Recent Retail Sales Growth: Re-evaluating Bank Of Canada's Monetary Policy

Table of Contents

The Unexpected Surge in Retail Sales

The Canadian economy has shown surprising resilience in the face of rising interest rates, evidenced by a robust increase in retail sales. This unexpected surge challenges the Bank of Canada's assumptions about the effectiveness of its monetary policy tightening.

Analyzing the Data

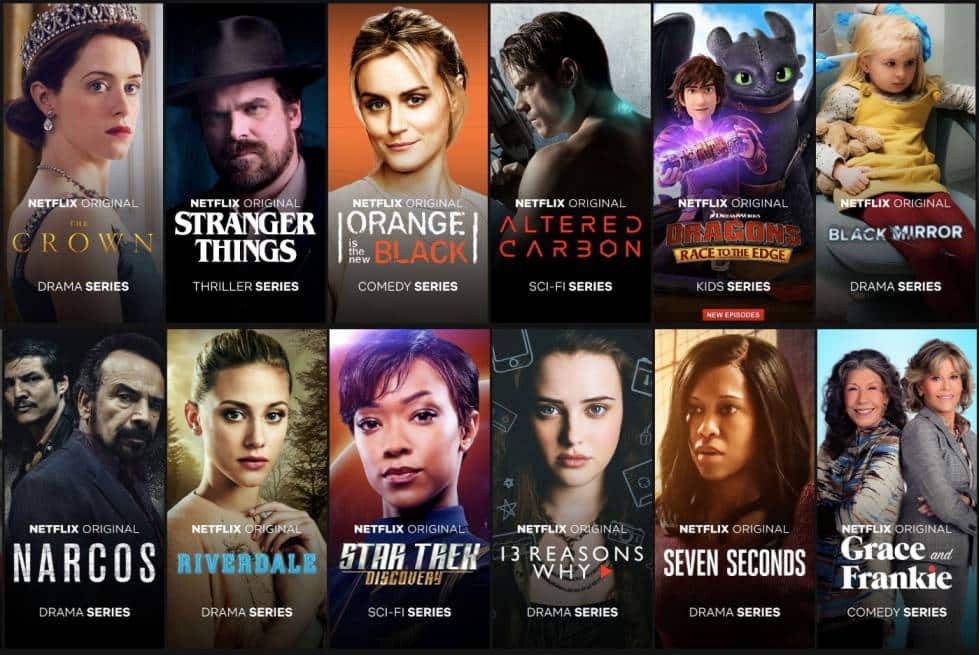

Statistics Canada recently reported [insert specific data and percentage increase here, e.g., a 2.5% increase in retail sales in July 2024 compared to June]. This follows [mention previous months' trends]. This significant growth surpasses expectations and raises concerns about persistent inflationary pressures. [Insert chart or graph visualizing the retail sales growth data].

-

Breakdown of Sales Growth: The increase was particularly strong in [mention specific sectors, e.g., automotive sales, up by X%, driven by strong demand for new vehicles; furniture sales also showed robust growth, up Y%, suggesting continued investment in home improvements]. However, other sectors, such as [mention sectors with less growth or decline, e.g., clothing sales] showed more moderate growth.

-

Seasonal Adjustments: While the figures presented are seasonally adjusted to account for typical fluctuations throughout the year, the magnitude of the increase still points to underlying strength in consumer spending.

-

Comparison with Previous Years: Compared to the same period last year, retail sales are up [insert percentage] reflecting the sustained strength of the Canadian consumer.

-

Potential Outliers: [Mention any potential unusual factors impacting the data, e.g., back-to-school spending, pent-up demand after COVID-19 restrictions, or specific government stimulus programs].

Conflicting Signals: Inflation vs. Economic Growth

The robust retail sales data presents the Bank of Canada with a significant dilemma: strong consumer spending indicates continued economic growth, but it also fuels inflationary pressures.

Inflationary Pressures

Canada's current inflation rate is [insert current inflation rate]. The significant rise in retail sales adds to existing inflationary pressures.

-

Consumer Spending and Inflation: Increased consumer spending leads to higher demand, potentially pushing prices up, especially if supply cannot keep pace.

-

Wage-Price Spiral: Strong consumer spending can lead to higher wages as businesses compete for workers, which can further fuel inflation in a potentially dangerous wage-price spiral.

-

Supply Chain Issues: Persistent supply chain disruptions continue to exacerbate price increases, making the impact of increased demand even more significant.

Sustained Economic Growth

Despite the Bank of Canada's interest rate hikes aimed at cooling the economy, strong retail sales suggest remarkable resilience in the Canadian economy.

-

Resilience of the Canadian Consumer: The data shows the Canadian consumer remains relatively confident and continues to spend, potentially drawing on savings accumulated during the pandemic.

-

Factors Driving Spending: [Discuss potential factors, e.g., government support programs, low unemployment rates, pent-up demand from the pandemic].

-

Risks to Sustained Growth: However, continued interest rate hikes could eventually curb consumer spending and lead to a slowdown in economic growth.

Implications for Bank of Canada's Monetary Policy

The unexpected retail sales growth significantly complicates the Bank of Canada's monetary policy strategy.

Re-evaluating the Current Strategy

The robust retail sales figures challenge the effectiveness of past interest rate hikes in cooling the economy and curbing inflation.

-

Effectiveness of Past Hikes: [Analyze the impact of previous interest rate increases on inflation and economic growth].

-

Future Rate Adjustments: The Bank of Canada may need to reconsider the pace and magnitude of future interest rate adjustments, potentially opting for a pause or even a slower increase.

-

Alternative Monetary Policy Tools: The Bank of Canada might explore alternative tools, such as quantitative tightening, to manage inflation without solely relying on interest rate hikes.

Predicting Future Policy Decisions

The conflicting signals regarding inflation and economic growth make predicting the Bank of Canada's future policy decisions challenging.

-

Inflation Targets: The Bank of Canada's commitment to its inflation target will significantly influence its decisions.

-

Communication Strategy: The Bank may need to adjust its communication strategy to manage market expectations given the surprising retail sales data.

-

Impact on the Canadian Dollar: The Bank of Canada's policy decisions will inevitably affect the value of the Canadian dollar.

Conclusion

The robust recent retail sales growth presents a complex challenge to the Bank of Canada's monetary policy. While aimed at curbing inflation, the data suggests continued economic strength and resilience in consumer spending, creating conflicting signals. The unexpected strength of recent retail sales growth necessitates continued close monitoring of the Canadian economy and a careful re-evaluation of the Bank of Canada's monetary policy approach. Stay informed on the latest developments regarding recent retail sales growth and its impact on the Bank of Canada’s decisions to make sound financial choices. Further analysis is required to fully understand the implications of these conflicting signals and how the Bank of Canada will navigate this uncertain economic landscape.

Featured Posts

-

See Taylor Swifts Eras Tour Wardrobe An In Depth Look At Every Outfit

May 27, 2025

See Taylor Swifts Eras Tour Wardrobe An In Depth Look At Every Outfit

May 27, 2025 -

New Movies On Netflix Featuring A Controversial Best Picture Film

May 27, 2025

New Movies On Netflix Featuring A Controversial Best Picture Film

May 27, 2025 -

Gratitude On Sesame Street Sza And Elmos Heartwarming Collaboration

May 27, 2025

Gratitude On Sesame Street Sza And Elmos Heartwarming Collaboration

May 27, 2025 -

111 Vagas De Emprego Em Petrolina Confira As Oportunidades

May 27, 2025

111 Vagas De Emprego Em Petrolina Confira As Oportunidades

May 27, 2025 -

Viyskova Pidtrimka Ukrayini Novi Rishennya Nimechchini

May 27, 2025

Viyskova Pidtrimka Ukrayini Novi Rishennya Nimechchini

May 27, 2025

Latest Posts

-

Anderlecht At Vaelge Den Rigtige Vej

May 30, 2025

Anderlecht At Vaelge Den Rigtige Vej

May 30, 2025 -

Analyse Af Et Potentielt Tilbud Til Anderlecht

May 30, 2025

Analyse Af Et Potentielt Tilbud Til Anderlecht

May 30, 2025 -

Elon Musks Alleged Paternity Examining The Amber Heard Twins Case

May 30, 2025

Elon Musks Alleged Paternity Examining The Amber Heard Twins Case

May 30, 2025 -

Forhandlinger Og Tilbud Anderlechts Situation

May 30, 2025

Forhandlinger Og Tilbud Anderlechts Situation

May 30, 2025 -

Did Elon Musk Father Amber Heards Twins A Look At The Evidence

May 30, 2025

Did Elon Musk Father Amber Heards Twins A Look At The Evidence

May 30, 2025