Reliance Industries Earnings Beat Expectations: Impact On Indian Equities

Table of Contents

Reliance Industries' Q[Quarter] Earnings: A Detailed Look

Key Highlights of the Earnings Report

Reliance Industries' Q[Quarter] earnings showcased impressive growth across various segments. The report revealed significant positive results, exceeding analysts' predictions and boosting investor confidence. Key highlights include:

- Revenue Growth: A [Insert Percentage]% year-on-year (YoY) increase in consolidated revenue, reaching [Insert Rupees Amount] crores. This robust growth demonstrates the company's strong market position and sustained demand for its products and services.

- Profit Margins: Improved profit margins across key segments, with [mention specific segment and percentage improvement]. This indicates efficient operational management and effective cost control strategies.

- Reliance Jio Performance: Reliance Jio, the telecom arm, reported a [Insert Percentage]% YoY increase in subscriber base, reaching [Insert Number] subscribers. This growth was fueled by the rollout of 5G services and aggressive marketing campaigns.

- Retail Segment Growth: The retail segment demonstrated impressive growth, with a [Insert Percentage]% YoY increase in revenue, driven by strong consumer demand and expansion into new markets.

These positive results were driven by several strategic initiatives, including the expansion of its 5G network, successful partnerships in the energy sector, and a strategic focus on digital transformation across all business verticals. While [mention any minor negative aspects, for example, a slight dip in one specific area, keeping it balanced], the overall performance was overwhelmingly positive.

Factors Contributing to Earnings Beat

The exceeding of expectations can be attributed to a confluence of factors:

- Strong Consumer Demand: Robust consumer spending in India fueled significant growth in the retail and telecom sectors.

- Successful Diversification: Reliance Industries' diversified business portfolio helped mitigate risks and capitalize on opportunities across various sectors.

- Efficient Operations: Improved operational efficiency and cost-cutting measures contributed to enhanced profit margins.

- Technological Innovation: Investment in technological advancements, particularly in the telecom and digital sectors, drove significant growth and market share gains.

- Strategic Partnerships: Strategic alliances and partnerships facilitated market access and expansion into new business areas.

These factors, working in synergy, contributed to Reliance Industries' remarkable Q[Quarter] earnings performance.

Sectoral Impact of Reliance Industries' Performance

Influence on the Energy Sector

Reliance's strong performance has significant implications for the Indian energy sector. The company's robust growth in its oil and gas businesses has a positive effect on oil and gas prices and related companies, increasing investor confidence within this sector. This positive momentum can potentially stimulate further investment in the sector and accelerate its overall growth. Any fluctuations in oil prices will, of course, continue to be a factor influencing the sector's performance.

Impact on the Telecom Sector

Reliance Jio's outstanding performance significantly impacts the Indian telecom sector. The substantial increase in its subscriber base has intensified competition, pushing other players to enhance their services and offerings. This increased competition could lead to improved network infrastructure and potentially lower tariffs for consumers. The overall impact is a more dynamic and competitive landscape within the Indian telecom market.

Broader Market Implications

Reliance Industries' strong earnings have a positive ripple effect on the broader Indian equity market. The positive sentiment surrounding Reliance has boosted investor confidence and contributed to increased trading activity, affecting major market indices like the Sensex and Nifty. This positive sentiment can spur further investment in the Indian market, potentially attracting both domestic and foreign investors.

Future Outlook for Reliance Industries and Indian Equities

Growth Projections and Predictions

Analysts predict continued growth for Reliance Industries, citing its strong market position, diversified business portfolio, and ongoing investments in technology and innovation. However, potential risks and challenges, such as global economic uncertainty and fluctuating commodity prices, need to be considered. [Mention any specific analyst predictions and their rationale].

Investment Implications for Indian Equities

The positive Reliance Industries earnings report presents attractive investment opportunities in the Indian equity market. Investors may consider allocating funds to companies within sectors positively impacted by Reliance's performance. However, it’s crucial to perform thorough due diligence and assess individual risk tolerance before making any investment decisions. Diversification remains a key strategy for mitigating risks in the dynamic Indian market.

Conclusion

Reliance Industries' impressive earnings results have undeniably impacted the Indian equities market, creating a wave of optimism and potentially triggering further investment. The strong performance stems from a combination of factors, including robust growth in key sectors and effective strategic management. This positive momentum significantly influences various sectors, boosting investor confidence and shaping the trajectory of the Indian stock market. Understanding the impact of these Reliance Industries Earnings is crucial for investors navigating the Indian equity landscape. Stay informed on future developments regarding Reliance Industries Earnings and their effect on related stocks to make well-informed investment decisions.

Featured Posts

-

Du Val Founder Kenyon Clarke Detained After Auckland Altercation

Apr 29, 2025

Du Val Founder Kenyon Clarke Detained After Auckland Altercation

Apr 29, 2025 -

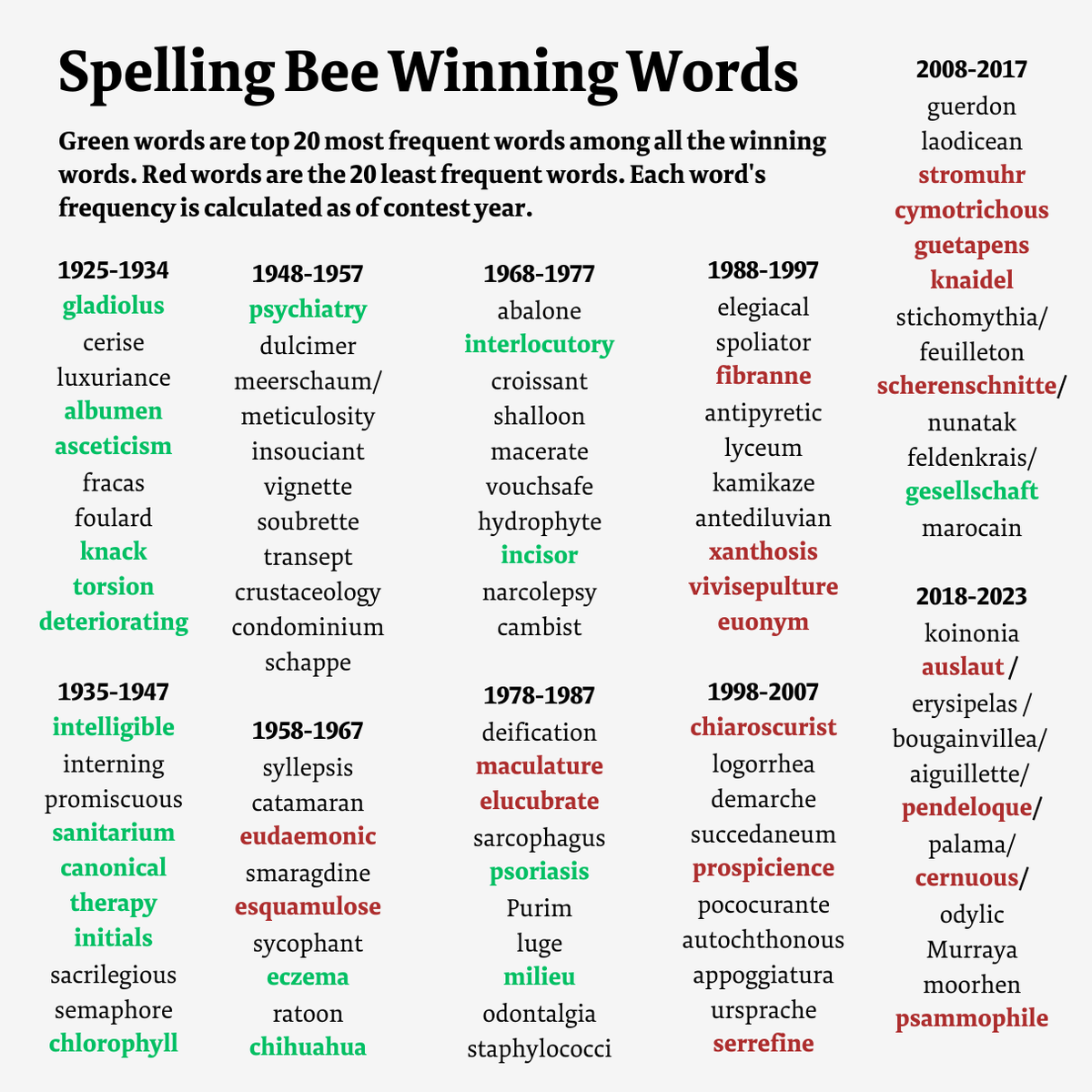

Nyt Spelling Bee March 14 2025 Solutions And Pangram

Apr 29, 2025

Nyt Spelling Bee March 14 2025 Solutions And Pangram

Apr 29, 2025 -

Pete Rose Pardon Trumps Post Presidency Announcement Explained

Apr 29, 2025

Pete Rose Pardon Trumps Post Presidency Announcement Explained

Apr 29, 2025 -

Growth Amidst Grief Fort Belvoir Honors Soldiers Lost In Helicopter Crash

Apr 29, 2025

Growth Amidst Grief Fort Belvoir Honors Soldiers Lost In Helicopter Crash

Apr 29, 2025 -

Timberwolves Vs Lakers Anthony Edwards Injury And Game Status

Apr 29, 2025

Timberwolves Vs Lakers Anthony Edwards Injury And Game Status

Apr 29, 2025

Latest Posts

-

Framtiden Oviss Foer Mueller Tva Klubbar I Jakten

May 12, 2025

Framtiden Oviss Foer Mueller Tva Klubbar I Jakten

May 12, 2025 -

Kompany Onder Vuur Na Vernederende Prestatie

May 12, 2025

Kompany Onder Vuur Na Vernederende Prestatie

May 12, 2025 -

Tva Klubbars Intresse Foer Thomas Mueller Naesta Steg I Karriaeren

May 12, 2025

Tva Klubbars Intresse Foer Thomas Mueller Naesta Steg I Karriaeren

May 12, 2025 -

Thomas Muellers Departing Bayern His Most Frequent On Field Companions

May 12, 2025

Thomas Muellers Departing Bayern His Most Frequent On Field Companions

May 12, 2025 -

Le Depart De Thomas Mueller Du Bayern Munich Confirme

May 12, 2025

Le Depart De Thomas Mueller Du Bayern Munich Confirme

May 12, 2025