Rate Cut Decision: Economists Pressure ECB To Avoid Delays

Table of Contents

The Urgent Need for a Rate Cut Decision

The Eurozone is currently navigating a treacherous economic landscape. High inflation, stubbornly persistent despite recent efforts, is squeezing household budgets and dampening consumer spending. Simultaneously, economic growth is slowing significantly, raising serious concerns about a potential recession. This challenging environment is characterized by:

- Weakening consumer confidence: Uncertainty about the future is leading to decreased spending and a reluctance to make significant purchases.

- Decreasing investment: Businesses are hesitant to invest in expansion or new projects due to the economic uncertainty and high borrowing costs.

- Rising unemployment concerns: As businesses scale back operations, job losses are becoming a growing concern, further depressing consumer demand.

- Geopolitical uncertainties impacting the economy: The ongoing war in Ukraine, energy crises, and global supply chain disruptions continue to exert downward pressure on the Eurozone economy.

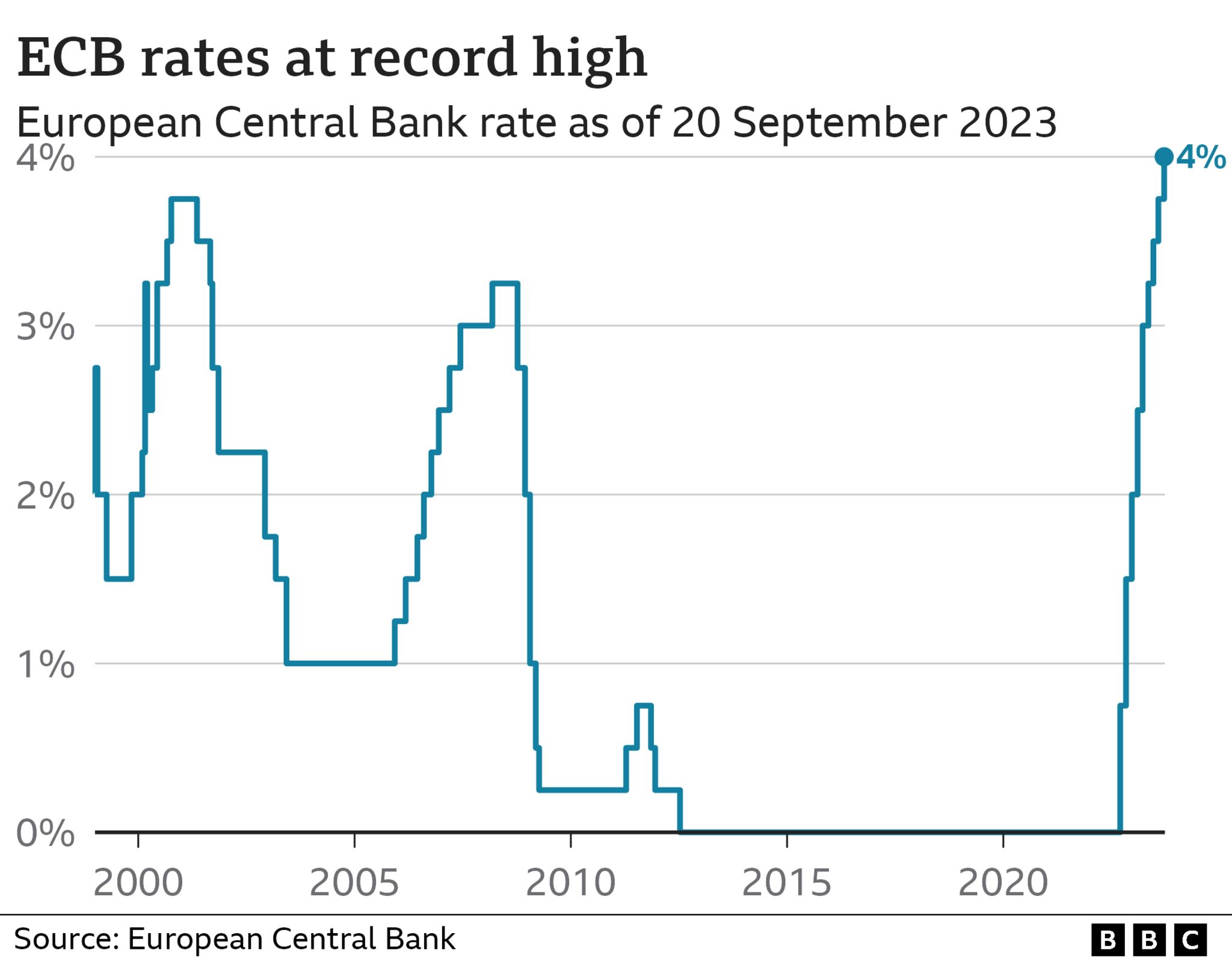

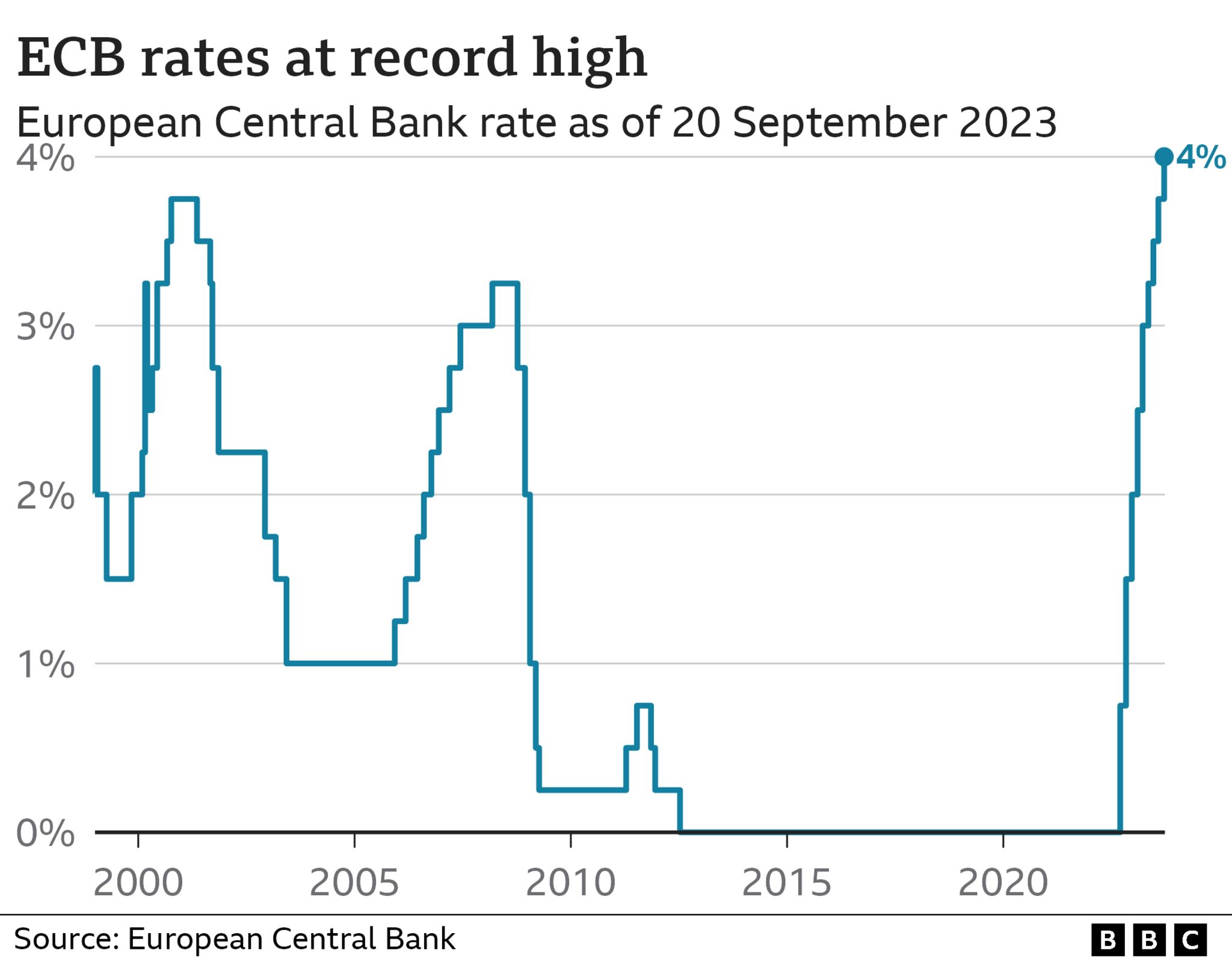

A rate cut decision, a key component of monetary policy, could help alleviate these pressures. By lowering interest rates, the ECB aims to stimulate borrowing, encouraging businesses to invest and consumers to spend. This injection of capital into the economy could help reignite growth and prevent a deeper economic downturn. Lower interest rates make loans cheaper, thereby boosting investment and consumer spending, crucial elements of economic stimulus.

Economists' Arguments for Immediate Action

There's a growing consensus among economists regarding the urgent need for a rate cut decision. Reputable institutions like the IMF and World Bank, along with prominent economists, are publicly advocating for swift action. Their arguments are supported by compelling evidence:

- Quotes from leading economists: Many leading economists have stated publicly that delaying a rate cut will only worsen the economic situation, calling for decisive action to prevent a deeper recession. For example, [Insert quote from a reputable economist here, citing source].

- Statistical data supporting their arguments: Data showing declining GDP growth, rising unemployment figures, and persistent high inflation rates all strengthen the case for immediate intervention through a rate cut decision. [Insert relevant statistical data and sources here].

- Analysis of the potential benefits of a preemptive rate cut: Economists argue that a preemptive rate cut would mitigate the severity of a potential recession by boosting economic activity before the situation deteriorates further.

- Discussion of the risks of inaction: The longer the ECB delays a rate cut decision, the greater the risk of a deeper and more prolonged recession, leading to increased unemployment and social unrest.

The potential consequences of delayed action are severe: an increased risk of a deeper recession, further economic slowdown, and a prolonged period of stagnation.

Potential Obstacles to a Swift Rate Cut Decision

Despite the compelling arguments for immediate action, several obstacles could hinder a swift rate cut decision by the ECB. Internal disagreements within the ECB itself pose a significant challenge:

- Different perspectives on inflation control versus economic growth stimulation: Some members of the ECB Governing Council may prioritize controlling inflation, even at the risk of slowing economic growth, while others may favor stimulating growth, even if it means temporarily accepting higher inflation.

- Concerns about potential inflationary pressures from a rate cut: Lowering interest rates could potentially fuel inflation further, creating a difficult trade-off for the ECB.

- Political pressures influencing the ECB's decision: Political considerations and pressure from various member states could also influence the timing and magnitude of a rate cut decision.

The ECB might consider compromises, such as a smaller rate cut than some economists advocate for, or a phased approach to rate reductions, to balance the competing goals of inflation control and economic growth stimulation.

The Role of Inflation in the Decision-Making Process

The ECB faces the complex challenge of managing inflation while simultaneously stimulating economic growth. This delicate balancing act requires careful consideration of various factors:

- Analysis of current inflation levels and their drivers: Understanding the underlying causes of inflation is crucial for determining the appropriate monetary policy response.

- Discussion of the potential impact of a rate cut on inflation: The ECB must carefully assess the potential for a rate cut to exacerbate inflationary pressures.

- Examination of alternative strategies to combat inflation: Exploring alternative strategies, such as targeted fiscal measures, could help alleviate inflationary pressures without solely relying on interest rate adjustments.

Conclusion

The arguments for and against a swift rate cut decision by the ECB highlight a critical juncture for the Eurozone economy. The urgency of the situation cannot be overstated; delaying a rate cut decision risks prolonging the economic slowdown and potentially deepening the recession. The potential consequences of inaction are significant, including increased unemployment, reduced investment, and diminished consumer confidence. The ECB's rate cut decision is a pivotal moment that will significantly impact the Eurozone's economic future. Swift and decisive action is needed to avoid further economic hardship. Closely monitoring the ECB's announcements and understanding the implications of their rate cut decision is crucial for businesses, investors, and policymakers alike. Stay informed on the latest developments in the rate cut decision process and its potential effects on the Eurozone's economic recovery.

Featured Posts

-

How To Livestream The Giro D Italia 2025 Without Cable

May 31, 2025

How To Livestream The Giro D Italia 2025 Without Cable

May 31, 2025 -

Jaime Munguias Tactical Changes Secure Rematch Win Over Bruno Surace

May 31, 2025

Jaime Munguias Tactical Changes Secure Rematch Win Over Bruno Surace

May 31, 2025 -

How To Achieve The Good Life A Step By Step Approach

May 31, 2025

How To Achieve The Good Life A Step By Step Approach

May 31, 2025 -

Programme Tv Soudain Seuls Avec Melanie Thierry Et Gilles Lellouche Ce Soir

May 31, 2025

Programme Tv Soudain Seuls Avec Melanie Thierry Et Gilles Lellouche Ce Soir

May 31, 2025 -

Brandon Inges Kalamazoo Return One Night In The Dugout

May 31, 2025

Brandon Inges Kalamazoo Return One Night In The Dugout

May 31, 2025