Renewed Trade War Concerns Trigger Another Fall In Dutch Stocks

Table of Contents

The Impact of Trade Wars on the Dutch Economy

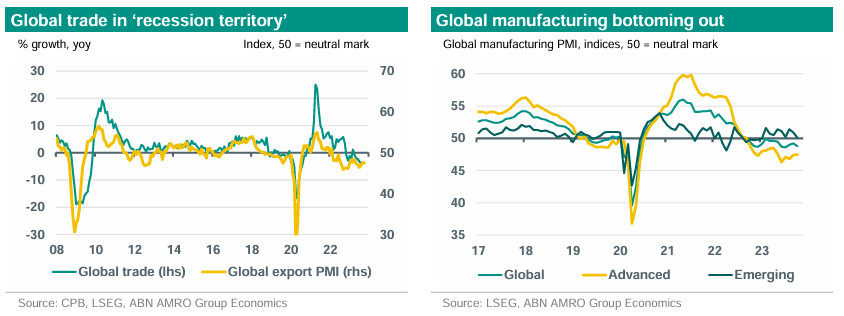

The Netherlands, renowned as a major trading hub in Europe, is highly vulnerable to the disruptions caused by global trade wars. Its economy is heavily reliant on international commerce, with exports and foreign investment playing crucial roles in its prosperity. This dependence makes it particularly susceptible to the negative consequences of tariffs, trade restrictions, and supply chain disruptions.

-

High Dependence on Global Trade: The Netherlands' open economy relies heavily on exports, particularly in sectors like agriculture, technology, and logistics. These sectors are directly exposed to the ramifications of trade disputes.

-

Foreign Investment Vulnerability: The country attracts significant foreign investment, which can be easily deterred by trade uncertainties and global market volatility. A decline in foreign investment directly impacts economic growth and job creation.

-

Supply Chain Disruptions: Many Dutch businesses are part of intricate global supply chains. Trade wars can lead to delays, increased costs, and shortages of essential goods and materials, disrupting production and impacting profitability.

-

Impact on Specific Sectors: The agricultural sector, a significant contributor to the Dutch economy, faces considerable challenges due to import/export tariffs. Similarly, the technology sector, reliant on global supply chains, is also experiencing significant pressure. These impacts ripple through the economy, affecting consumers through increased prices and reduced choices.

Analysis of the Recent Fall in Dutch Stock Prices

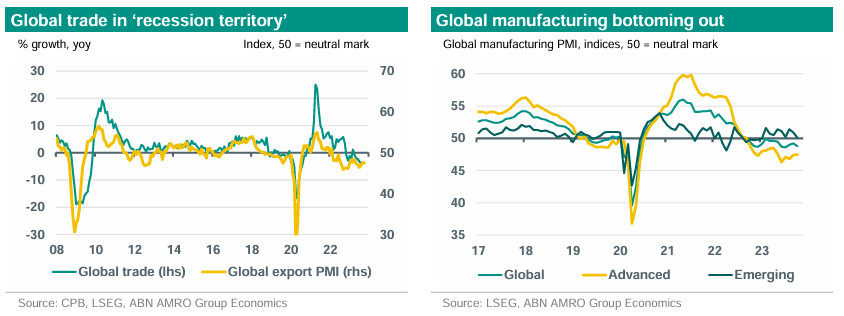

The renewed trade war anxieties have resulted in a notable decline in major Dutch stock indices, most significantly the AEX index. This fall reflects a growing pessimism among investors regarding the future economic performance of the country.

-

AEX Index Decline: The AEX index has experienced a [Insert percentage]% drop in recent weeks [Insert timeframe], mirroring the broader global market downturn triggered by trade war concerns.

-

Sector-Specific Impacts: The [mention specific sectors, e.g., technology, financial services] sectors have been disproportionately affected, experiencing steeper falls than others due to their higher exposure to global trade.

-

Investor Sentiment and Volatility: Investor sentiment has turned decidedly negative, characterized by increased market volatility and reduced trading activity. Uncertainty about the future trajectory of global trade is driving this apprehension.

-

Comparison to Past Downturns: While the current situation shares similarities with previous market downturns, the specific context of the escalating trade war adds a unique layer of complexity and uncertainty. The prolonged nature of the trade disputes is a key differentiating factor.

Government Response and Potential Mitigation Strategies

The Dutch government is actively responding to the falling stock market and the broader economic challenges posed by the trade war. However, the effectiveness of these measures remains to be seen.

-

Economic Stimulus Packages: The government is considering [mention specific measures, e.g., tax cuts, infrastructure investments] to stimulate economic activity and support affected businesses.

-

Policy Changes to Support Businesses: [Mention any policy changes, e.g., export subsidies, trade promotion initiatives] are being explored to help Dutch companies navigate the trade uncertainties.

-

International Collaborations: The Netherlands is actively engaged in international discussions and collaborations to find solutions to the ongoing trade disputes. Participation in EU initiatives is central to its approach.

-

Effectiveness Assessment: The effectiveness of these government interventions depends largely on the resolution of the underlying trade conflicts. Past government interventions have yielded varying degrees of success, highlighting the complexity of the problem.

Implications for Investors and Future Outlook

The current situation presents both risks and opportunities for investors in the Dutch stock market. A prudent approach involves careful consideration of risk mitigation strategies.

-

Investment Strategies: During periods of market uncertainty, diversification across different asset classes is crucial. Investing in less trade-sensitive sectors could offer some protection.

-

Diversification: Spreading investments across different geographical regions and industries can help to reduce overall portfolio risk.

-

Long-Term Implications: The long-term implications for Dutch stocks depend heavily on the resolution of the trade disputes. A prolonged trade war could lead to sustained economic weakness, while a swift resolution could trigger a market rebound.

-

Future Predictions: Expert opinions are divided, with some predicting a continued downturn while others anticipate a gradual recovery. Close monitoring of global trade developments is crucial for making informed investment decisions. The outlook for Dutch stocks remains uncertain but largely dependent on the resolution of the trade war.

Conclusion

Renewed trade war concerns have undeniably triggered a significant fall in Dutch stocks, impacting the Dutch economy and causing considerable anxiety among investors. The Netherlands' heavy reliance on global trade makes it particularly vulnerable to these external pressures. While the government is implementing mitigation strategies, their effectiveness hinges on the resolution of global trade disputes. Understanding the impact of the trade war on Dutch stocks is crucial for investors. Stay informed about the evolving global trade situation and its effect on Dutch stocks. Monitor relevant news and consider consulting a financial advisor to make informed investment decisions and navigate this period of market volatility. Making sound investment choices regarding Dutch stocks requires careful consideration of the risks and opportunities presented by this ongoing global trade uncertainty.

Featured Posts

-

Gauffs Grit Reaching The Italian Open Third Round

May 25, 2025

Gauffs Grit Reaching The Italian Open Third Round

May 25, 2025 -

Madrid Open Update De Minaurs Early Exit And Swiateks Dominant Win

May 25, 2025

Madrid Open Update De Minaurs Early Exit And Swiateks Dominant Win

May 25, 2025 -

Bangladeshs European Strategy Collaboration And Economic Growth

May 25, 2025

Bangladeshs European Strategy Collaboration And Economic Growth

May 25, 2025 -

Models Partners Posts After Night Out With Kyle Walker Raise Questions

May 25, 2025

Models Partners Posts After Night Out With Kyle Walker Raise Questions

May 25, 2025 -

Sean Penn Questions Dylan Farrows Allegations Against Woody Allen

May 25, 2025

Sean Penn Questions Dylan Farrows Allegations Against Woody Allen

May 25, 2025