Rent Freeze: €3 Billion Hit Predicted For Dutch Housing Corporations

Table of Contents

The €3 Billion Prediction: A Detailed Breakdown

The €3 billion figure, a prediction stemming from a recent study by [Insert Research Source Here – e.g., the Dutch Association of Housing Corporations], represents a potential shortfall in revenue for housing corporations over [Insert Timeframe – e.g., the next five years]. This estimation is based on [Explain Methodology – e.g., analysis of current rental income, projected occupancy rates, and the estimated reduction in rental income due to the freeze].

-

Breakdown of Losses: The predicted losses aren't evenly distributed. Larger housing corporations in urban areas like Amsterdam and Rotterdam are expected to bear a disproportionately larger burden compared to smaller corporations in rural regions. This disparity highlights the uneven impact of the proposed policy across the country.

-

Revenue Shortfalls and Maintenance: The €3 billion loss translates directly into reduced revenue streams, significantly impacting the capacity for essential maintenance and renovations of existing social housing properties. Deferred maintenance can lead to deterioration, increased repair costs in the future, and a decline in the overall quality of rental units.

-

Impact on New Construction: Crucially, this financial strain will almost certainly affect investment in new social housing projects. With reduced income, housing corporations will struggle to secure funding for new builds, exacerbating the already severe housing shortage in the Netherlands. The ripple effect will be felt by those desperately seeking affordable rental housing.

-

Funding and Investment: The impact extends beyond simple operational expenses. The ability to invest in energy-efficient upgrades and modernization of existing buildings, a crucial element in meeting sustainability targets, will be severely compromised, leading to long-term consequences for both tenants and the environment.

Impact on Housing Corporation Operations and Services

The financial implications of a rent freeze extend far beyond balance sheets; they directly impact the quality of services offered by housing corporations and the lives of their tenants.

-

Maintenance and Repairs: Reduced funding will inevitably lead to cuts in maintenance and repair budgets. This could mean longer waiting times for repairs, a decline in the overall condition of properties, and a potential increase in health and safety risks for tenants.

-

Renovations and Upgrades: Planned renovations and upgrades, crucial for improving energy efficiency, accessibility, and the overall quality of life for tenants, are likely to be delayed or cancelled entirely. This negatively impacts both tenant comfort and the long-term sustainability of the housing stock.

-

New Social Housing: The construction of new social housing units, desperately needed to address the housing crisis, will be severely hampered. Reduced investment capacity will directly translate into fewer affordable homes being built, leaving many vulnerable individuals and families without adequate housing.

-

Tenant Services: Housing corporations may also be forced to reduce tenant services, including support programs and community initiatives, further impacting the well-being of their residents.

Long-Term Consequences for the Dutch Rental Market

A rent freeze, while seemingly a solution to immediate affordability concerns, carries significant long-term consequences for the Dutch rental market and the wider housing crisis.

-

Exacerbating the Housing Shortage: Reduced investment in new builds and the potential deterioration of existing properties will only worsen the already severe housing shortage. This will drive up prices in the private rental sector, creating a more unequal and less stable rental market.

-

Impact on Affordable Housing: The availability of affordable rental properties will decrease drastically, disproportionately affecting low-income households and vulnerable groups. The reduction in quality and availability will likely lead to overcrowding and substandard living conditions.

-

Market Instability: A rent freeze could create market instability. Investors may be less inclined to invest in the rental sector, leading to a further reduction in available housing. The long-term health and sustainability of the rental market could be severely compromised.

-

Alternative Solutions: Addressing the housing crisis requires a multi-faceted approach, moving beyond a simplistic rent freeze. This includes increased investment in social housing, streamlining building permits, and exploring innovative housing solutions.

The Role of Government Subsidies

Government subsidies play a crucial role in funding social housing in the Netherlands. A rent freeze necessitates a significant increase in government funding to compensate for the projected €3 billion loss to housing corporations.

-

Increased Government Spending: The government will need to consider a substantial increase in subsidies to maintain the current level of services provided by housing corporations. This increase will have significant budget implications and may necessitate adjustments to other government programs.

-

Sustainability of Increased Funding: The long-term sustainability of significantly increased government spending on housing subsidies needs careful consideration. A sustainable financial model is crucial to avoid future crises.

-

Political Implications: The decision to increase subsidies will have significant political ramifications, demanding a robust public dialogue about the allocation of public funds and the prioritization of social housing.

Conclusion

The proposed rent freeze in the Netherlands poses a significant threat, with a predicted €3 billion hit to Dutch housing corporations. This substantial financial impact will likely hinder crucial operations such as maintenance, renovations, and new construction, potentially worsening the housing shortage and impacting the quality of affordable rental housing. The long-term consequences demand careful consideration, and alternative strategies need to be explored to address the housing crisis effectively. A balanced approach combining increased government investment, strategic planning, and innovative housing solutions is crucial.

Call to Action: Understanding the potential ramifications of a rent freeze is crucial for all stakeholders. Learn more about the predicted impact and explore alternative solutions to the Dutch housing crisis. Engage in the discussion on the future of affordable housing and the necessity for sustainable policies beyond a simple rent freeze. Let's find sustainable solutions for affordable housing in the Netherlands, moving beyond the limitations of a simple rent freeze.

Featured Posts

-

Wes Andersons Phoenician Scheme Venetian Palazzo Inspiration

May 28, 2025

Wes Andersons Phoenician Scheme Venetian Palazzo Inspiration

May 28, 2025 -

Housing Corporations Initiate Legal Proceedings Against Rent Freeze Policy

May 28, 2025

Housing Corporations Initiate Legal Proceedings Against Rent Freeze Policy

May 28, 2025 -

Could You Win The 202m Euromillions Jackpot

May 28, 2025

Could You Win The 202m Euromillions Jackpot

May 28, 2025 -

Sparta Rotterdam Takluk Psv Resmi Juara Liga Belanda

May 28, 2025

Sparta Rotterdam Takluk Psv Resmi Juara Liga Belanda

May 28, 2025 -

Abd De Tueketici Kredileri Mart Ayinda Artti Detayli Analiz

May 28, 2025

Abd De Tueketici Kredileri Mart Ayinda Artti Detayli Analiz

May 28, 2025

Latest Posts

-

Integracion Setlist Fm Y Ticketmaster Beneficios Para La Experiencia Del Fan

May 30, 2025

Integracion Setlist Fm Y Ticketmaster Beneficios Para La Experiencia Del Fan

May 30, 2025 -

Setlist Fm Se Integra Con Ticketmaster Ventajas Para Los Usuarios

May 30, 2025

Setlist Fm Se Integra Con Ticketmaster Ventajas Para Los Usuarios

May 30, 2025 -

Setlist Fm Se Une A Ticketmaster Nueva Experiencia Para Los Fans De Musica

May 30, 2025

Setlist Fm Se Une A Ticketmaster Nueva Experiencia Para Los Fans De Musica

May 30, 2025 -

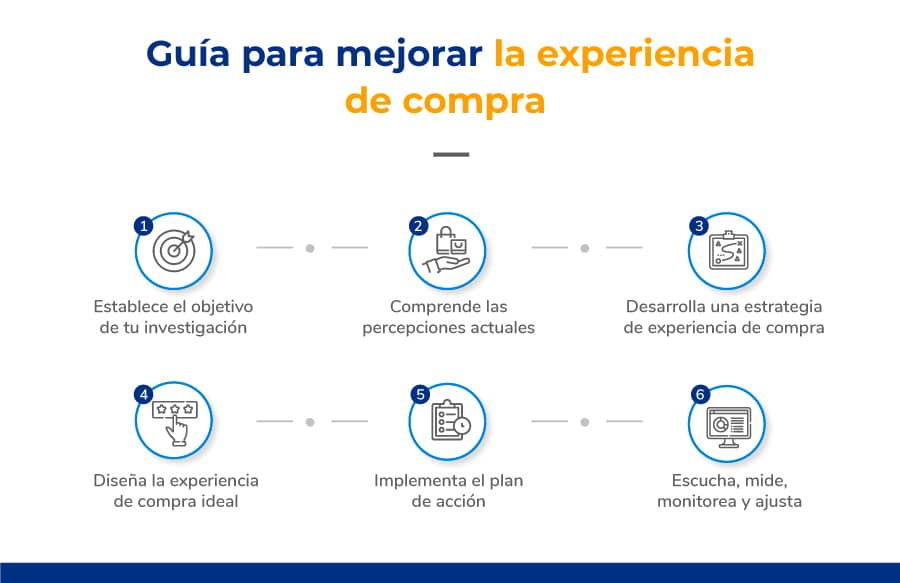

Nueva Alianza Setlist Fm Mejora La Experiencia De Compra En Ticketmaster

May 30, 2025

Nueva Alianza Setlist Fm Mejora La Experiencia De Compra En Ticketmaster

May 30, 2025 -

Ticketmaster Y Setlist Fm Integracion Para Una Mejor Experiencia De Conciertos

May 30, 2025

Ticketmaster Y Setlist Fm Integracion Para Una Mejor Experiencia De Conciertos

May 30, 2025