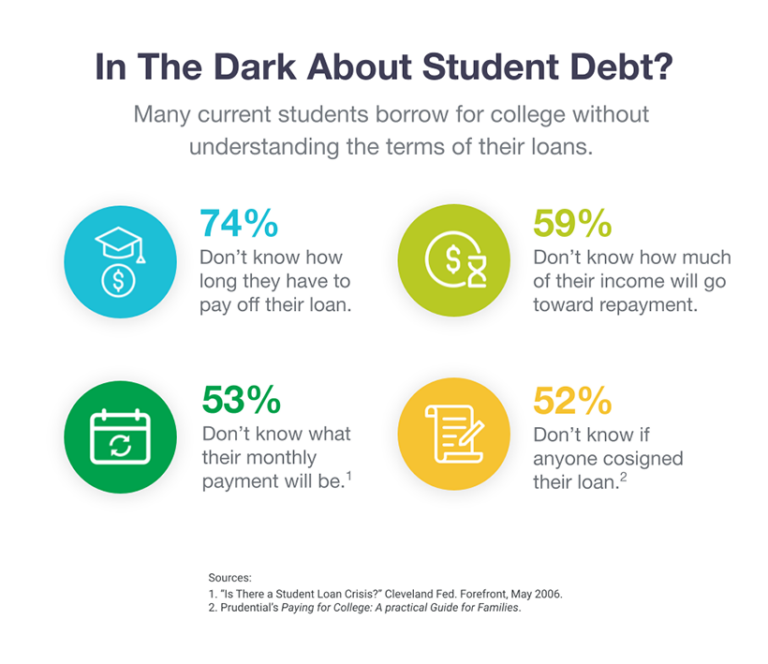

Before diving into private lender refinancing, it's essential to understand the differences between federal and private student loans. Federal student loans are offered by the government and come with various benefits, such as income-driven repayment plans (IDR) and potential forgiveness programs. These programs are designed to make repayment more manageable based on your income and circumstances. For example, the Public Service Loan Forgiveness (PSLF) program forgives remaining debt after 120 qualifying payments for those working in public service.

However, refinancing your federal student loans with a private lender means losing these crucial protections and benefits. This is a critical trade-off to consider carefully.

- Loss of federal protections: You forfeit the legal safeguards and protections offered by the federal government, such as forbearance and deferment options during financial hardship.

- Potential for higher interest rates in certain market conditions: While you might secure a lower rate initially, interest rates fluctuate, and your rate could potentially increase over time.

- No access to income-driven repayment or forgiveness programs: Once you refinance, you lose eligibility for federal income-driven repayment plans and forgiveness programs like PSLF.

Advantages of Private Lender Refinancing

Despite the loss of federal benefits, private lender refinancing offers several potential advantages:

-

Lower interest rates: Depending on your credit score and market conditions, you might qualify for a lower interest rate than your current federal loan rate, leading to significant savings over the life of the loan. This can translate into substantial long-term cost savings.

-

Simplified repayment plan: Instead of managing multiple federal loans with varying interest rates and repayment schedules, refinancing consolidates them into a single monthly payment, making budgeting easier.

-

Longer repayment term: A longer repayment term will result in lower monthly payments, although it will usually mean paying more interest overall. This can provide short-term financial relief, but it’s important to calculate the total interest paid to avoid long-term financial burden.

-

Bullet Points:

- Lower monthly payments: Makes budgeting easier and frees up cash flow.

- Potential for significant long-term savings on interest: If you secure a significantly lower interest rate.

- Simplified repayment process: One monthly payment instead of multiple.

Disadvantages of Private Lender Refinancing

While the allure of lower monthly payments is tempting, it's crucial to acknowledge the potential drawbacks of private lender refinancing:

-

Loss of federal student loan benefits: This is the most significant disadvantage, as you lose access to income-driven repayment plans and forgiveness programs.

-

Risk of higher interest rates: Market fluctuations could lead to interest rates increasing unexpectedly, potentially negating the initial savings. Always check the terms and conditions to understand how the interest rate may adjust.

-

Good credit is crucial for qualification: Private lenders typically require excellent credit scores for approval. If your credit score is less than ideal, you may not qualify or may receive a higher interest rate.

-

Bullet Points:

- Higher interest rates compared to current federal rates (possible): Market conditions can impact interest rates.

- No government protections if you lose your job or face financial hardship: You'll need to manage repayment independently.

- Risk of losing access to income-driven repayment plans: This can significantly impact affordability over the loan's life.

Finding the Right Private Lender for Refinancing

Choosing the right private lender is crucial for securing favorable terms. Shop around and compare offers from multiple lenders to find the best deal.

- Compare APRs (Annual Percentage Rates): This is the true cost of your loan, incorporating interest and fees.

- Check for origination fees and prepayment penalties: These fees can significantly impact the overall cost.

- Read online reviews to assess lender reputation: Look for feedback on customer service, responsiveness, and transparency.

- Consider lender terms: Look for options like variable vs fixed interest rate loans to suit your financial needs.

The Refinancing Application Process

The application process generally involves these steps:

- Gather necessary documentation: This typically includes your credit report, income verification, and details of your existing federal student loans.

- Complete the lender's application: Provide accurate and complete information to avoid delays.

- Provide verification of income and employment: Lenders will verify your employment and income to assess your repayment ability.

- Understand the loan terms and conditions before signing: Review the loan agreement thoroughly before committing.

Conclusion

Private lender refinancing can offer significant advantages, such as lower monthly payments and potential long-term savings on interest. However, it's crucial to carefully weigh the benefits against the loss of federal student loan protections. Before making a decision, compare offers from multiple lenders, assess your financial situation, and understand the terms and conditions thoroughly. By carefully considering all aspects of private lender refinancing, you can make an informed choice that best suits your financial goals. Don't hesitate to explore your student loan refinancing options today to determine if this is the right path for you.

Featured Posts

-

Zhevago Prigrozil Prekrascheniem Investitsiy Ferrexpo V Ukrainu

May 17, 2025

Zhevago Prigrozil Prekrascheniem Investitsiy Ferrexpo V Ukrainu

May 17, 2025 -

2024 25 High School Confidential Week 26 Highlights

May 17, 2025

2024 25 High School Confidential Week 26 Highlights

May 17, 2025 -

President Trumps Middle East Journey May 15 2025 A Retrospective

May 17, 2025

President Trumps Middle East Journey May 15 2025 A Retrospective

May 17, 2025 -

Investiranje U Nekretnine U Inostranstvu Sta Srbi Treba Da Znaju

May 17, 2025

Investiranje U Nekretnine U Inostranstvu Sta Srbi Treba Da Znaju

May 17, 2025 -

Delinquent Student Loans Understanding The Governments Intensified Pursuit

May 17, 2025

Delinquent Student Loans Understanding The Governments Intensified Pursuit

May 17, 2025

Latest Posts

-

Fortnite Cowboy Bebop Bundle Price And Details For Faye Valentine And Spike Spiegel Skins

May 17, 2025

Fortnite Cowboy Bebop Bundle Price And Details For Faye Valentine And Spike Spiegel Skins

May 17, 2025 -

Cowboy Bebop Faye Valentine And Spike Spiegel Fortnite Skin Bundle Price Check

May 17, 2025

Cowboy Bebop Faye Valentine And Spike Spiegel Fortnite Skin Bundle Price Check

May 17, 2025 -

Fortnites Cowboy Bebop Skins How Much Does The Faye Valentine And Spike Spiegel Bundle Cost

May 17, 2025

Fortnites Cowboy Bebop Skins How Much Does The Faye Valentine And Spike Spiegel Bundle Cost

May 17, 2025 -

Fortnite Cowboy Bebop Skins Faye Valentine And Spike Spiegel Bundle Price Revealed

May 17, 2025

Fortnite Cowboy Bebop Skins Faye Valentine And Spike Spiegel Bundle Price Revealed

May 17, 2025 -

Fortnite The Return Of Beloved Skins After 1000 Days In The Item Shop

May 17, 2025

Fortnite The Return Of Beloved Skins After 1000 Days In The Item Shop

May 17, 2025