RBC Earnings Miss Estimates Amidst Rising Loan Concerns

Table of Contents

RBC Earnings Miss: A Detailed Breakdown

RBC's recent earnings report revealed a significant discrepancy between actual and projected figures. The bank reported earnings per share (EPS) of $2.20, falling short of the consensus analyst estimate of $2.40. This represents a notable decline compared to the previous quarter and the same period last year. Several factors contributed to this disappointing performance. Increased loan losses, particularly within the commercial real estate sector, played a significant role. A weakening economic outlook also impacted certain lending portfolios, resulting in higher provisions for credit losses.

- Specific Financial Metrics:

- Net Income: A decrease of X% compared to the previous quarter and Y% compared to the same period last year.

- Revenue: Slight growth, but lower than projected, indicating pressure on margins.

- Return on Equity (ROE): A notable decline, reflecting the impact of increased loan losses.

- Comparison to Previous Periods: The current quarter's RBC earnings represent a significant downturn compared to both the previous quarter and the same quarter last year, signaling a concerning trend.

- Revised Earnings Guidance: RBC revised its earnings guidance for the remainder of the year, reflecting the uncertainty surrounding the current economic climate and the potential for further loan losses.

Rising Loan Concerns and Credit Risk

The RBC earnings miss highlights growing concerns about rising loan defaults and credit risk within the Canadian banking sector. The increase in non-performing loans is primarily concentrated in the commercial real estate and consumer credit sectors. Rising interest rates and a slowing economy are putting pressure on borrowers, leading to higher delinquency rates and increased loan losses.

- Statistics on Non-Performing Loans: Data released alongside the RBC earnings report indicated a significant increase in non-performing loans, exceeding expectations.

- Sectors Experiencing High Defaults: The commercial real estate sector is particularly vulnerable, with developers facing challenges completing projects and servicing their debt. Consumer credit is also seeing a rise in delinquencies as household budgets tighten.

- Impact on RBC's Balance Sheet: The increased provisions for loan losses are putting pressure on RBC's profitability and could potentially affect its credit rating if the trend continues.

Market Reaction and Investor Sentiment

The market reacted negatively to the RBC earnings announcement. RBC's stock price fell by 3% immediately following the release of the report, reflecting investor concern about the bank's performance and the wider implications for the Canadian banking sector. Analyst ratings were downgraded by several firms, and many expressed concerns about the potential for further loan losses in the coming quarters. Overall, investor sentiment is cautious, with many analysts adopting a wait-and-see approach.

- Stock Price Movements: A clear downward trend in RBC's stock price is observed post-announcement.

- Analyst Ratings and Price Targets: Several analysts have lowered their price targets for RBC stock, reflecting a more pessimistic outlook.

- Investor Actions: There has been a notable increase in sell-offs following the announcement, indicating a lack of investor confidence.

Comparison with Other Canadian Banks

While RBC's performance was disappointing, it's important to note that other Canadian banks also faced challenges during this reporting period. However, the extent of the RBC earnings miss and the pronounced increase in loan concerns set it apart from its peers. A detailed comparison of key financial metrics with TD Bank and BMO reveals some similarities, such as pressure on net interest margins, but RBC's experience with loan defaults appears more significant.

- Comparison of Key Metrics: While all major banks showed some slowing in growth, the degree of decline in certain metrics like ROE varied considerably.

- Similarities and Differences: While all Canadian banks are experiencing increased economic headwinds, RBC's exposure to certain sectors appears to have amplified the impact.

Analyzing RBC Earnings and the Path Forward

The RBC earnings report reveals a concerning trend of rising loan concerns within the Canadian banking sector. The significant miss in earnings expectations, coupled with increased loan losses, particularly in the commercial real estate sector, indicates challenges ahead. The negative market reaction and downward revisions in analyst forecasts reflect a cautious outlook. The long-term implications for RBC and the broader Canadian banking sector remain uncertain, and further developments will be crucial in gauging the extent and duration of this downturn. Careful monitoring of loan default rates, economic indicators, and the bank’s strategic responses will be essential for assessing the situation moving forward. Stay tuned for further updates on RBC earnings and the evolving landscape of the Canadian banking sector. Understanding RBC's performance is crucial for investors navigating the complexities of the Canadian financial market.

Featured Posts

-

May 27 2025 Horoscope By Christine Haas

May 31, 2025

May 27 2025 Horoscope By Christine Haas

May 31, 2025 -

Complete 2025 Glastonbury And San Remo Festival Lineups Unveiled

May 31, 2025

Complete 2025 Glastonbury And San Remo Festival Lineups Unveiled

May 31, 2025 -

Detroit Tigers Vs Chicago White Sox Opening Day 2025 Showdown At Comerica Park

May 31, 2025

Detroit Tigers Vs Chicago White Sox Opening Day 2025 Showdown At Comerica Park

May 31, 2025 -

Federal Probe Impersonating White House Chief Of Staff Susie Wiles

May 31, 2025

Federal Probe Impersonating White House Chief Of Staff Susie Wiles

May 31, 2025 -

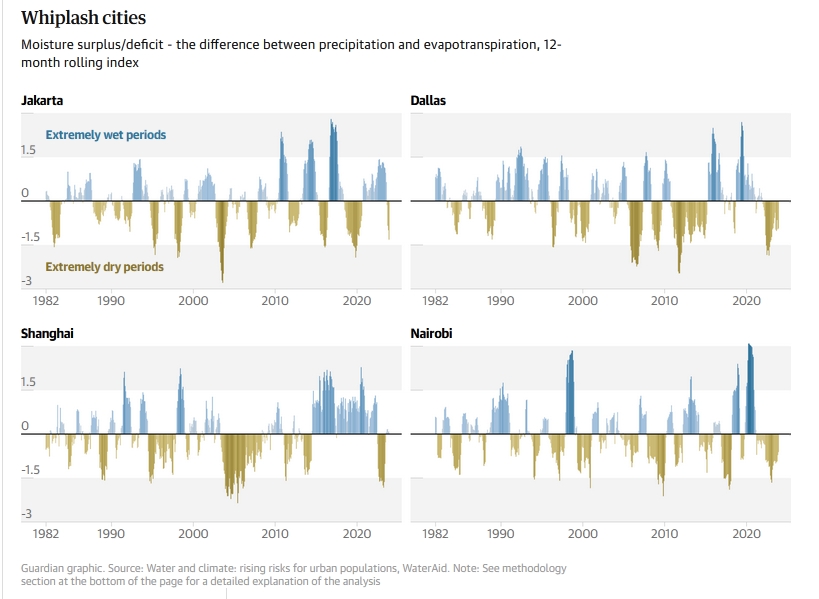

Dangerous Climate Whiplash A Growing Threat To Cities Around The World

May 31, 2025

Dangerous Climate Whiplash A Growing Threat To Cities Around The World

May 31, 2025