PWC's Withdrawal From Nine African Countries: A Detailed Analysis

Table of Contents

The Nine Affected African Countries

PwC's withdrawal directly impacts nine African nations. While the exact details of the withdrawal may vary across these countries, the overall implications are significant. The affected countries are: [Insert the list of nine countries here].

Prior to the withdrawal, PwC held a substantial market share in many of these countries, offering a wide range of services including auditing, tax advisory, and consulting. The firm's presence varied significantly depending on the size and economic development of each nation.

- [Country 1]: PwC employed approximately [Number] staff and generated an estimated [Revenue] in revenue. [Add further details on their specific operations and market share].

- [Country 2]: [Similar details as above for each country]

- [Country 3]: [Similar details as above for each country]

- [Country 4]: [Similar details as above for each country]

- [Country 5]: [Similar details as above for each country]

- [Country 6]: [Similar details as above for each country]

- [Country 7]: [Similar details as above for each country]

- [Country 8]: [Similar details as above for each country]

- [Country 9]: [Similar details as above for each country]

This significant reduction in professional services capacity within these nations raises concerns regarding the long-term effects on the African market and PwC Africa's overall strategy.

Reasons Behind PwC's Withdrawal

The reasons behind PwC's sweeping decision are complex and likely multifaceted. Several factors likely contributed to this strategic shift:

Regulatory Changes

Recent changes in auditing regulations and tax laws in some of the affected countries may have increased the compliance burden and operational costs for PwC. Navigating varying African regulations, particularly regarding auditing standards, can be incredibly challenging and expensive. This could have made operations in these markets less attractive compared to others. Keywords: regulatory compliance, tax laws, auditing standards, African regulations.

Economic Instability

Economic instability and political risks in several of the affected nations are also strong contributing factors. An uncertain investment climate, coupled with potential economic downturns, could have led PwC to reassess its risk profile and decide to withdraw from these markets. Keywords: economic downturn, political risk, investment climate, African economies.

Internal Restructuring

It's also plausible that PwC's withdrawal is part of a broader internal restructuring or strategic realignment within the global PwC network. The firm may be focusing its resources on more profitable or strategically important markets. Keywords: global strategy, internal restructuring, PwC network, strategic realignment.

- Supporting Evidence: [Cite credible sources, news articles, or official statements to back up each of the above points].

Impact on the African Business Landscape

PwC's withdrawal will undoubtedly have significant repercussions across the African business landscape:

Impact on Businesses

Smaller businesses in the affected countries are likely to feel the impact the most acutely. The loss of access to PwC's auditing and advisory services could hinder their ability to secure funding, comply with regulations, and grow sustainably. Keywords: small businesses, auditing services, financial advisory, business impact.

Impact on Investors

The withdrawal could also negatively impact foreign direct investment (FDI) in the affected regions. Investors may perceive this move as a sign of market instability or increased risk, potentially deterring future investment. Keywords: foreign direct investment, investment confidence, market instability.

Impact on the Auditing Profession

The withdrawal will alter the competitive landscape of the auditing profession in these countries. Other firms will likely vie for PwC's lost market share, potentially leading to both opportunities and challenges for the remaining players. Keywords: auditing profession, competition, market share, professional services.

- Short-term effects: Increased competition among remaining firms, potential disruption to ongoing audits.

- Long-term effects: Potential consolidation within the auditing sector, changes in the availability and cost of auditing services.

PwC's Official Statement and Response

PwC has issued an official statement regarding its withdrawal. [Summarize PwC's official statement here, including direct quotes if available and properly attributed]. The statement should be analyzed for clarity and any insights into their rationale and future plans for engagement in Africa. Keywords: PwC statement, official announcement, corporate response, future plans.

Conclusion

PwC's withdrawal from nine African countries marks a significant event with far-reaching implications for the continent's business environment. The reasons for the withdrawal appear to be multifaceted, encompassing regulatory changes, economic instability, and internal restructuring within PwC. The impact on businesses, investors, and the auditing profession will likely be considerable, requiring careful monitoring and analysis. The long-term consequences of this decision remain to be seen, but it underscores the complexities and challenges facing both multinational corporations and the African business landscape. Stay informed about the evolving situation by following further updates on PwC's African operations and the broader implications for the continent's economic development.

Featured Posts

-

Will Trump Pardon Pete Rose Examining The Baseball Betting Ban And Presidential Clemency

Apr 29, 2025

Will Trump Pardon Pete Rose Examining The Baseball Betting Ban And Presidential Clemency

Apr 29, 2025 -

Finding Natural Relief From Adhd Symptoms Practical Tips And Techniques

Apr 29, 2025

Finding Natural Relief From Adhd Symptoms Practical Tips And Techniques

Apr 29, 2025 -

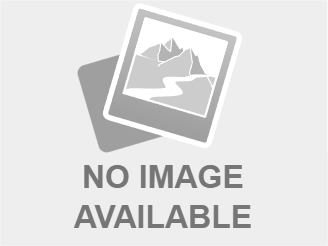

New Business Hotspots Across The Country A Comprehensive Map And Analysis

Apr 29, 2025

New Business Hotspots Across The Country A Comprehensive Map And Analysis

Apr 29, 2025 -

Activision Blizzard Deal Uncertain Ftc Files Appeal Against Court Ruling

Apr 29, 2025

Activision Blizzard Deal Uncertain Ftc Files Appeal Against Court Ruling

Apr 29, 2025 -

At And T Slams Broadcoms V Mware Price Hike A 1 050 Increase

Apr 29, 2025

At And T Slams Broadcoms V Mware Price Hike A 1 050 Increase

Apr 29, 2025

Latest Posts

-

Mirni Peregovori Dzhonson Kritikuye Plan Trampa Schodo Viyni V Ukrayini

May 12, 2025

Mirni Peregovori Dzhonson Kritikuye Plan Trampa Schodo Viyni V Ukrayini

May 12, 2025 -

Raznye Otsenki Reytinga Zelenskogo Pozitsiya Dzhonsona Protiv Pozitsii Trampa

May 12, 2025

Raznye Otsenki Reytinga Zelenskogo Pozitsiya Dzhonsona Protiv Pozitsii Trampa

May 12, 2025 -

Spor Dzhonsona I Trampa Realniy Reyting Prezidenta Zelenskogo

May 12, 2025

Spor Dzhonsona I Trampa Realniy Reyting Prezidenta Zelenskogo

May 12, 2025 -

Valspar Championship Lowry In Contention For The Title

May 12, 2025

Valspar Championship Lowry In Contention For The Title

May 12, 2025 -

Lowry Pushes For Victory Valspar Championship Update

May 12, 2025

Lowry Pushes For Victory Valspar Championship Update

May 12, 2025