Proposed Legislation: Substantial Tax Increase On Harvard And Yale Endowments

Table of Contents

The Rationale Behind the Proposed Tax Increase

The proposed legislation is driven by a desire to address pressing societal issues using the substantial wealth held by these Ivy League institutions.

Addressing Wealth Inequality

The concentration of wealth in the hands of a few is a significant concern in the United States. Proponents argue that taxing large endowments like those of Harvard and Yale could help redistribute wealth and alleviate inequality.

- The top 1% of Americans hold a disproportionate share of national wealth.

- Endowment funds could be utilized to fund affordable housing initiatives, providing much-needed shelter for low-income families.

- Significant investment in scholarships could broaden access to higher education for students from disadvantaged backgrounds.

Funding Public Education

Another key argument centers on using the tax revenue to bolster public education. The persistent underfunding of public schools across the nation is a critical issue, and proponents suggest that redirecting funds from university endowments could alleviate this problem.

- Public schools often lack the resources to provide adequate facilities, technology, and teacher training.

- Increased funding could lead to smaller class sizes, improved curriculum, and better educational outcomes for all students.

- This could reduce the reliance on expensive private education, making higher education more accessible.

Taxing Non-Profit Organizations

A central point of contention revolves around the taxation of non-profit organizations. This proposal challenges established legal frameworks and raises concerns about potential legal challenges.

- Non-profit status typically grants tax exemptions, based on their charitable mission.

- Legal precedents exist for taxing certain non-profit activities, but the scale of the proposed tax on university endowments is unprecedented.

- Legal experts foresee potential court battles and protracted legal challenges to the constitutionality of such a tax.

Potential Consequences of the Proposed Legislation

While the aims of the proposed legislation are laudable, the potential consequences need careful consideration.

Impact on University Funding

A substantial tax on endowments would drastically impact university budgets. This could lead to cuts in various areas, with potentially devastating effects.

- Research funding could be significantly reduced, hindering scientific breakthroughs and innovation.

- Financial aid programs could be slashed, impacting students from low-income families who rely on this support.

- Academic programs might be eliminated or reduced, impacting the quality and breadth of education offered.

Effects on Philanthropy

The proposed legislation could have a chilling effect on future donations to universities and other non-profit organizations. Donors may be hesitant to contribute if they anticipate their contributions being taxed heavily.

- Reduced charitable giving would have long-term consequences for numerous institutions and causes.

- This could lead to a decrease in overall philanthropic activity, impacting numerous sectors of society.

- The loss of private funding could exacerbate the already strained budgets of many non-profit organizations.

Economic Implications

The proposed tax increase carries broader economic implications, both positive and negative. Increased tax revenue could stimulate the economy, but it could also lead to job losses and economic instability.

- The potential for job losses in the higher education sector due to budget cuts is a serious concern.

- The impact on local economies surrounding universities would be significant, potentially leading to reduced economic activity.

- Increased tax revenue could be used to fund other public services, benefiting the broader economy.

Counterarguments and Alternative Solutions

Opponents of the proposed legislation raise valid concerns about its potential negative consequences.

Arguments Against the Tax Increase

Critics argue that taxing university endowments could severely harm academic excellence and stifle crucial research.

- University officials and experts contend that such a tax would undermine their ability to attract and retain top faculty and students.

- Reduced funding for research could impede scientific progress and innovation.

- The long-term effects on the reputation and competitiveness of American universities on a global scale are also a concern.

Alternative Approaches to Address Wealth Inequality

There are alternative approaches to addressing wealth inequality without directly targeting university endowments.

- Progressive tax policies, such as higher taxes on the wealthiest individuals and corporations, could be implemented.

- Increased estate taxes could help reduce wealth concentration across generations.

- Closing loopholes in the current tax code could generate significant revenue and increase tax fairness.

Conclusion: The Future of Taxation on University Endowments

The proposed substantial tax increase on Harvard and Yale endowments presents a complex dilemma. While addressing wealth inequality and improving public education are laudable goals, the potential negative consequences for higher education, philanthropy, and the broader economy warrant careful consideration. Alternative approaches to wealth redistribution should be explored before implementing such a drastic measure. Learn more about the proposed tax increase on Harvard and Yale endowments and stay informed about the debate surrounding the taxation of university endowments. Contact your legislators to voice your opinion on this crucial issue affecting university endowments.

Featured Posts

-

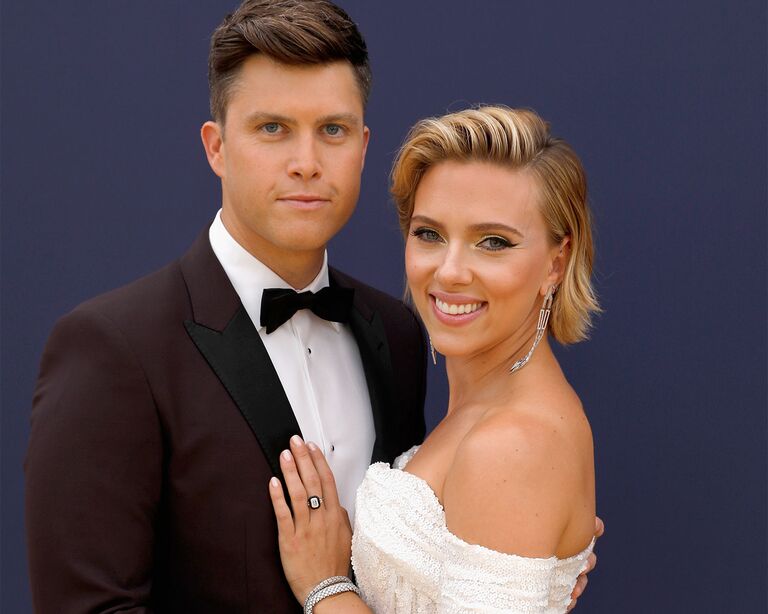

Colin Josts Earnings Compared To Scarlett Johansson Analyzing The Wealth Gap In Celebrity Relationships

May 13, 2025

Colin Josts Earnings Compared To Scarlett Johansson Analyzing The Wealth Gap In Celebrity Relationships

May 13, 2025 -

Sicherheitsalarm An Braunschweiger Schule Gebaeude Geraeumt

May 13, 2025

Sicherheitsalarm An Braunschweiger Schule Gebaeude Geraeumt

May 13, 2025 -

Gerard Butlers Box Office Flop Finds New Life As A Netflix Hit

May 13, 2025

Gerard Butlers Box Office Flop Finds New Life As A Netflix Hit

May 13, 2025 -

The Enduring Legacy Of The Da Vinci Code

May 13, 2025

The Enduring Legacy Of The Da Vinci Code

May 13, 2025 -

Prekmurski Romi Muzikantska Dediscina In Kulturni Vpliv

May 13, 2025

Prekmurski Romi Muzikantska Dediscina In Kulturni Vpliv

May 13, 2025

Latest Posts

-

Country Music Legend George Strait Makes Surprise Dairy Queen Appearance

May 14, 2025

Country Music Legend George Strait Makes Surprise Dairy Queen Appearance

May 14, 2025 -

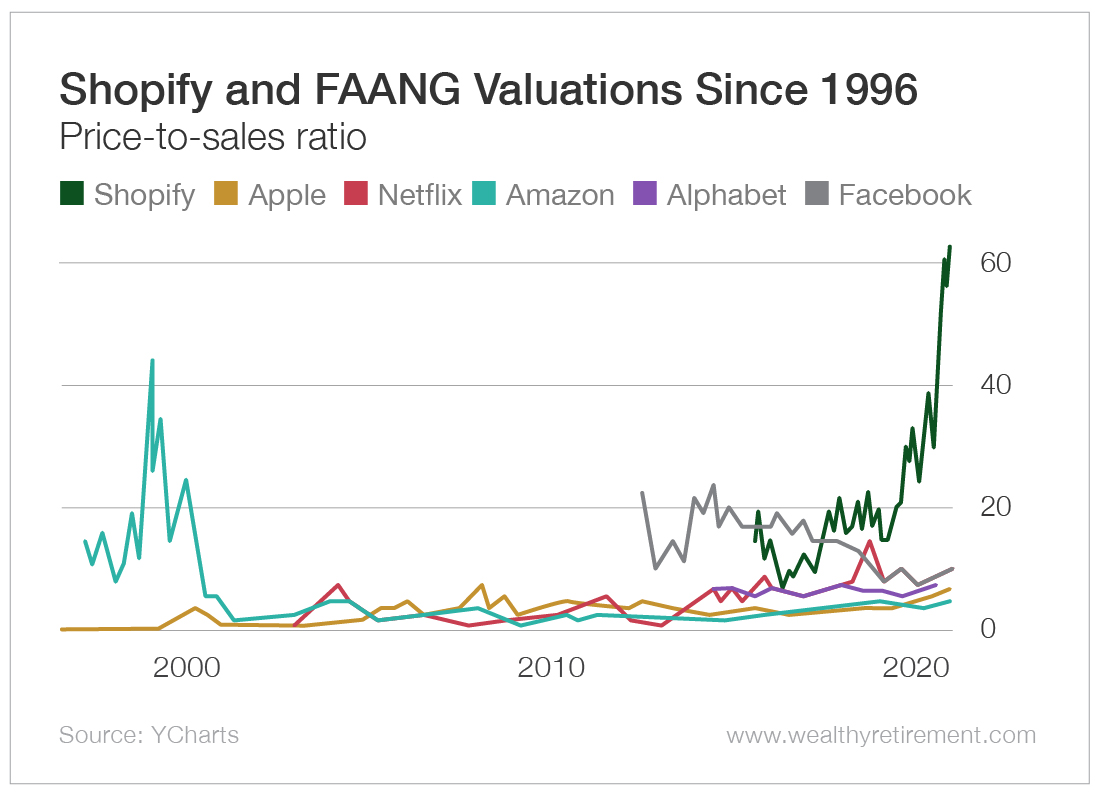

Market Update Shopify Stocks Reaction To Nasdaq 100 Listing

May 14, 2025

Market Update Shopify Stocks Reaction To Nasdaq 100 Listing

May 14, 2025 -

Bell Urges Federal Government To Reverse Wholesale Fibre Policy

May 14, 2025

Bell Urges Federal Government To Reverse Wholesale Fibre Policy

May 14, 2025 -

Why Parker Mc Collum Is Being Compared To George Strait

May 14, 2025

Why Parker Mc Collum Is Being Compared To George Strait

May 14, 2025 -

George Strait At Dairy Queen Unexpected Selfie Delight

May 14, 2025

George Strait At Dairy Queen Unexpected Selfie Delight

May 14, 2025